Answered step by step

Verified Expert Solution

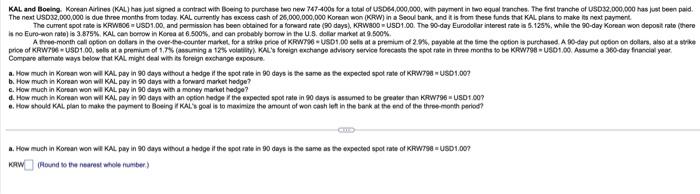

Question

1 Approved Answer

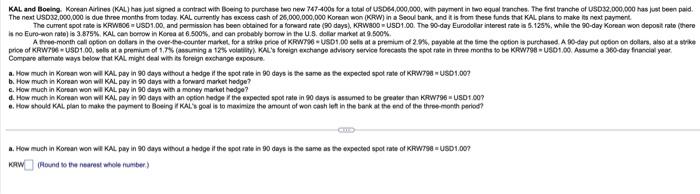

please answer entire question a,b,c,d,and e with steps shown. Compare atomate ways below that KAL might deal whib is loreign exchange exposure. a. How much

please answer entire question a,b,c,d,and e with steps shown.

Compare atomate ways below that KAL might deal whib is loreign exchange exposure. a. How much in Korosn won wil KAL pey in 90 days without a hedpe it the soot rale in 90 days is the same as te expectad spot rale of KRWT99 = USD1.00? b. How much in Korean won wal KAL. pay in 90 days with a forward market hadge? e. How much in Koroan won well KAL pay in 90 days with a money markot hedgo? e. How should KAL plan to make the poyment to Boeing i KCAl: goal is to maximise the amsunt of wen cash ioth in the bank at the end of the three-month perion? a. How much in Korpan won wil KAL poy in 90 days wibout a hedge it the spot nate in 90 days is the same as the expected spot rate of KRWT99 = USDi:00n rim (Fiound so the nearest whote number)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started