Answered step by step

Verified Expert Solution

Question

1 Approved Answer

ABC Corporation, which specializes in the furniture business, is considering an expansion. ABC maintains a constant debt-to-value ratio (i.e., D/V) of 40%. The firm's

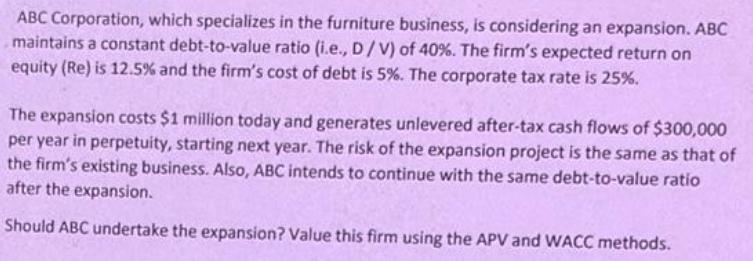

ABC Corporation, which specializes in the furniture business, is considering an expansion. ABC maintains a constant debt-to-value ratio (i.e., D/V) of 40%. The firm's expected return on equity (Re) is 12.5% and the firm's cost of debt is 5%. The corporate tax rate is 25%. The expansion costs $1 million today and generates unlevered after-tax cash flows of $300,000 per year in perpetuity, starting next year. The risk of the expansion project is the same as that of the firm's existing business. Also, ABC intends to continue with the same debt-to-value ratio after the expansion. Should ABC undertake the expansion? Value this firm using the APV and WACC methods.

Step by Step Solution

★★★★★

3.38 Rating (154 Votes )

There are 3 Steps involved in it

Step: 1

Given Information o Debt Equity rate Re 40 retum on Equity 25 Rd Cast of dont 5 25 t tam retet ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started