Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Above is the case study that needs to be worked out.. For this case please calculate the economic life for the defender and the challenger.

Above is the case study that needs to be worked out.. For this case please calculate the economic life for the defender and the challenger. Based on this analysis, recommend when (if ever) the defender should be replaced with the challenger. Do the analysis two ways: before tax and after tax. Do not worry about the options listed for this case. The problem can be worked out on excel thank you!

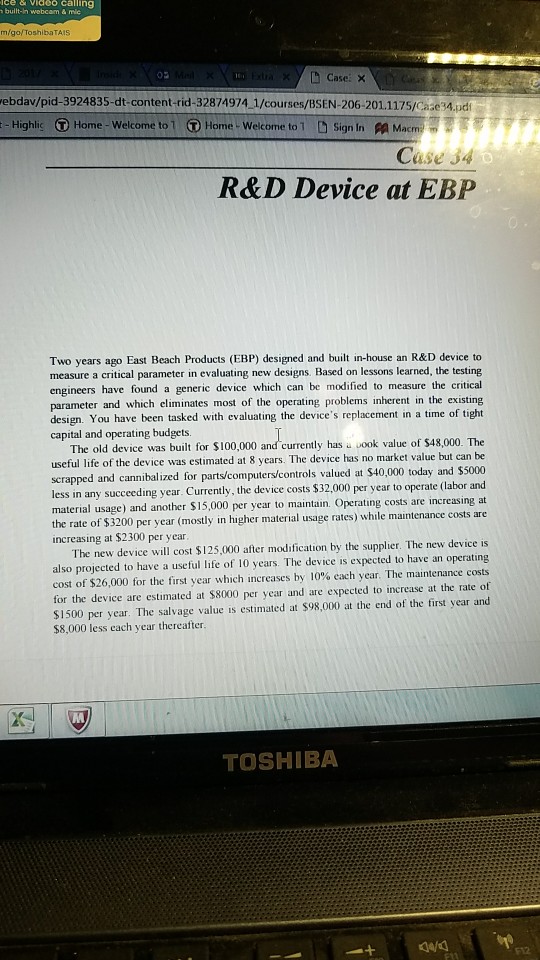

ce & viaco calling bult-in webcam & mic m/go/ ToshibaTAIS Case. ebdav/pid-3924835-dt-content-rid-32874974 1/courses/BSEN-206-201.1175/Case34.pdf -Highlic Home-Welcome to l Home-welcome to 1 D Sign In A Macm: -TTTT Case 34 R&D Device at EBP Two years ago East Beach Products (EBP) designed and built in-house an R&D device to measure a critical parameter in evaluating new designs. Based on lessons learned, the testing engineers have found a generic device which can be modified to measure the critical parameter and which eliminates most of the operating problems inherent in the existing design. You have been tasked with evaluating the device's replacement in a time of tight capital and operating budgets. The old device was built for $100,000 and currently has a uook value of S48,000. The useful life of the device was estimated at 8 years. The device has no market value but can be scrapped and cannibalized for parts/computers/controls valued ats less in any succeeding year. Currently, the device costs $32,000 per year to operate (labor and material usage) and another $15,000 per year to maintain Operating costs are increasing at the rate of $3200 per year (mostly in higher material usage rates) while maintenance c increasing at $2300 per year rs/controls valued at $40,000 today and $5000 The new device will cost $125,000 after modification by the supplier. The new device is also projected to have a useful life of 10 years. The device is expected to have an operating cost of $26,000 for the first year which increases by 10% each year. The maintenance costs for the device are estimated at $8000 per year and are expected to increase at the rate of S1500 per year. The salvage value is estimated at $98,000 at the end of the first year and $8,000 less each year thereafter TOSHIBA F12Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started