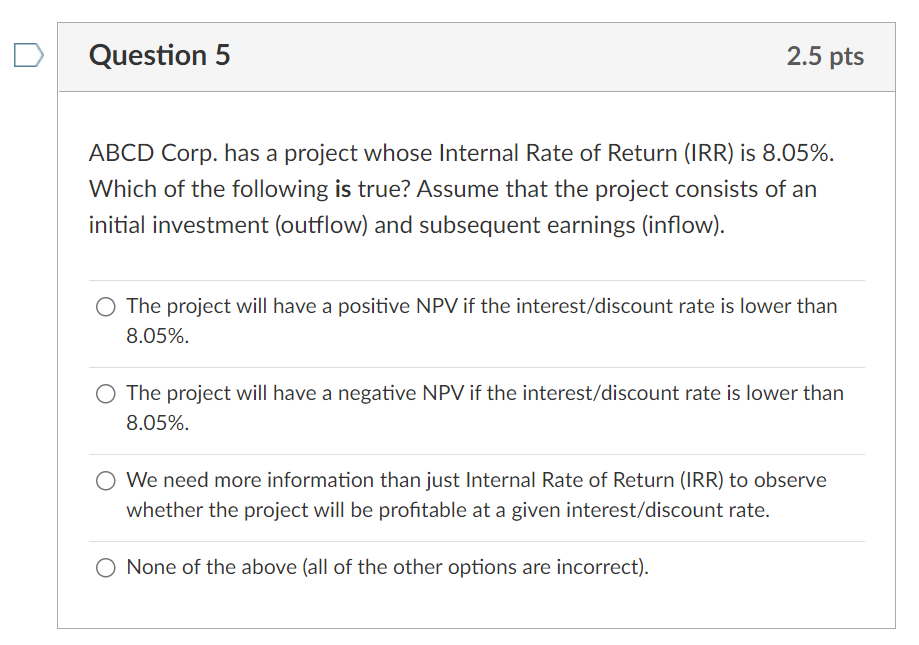

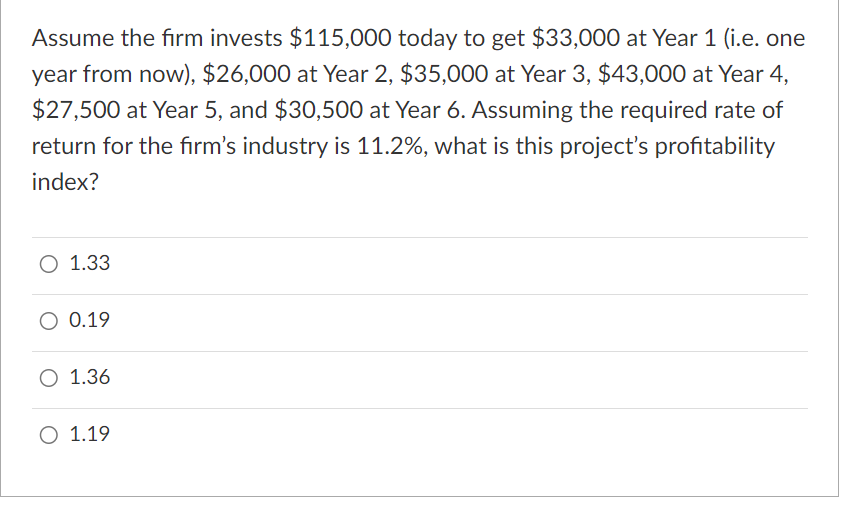

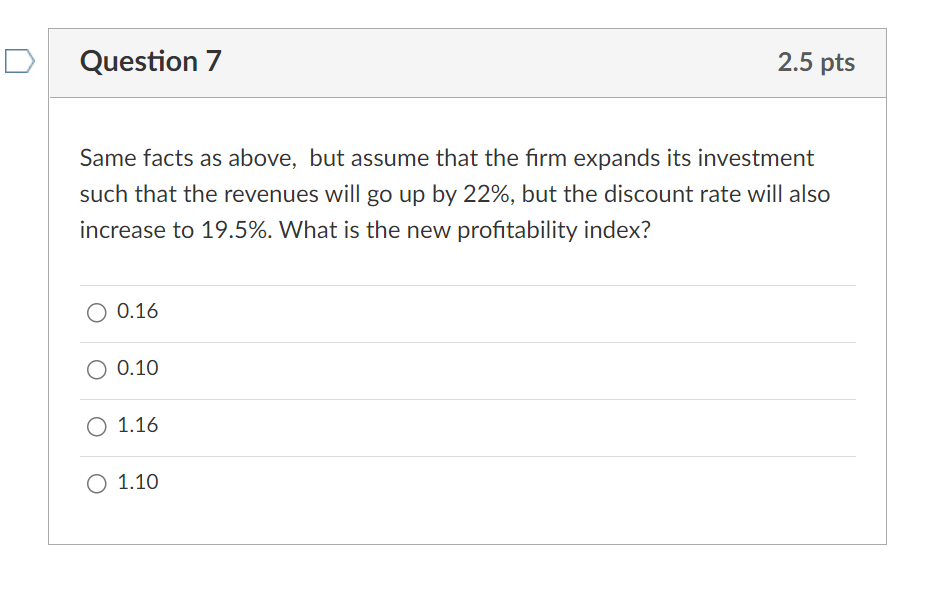

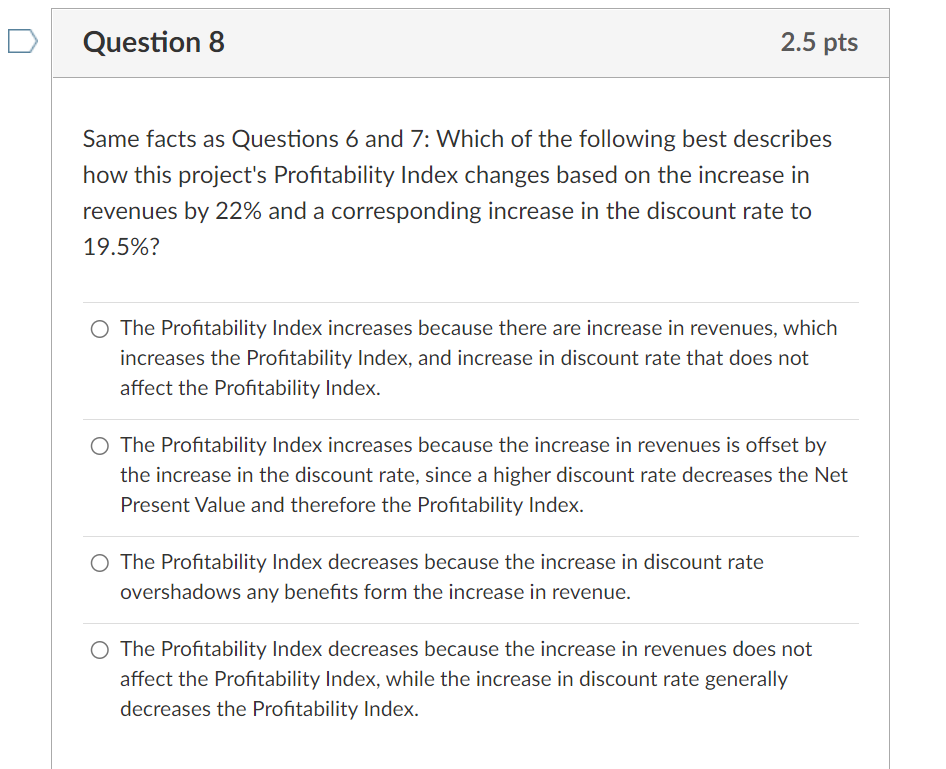

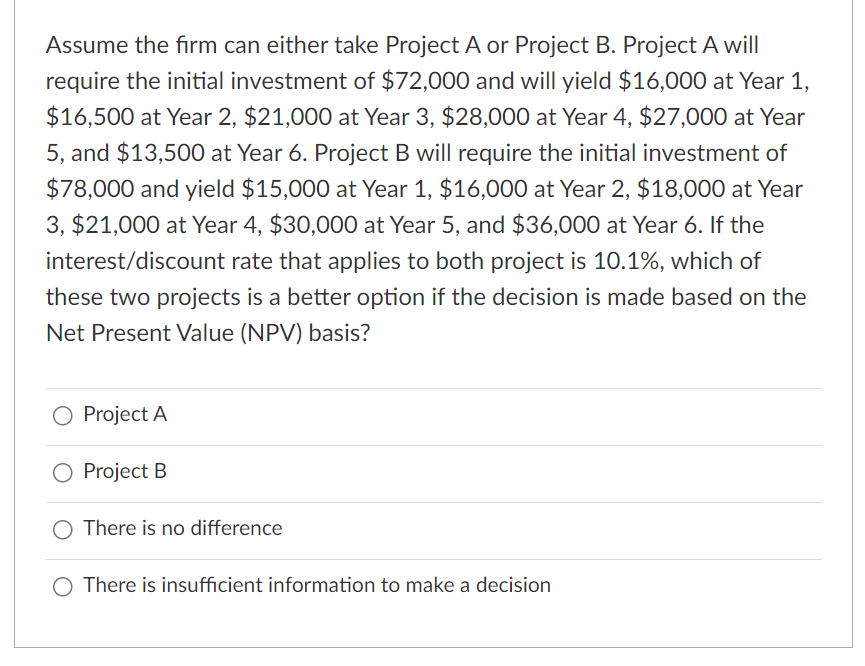

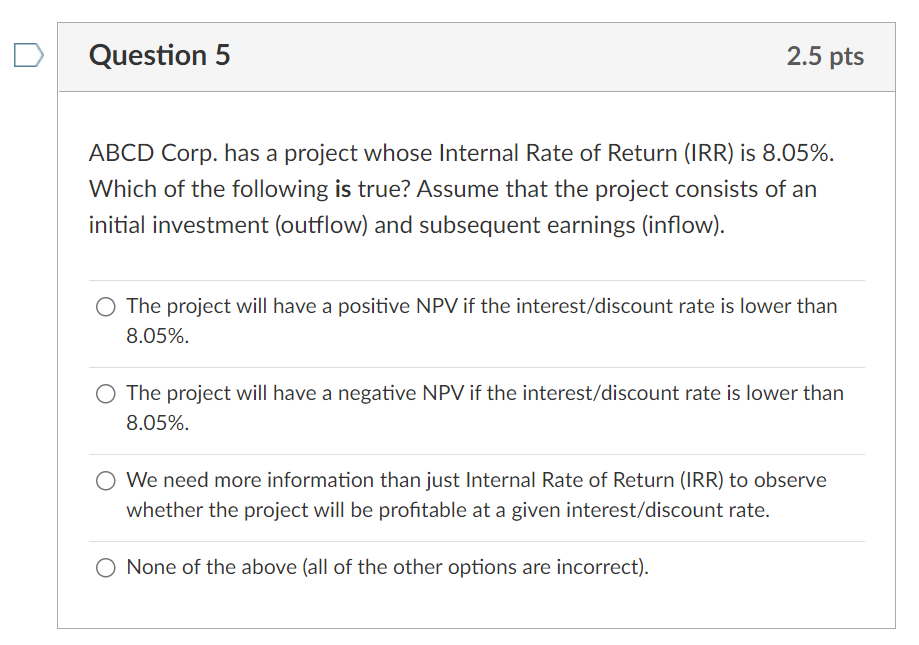

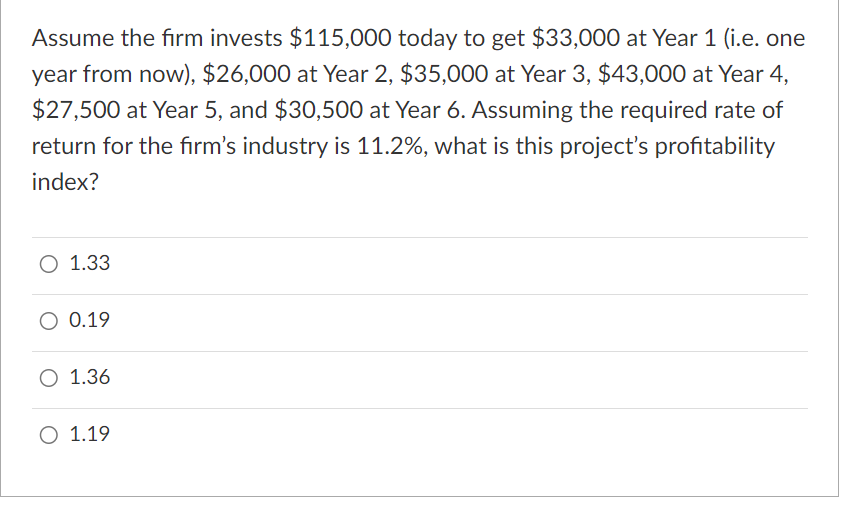

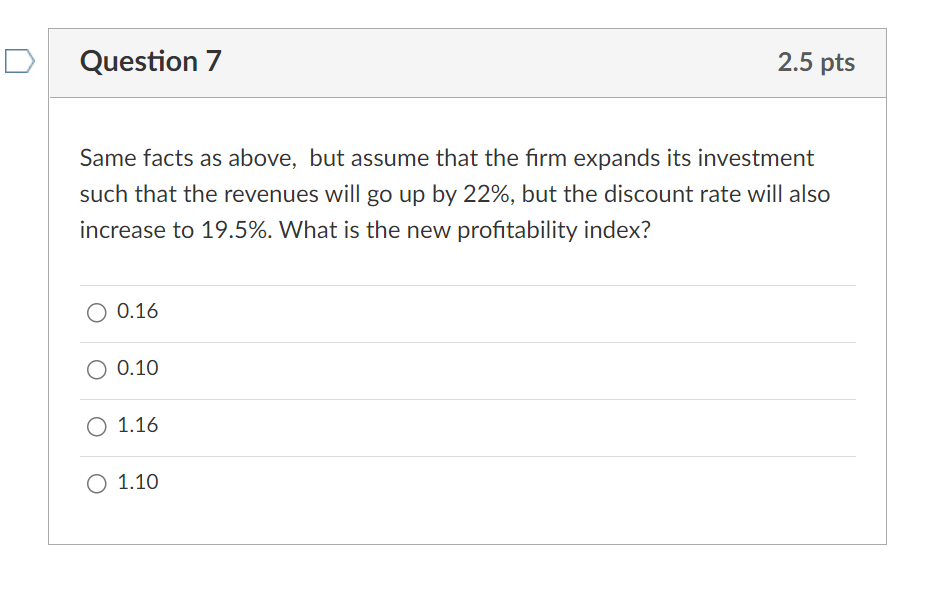

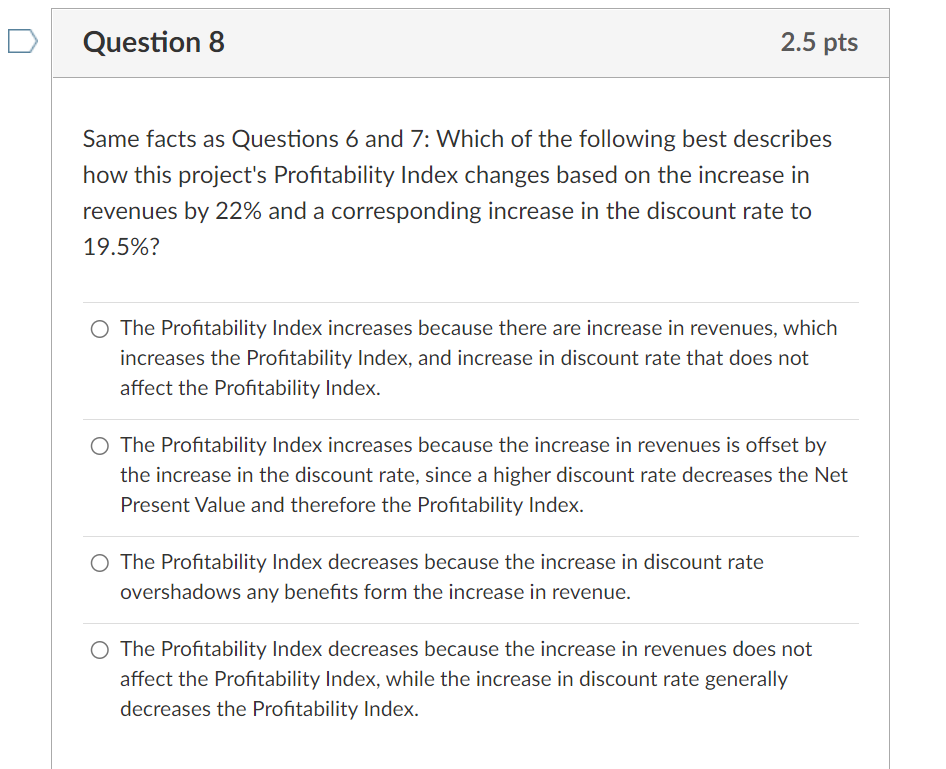

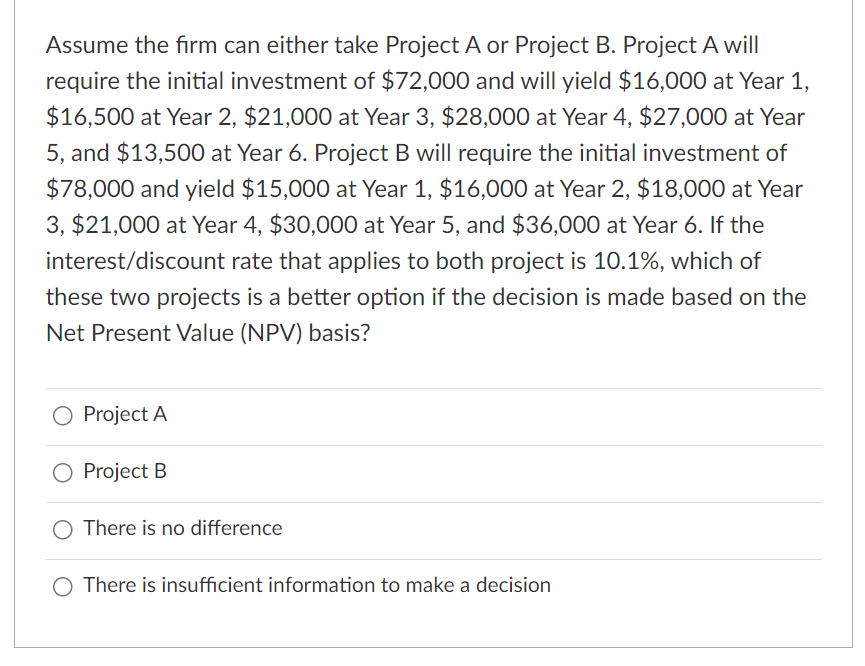

ABCD Corp. has a project whose Internal Rate of Return (IRR) is 8.05%. Which of the following is true? Assume that the project consists of an initial investment (outflow) and subsequent earnings (inflow). The project will have a positive NPV if the interest/discount rate is lower than 8.05%. The project will have a negative NPV if the interest/discount rate is lower than 8.05\%. We need more information than just Internal Rate of Return (IRR) to observe whether the project will be profitable at a given interest/discount rate. None of the above (all of the other options are incorrect). Assume the firm invests $115,000 today to get $33,000 at Year 1 (i.e. one year from now), $26,000 at Year 2,$35,000 at Year 3,$43,000 at Year 4, $27,500 at Year 5 , and $30,500 at Year 6. Assuming the required rate of return for the firm's industry is 11.2%, what is this project's profitability index? 1.33 0.19 1.36 1.19 Same facts as above, but assume that the firm expands its investment such that the revenues will go up by 22%, but the discount rate will also increase to 19.5%. What is the new profitability index? 0.16 0.10 1.16 1.10 Same facts as Questions 6 and 7: Which of the following best describes how this project's Profitability Index changes based on the increase in revenues by 22% and a corresponding increase in the discount rate to 19.5% ? The Profitability Index increases because there are increase in revenues, which increases the Profitability Index, and increase in discount rate that does not affect the Profitability Index. The Profitability Index increases because the increase in revenues is offset by the increase in the discount rate, since a higher discount rate decreases the Net Present Value and therefore the Profitability Index. The Profitability Index decreases because the increase in discount rate overshadows any benefits form the increase in revenue. The Profitability Index decreases because the increase in revenues does not affect the Profitability Index, while the increase in discount rate generally decreases the Profitability Index. Assume the firm can either take Project A or Project B. Project A will require the initial investment of $72,000 and will yield $16,000 at Year 1 , $16,500 at Year 2, $21,000 at Year 3, $28,000 at Year 4, $27,000 at Year 5 , and $13,500 at Year 6. Project B will require the initial investment of $78,000 and yield $15,000 at Year 1,$16,000 at Year 2,$18,000 at Year 3, $21,000 at Year 4, $30,000 at Year 5, and $36,000 at Year 6. If the interest/discount rate that applies to both project is 10.1%, which of these two projects is a better option if the decision is made based on the Net Present Value (NPV) basis? Project A Project B There is no difference There is insufficient information to make a decision