Problem 3 and 4

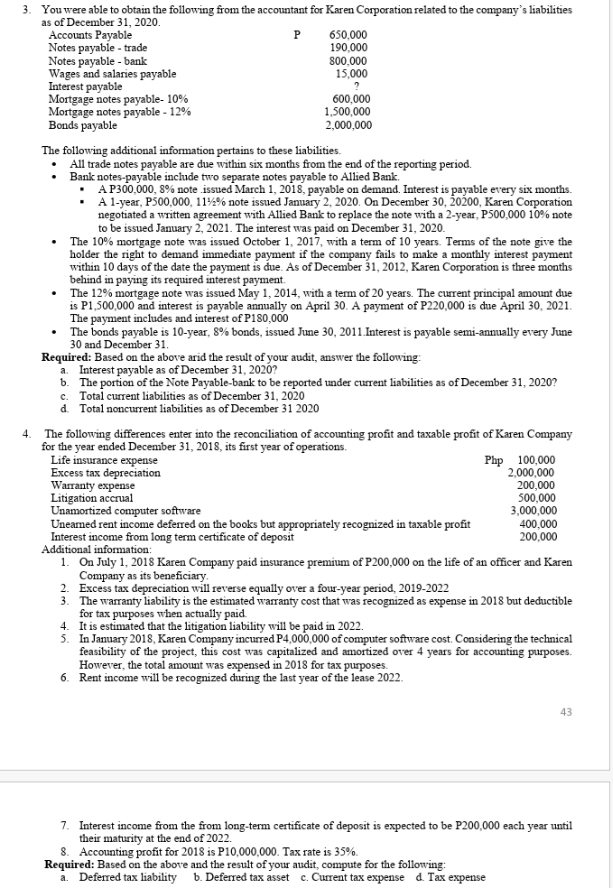

3. You were able to obtain the following from the accountant for Karen Corporation related to the company's liabilities as of December 31, 2020. Accounts Payable P 650,000 Notes payable - trade 190,000 Notes payable - bank 800,000 Wages and salaries payable 15,000 Interest payable Mortgage notes payable- 10% 600,000 Mortgage notes payable - 12% 1,500,000 Bonds payable 2,000,000 The following additional information pertains to these liabilities. All trade notes payable are due within six months from the end of the reporting period. Bank notes-payable include two separate notes payable to Allied Bank. A P300,000, 8% note .issued March 1, 2018, payable on demand. Interest is payable every six months. A 1-year, P500,000, 1192% note issued January 2, 2020. On December 30, 20200, Karen Corporation negotiated a written agreement with Allied Bank to replace the note with a 2-year, P500,000 10% note to be issued January 2, 2021. The interest was paid on December 31, 2020. The 10% mortgage note was issued October 1, 2017, with a term of 10 years. Terms of the note give the holder the right to demand immediate payment if the company fails to make a monthly interest payment within 10 days of the date the payment is due. As of December 31, 2012, Karen Corporation is three months behind in paying its required interest payment. The 12% mortgage note was issued May 1, 2014, with a term of 20 years. The current principal amount due is P1,500,000 and interest is payable annually on April 30. A payment of P220,000 is due April 30, 2021. The payment includes and interest of P180,000 The bonds payable is 10-year, 8% bonds, issued June 30, 2011.Interest is payable semi-annually every June 30 and December 31. Required: Based on the above arid the result of your audit, answer the following: a. Interest payable as of December 31, 2020? b. The portion of the Note Payable-bank to be reported under current liabilities as of December 31, 2020? C. Total current liabilities as of December 31, 2020 Total noncurrent liabilities as of December 31 2020 4. The following differences enter into the reconciliation of accounting profit and taxable profit of Karen Company for the year ended December 31, 2018, its first year of operations. Life insurance expense Php 100,000 Excess tax depreciation 2,000,000 Warranty expense 200,000 Litigation accrual 500,000 Unamortized computer software 3,000,000 Unearned rent income deferred on the books but appropriately recognized in taxable profit 400,000 Interest income from long term certificate of deposit 200,000 Additional information: 1. On July 1, 2018 Karen Company paid insurance premium of P200,000 on the life of an officer and Karen Company as its beneficiary. 2. Excess tax depreciation will reverse equally over a four-year period, 2019-2022 3. The warranty liability is the estimated warranty cost that was recognized as expense in 2018 but deductible for tax purposes when actually paid. It is estimated that the litigation liability will be paid in 2022. 5. In January 2018, Karen Company incurred P4,000,000 of computer software cost. Considering the technical feasibility of the project, this cost was capitalized and amortized over 4 years for accounting purposes. However, the total amount was expensed in 2018 for tax purposes. 6. Rent income will be recognized during the last year of the lease 2022. 43 7. Interest income from the from long-term certificate of deposit is expected to be P200,000 each year until their maturity at the end of 2022. 8. Accounting profit for 2018 is P10,000,000. Tax rate is 35%. Required: Based on the above and the result of your audit, compute for the following: a. Deferred tax liability b. Deferred tax asset c. Current tax expense d. Tax expense