Answered step by step

Verified Expert Solution

Question

1 Approved Answer

About the companies TanCorp is a Chinese subsidiary of TechSmart Inc., a U . S . technology manufacturer. TanCorp and TechSmart have a 1 2

About the companies

TanCorp is a Chinese subsidiary of TechSmart Inc., a US technology manufacturer. TanCorp and TechSmart have a Y year end.

Foreign currency transaction

On November Y TechSmart sells services to a Chinese customer not TanCorp at a price of Yuan. This account was still unpaid by the customer on Y The customer is expected to pay on January Y

To protect against foreign currency risk associated with this transaction, on November Y TechSmart entered into a forward contract to sell Yuan on January Y TechSmart properly documented this transaction and designated the contract as a fair value hedge.

Note: The financial statements provided in the Excel template DO NOT include the effects of the foreign currencyhedging transactions described above or the original journal entry to record the sale. You will need to update the TechSmart financials to include these transactions on the tab titled Updated TS FS

Exchange rates

Relevant exchange rates are provided in the Excel template.

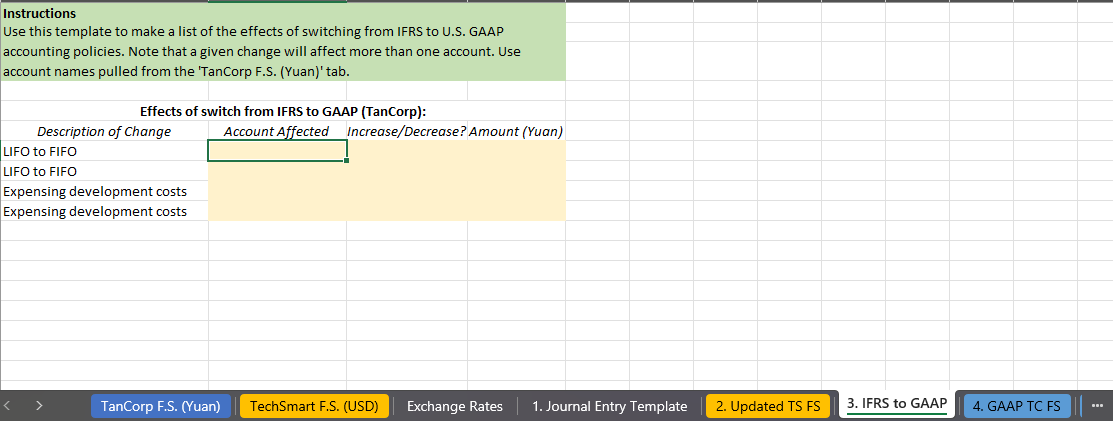

Accounting policies

TechSmart uses LIFO for its consolidated financial statements. TanCorp cannot use LIFO for reporting purposes; thus, their subsidiaryonly financial statements utilize FIFO. Ending inventory measured under LIFO would be Yuan lower than when measured using FIFO; COGS would be higher.

TanCorp capitalized Yuan in development costs on December Y as part of their Other Intangible Asset balance. Because this expenditure was made on Y no amortization was recorded during Y

These changes affect TanCorps financial income but not their taxable income reported to the Chinese government. Thus, these changes will have no effect on TanCorps income tax expense.

Financial statement translation

TanCorps Y income statement and balance sheet are presented in Chinese Yuan see Excel template, available in Canvas TechSmarts parentonly financial statements are also presented in the Excel template.

TechSmart management has deemed that the Yuan is deemed to be the functional currency of TanCorp. All stock was issued at Y when TanCorp was incorporated as a subsidiary.

Translated ending retained earnings at Y were $

Financial statement consolidation

TechSmart owns of TanCorp. TanCorp is TechSmarts only majorityowned subsidiary. TanCorp declared and paid Yuan in dividends on Y all to TechSmart.

At the time of acquisition on Y TanCorps translated stockholders equity section was as follows:

Common stock: $

APIC common stock: $

Retained earnings: $

TanCorp is a whollyowned subsidiary. When it was acquired, TechSmart paid consideration exactly equal to the book value of TanCorp. There were no intercompany transactions between the two companies during the year other than the dividend declared by TanCorp. TechSmart uses the cost method to account for this investment during the year. Because TanCorp began operations on Y and paid no dividends in Y the Y balance of retained earnings is equal to TanCorps Y net income.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started