Answered step by step

Verified Expert Solution

Question

1 Approved Answer

ABC's tax accounting methods and GAAP accounting methods are the same except for the method used to account for earned but uncollected service revenues.

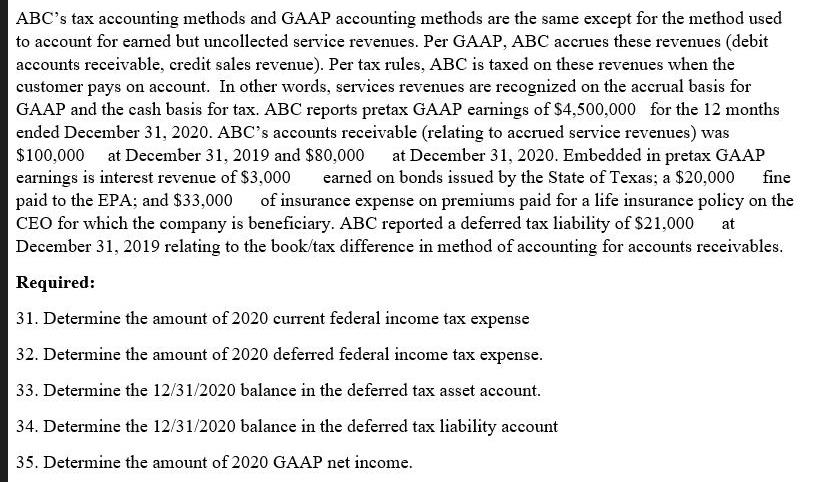

ABC's tax accounting methods and GAAP accounting methods are the same except for the method used to account for earned but uncollected service revenues. Per GAAP, ABC accrues these revenues (debit accounts receivable, credit sales revenue). Per tax rules, ABC is taxed on these revenues when the customer pays on account. In other words, services revenues are recognized on the accrual basis for GAAP and the cash basis for tax. ABC reports pretax GAAP earnings of $4,500,000 for the 12 months ended December 31, 2020. ABC's accounts receivable (relating to accrued service revenues) was $100,000 at December 31, 2019 and $80,000 at December 31, 2020. Embedded in pretax GAAP earnings is interest revenue of $3,000 earned on bonds issued by the State of Texas; a $20,000 fine paid to the EPA; and $33,000 of insurance expense on premiums paid for a life insurance policy on the CEO for which the company is beneficiary. ABC reported a deferred tax liability of $21,000 at December 31, 2019 relating to the book/tax difference in method of accounting for accounts receivables. Required: 31. Determine the amount of 2020 current federal income tax expense 32. Determine the amount of 2020 deferred federal income tax expense. 33. Determine the 12/31/2020 balance in the deferred tax asset account. 34. Determine the 12/31/2020 balance in the deferred tax liability account 35. Determine the amount of 2020 GAAP net income.

Step by Step Solution

★★★★★

3.33 Rating (144 Votes )

There are 3 Steps involved in it

Step: 1

Answer To solve this problem we need to use the information provided to calculate the various taxrel...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started