Answered step by step

Verified Expert Solution

Question

1 Approved Answer

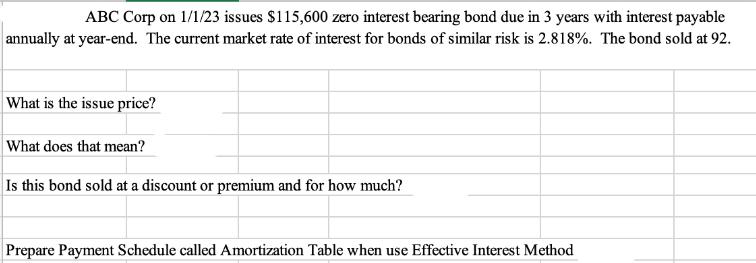

ABC Corp on 1/1/23 issues $115,600 zero interest bearing bond due in 3 years with interest payable annually at year-end. The current market rate

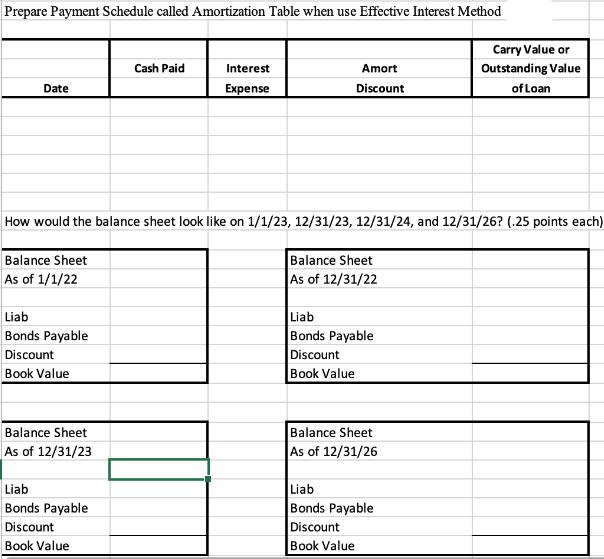

ABC Corp on 1/1/23 issues $115,600 zero interest bearing bond due in 3 years with interest payable annually at year-end. The current market rate of interest for bonds of similar risk is 2.818%. The bond sold at 92. What is the issue price? What does that mean? Is this bond sold at a discount or premium and for how much? Prepare Payment Schedule called Amortization Table when use Effective Interest Method Prepare Payment Schedule called Amortization Table when use Effective Interest Method Date Balance Sheet As of 1/1/22 Liab Bonds Payable Discount Book Value Balance Sheet As of 12/31/23 Cash Paid How would the balance sheet look like on 1/1/23, 12/31/23, 12/31/24, and 12/31/26? (.25 points each) Balance Sheet As of 12/31/22 Liab Bonds Payable Discount Book Value Interest Expense Amort Discount Liab Bonds Payable Discount Book Value Balance Sheet As of 12/31/26 Carry Value or Outstanding Value of Loan Liab Bonds Payable Discount Book Value

Step by Step Solution

★★★★★

3.41 Rating (157 Votes )

There are 3 Steps involved in it

Step: 1

1 Calculate issue price Par value of bond 115600 Bond sold at 92 of par value To calculate price take 92 of par value 92 092 092 x 115600 106272 There...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started