Answered step by step

Verified Expert Solution

Question

1 Approved Answer

ABC Inc. plans to issue a 15-year, 15% annual coupon callable bond. The current yield is 12%. At the end of year 5, the

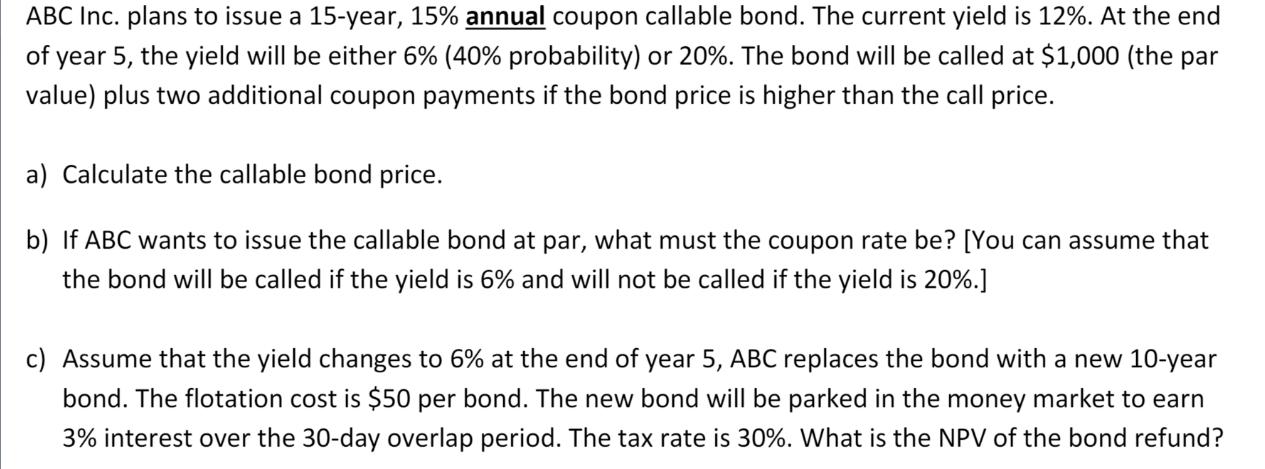

ABC Inc. plans to issue a 15-year, 15% annual coupon callable bond. The current yield is 12%. At the end of year 5, the yield will be either 6% (40% probability) or 20%. The bond will be called at $1,000 (the par value) plus two additional coupon payments if the bond price is higher than the call price. a) Calculate the callable bond price. b) If ABC wants to issue the callable bond at par, what must the coupon rate be? [You can assume that the bond will be called if the yield is 6% and will not be called if the yield is 20%.] c) Assume that the yield changes to 6% at the end of year 5, ABC replaces the bond with a new 10-year bond. The flotation cost is $50 per bond. The new bond will be parked in the money market to earn 3% interest over the 30-day overlap period. The tax rate is 30%. What is the NPV of the bond refund?

Step by Step Solution

★★★★★

3.53 Rating (153 Votes )

There are 3 Steps involved in it

Step: 1

ABC Inc Callable Bond Analysis a Callable Bond Price There are two potential scenarios for the bond price after 5 years Yield drops to 6 The bond will ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started