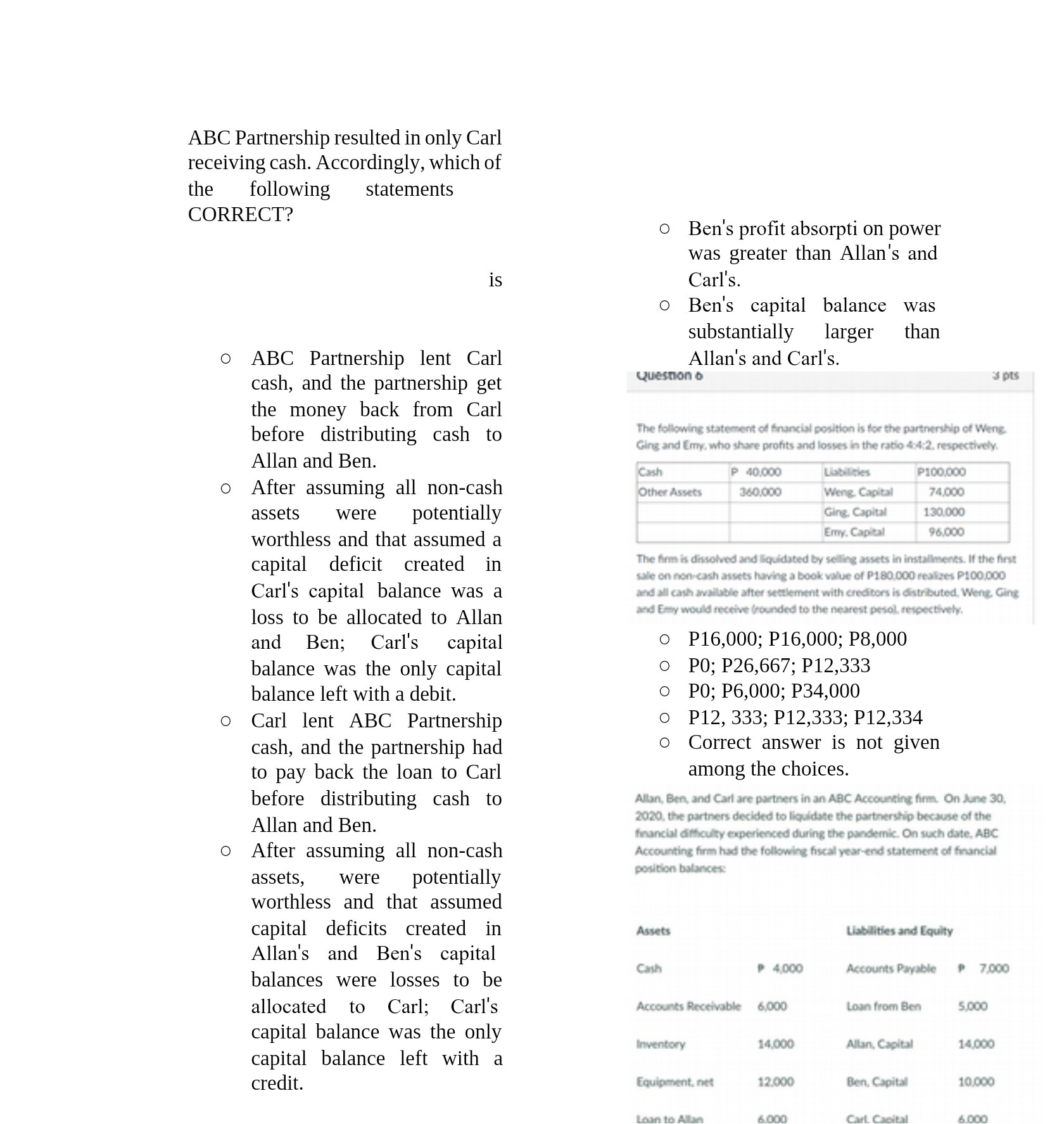

ABC Partnership resulted in only Carl receiving cash. Accordingly, which of the following statements CORRECT? Ben's profit absorption power was greater than Allan's and is Carl's. Ben's capital balance was substantially larger than o ABC Partnership lent Carl Allan's and Carl's. cash, and the partnership get question o 3 pts the money back from Carl before distributing cash to The following statement of financial position is for the partnership of Weng. Ging and Emy. who share profits and losses in the ratio 4:1:2. respectively. Allan and Ben. Cash P 40,000 Liabilities P100,000 O After assuming all non-cash Other Assets 360,000 Weng. Capital 74,000 assets were potentially Ging. Capital 130.000 worthless and that assumed a Emy. Capital 96,000 capital deficit created in The firm is dissolved and liquidated by selling assets in installments. If the first sale on non-cash assets having a book value of P180,000 realizes P100,000 Carl's capital balance was a and all cash available itors is distributed, Weng, Ging loss to be allocated to Allan and Emy would ol. respectively. and Ben; Carl's capital P16,000; P16,000; P8,000 balance was the only capital PO; P26,667; P12,333 balance left with a debit. PO; P6,000; P34,000 Carl lent ABC Partnership o P12, 333; P12,333; P12,334 cash, and the partnership had O Correct answer is not given to pay back the loan to Carl among the choices. before distributing cash to Allan, Ben, and Carl are partners in an ABC Accounting firm. On June 30. Allan and Ben. 2020. the partners de ided to liquidate the partnership because of the financial difficulty experienced during the pandemic. On such date, ABC O After assuming all non-cash Accounting firm had the following fiscal year-end statement of financial assets, were potentially position balances: worthless and that assumed capital deficits created in Assets Liabilities and Equity Allan's and Ben's capital P 4,000 balances were losses to be Accounts Payable P 7.000 allocated to Carl; Carl's Accounts Receivable 6,000 Loan from Ben 5,000 capital balance was the only Inventory 14,000 Allan, Capital 14,000 capital balance left with a credit. Equipment. net 12.000 Ben. Capital 10,000