Answered step by step

Verified Expert Solution

Question

1 Approved Answer

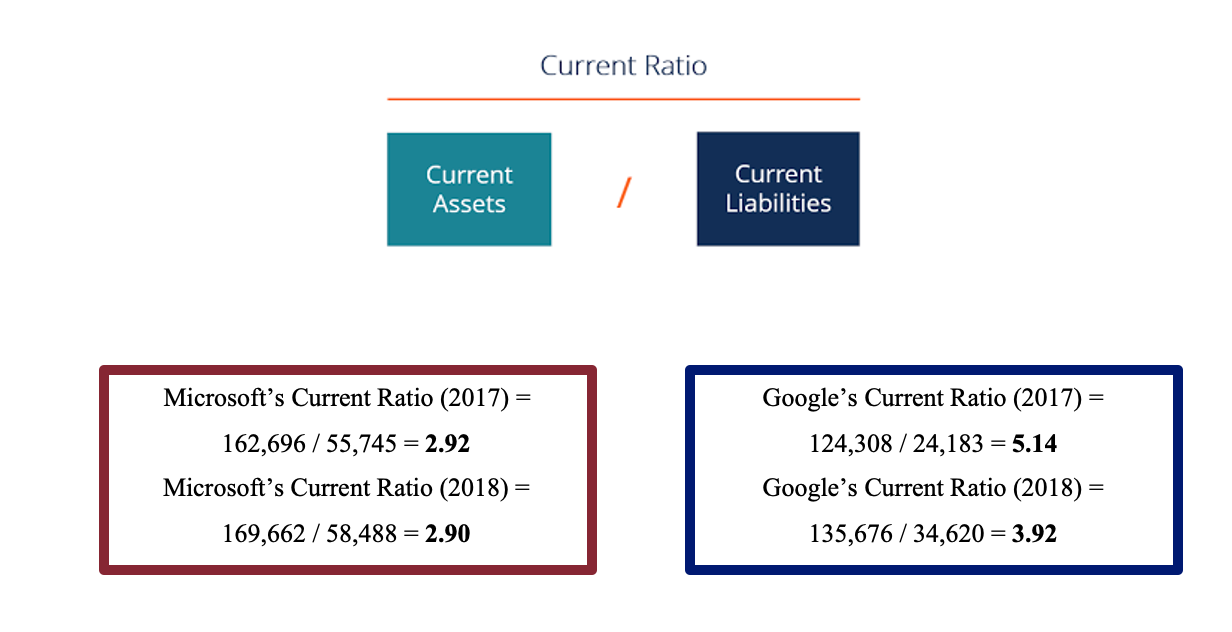

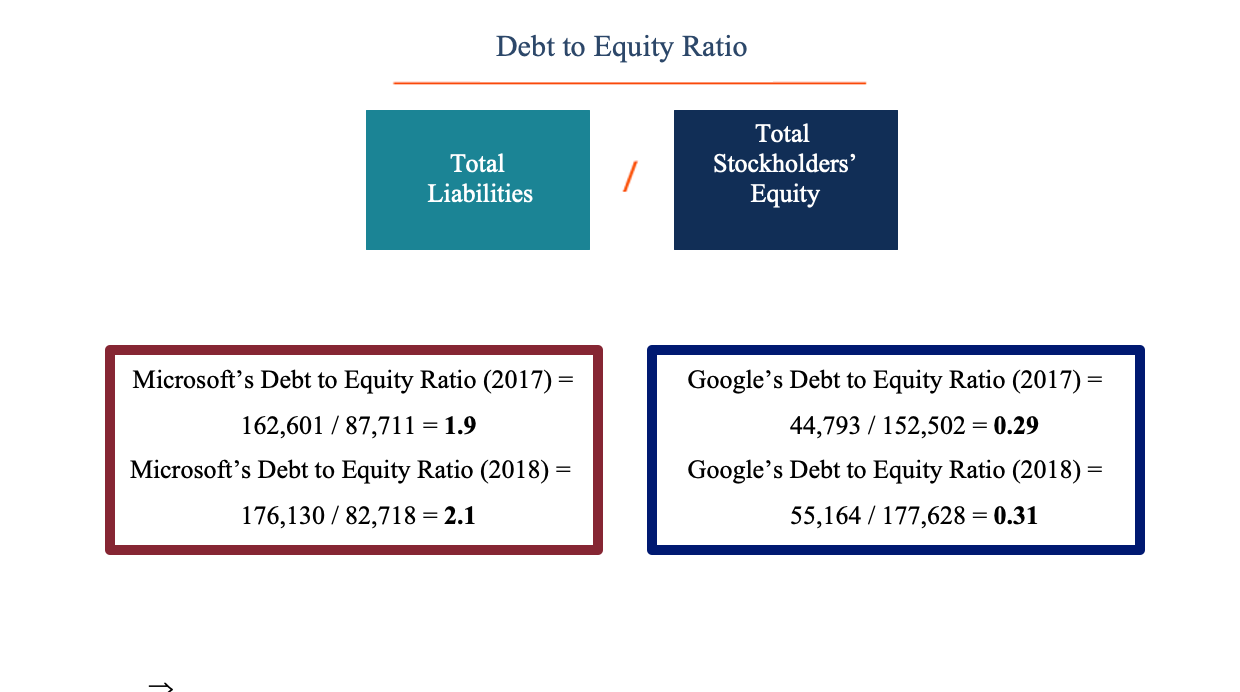

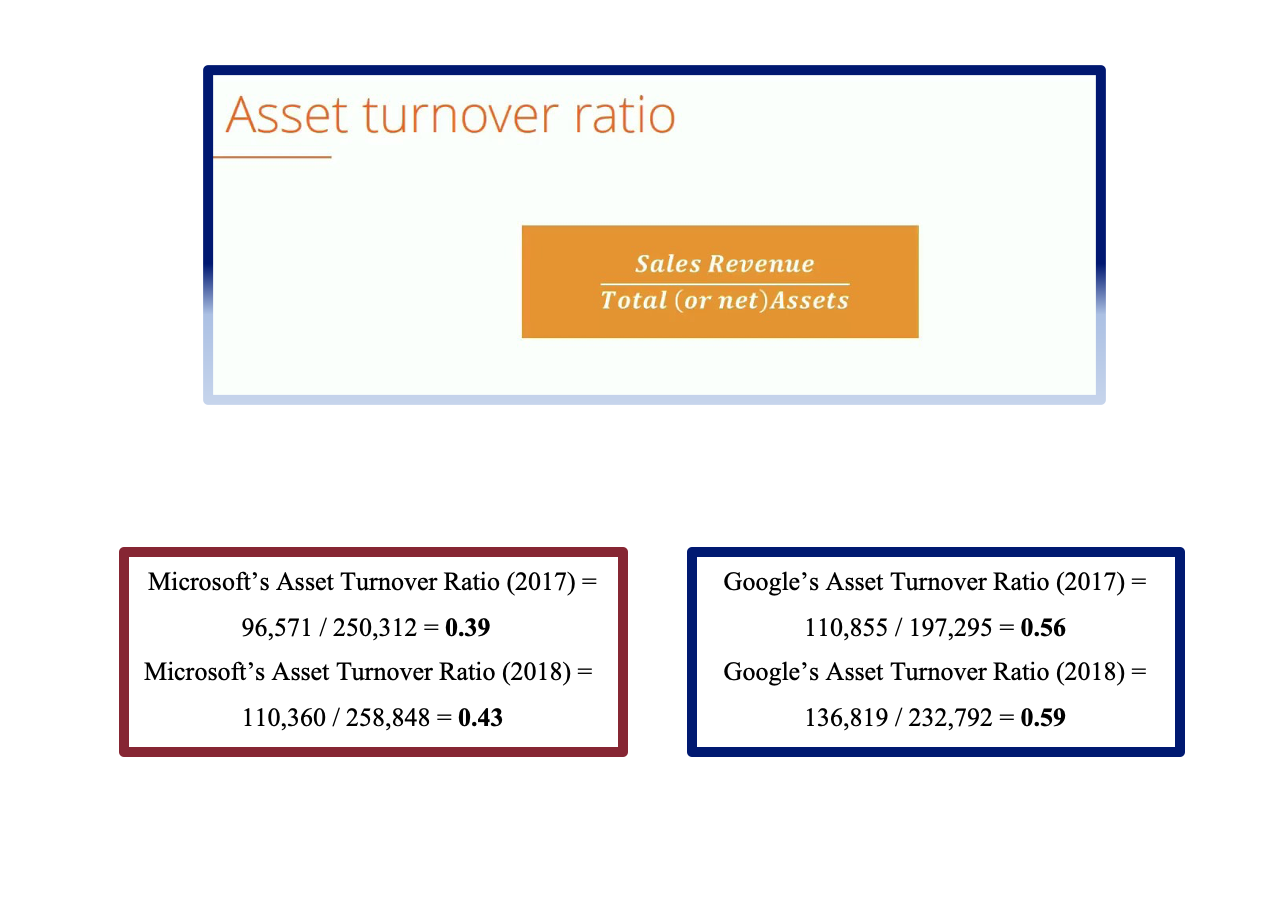

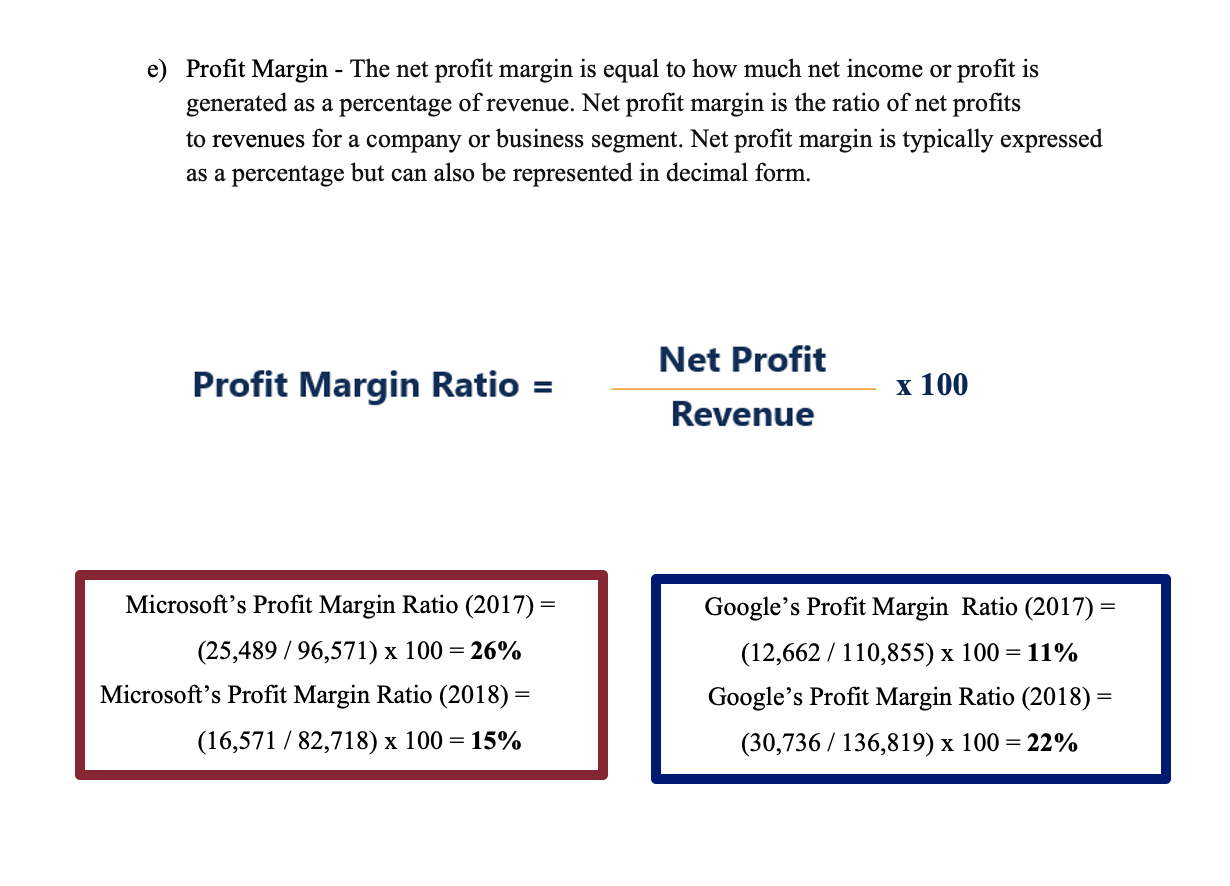

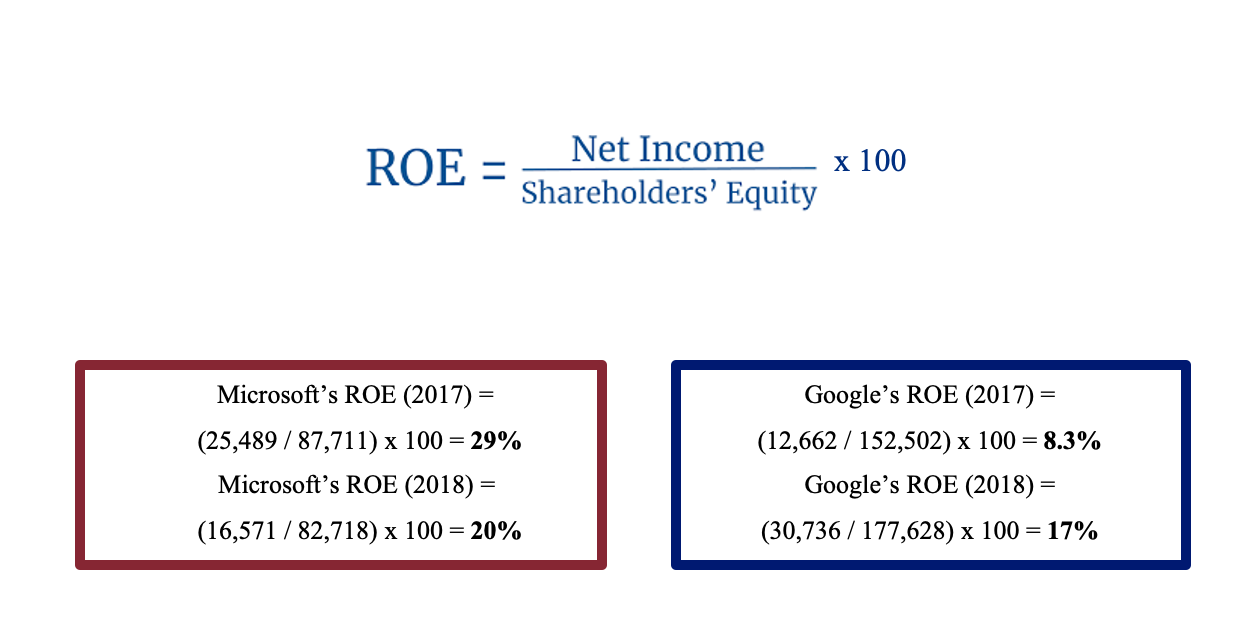

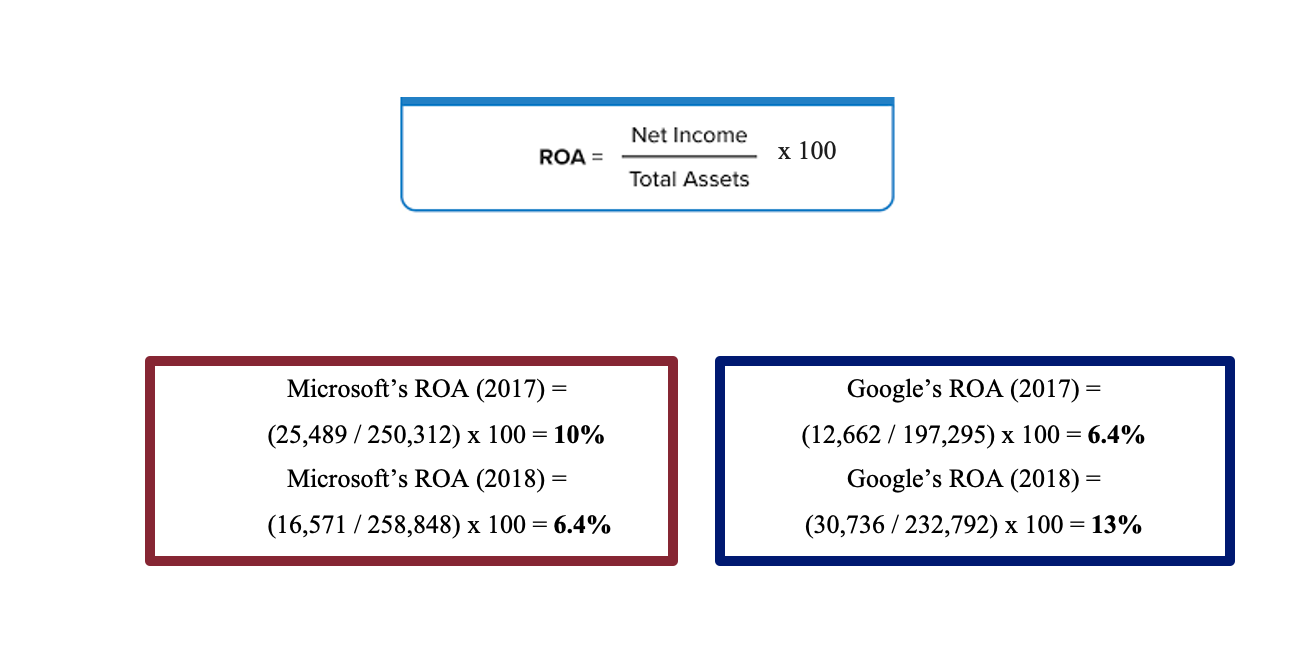

Above are Microsoft's and Google's current ratio, debt to equity ratio, asset turnover ratio, profit margin ratio, ROE and ROA. Please compare the ratios 2017

Above are Microsoft's and Google's current ratio, debt to equity ratio, asset turnover ratio, profit margin ratio, ROE and ROA.

- Please compare the ratios 2017 vs. 2018 for both firms and answer the following:

- Did the firms liquidity improve? Why?

- Did the firms ability to pay their long-term debt improve? Why?

- Did the firms ability to utilize their assets improve? Why?

- Did the firms profitability improve? Why?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started