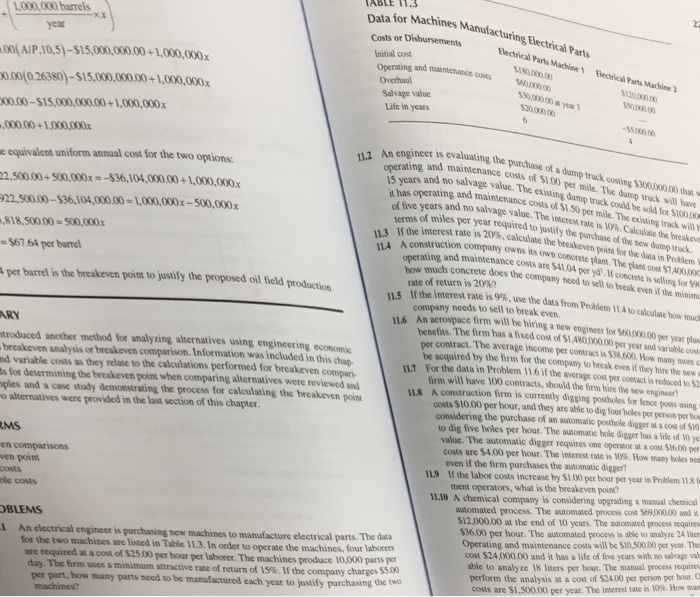

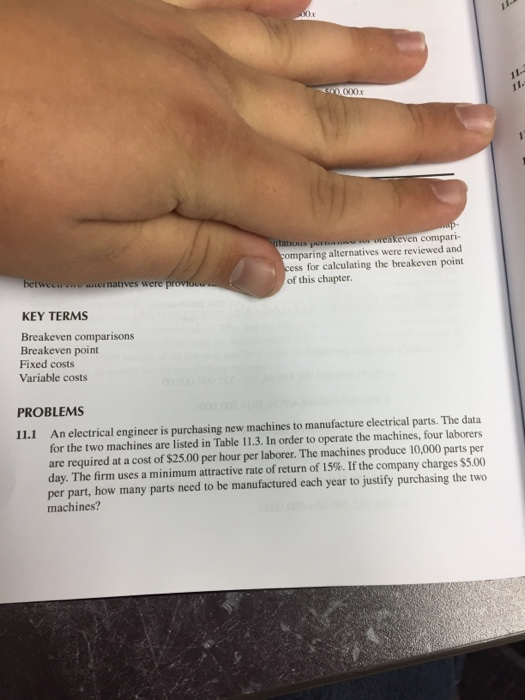

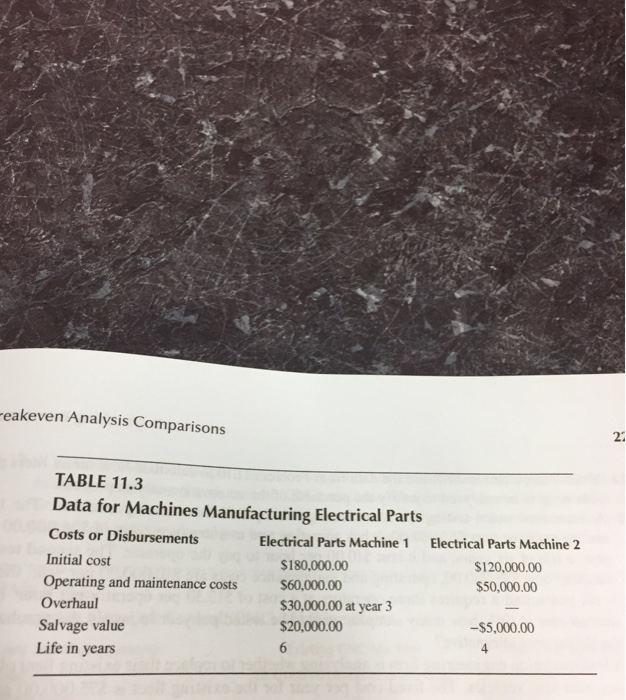

ABLE T1.3 Machines Manufacturing Electrical Parts 1,000,000 barrels Costs or Disbursements year Electrical Parts Machine 1 Electrical Parts initial cost 10 000 00AIP.10.5)-$15,000,000.00+1,000,000x 0.00(0.26380)-$15,000,000.00+1,000,000x 00.00-$15,000,000.00+1,000,000x 000.00+1,000,000x e equivalent uniform annual cost for the two options: 22,500.00+500,000x-$36,104,000.00+1,000,000x 22.500.00-$36,104,000.00-1,000,000x-500,000x ,818,500.00 = 500,000x and maintenance cons$600000 Machine 2 $130000 5000.00 Ovethaul Salvage value Life in years 30,000 00 ycar 2000000 -S500000 is evaluating the purchase of a dump truck costing $300,000.00 ha aintenance costs of $1.00 per mile. The dump truck will have operatins and no salvage value. The existing dump truck could be sold for $1000%0 t has operating and maintenance costs of $1.50 of five years and no salvage value. The inkcres terms of miles per year required to justify the Ifthe interest rate is 20%, calculate the breakeven point forthe per mile. The exising truck will b rate is 10%. Calculate the breakew of the new dump truck data in Problem construction company owns its own concrete plant. The plant cos $7,40000 ng and maintenance costs are $41.04 per yd). If concrete is sel per yd'.If concrete is selling for $9 how much concrete does the company ned to ell to break even if the minim $67.64 per barrel rate of return is 20%? per barrel is the breakeven point to justify the proposed oil field production the interest rate is 9%, use the data from Problem 11.4 to calculate how much company needs to sell to break even An acrospace firm will be hiring a new engineer for $60,000.00 per year plus benefius. The firm has a fixed cost of S1.480,000.0) per year and variable cos per contract. The average income per contract is $38,600. How many moe o be acquired by the frm for the company to break even if they hire the new For the data in Problem 11.,6 if the average cost per contact is reduced to $2 ARY troduced another method for analyzing alternatives using engineering economic breakeven analysis or breakeven comparison. Information was included in this chap d variable costs as they relate to the calculations performed for breakeven compar irm will have 100 contracts, should the firm hire the new engineer s for determining the breakeven point when comparing alternatives were reviewed and ples and a case study demonstrating the process for calculating the breakeven point o alternatives were provided in the last section of this chapter costs $10.00 per hour, and they are able to dig four holes per person per b considering the purchase of an automatic posthole digger at a cost of $10 to dig five holes per hour The automatic hole digger has a life of ye value. The automatic digger requires one operalor at a cost S16.00 per MS costs are S400 per hour. The interest rate is 0%. How many holes n even if the firm purchases the automatic digger en en point costs ble costs sons 119 If the labor costs increase by $1.00 per hour per year in Problem 118 11.10 A chemical company is considering upgrading a mamual chemical automated process. The automated process cost $69,000.00 and i S12,00000 at the end of 10 years. The automated process requires ment operators, what is the breakeven poinc $36.00 per hour. The automated process is able to analyze 24 Iinte Operating and maintenance costs will be $10,500.00 per year. T cost $24,000.00 and it has a life of five years with no salvage va able to analyze 18 liters per hour. The manual process requires perform the analysis at a cost of $24.00 per person per bour. C BLEMS 1 An electrical engineer is purchasing new machines to manufacture electrical parts. The for the two machines are listed in Table 11.3. In ordet to operate the machines, four laborers are required at a cost of $25.00 per hour per laborer. The machines produce 10,000 parts per day. The firm uses a minimum attractive rate of return of 15%. If the company charges S500 costs are $1,500.00 per year. The interest rate is 10%. How man per part, how mamy parts need to be manufactured each year to justify purchasing the two eakeven Analysis Comparisons TABLE 11.3 Data for Machines Manufacturing Electrical Parts Costs or Disbursements Initial cost Operating and maintenance costs $60,000.00 Overhaul Electrical Parts Machine 2 $120,000.00 $50,000.00 Electrical Parts Machine 1 $180,000.00 30,000.00 at year 3 $20,000.00 -$5,000.00 Salvage value Life in years 4