Answered step by step

Verified Expert Solution

Question

1 Approved Answer

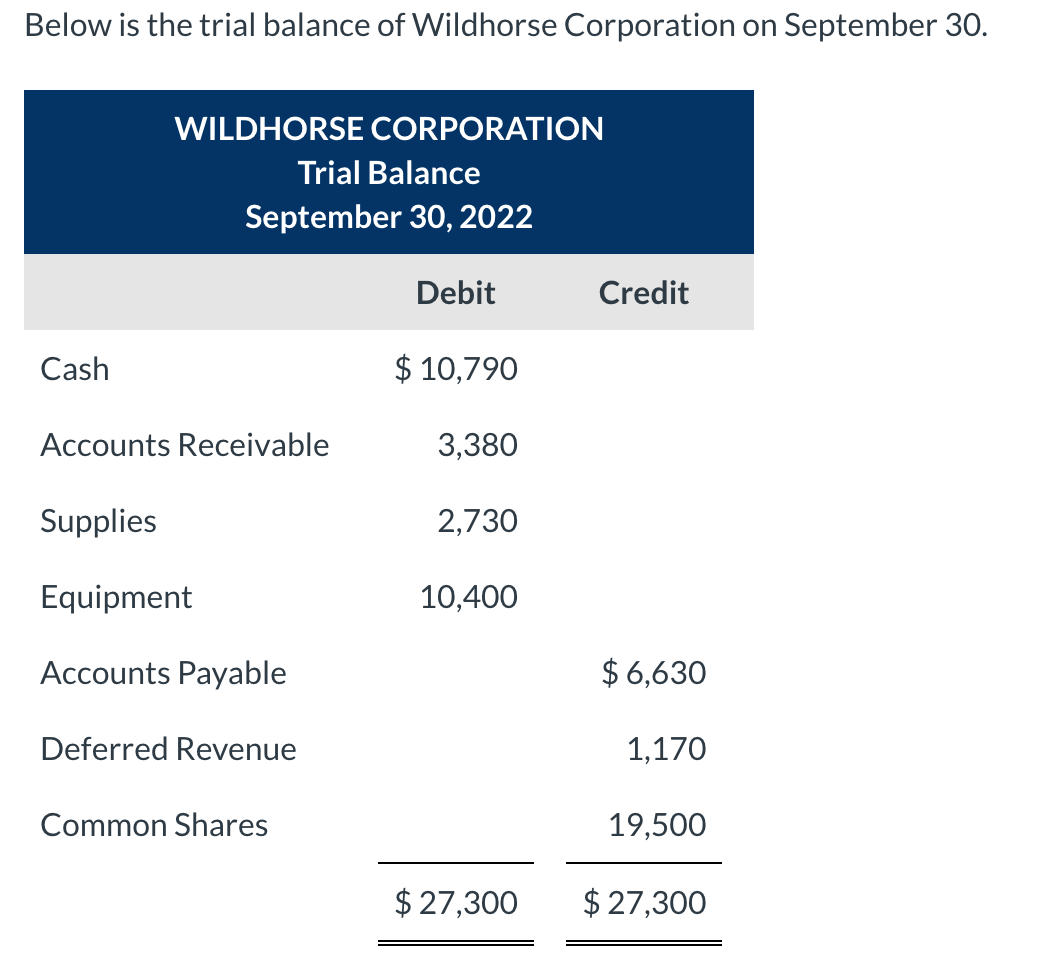

Above is the trial balance of Wildhorse Corporation on September 30. The October transactions were as follows: Oct. 2 Paid rent for the month of

Above is the trial balance of Wildhorse Corporation on September 30.

Above is the trial balance of Wildhorse Corporation on September 30.

The October transactions were as follows:

| Oct. | 2 | Paid rent for the month of October of $ 1,560 in cash. | |

| 5 | Received $ 1,690 in cash from customers for accounts receivable due. | ||

| 10 | Billed customers for services performed in the amount of $ 6,630. | ||

| 15 | Paid employee salaries of $ 1,820. | ||

| 17 | Performed $ 780 of services for customers who paid in advance in August. | ||

| 20 | Paid $ 1,950 to creditors for accounts payable due. | ||

| 29 | Declared and paid a $ 390 cash dividend. | ||

| 31 | Paid utilities of $ 650. | ||

| 31 | Paid $ 910 for income tax. |

1. Using T accounts, enter the opening balances in the general ledger accounts at September 30,

2. Prepare a trial balance at October 31, 2022.

Below is the trial balance of Wildhorse Corporation on September 30. WILDHORSE CORPORATION Trial Balance September 30, 2022 Debit Credit Cash $ 10,790 Accounts Receivable 3,380 Supplies 2,730 Equipment 10,400 Accounts Payable $ 6,630 Deferred Revenue 1,170 Common Shares 19,500 $ 27,300 $ 27,300

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started