Answered step by step

Verified Expert Solution

Question

1 Approved Answer

ABC Pty Ltd is a company incorporated in Australia. During the year they received $200,000 from sales of lolly pops in Australia, $50,000 interest from

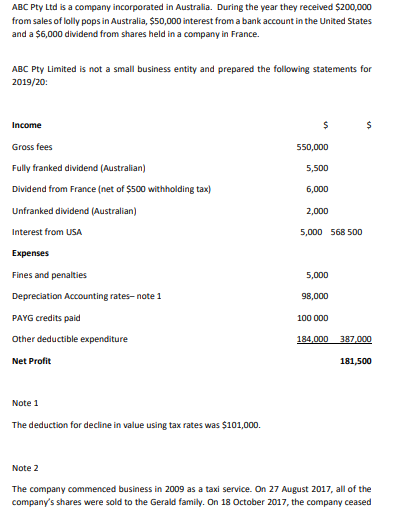

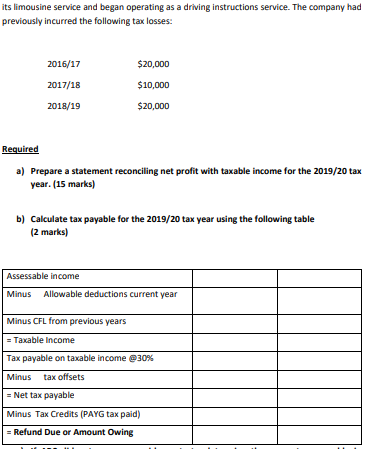

ABC Pty Ltd is a company incorporated in Australia. During the year they received $200,000 from sales of lolly pops in Australia, $50,000 interest from a bank account in the United States and a $6,000 dividend from shares held in a company in France. ABC Pty Limited is not a small business entity and prepared the following statements for 2019/20 Income $ $ 550,000 5,500 Gross fees Fully franked dividend (Australian) Dividend from France (net of $500 withholding tax) Unfranked dividend (Australian) Interest from USA 6,000 2,000 5,000 568 500 Expenses 5,000 98,000 Fines and penalties Depreciation Accounting rates-note 1 PAYG credits paid Other deductible expenditure 100 000 184.000 387,000 Net Profit 181,500 Note 1 The deduction for decline in value using tax rates was $101,000. Note 2 The company commenced business in 2009 as a taxi service. On 27 August 2017, all of the company's shares were sold to the Gerald family. On 18 October 2017, the company ceased its limousine service and began operating as a driving instructions service. The company had previously incurred the following tax losses: 2016/17 $20,000 2017/18 $10,000 2018/19 $20,000 Required a) Prepare a statement reconciling net profit with taxable income for the 2019/20 tax year. (15 marks) b) Calculate tax payable for the 2019/20 tax year using the following table (2 marks) Assessable income Minus Allowable deductions current year Minus CFL from previous years = Taxable income Tax payable on taxable income 30% Minus tax offsets = Net tax payable Minus Tax Credits (PAYG tax paid) = Refund Due or Amount Owing

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started