Answered step by step

Verified Expert Solution

Question

1 Approved Answer

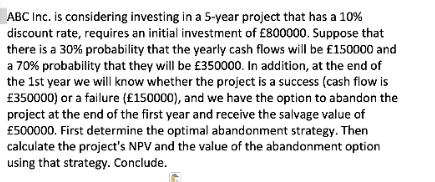

ABC Inc. is considering investing in a 5-year project that has a 10% discount rate, requires an initial investment of 800000. Suppose that there

ABC Inc. is considering investing in a 5-year project that has a 10% discount rate, requires an initial investment of 800000. Suppose that there is a 30% probability that the yearly cash flows will be 150000 and a 70% probability that they will be 350000. In addition, at the end of the 1st year we will know whether the project is a success (cash flow is 350000) or a failure (150000), and we have the option to abandon the project at the end of the first year and receive the salvage value of 500000. First determine the optimal abandonment strategy. Then calculate the project's NPV and the value of the abandonment option using that strategy. Conclude.

Step by Step Solution

★★★★★

3.53 Rating (163 Votes )

There are 3 Steps involved in it

Step: 1

Optimal Abandonment Strategy The optimal abandonment strategy for this project will depend on the ex...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started