Answered step by step

Verified Expert Solution

Question

1 Approved Answer

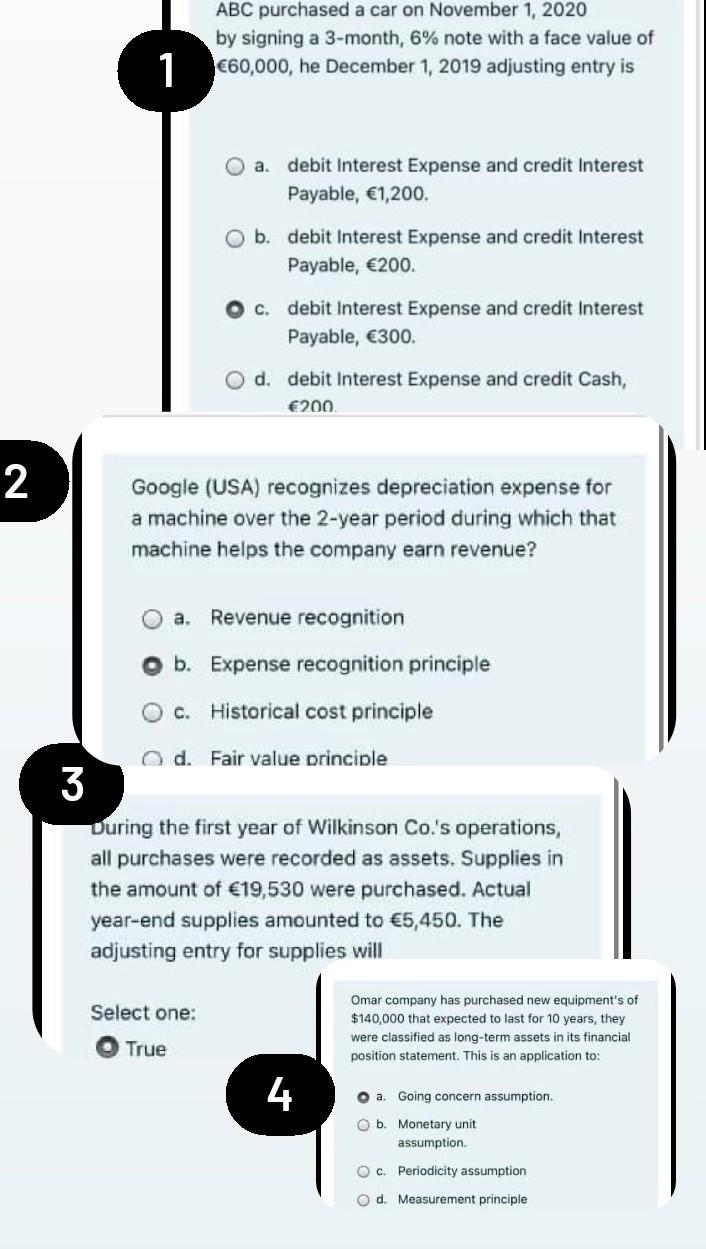

ABC purchased a car on November 1, 2020 by signing a 3-month, 6% note with a face value of 60,000, he December 1, 2019 adjusting

ABC purchased a car on November 1, 2020 by signing a 3-month, 6% note with a face value of 60,000, he December 1, 2019 adjusting entry is 1 O a. debit Interest Expense and credit Interest Payable, 1,200. O b. debit Interest Expense and credit Interest Payable, 200. O c. debit Interest Expense and credit Interest Payable, 300. O d. debit Interest Expense and credit Cash, 200 2 Google (USA) recognizes depreciation expense for a machine over the 2-year period during which that machine helps the company earn revenue? a. Revenue recognition b. Expense recognition principle OC. Historical cost principle O d. Fair value principle 3 During the first year of Wilkinson Co.'s operations, all purchases were recorded as assets. Supplies in the amount of 19,530 were purchased. Actual year-end supplies amounted to 5,450. The adjusting entry for supplies will Select one: Omar company has purchased new equipment's of $140,000 that expected to last for 10 years, they were classified as long-term assets in its financial position statement. This is an application to: True 4 a Going concern assumption. O b. Monetary unit assumption Oc Periodicity assumption O d. Measurement principle

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started