Answered step by step

Verified Expert Solution

Question

1 Approved Answer

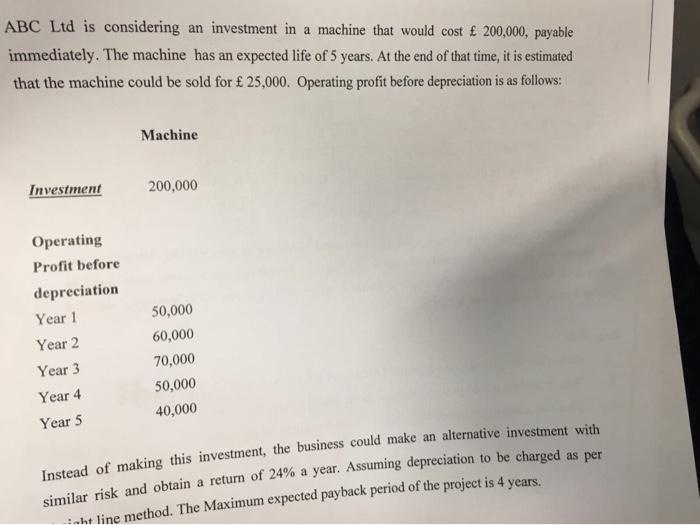

ABC Ltd is considering an investment in a machine that would cost 200,000, payable immediately. The machine has an expected life of 5 years.

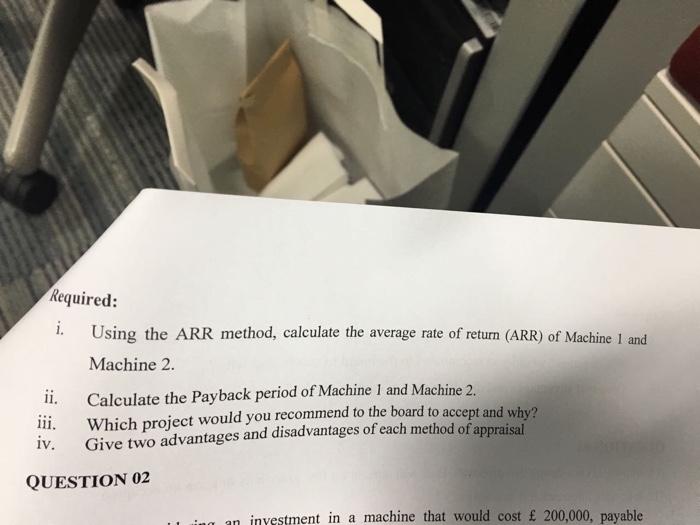

ABC Ltd is considering an investment in a machine that would cost 200,000, payable immediately. The machine has an expected life of 5 years. At the end of that time, it is estimated that the machine could be sold for 25,000. Operating profit before depreciation is as follows: Investment Operating Profit before depreciation Year 1 Year 2 Year 3 Year 4 Year 5 Machine 200,000 50,000 60,000 70,000 50,000 40,000 Instead of making this investment, the business could make an alternative investment with similar risk and obtain a return of 24% a year. Assuming depreciation to be charged as per ht line method. The Maximum expected payback period of the project is 4 years. Required: i. Using the ARR method, calculate the average rate of return (ARR) of Machine 1 and Machine 2. ii. iii. iv. Calculate the Payback period of Machine 1 and Machine 2. Which project would you recommend to the board to accept and why? Give two advantages and disadvantages of each method of appraisal QUESTION 02 ing an investment in a machine that would cost 200,000, payable

Step by Step Solution

★★★★★

3.48 Rating (155 Votes )

There are 3 Steps involved in it

Step: 1

Particulars Capital outlay Operating profit before depreciation Deprec...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started