a,b,c,d

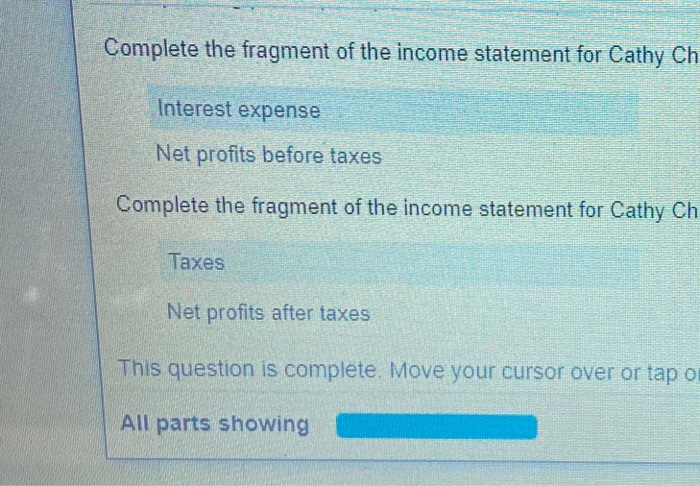

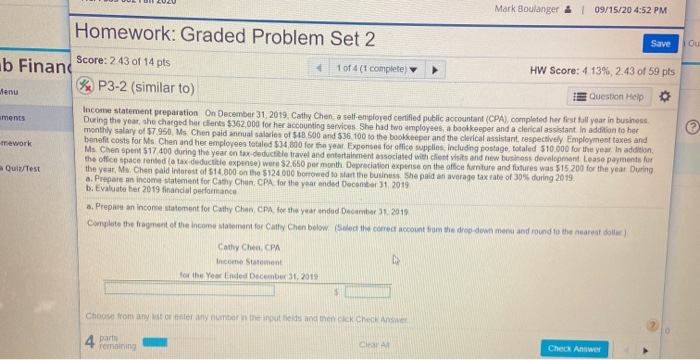

Complete the fragment of the income statement for Less: Operating expenses Salaries Employment taxes and benefits Supplies Travel and entertainment Lease payment This question is complete. Move your cursor over Complete the fragment of the income statement for Cathy Ch Interest expense Net profits before taxes Complete the fragment of the income statement for Cathy Ch Taxes Net profits after taxes This question is complete. Move your cursor over or tap o All parts showing Mark Boulanger 09/15/20 4:52 PM Homework: Graded Problem Set 2 Save Ou b Finand Score: 2 43 of 14 pts 1 of 4 (1 complete) HW Score: 4.13%, 2.43 of 59 pts P3-2 (similar to) Question Help tenu Income statement preparation On December 31, 2019. Cathy Chen a self-employed certified public accountant (CPA), completed her first full year in business aments During the year, she charged her clients 5362,000 for her accounting services She had to employees a bookkeeper and a clerical assistant. In addition to her monthly salary of $7.950. Ms. Chen paid annual salaries of $48.500 and 536,100 to the bookkeeper and the clerical assistant, respectively Employment taxes and mework benefit costs for Ms Chen and her employees totaled 534,800 for the year Expenses for office supplies, including postage, totaled $10.000 for the year. In addition, Ms. Chen spent 517400 during the year on tax deductible travel and entertainment associated with client visits and new business development Lease payments for the office space rented a tax deductible expense) were $2,650 per month Depreciation expense on the office furniture and fixtures was 515.200 for the year During a Quia/Test the year, Ms. Chen paid interest of $14.000 on the 5124000 borrowed to start the business. She paid an average tax rate of 30% during 2019 a. Prepare an income statement for Cathy Chan, CPA for the year ended December 31, 2019 b. Evaluate her 2019 financial performance a. Prepare an income statement for Cathy Chen, CPA for the year anded December 31, 2018 Complete the fragment of the income statement for Cathy Chen below. Select the correct account from the drop down menu and round to the nearest dollar) Cathy Chen, CPA Income Statement for the Year Ended December 31, 2019 $ Choose from any list or eater any number in the input ids and then I Check Answer 4 part remaining Clear Check