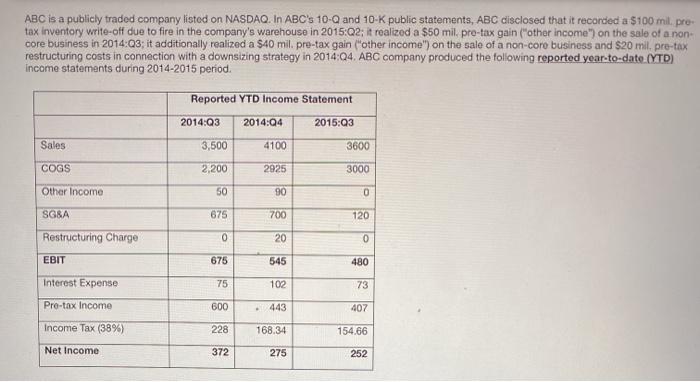

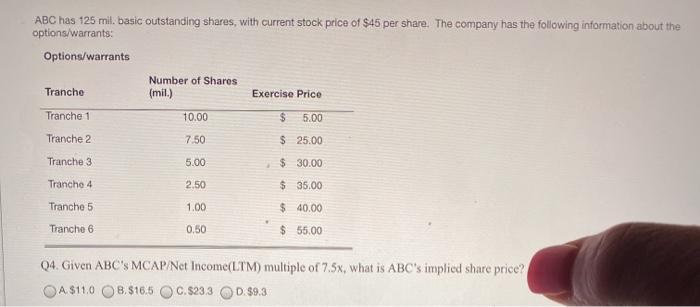

ABC is a publicly traded company listed on NASDAQ. In ABC's 10-Q and 10-K public statements, ABC disclosed that it recorded a $100 mil. pro tax inventory write-off due to fire in the company's warehouse in 2015:02; it realized a $50 mil . pre-tax gain ("other income") on the sale of a non- core business in 2014:03; it additionally realized a 540 mil. pre-tax gain other income") on the sale of a non-core business and $20 mil. pre-tax restructuring costs in connection with a downsizing strategy in 2014:04. ABC company produced the following reported year-to-date (TD) income statements during 2014-2015 period. Reported YTD Income Statement 2014:03 2014:04 2015:03 Sales 3,500 4100 3600 COGS 2,200 2925 3000 Other Income 50 90 0 SGSA 675 700 120 Restructuring Charge 0 20 0 EBIT 675 545 480 Interest Expense 75 102 73 Pro-tax Income 600 . 443 407 Income Tax (38%) 228 168.34 154.66 Net Income 372 275 252 ABC has 125 mil. basic outstanding shares, with current stock price of $45 per share. The company has the following information about the options/warrants: Options/warrants Number of Shares Tranche (mil.) Exercise Price Tranche 1 10.00 $ 5.00 Tranche 2 7.50 $ 25.00 Tranche 3 5.00 $ 30.00 2.50 $ 35,00 Tranche 4 Tranche 5 1.00 $ 40.00 Tranche 6 0,50 $ 55.00 04. Given ABC's MCAP/Net Income(LTM) multiple of 7.5x, what is ABC's implied share price? O A $110 OB.$16.5 C.$23.3 D.59.3 ABC is a publicly traded company listed on NASDAQ. In ABC's 10-Q and 10-K public statements, ABC disclosed that it recorded a $100 mil. pro tax inventory write-off due to fire in the company's warehouse in 2015:02; it realized a $50 mil . pre-tax gain ("other income") on the sale of a non- core business in 2014:03; it additionally realized a 540 mil. pre-tax gain other income") on the sale of a non-core business and $20 mil. pre-tax restructuring costs in connection with a downsizing strategy in 2014:04. ABC company produced the following reported year-to-date (TD) income statements during 2014-2015 period. Reported YTD Income Statement 2014:03 2014:04 2015:03 Sales 3,500 4100 3600 COGS 2,200 2925 3000 Other Income 50 90 0 SGSA 675 700 120 Restructuring Charge 0 20 0 EBIT 675 545 480 Interest Expense 75 102 73 Pro-tax Income 600 . 443 407 Income Tax (38%) 228 168.34 154.66 Net Income 372 275 252 ABC has 125 mil. basic outstanding shares, with current stock price of $45 per share. The company has the following information about the options/warrants: Options/warrants Number of Shares Tranche (mil.) Exercise Price Tranche 1 10.00 $ 5.00 Tranche 2 7.50 $ 25.00 Tranche 3 5.00 $ 30.00 2.50 $ 35,00 Tranche 4 Tranche 5 1.00 $ 40.00 Tranche 6 0,50 $ 55.00 04. Given ABC's MCAP/Net Income(LTM) multiple of 7.5x, what is ABC's implied share price? O A $110 OB.$16.5 C.$23.3 D.59.3