Answered step by step

Verified Expert Solution

Question

1 Approved Answer

ABCJet is a leading major airline which launched in 1996 with 220 passengers and three aircraft flying to five destinations. By 2019, the company

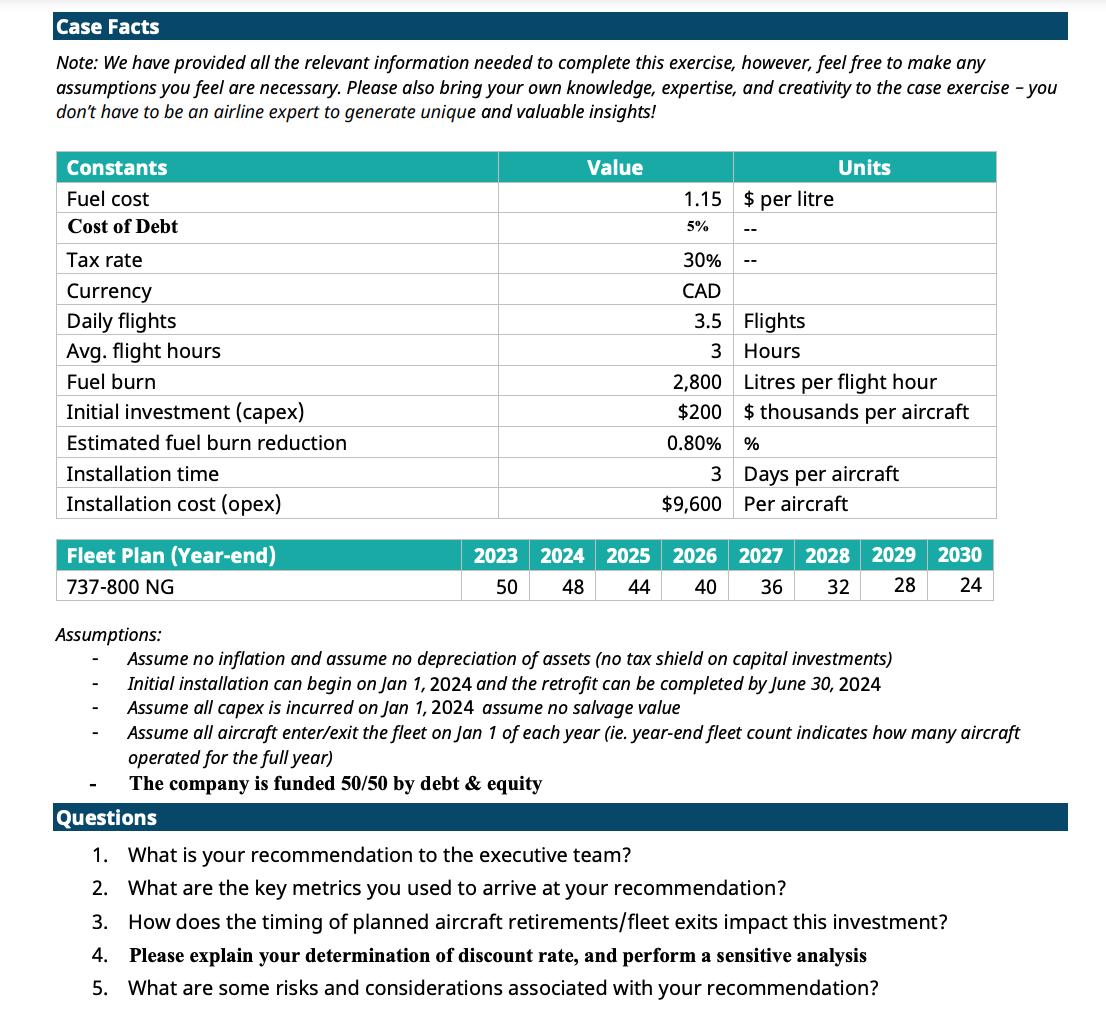

ABCJet is a leading major airline which launched in 1996 with 220 passengers and three aircraft flying to five destinations. By 2019, the company had grown to 180+ aircraft flying to over 100 destinations across the United States, Mexico, Caribbean, Central America, and Europe. Due to the COVID-19 pandemic, ABCJet has had to shift its focus, grounding aircraft and reducing cash burn. As demand began to recovery in 2022, ABCJet announced a new strategic direction that refocuses on three core pillars: 1) West, 2) Leisure, and 3) Low-cost. As a result, ABCJet has placed a significant order for the Boeing 737-10 MAX aircraft. West Strengthen presence and connectivity Concentrate 787 fleet . Serve leisure & corporate community Leisure Expand from communities all over Canada . Leverage Sunwing acquisition, pending regulatory approval Low-Cost Safeguard affordability of our offering - Grow fleet by adding large narrow-body aircraft ABCJet Fleet Team ABCJet's Fleet team was created in 2022 with the mandate to maximize the value of the ABCJet Group's fleet. The team provides guidance and oversight on all fleet related decisions and investments. Key deliverables of the team include: 1) long-term fleet & capacity plan, 2) aircraft operating economics & impacts of future changes, and 3) key industry & competitive fleet trends / opportunities. Scenario You have joined the team and have been tasked with evaluating the retrofit of a new fuel-saving technology on ABCJet's fleet of Boeing 737-800 NG aircraft. The proposed product is a riblet film that is applied to the exterior of the airframe and delivers improved aerodynamic efficiency. You have been instructed to analyze the opportunity and present your recommendations to the Executive Leadership Team (ELT). Case Facts Note: We have provided all the relevant information needed to complete this exercise, however, feel free to make any assumptions you feel are necessary. Please also bring your own knowledge, expertise, and creativity to the case exercise - you don't have to be an airline expert to generate unique and valuable insights! Constants Fuel cost Cost of Debt Tax rate Currency Daily flights Avg. flight hours Fuel burn Initial investment (capex) Estimated fuel burn reduction Installation time Installation cost (opex) Fleet Plan (Year-end) 737-800 NG Assumptions: Value 1.15 $ per litre 5% 2023 2024 2025 50 48 30% CAD -- -- 3.5 Flights 3 Hours 3 $9,600 Units 2,800 Litres per flight hour $200 $ thousands per aircraft 0.80% % Days per aircraft Per aircraft 2026 2027 2028 2029 2030 44 40 36 32 28 24 Assume no inflation and assume no depreciation of assets (no tax shield on capital investments) Initial installation can begin on Jan 1, 2024 and the retrofit can be completed by June 30, 2024 Assume all capex is incurred on Jan 1, 2024 assume no salvage value Assume all aircraft enter/exit the fleet on Jan 1 of each year (ie. year-end fleet count indicates how many aircraft operated for the full year) The company is funded 50/50 by debt & equity Questions 1. What is your recommendation to the executive team? 2. What are the key metrics you used to arrive at your recommendation? 3. How does the timing of planned aircraft retirements/fleet exits impact this investment? 4. Please explain your determination of discount rate, and perform a sensitive analysis 5. What are some risks and considerations associated with your recommendation?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

SOLUTION 1 Recommendation to the executive team Based on the analysis of retrofitting the riblet film on ABCJets fleet of Boeing 737800 NG aircraft my recommendation to the executive team is to procee...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started