Answered step by step

Verified Expert Solution

Question

1 Approved Answer

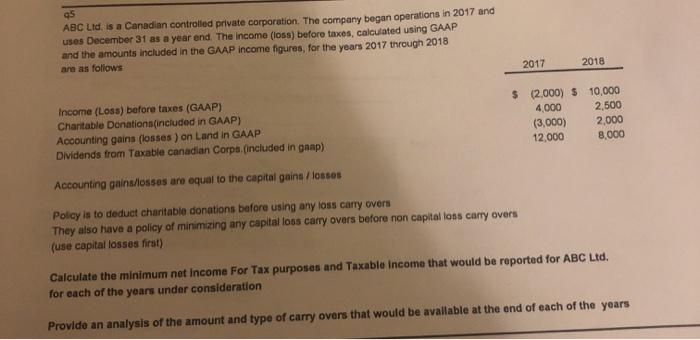

q5 ABC Lid. is a Canadian controlled private corporation. The company began operations in 2017 and uses December 31 as a year end. The

q5 ABC Lid. is a Canadian controlled private corporation. The company began operations in 2017 and uses December 31 as a year end. The income (loss) before taxes, calculated using GAAP and the amounts included in the GAAP income figures, for the years 2017 through 2018 are as foliows 2017 2018 Income (Loss) before taxes (GAAP) Chartable Donations(included in GAAP) Accounting gains (losses ) on Land in GAAP Dividends from Taxable canadian Corps.(included in gaap) $ (2.000) $ 10,000 4,000 (3,000) 12,000 2,500 2,000 8,000 Accounting gains/losses are equal to the capital gains / losses Polcy is to deduct charitable donations before using any loss carry overs They also have a policy of minimizing any capital loss carry overs before non capital loss carry overs (use capital losses first) Calculate the minimum net income For Tax purposes and Taxable Income that would be reported for ABC Ltd. for each of the years under consideration Provide an analysis of the amount and type of carry overs that would be available at the end of each of the years q5 ABC Lid. is a Canadian controlled private corporation. The company began operations in 2017 and uses December 31 as a year end. The income (loss) before taxes, calculated using GAAP and the amounts included in the GAAP income figures, for the years 2017 through 2018 are as foliows 2017 2018 Income (Loss) before taxes (GAAP) Chartable Donations(included in GAAP) Accounting gains (losses ) on Land in GAAP Dividends from Taxable canadian Corps.(included in gaap) $ (2.000) $ 10,000 4,000 (3,000) 12,000 2,500 2,000 8,000 Accounting gains/losses are equal to the capital gains / losses Polcy is to deduct charitable donations before using any loss carry overs They also have a policy of minimizing any capital loss carry overs before non capital loss carry overs (use capital losses first) Calculate the minimum net income For Tax purposes and Taxable Income that would be reported for ABC Ltd. for each of the years under consideration Provide an analysis of the amount and type of carry overs that would be available at the end of each of the years q5 ABC Lid. is a Canadian controlled private corporation. The company began operations in 2017 and uses December 31 as a year end. The income (loss) before taxes, calculated using GAAP and the amounts included in the GAAP income figures, for the years 2017 through 2018 are as foliows 2017 2018 Income (Loss) before taxes (GAAP) Chartable Donations(included in GAAP) Accounting gains (losses ) on Land in GAAP Dividends from Taxable canadian Corps.(included in gaap) $ (2.000) $ 10,000 4,000 (3,000) 12,000 2,500 2,000 8,000 Accounting gains/losses are equal to the capital gains / losses Polcy is to deduct charitable donations before using any loss carry overs They also have a policy of minimizing any capital loss carry overs before non capital loss carry overs (use capital losses first) Calculate the minimum net income For Tax purposes and Taxable Income that would be reported for ABC Ltd. for each of the years under consideration Provide an analysis of the amount and type of carry overs that would be available at the end of each of the years

Step by Step Solution

★★★★★

3.44 Rating (157 Votes )

There are 3 Steps involved in it

Step: 1

Calculation of ABC Ltd Minimum net income for tax purposes and taxable inco...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started