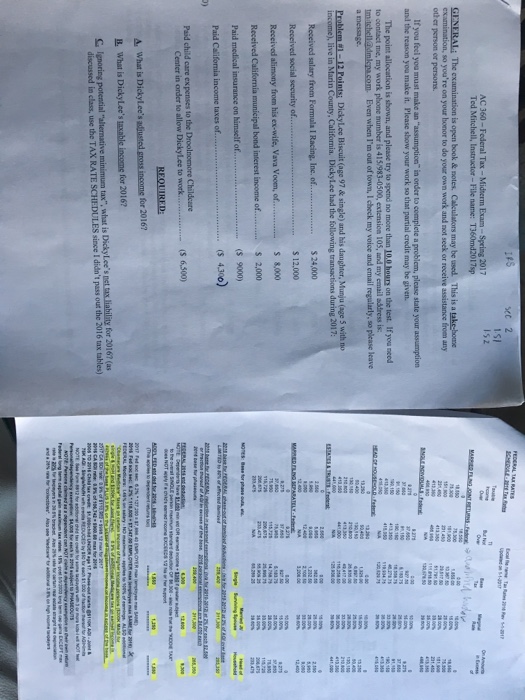

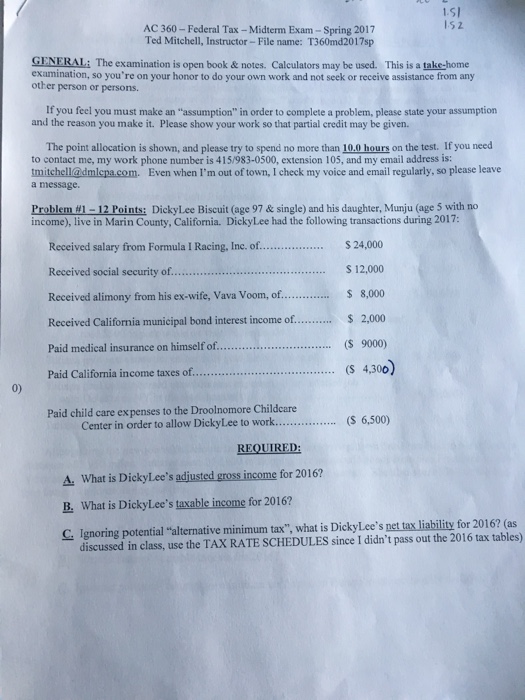

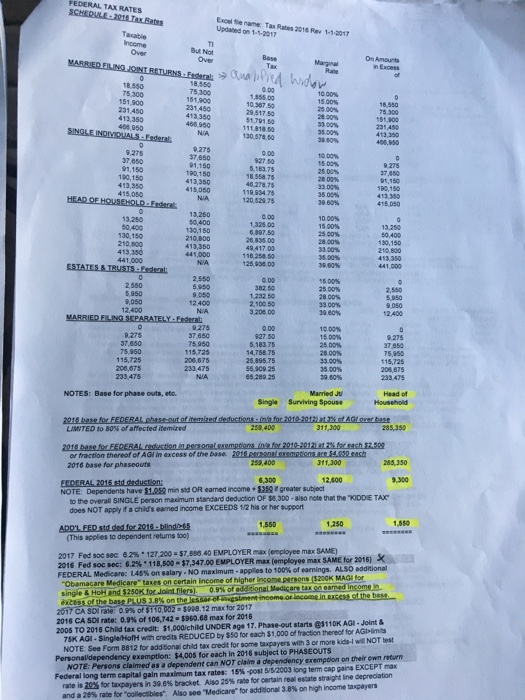

AC 360 Federal Tax Midterm Exam-Spring 2017 Ted Mitchell, Instructor File name: T360md2017sp GENERAL The examination is open book & notes, Caleulators may be ased. This is a ake-home so you're on your honor to do your own work and mot seek or receive assistance from any other person or persons. If you feel you must make an "assumption in order to complete a problem, please state your assumption and the reason you make it. Please show your work so that partial credit may be given. The point allocation is shown, and please try to spend no more than 100haurs on the test. If you need to contact me, my work phone mumber is 415/983-0500, extension 105, and my email address is: umilehell@dmkpacom. Even when I'm out of town. Icheck my voice and email regularly, so please leave Problem Au-12 Points: Dicky Lee Biscuit (age 97 & single) and his daughter, Munju (age 5 with no income), live in Marin County, California. Diekyl.ee had the following transactions during 2017 Received salary from Formula I Racing, Inc. of.................. S24,000 S 12,000 Received social security of Received alimony from his ex-wife, vava Voom, of.............. s 8.000 S 2.000 Received California municipal bond interest income of..... (S 9000) Paid medical insurance on himself of.......... Paid california income taxes of Paid child care expenses to the Droolnomore Childcare center in order to allow Dickylee to work 65000 Au What is Dickyl.ee's adiusted grossincome for 2016? B. What is DickyLee's laxable income for 20 C Ignoring potential "allemative minimum tax" what is Dicky Lee's Det taxliability for 2016? (as discussed in class, use the TAx RATESCHEDULES since didn't pass out the 2016 tax tables) FEDERAL RATES AC 360 Federal Tax Midterm Exam-Spring 2017 Ted Mitchell, Instructor File name: T360md2017sp GENERAL The examination is open book & notes, Caleulators may be ased. This is a ake-home so you're on your honor to do your own work and mot seek or receive assistance from any other person or persons. If you feel you must make an "assumption in order to complete a problem, please state your assumption and the reason you make it. Please show your work so that partial credit may be given. The point allocation is shown, and please try to spend no more than 100haurs on the test. If you need to contact me, my work phone mumber is 415/983-0500, extension 105, and my email address is: umilehell@dmkpacom. Even when I'm out of town. Icheck my voice and email regularly, so please leave Problem Au-12 Points: Dicky Lee Biscuit (age 97 & single) and his daughter, Munju (age 5 with no income), live in Marin County, California. Diekyl.ee had the following transactions during 2017 Received salary from Formula I Racing, Inc. of.................. S24,000 S 12,000 Received social security of Received alimony from his ex-wife, vava Voom, of.............. s 8.000 S 2.000 Received California municipal bond interest income of..... (S 9000) Paid medical insurance on himself of.......... Paid california income taxes of Paid child care expenses to the Droolnomore Childcare center in order to allow Dickylee to work 65000 Au What is Dickyl.ee's adiusted grossincome for 2016? B. What is DickyLee's laxable income for 20 C Ignoring potential "allemative minimum tax" what is Dicky Lee's Det taxliability for 2016? (as discussed in class, use the TAx RATESCHEDULES since didn't pass out the 2016 tax tables) FEDERAL RATES