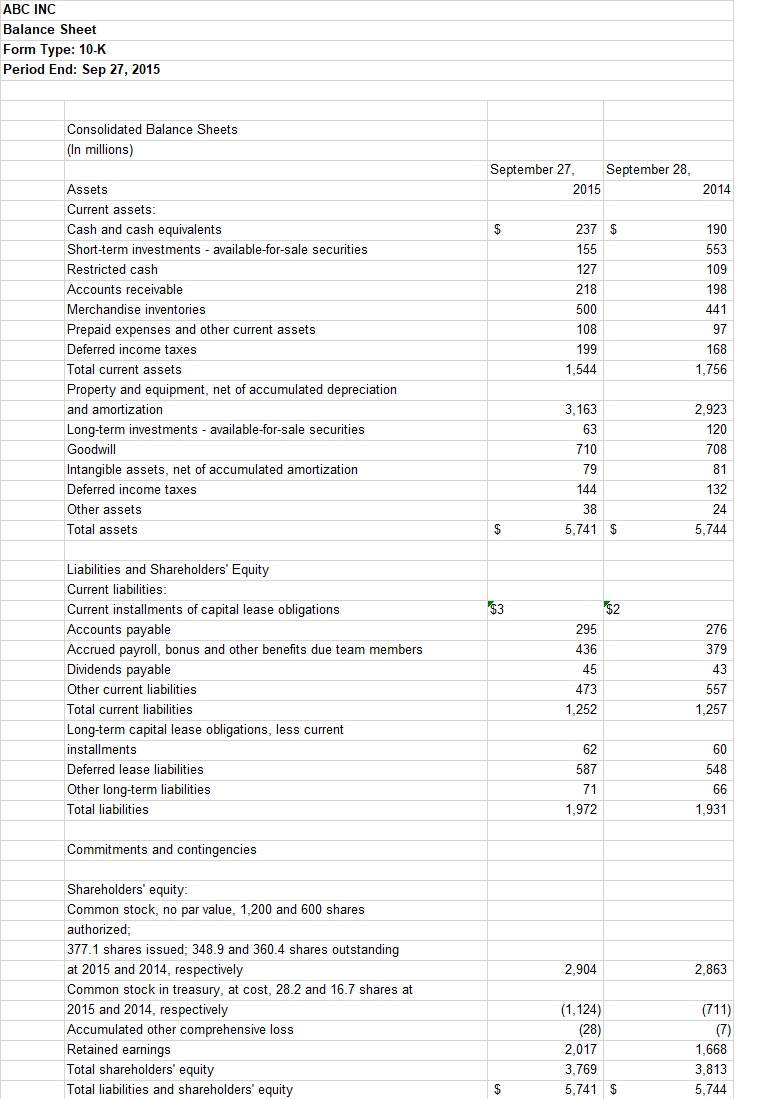

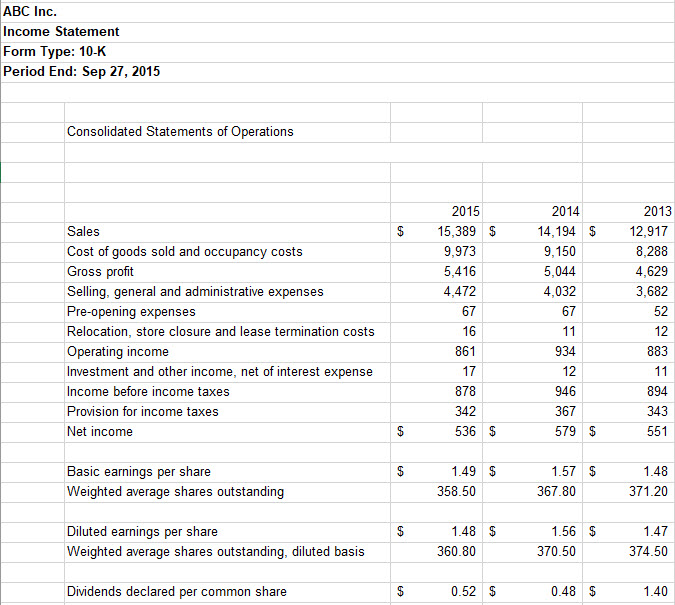

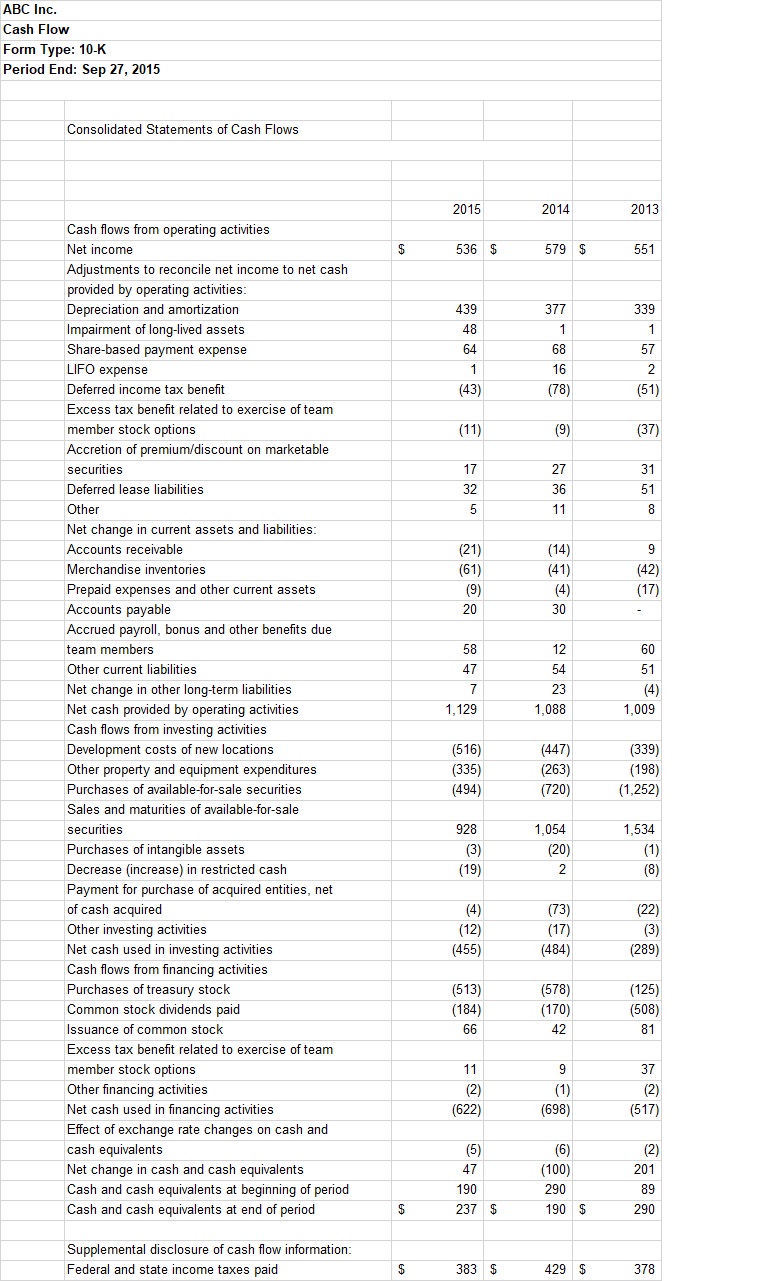

ABE IHC Balance Sheet Form Type: 10-K Period End: 59p 2]", 2015 Consolidated Balance Sheets [In millions} September 2?, September 25, Assets 2015 2014 Current assets: Cash and cash equivalents $ 23? $ 150 Short-term investments - availableforsale securities 155 553 Restricted cash 12? 100 Accounts receivable 215 158 Merchandise inventories 500 441 Prepaid expenses and other current assets 105 5? Deferred income taxes 105 158 Total current assets 1,544 1,?55 Property and equipment, net of accumulated depreciation and amortization 3,153 2,523 Longterm investments availableforsale securities 53 120 Goodwill F10 T08 Intangible assets, net of accumulated amortization T5 51 Deferred income taxes 144 132 Other assets 35 24 Total assets 5 5,?41 $ 5,?44 Liabilities and Shareholders' Equity Current liabilities: Current installments of capital lease obligations $3 '52 Accounts payable 255 2i'5 Accrued payroll, bonus and other benets due team members 435 3?5 Dividends payable 45 43 Other current liabilities 4T3 55?Ir Total current liabilities 1,252 1,25? Long-term capital lease obligations, less current installments 52 50 Deferred lease liabilities 58? 545 Other long-term liabilities T1 55 Total liabilities 1,5?2 1,531 Commitments and contingencies Shareholders' equity: Common stock, no par value, 1,200 and 500 shares authorized; 3Ti".1 shares issued; 345.3 and 350.4 shares outstanding at 2015 and 2014, respectively 2,504 2,553 Common stock in treasury, at cost, 20.2 and 15.?r shares at 2015 and 2014, respectively {1,124} [711} Accumulated other comprehensive loss {25} {T} Retained earnings 2,01 i" 1,555 Total shareholders' equity 3,?55 3,513 Total liabilities and shareholders' equity 5 5,741 $ 5,?44 ABC Inc. Income Statement Form Type: 10-K Period End: Sep 27, 2015 Consolidated Statements of Operations 2015 2014 2013 Sales 15,389 $ 14, 194 $ 12,917 Cost of goods sold and occupancy costs 9,973 9,150 8,288 Gross profit 5,416 5,044 4,629 Selling, general and administrative expenses 4,472 4,032 3,682 Pre-opening expenses 67 67 52 Relocation, store closure and lease termination costs 16 11 12 Operating income 861 934 383 Investment and other income, net of interest expense 17 12 11 Income before income taxes 878 946 894 Provision for income taxes 342 367 343 Net income $ 536 $ 579 $ 551 Basic earnings per share 1.49 $ 1.57 $ 1.48 Weighted average shares outstanding 358.50 367.80 371.20 Diluted earnings per share $ 1.48 $ 1.56 $ 1.47 Weighted average shares outstanding, diluted basis 360.80 370.50 374.50 Dividends declared per common share 0.52 $ 0.48 $ 1.40ABC Inc. Cash Flow Form Type: 10-K Period End: Sep 27, 2015 Consolidated Statements of Cash Flows 2015 2014 2013 Cash flows from operating activities Net income $ 536 $ 679 $ 551 Adjustments to reconcile net income to net cash provided by operating activities: Depreciation and amortization 439 377 339 Impairment of long-lived assets 48 Share-based payment expense 64 68 57 LIFO expense 16 2 Deferred income tax benefit (43) (78) (51) Excess tax benefit related to exercise of team member stock options (11) (9) (37) Accretion of premium/discount on marketable securities 17 27 31 Deferred lease liabilities 32 36 51 Other 5 11 8 Net change in current assets and liabilities: Accounts receivable (21) (14) 9 Merchandise inventories (61) (41) (42) Prepaid expenses and other current assets (9) (4) (17) Accounts payable 20 30 Accrued payroll, bonus and other benefits due team members 58 12 60 Other current liabilities 47 54 51 Net change in other long-term liabilities 7 23 (4) Net cash provided by operating activities 1,129 1,088 1,009 Cash flows from investing activities Development costs of new locations (516) (447) (339) Other property and equipment expenditures 335) (263) (198) Purchases of available-for-sale securities (494) 720) (1,252) Sales and maturities of available-for-sale securities 928 1,054 1,534 Purchases of intangible assets (3) (20) (1) Decrease (increase) in restricted cash (19) 2 (8) Payment for purchase of acquired entities, net of cash acquired (4) (73) (22) Other investing activities (12) (17) (3) Net cash used in investing activities (455) (484) (289) Cash flows from financing activities Purchases of treasury stock (513) (578) (125) Common stock dividends paid (184) (170) (508) Issuance of common stock 66 42 81 Excess tax benefit related to exercise of team member stock options 11 9 37 Other financing activities (2) (1) (2) Net cash used in financing activities 622 698 (517) Effect of exchange rate changes on cash and cash equivalents (5) (6) (2) Net change in cash and cash equivalents 47 100) 201 Cash and cash equivalents at beginning of period 190 290 89 Cash and cash equivalents at end of period $ 237 $ 190 $ 290 Supplemental disclosure of cash flow information: Federal and state income taxes paid 383 $ 429 $ 378