Answered step by step

Verified Expert Solution

Question

1 Approved Answer

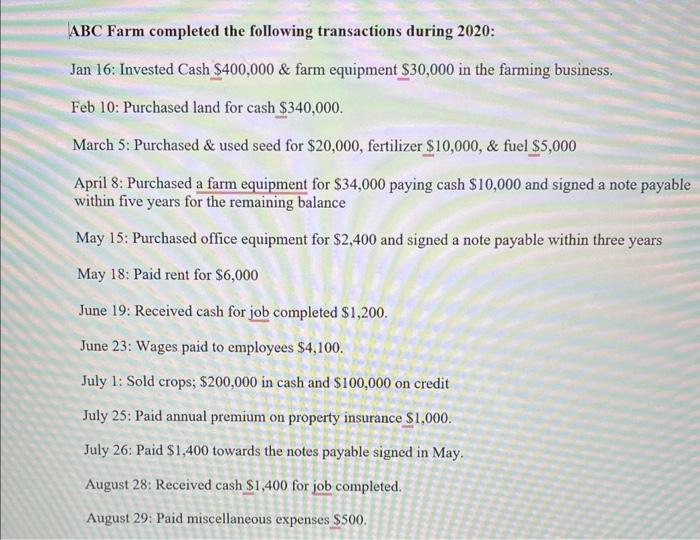

ABC Farm completed the following transactions during 2020: Jan 16: Invested Cash $400,000 & farm equipment $30,000 in the farming business. Feb 10: Purchased

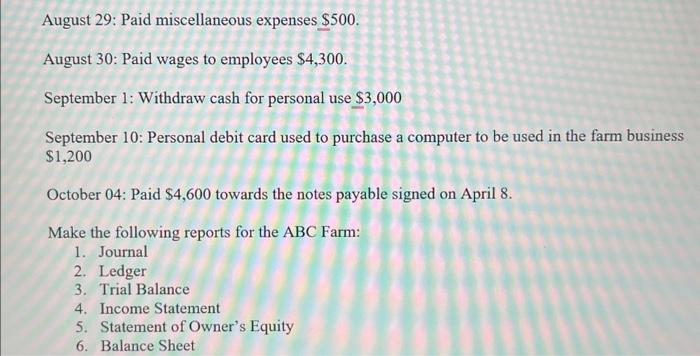

ABC Farm completed the following transactions during 2020: Jan 16: Invested Cash $400,000 & farm equipment $30,000 in the farming business. Feb 10: Purchased land for cash $340,000. March 5: Purchased & used seed for $20,000, fertilizer $10,000, & fuel $5,000 April 8: Purchased a farm equipment for $34,000 paying cash $10,000 and signed a note payable within five years for the remaining balance May 15: Purchased office equipment for $2,400 and signed a note payable within three years May 18: Paid rent for $6,000 June 19: Received cash for job completed $1,200. June 23: Wages paid to employees $4,100. July 1: Sold crops; $200,000 in cash and $100,000 on credit July 25: Paid annual premium on property insurance $1,000. July 26: Paid $1,400 towards the notes payable signed in May. August 28: Received cash $1,400 for job completed. August 29: Paid miscellaneous expenses $500. August 29: Paid miscellaneous expenses $500. August 30: Paid wages to employees $4,300. September 1: Withdraw cash for personal use $3,000 September 10: Personal debit card used to purchase a computer to be used in the farm business $1,200 October 04: Paid $4,600 towards the notes payable signed on April 8. Make the following reports for the ABC Farm: 1. Journal 2. Ledger 3. Trial Balance 4. Income Statement 5. Statement of Owner's Equity 6. Balance Sheet

Step by Step Solution

★★★★★

3.51 Rating (158 Votes )

There are 3 Steps involved in it

Step: 1

1 Journal Date Account Title Debit Credit Jan 16 Cash 400000 Farm Equipment 30000 Capital 430000 Feb 10 Land 340000 Cash 340000 Mar 5 Seed 20000 Ferti...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started