Answered step by step

Verified Expert Solution

Question

1 Approved Answer

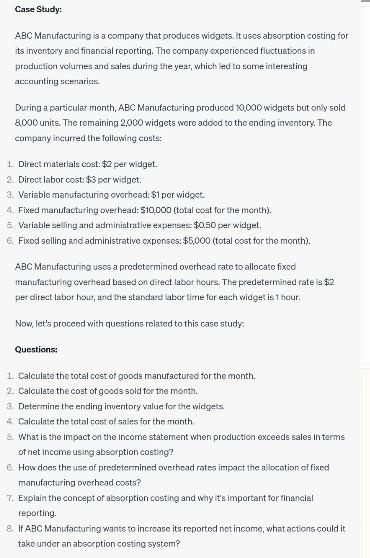

ABC Manufacturing is a company that produces widgets. It uses absorption costing for its inventory and financial reporting. The company experienced fluctuations in production volumes

ABC Manufacturing is a company that produces widgets. It uses absorption costing for its inventory and financial reporting. The company experienced fluctuations in production volumes and sales during the year, which led to some interesting acc:curnting scemarick During a particular month, ABC Manufacturing producod 10,000 widgets but only sold 8,000 units. The remaining 2,000 widgets were addod to the ending inventory. The company incurred the following costs: 1 Direct materials cost: $2 per widget. 2. Diroct labor cost: $3 per widget. 3. Variable manufacturing owcrhoad: $1 per widget. 4. Fixed manufacturing overhead: $10,000 (total cost for the month). 5. Variable selling ard administrative expenses $0.50 per widget. 6. Fixod selling and administrative oxpenses: $5,000 (total cost for the month). ABC Manufacturing uses a predetermined overhead rate to allocate fixod manufacturing owertead based on direct labor hours. The predetermined rate is $2 per direct labor hour, and the standard labor time for each widget is 1 hour. Now, let's proceed with questions related to this case study: Questions: 1 Calculate the total cost of goods manutactured tor the month. 2 Calculate the cost of goods sold tor the month. 3. Determine the ending inventory value for the widgets. 4. Calculate the tatal cost af sales for the month. 8. What is the impact on the income statement when production exceeds sales in terms of net income using absorption costing? 6. How does the use of predeternined cverhead rates impact the allocation of fixed manufacturing overhead costs? 7. Explain the concept of absorption costing and wny its important for tinancial reporting. 8. If ABC Manufacturing wants to increase its reported net income, what actions could it tako under an absorption costing system

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started