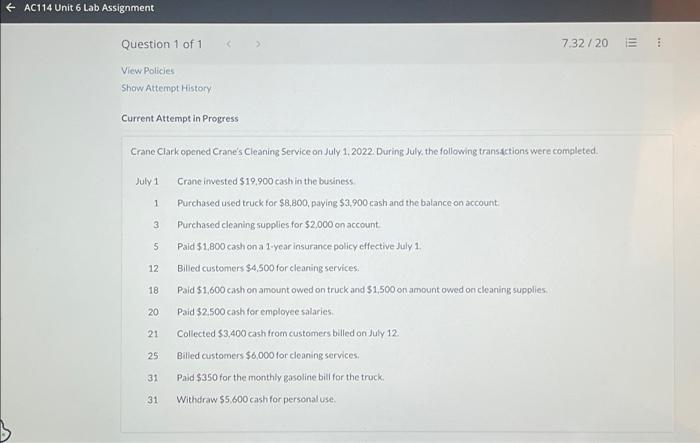

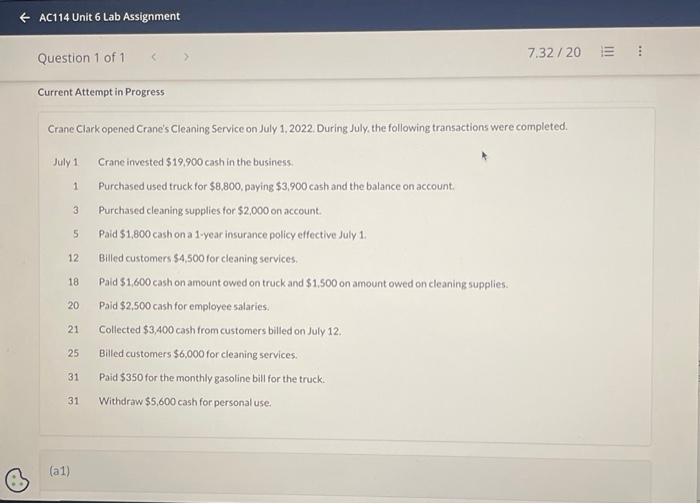

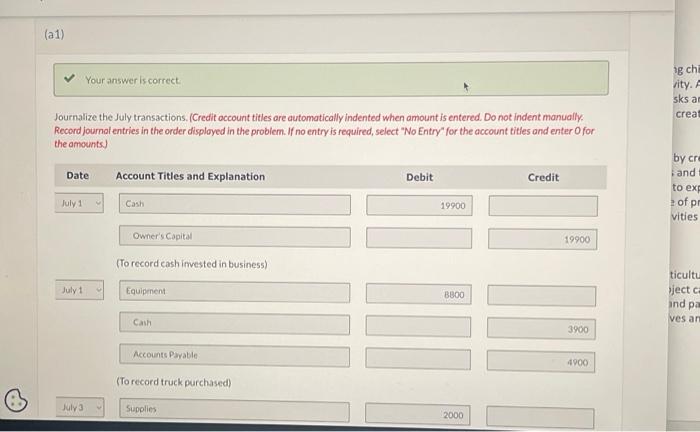

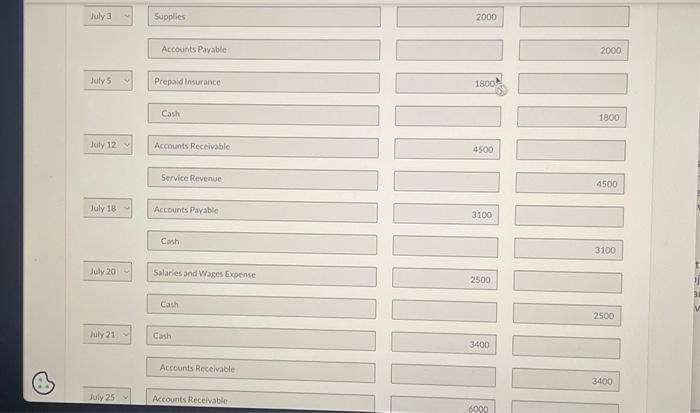

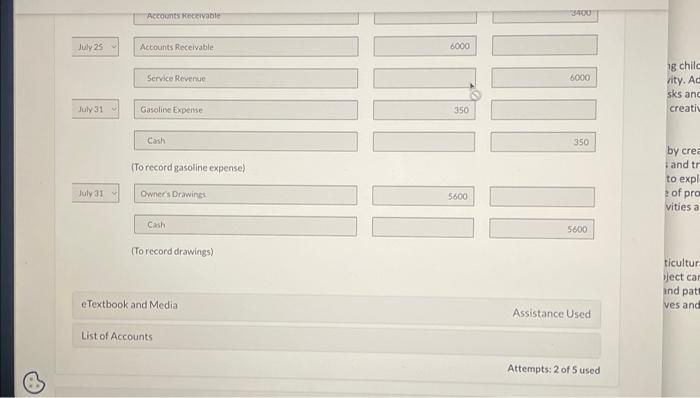

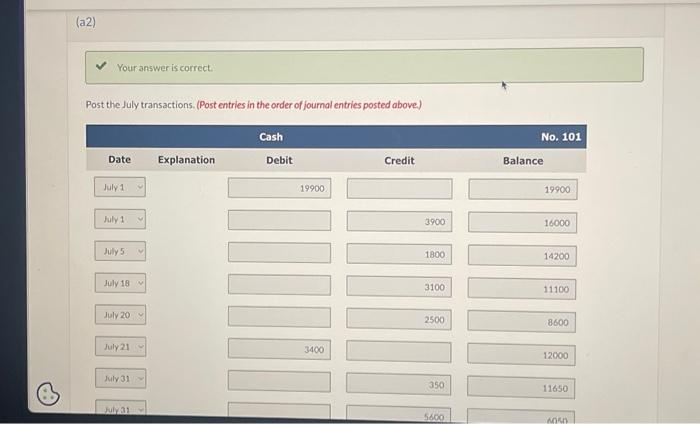

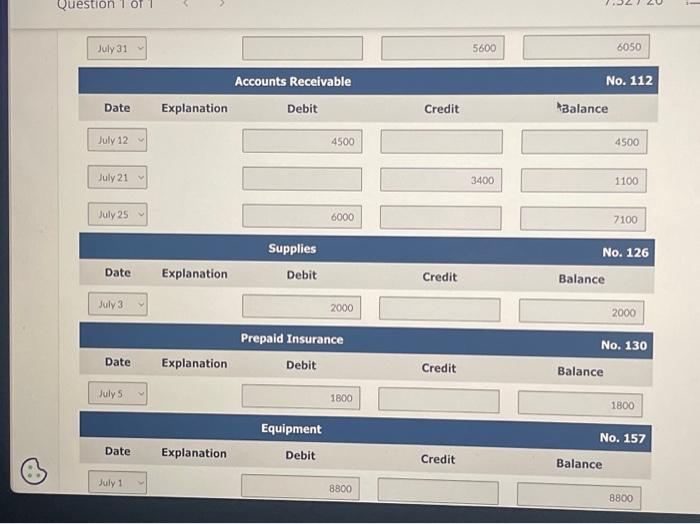

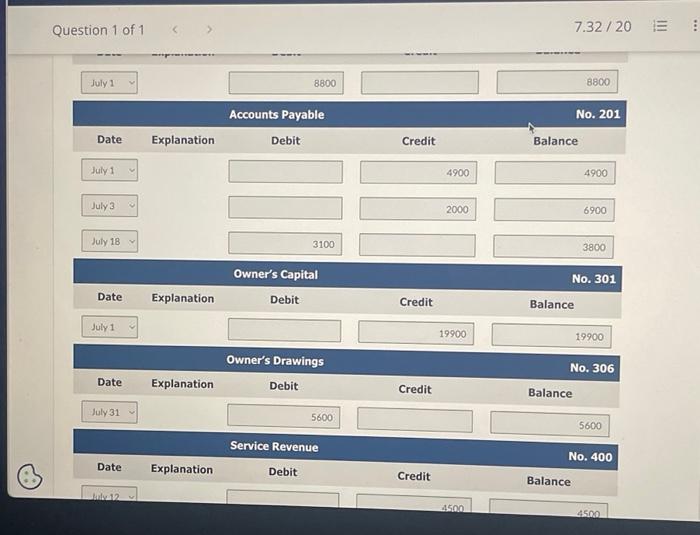

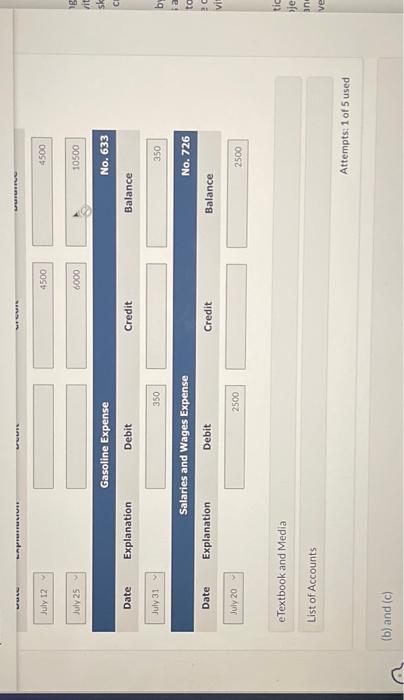

AC114 Unit 6 Lab Assignment Question 1 of 1 View Policies Show Attempt History Current Attempt in Progress Crane Clark opened Crane's Cleaning Service on July 1, 2022. During July, the following transactions were completed. July 1 1 3 5 12 18 20 21 25 31 31 7.32/20 Crane invested $19,900 cash in the business. Purchased used truck for $8,800, paying $3,900 cash and the balance on account. Purchased cleaning supplies for $2,000 on account. Paid $1,800 cash on a 1-year insurance policy effective July 1. Billed customers $4,500 for cleaning services. Paid $1,600 cash on amount owed on truck and $1,500 on amount owed on cleaning supplies. Paid $2,500 cash for employee salaries. Collected $3,400 cash from customers billed on July 12. Billed customers $6,000 for cleaning services. Paid $350 for the monthly gasoline bill for the truck. Withdraw $5,600 cash for personal use.

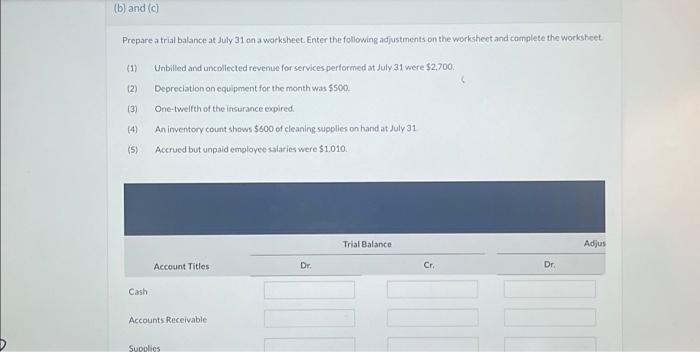

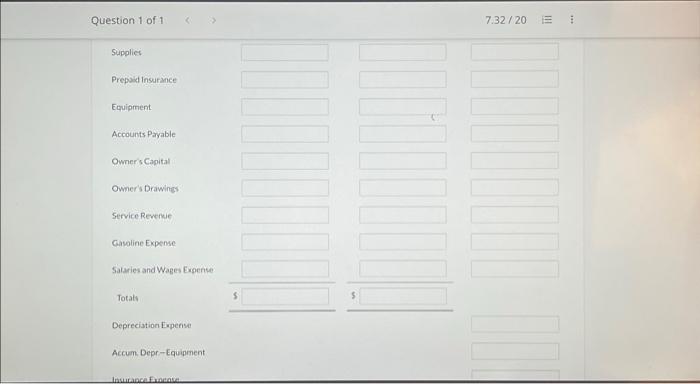

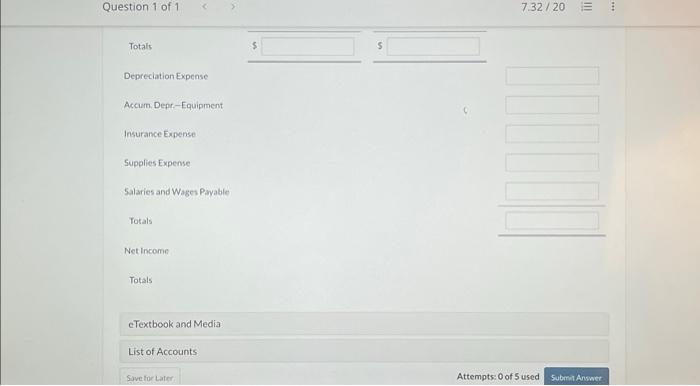

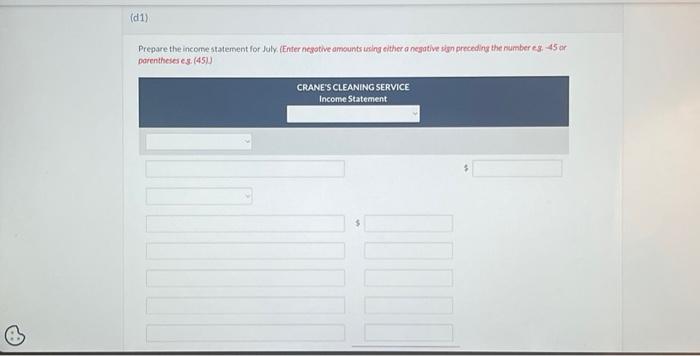

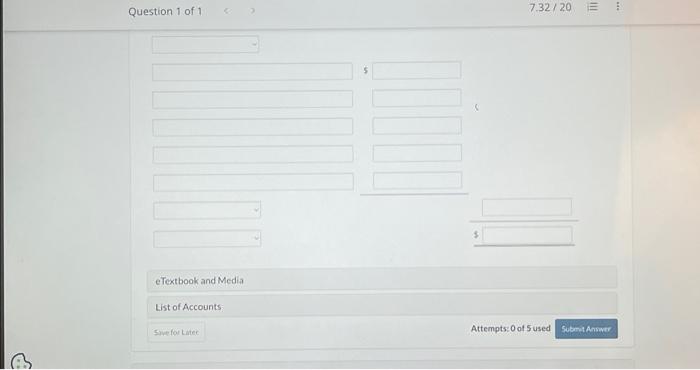

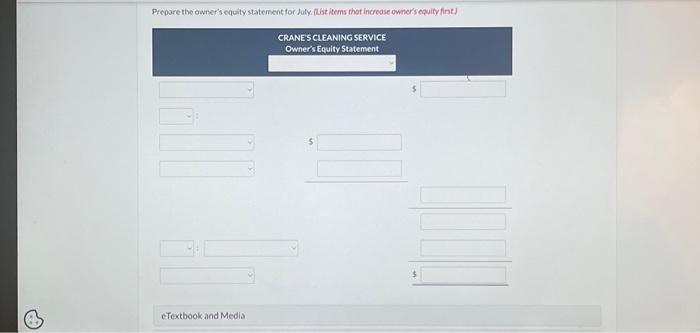

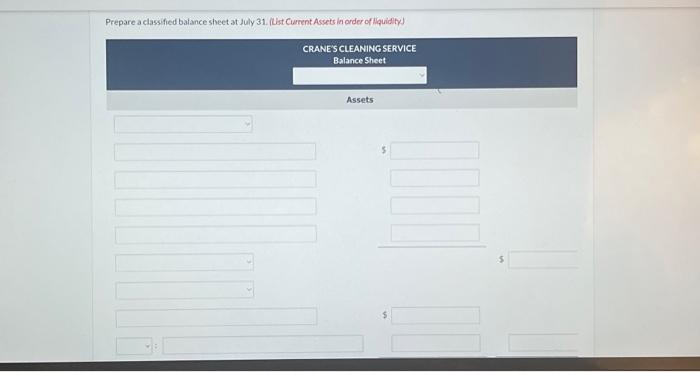

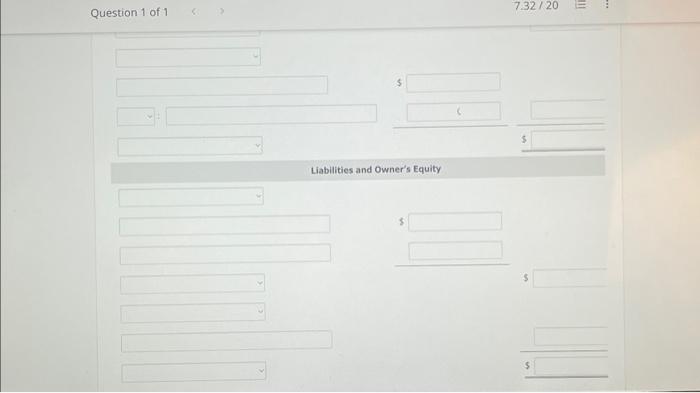

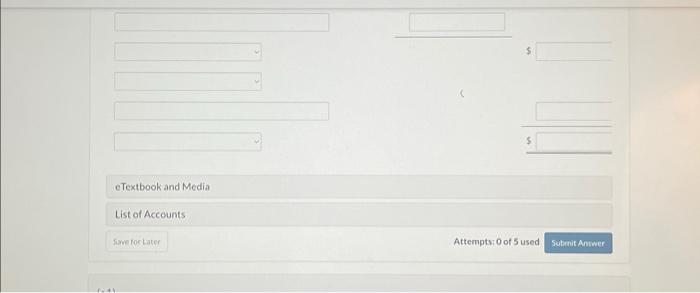

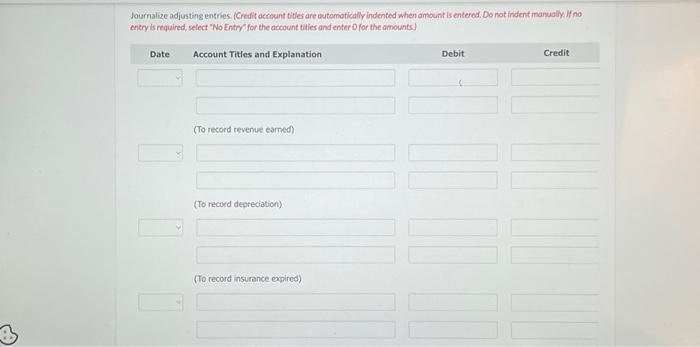

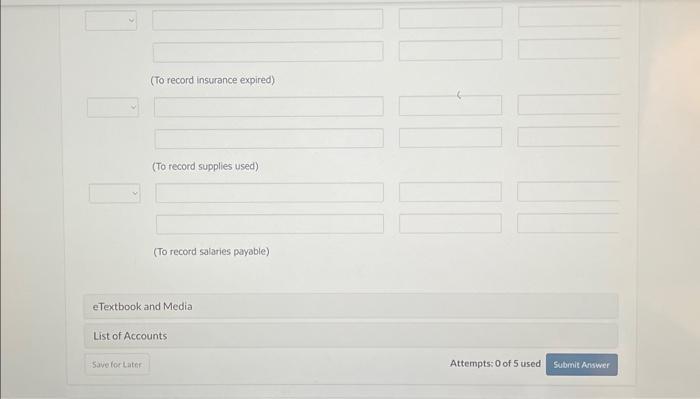

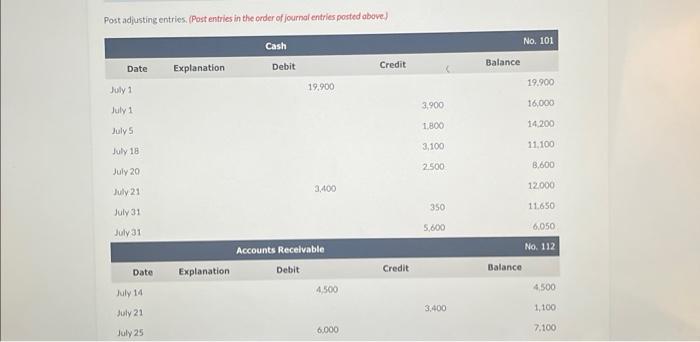

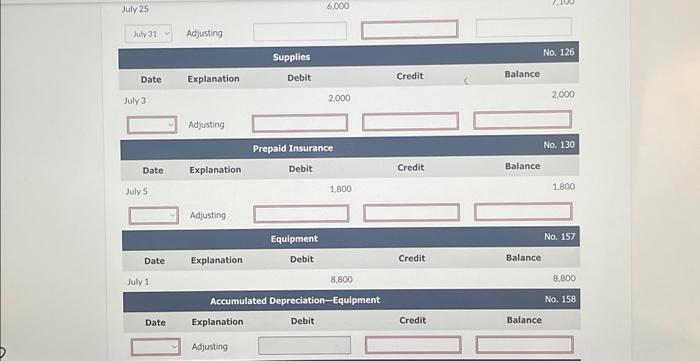

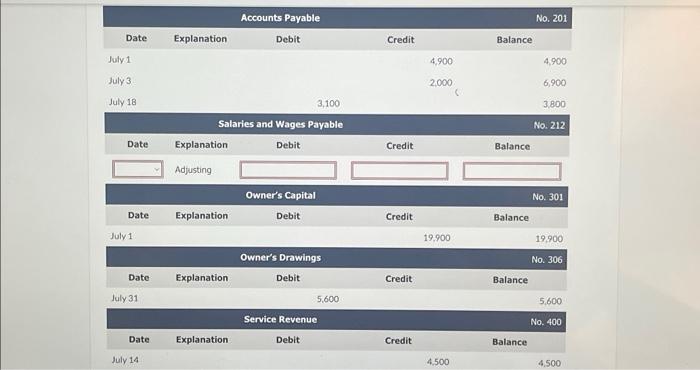

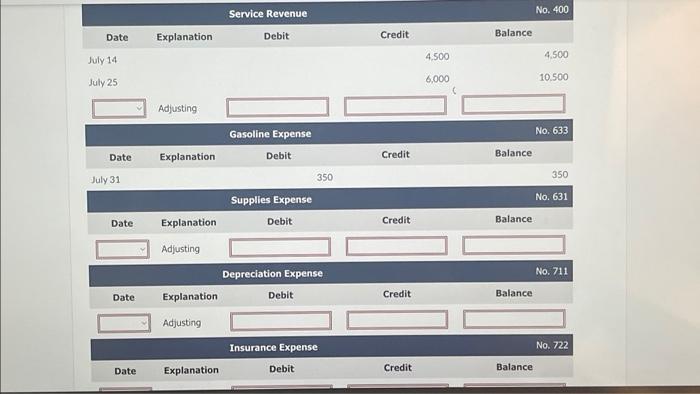

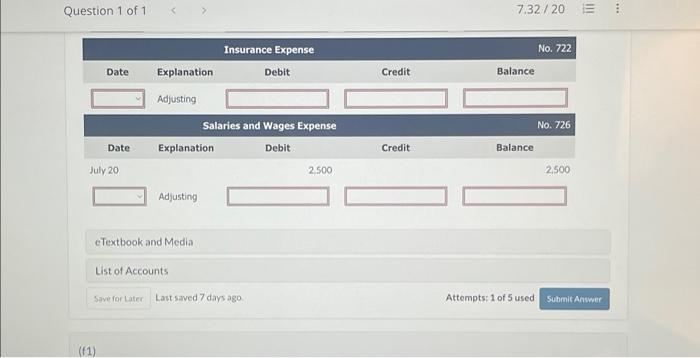

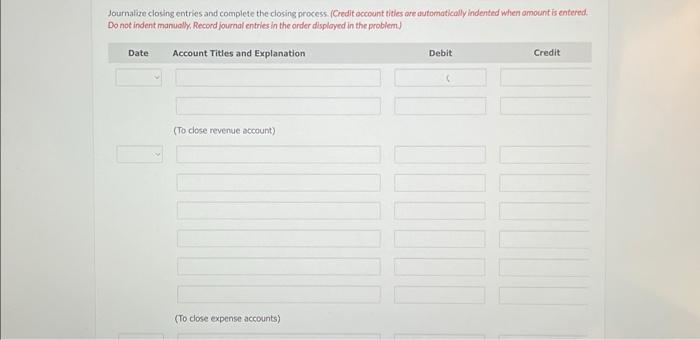

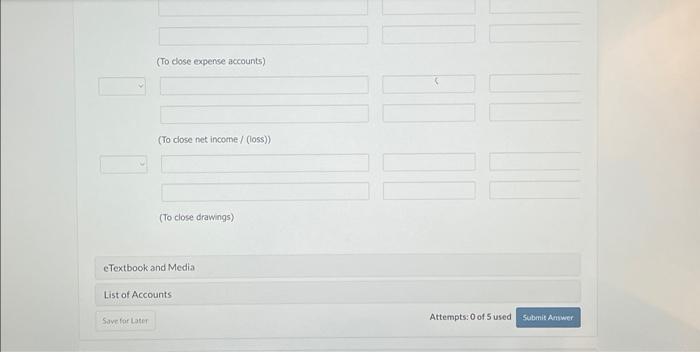

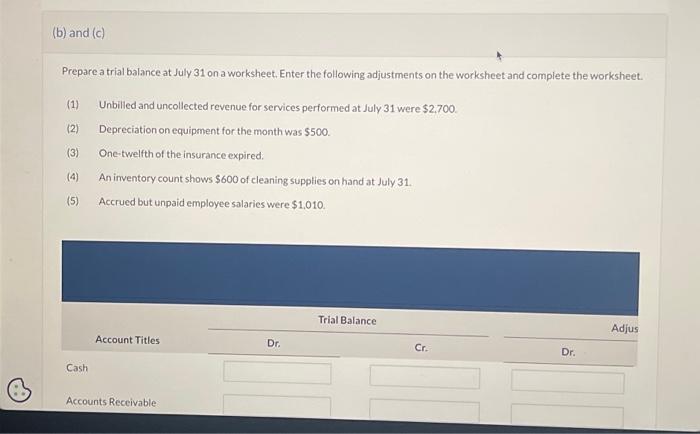

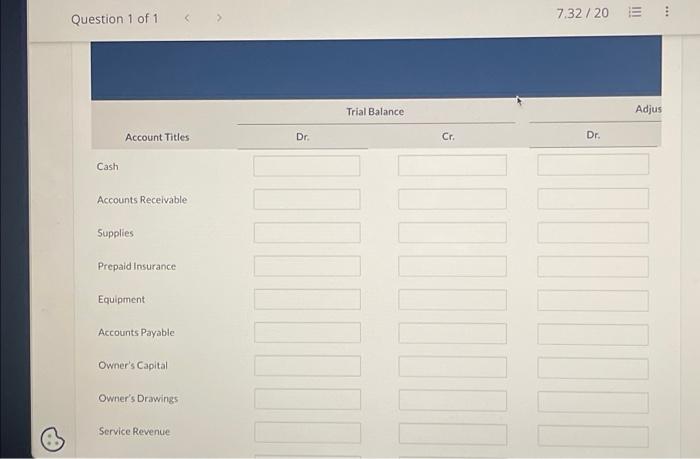

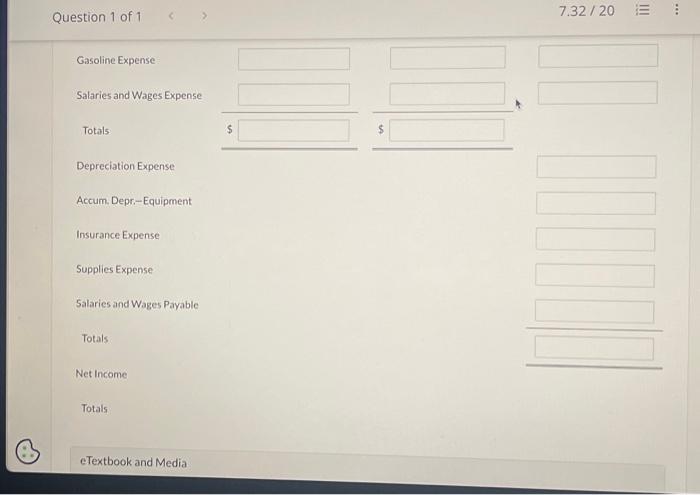

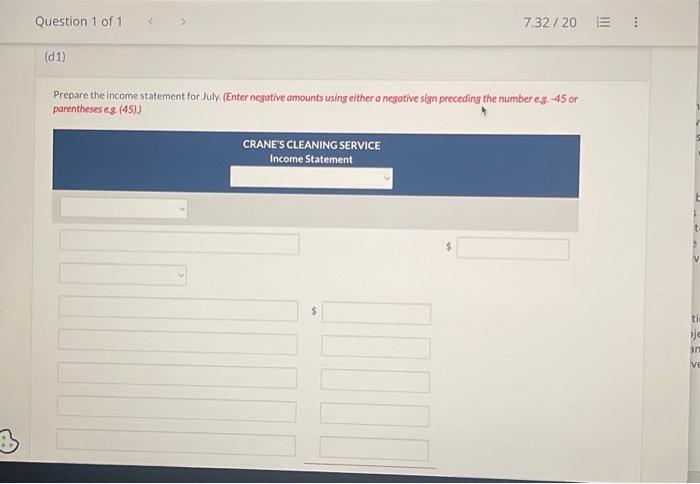

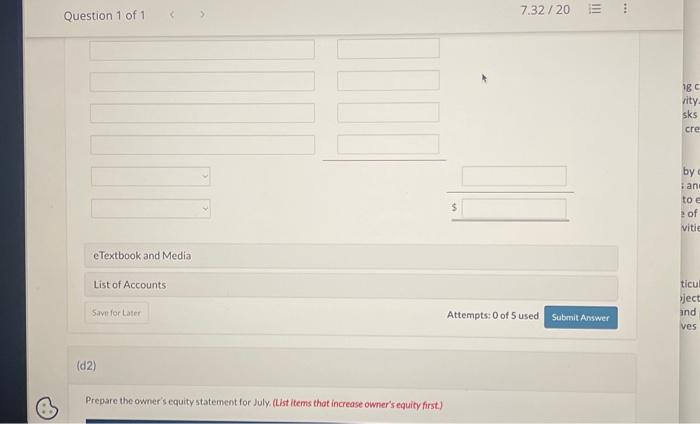

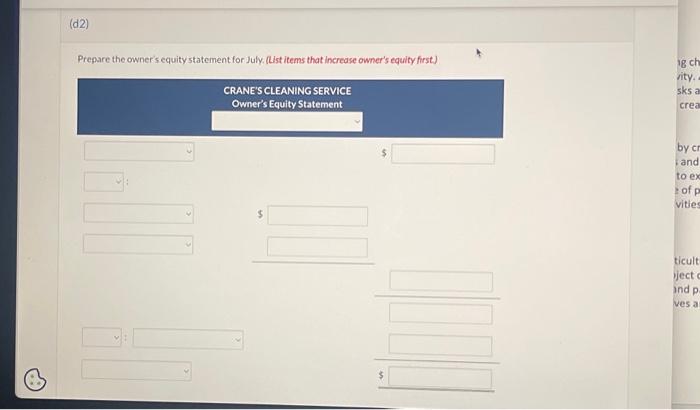

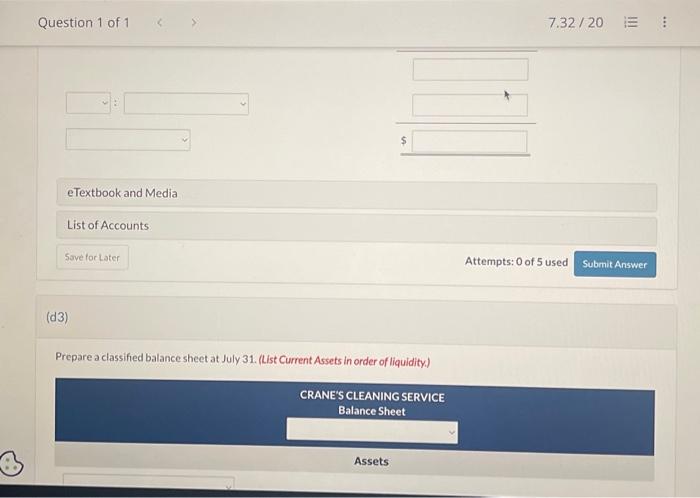

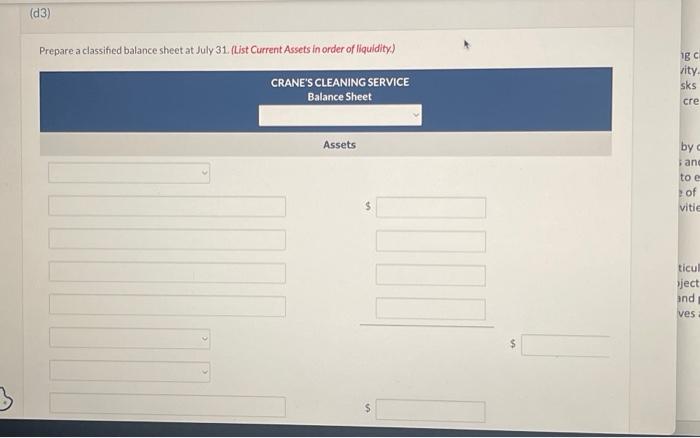

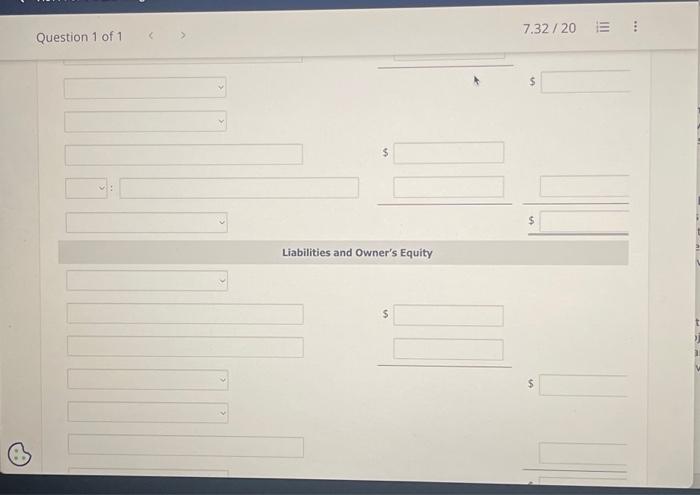

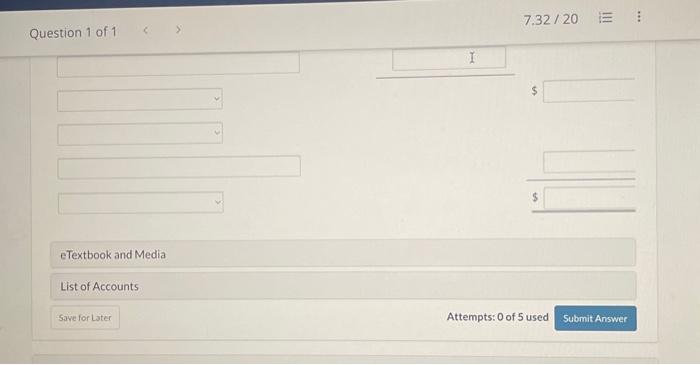

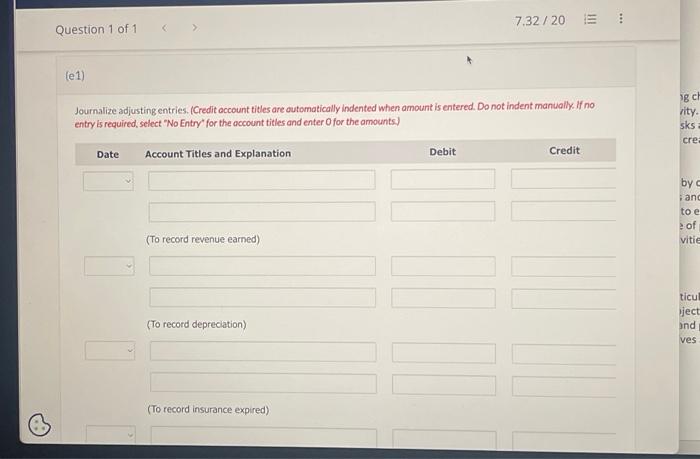

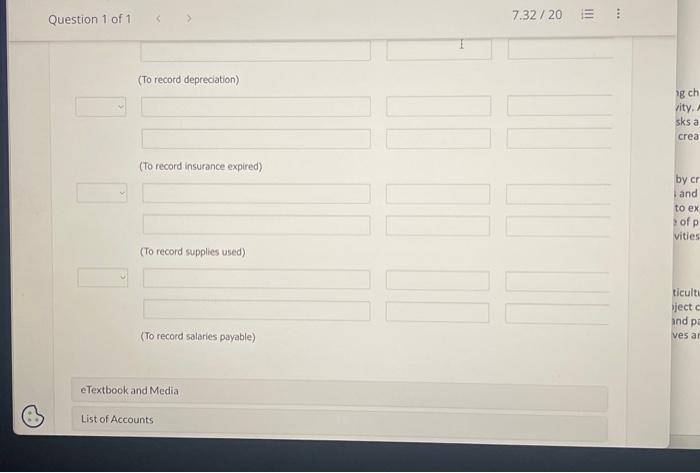

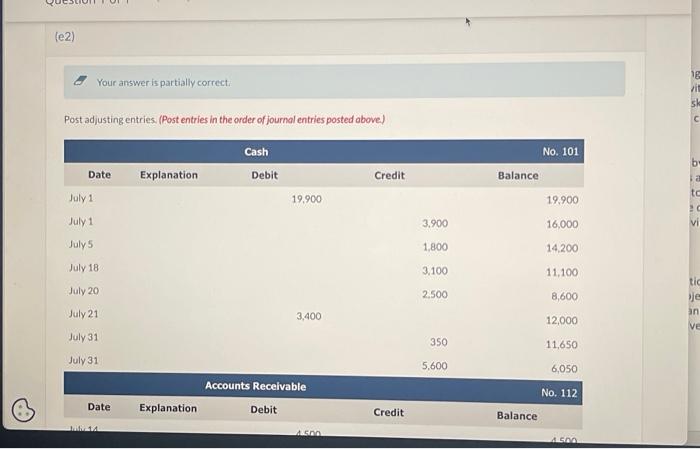

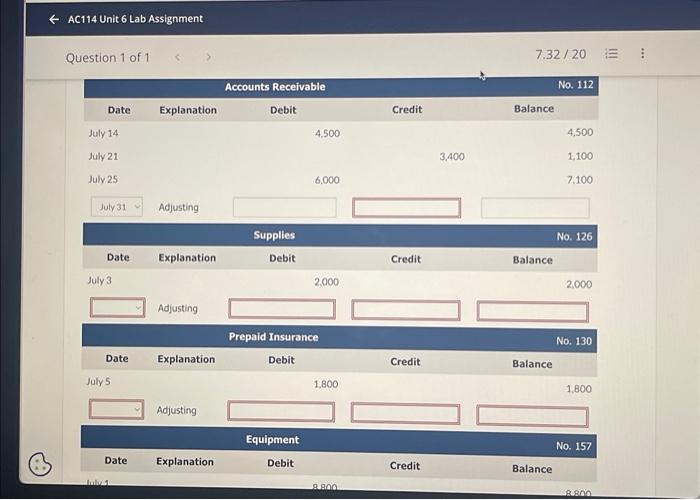

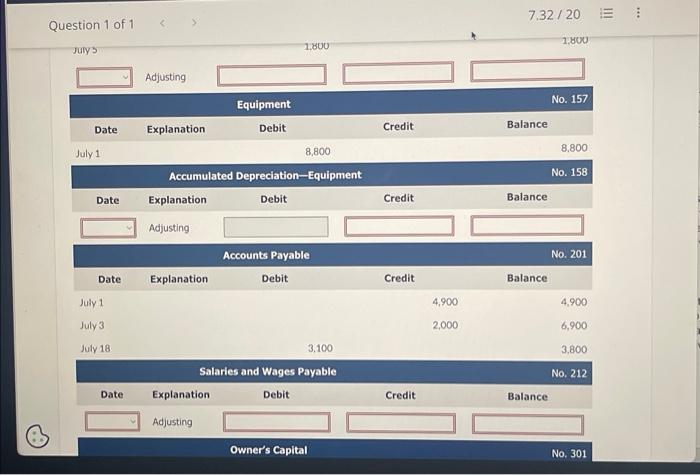

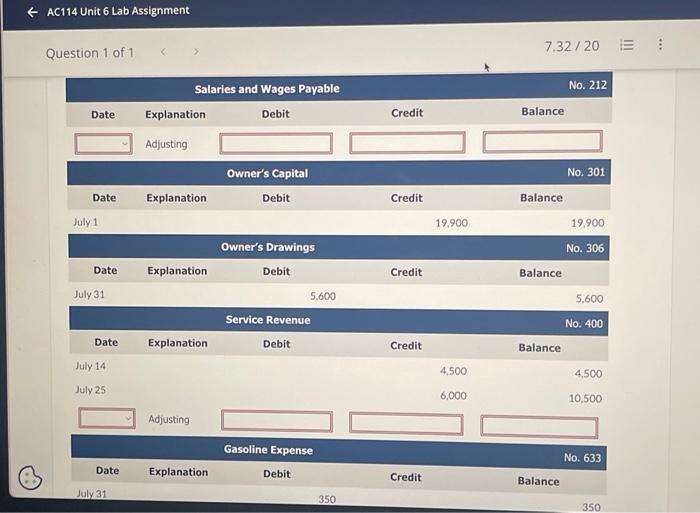

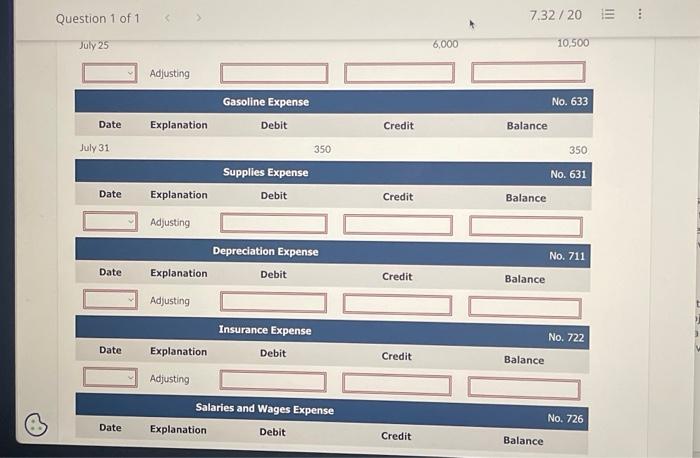

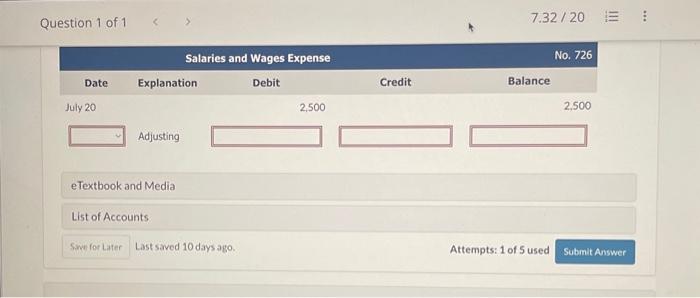

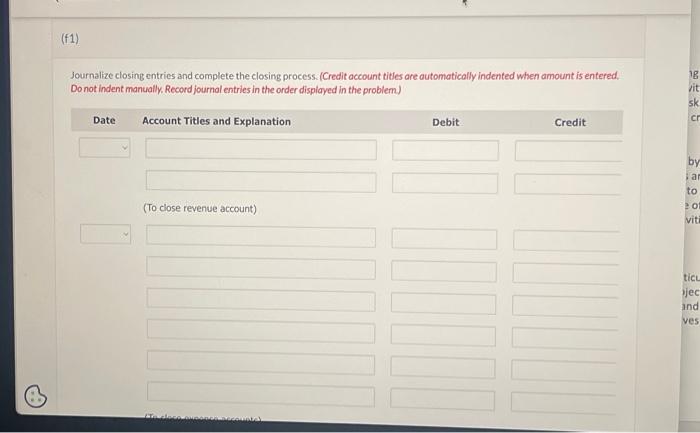

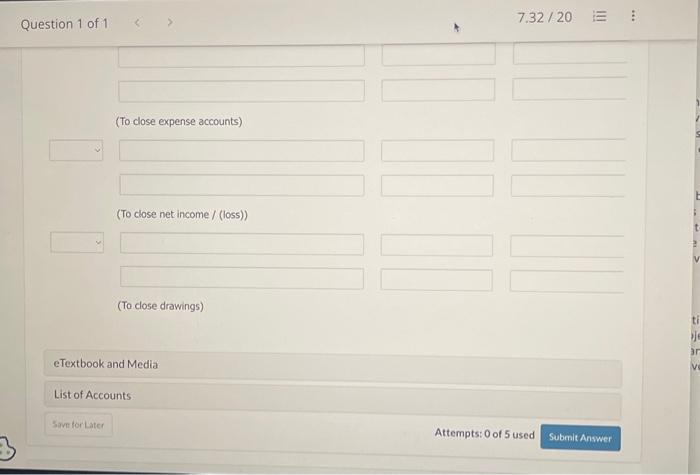

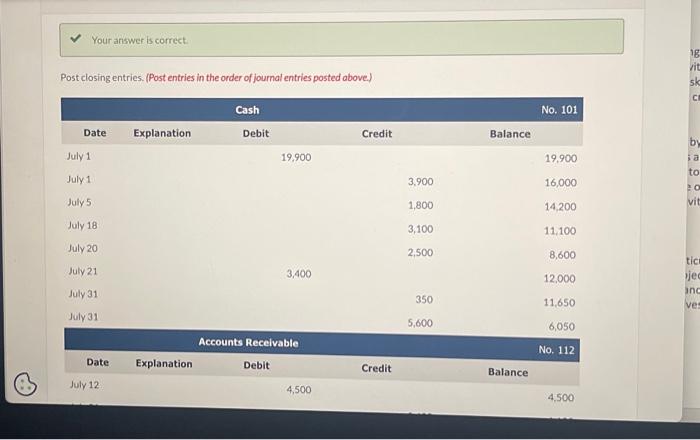

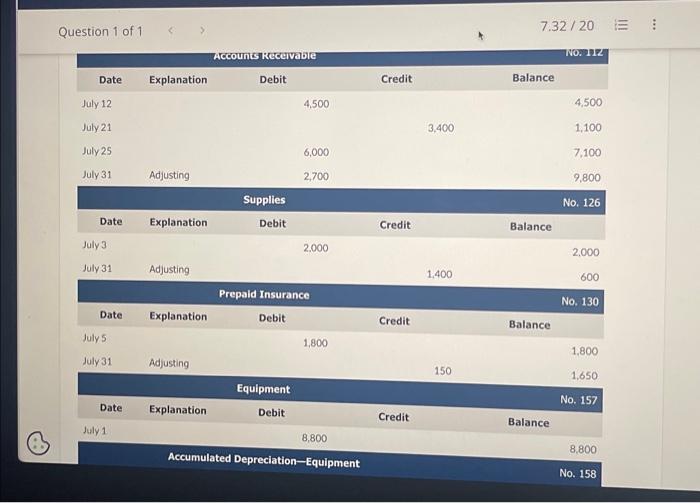

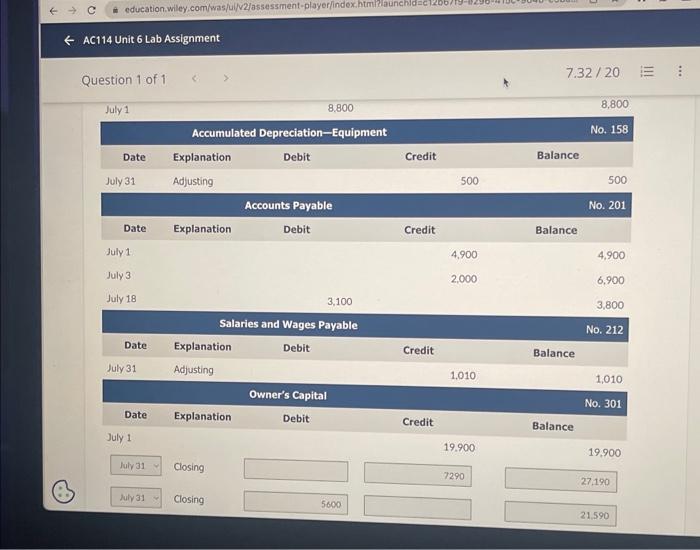

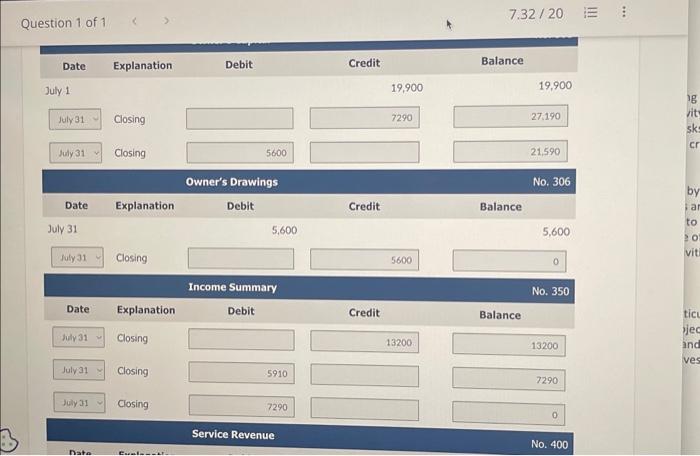

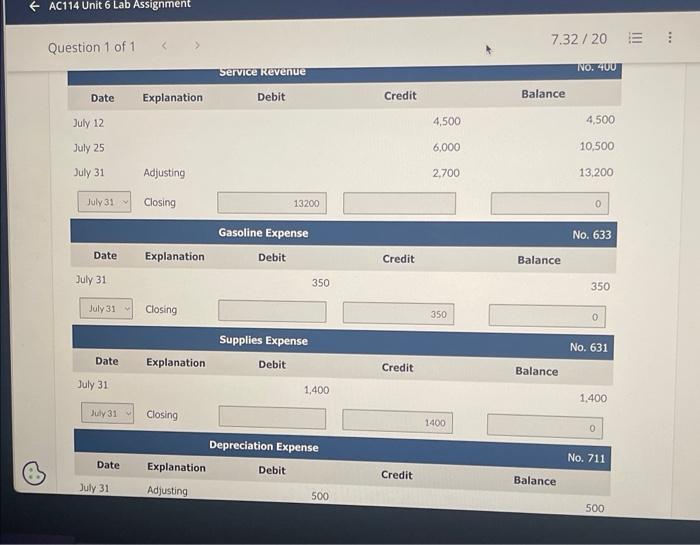

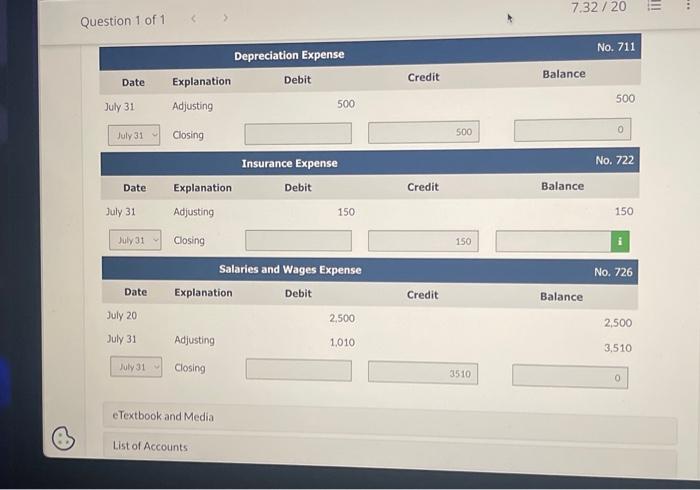

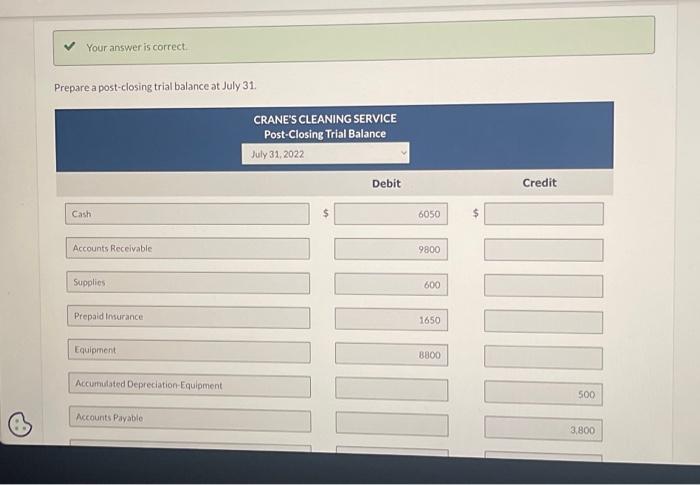

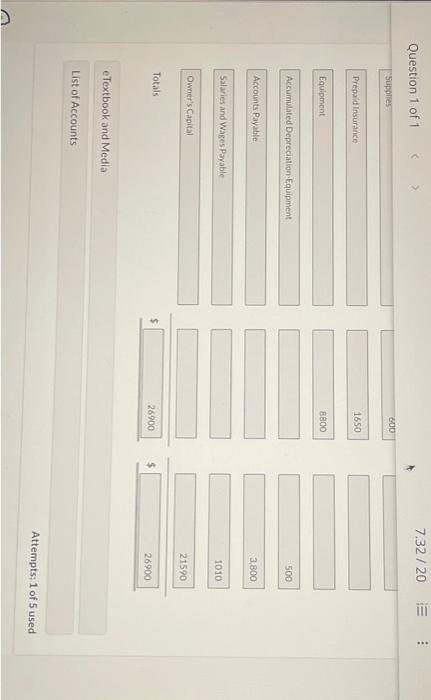

Erane Clark opened Crane's Cleaning Service on July 1,2022 During July, the following transactions were completed. July 1 Cranc invested $19,900 cash in the business 1 Purchased used truck for $8,800, paying $3,900 cash and the balance on account. 3 Purchased cleaning supplies for $2,000 on account 5 Paid 51,800 cash on a 1-year insurance policy effective July 1. 12 Billed customers $4,500 for cleaning services: 18 Paid $1,600 cash on amount owed on truck and $1,500 on amount owed on cleaning supplies. 20 Paid \$2.500 cash for employee salaries. 21 Collected $3,400 cash from customers billed on July 12 25 Billed customers $6,000 for cleaning services. 31 Paid $350 for the monthiy gasoline bill for the truck. 31 Withdraw $5,600 cash for personal use Prepare a trial balance at July 31 on a worksheet. Enter the following adjustinents on the worksheet and coinplete the worksheet (1) Unbilled and uncollected revenue for services performed at July 31 were $2,700. (2) Depreciation on equipment for the month was $500 (3) One-twelth of the irsurance expired. (4) An inventory count shows $600 of cleaning supplies on hand at July 31 (5) Accrued but unpaid employee salaries were $1.010. Question 1 of 1 7.32/20 Supolies Prepolit Insurance Equipment Accounts Payable Owneris Capital Owner's Drawings Service Revenue Gavoline Expense Saluries and Wages Expense Totals Depreciation Expense Accum. Depr-Equipment Invuncifincave Question 1 of 1 7.32/20 Totals Depreciation Expense Accurn. Dept--Equipment Insurance Expense Supplies Expense Salaries and Wages Pavable Totals Net Income Totals eTextbook and Media List of Accounts Sive for Later Attempts: 0 of 5 used Submit Answer Prepare the income statement for July. Enter ncgothe amounts uning either a negative sign preceding the number es. 45 or Darentheseses (45)) Question 1 of 1 7.32120 5 eTextbook and Media List of Accounts: suve for Liatec Attempts: 0 of 5 used Prepare the owner's equity statement for July. (Uist iterns that increase owners equity fint) eTextbook and Media Prepare a classified balance sheet at July 31 . (Lht Curent Assets in order of Hiquidity) Question 1 of 1 7.32120 5 Liabilities and Owner's Equity eTextbook and Media List af Accounts sime for Later Attempts: 0 of 5 used Subrit Antwer Journalize adjusting entries. (Credit occount title are automatically indented when ambunt is entered. Do not indent manually. If no entry is required, select "No Entry' for the account titles and enter of for the amounts. (To record insurance expired) (To record supplies used) (To record salaries payoble) eTextbook and Media List of Accounts Save for Later Attempts: 0 of 5 used Submit Answer Post adjusting entries. (Post entries in the order of journal entries ported above) July 25 6,000 Julv 31 Adjusting \begin{tabular}{|ll} \hline Date Explanation \\ July 3 \\ \hline & Adjusting \end{tabular} Question 1 of 1 7.32/20 eTextbook and Media List of Accounts Sove for Later Lavtsaved 7 days ago. Attempts: 1 of 5 used Submit Anwwer (f1) Journalize closing entries and complete the closing process. (Credit occount titles are dutornatically indented when amount is entered. Do not indent manually. Record journal entries in the order displayed in the problem. (To dose expense accounts) (To close net income/ / (loss)) (To close drawings) eTextbook and Media List of Accounts Save for Later Attempts: 0 of 5 used Crane Clark opened Crane's Cleaning Service on July 1. 2022. During July, the following transactions were complete July 1 Crane invested $19,900 cash in the business. 1 Purchased used truck for $8,800, paying $3,900 cash and the balance on account. 3 Purchased cleaning supplies for $2,000 on account. 5 Paid $1,800 cash on a 1-year insurance policy effective July 1. 12 Billed customers $4,500 for cleaning services. 18 Paid $1,600 cash on amount owed on truck and $1,$00 on amount owed on cleaning supplies. 20 Paid $2,500 cash for employee salaries: 21 Collected $3,400 cash from customers billed on July 12 . 25 Billed customers $6,000 for cleaning services. 31 Paid $350 for the monthly gasoline bill for the truck. 31 Withdraw $5,600 cash for personal use. Journalize the July transactions. (Credit account titles are automatically indented when amount is entered. Do not indent manually. Record journalentries in the order displayed in the problem. If no entry is required, select "No Entry' for the account titles and enter O for the amounts.) Accounts recedvoble July 25 Accounts Receivable d000 Service Reverue July 31 Gasolime Expense 350 Eash 18 chilc ity. Ac sks an creatis (To record gasoline expense) July 31= Owners Drawings 5800 Cisty 350 (To record drawings) eTextbook and Media Assistance Used ticultur ject ca ind pat ves and List of Accounts Attempts: 2 of 5 used Your answer is correct Post the July transactions. (Post entries in the order of journal entries posted above.) Question 1 of 1 7.32/20 Prepare a trial balance at July 31 on a worksheet. Enter the following adjustments on the worksheet and complete the worksheet. (1) Unbilied and uncollected revenue for services performed at July 31 were $2,700. (2) Depreciation on equipment for the month was $500. (3) One-twelfth of the insurance expired. (4) An inventory count shows $600 of cleaning supplies on hand at July 31 . (5) Accrued but unpaid employee salaries were $1,010. Question 1 of 1 7.32/20 Trial Balance Adjus Account Titles Dr Cr. Dr. Cash Accounts Receivable Supplies Prepaid Insurance Equipment Accounts Payable Owner's Capital Owner's Drawings Service Revenue Question 1 of 1 7.32/20 Gasoline Expense Salaries and Wages Expense Totals Depreciation Expense Accum. Depr--Equipment Insurance Expense Supplies Expense Salaries and Wages Payable Totals Net Income Totals eTextbook and Media Prepare the income statement for July. (Enter negative amounts using either a negative sign preceding the number eg. -45 or parentheseseg. (45)) Question 1 of 1 7.32/20 eTextbook and Media List of Accounts 5 Save for Later Attempts: 0 of 5 used (d2) Prepare the owner's equity statement for July. (List items that increase owner's equity first.) Prepare the owner's equity statement for July. (List items that increase owner's equity first). Prepare a classified balance sheet at July 31. (List Current Assets in order of liquidity.) Prepare a classified balance sheet at July 31. (List Current Assets in order of liquidity) Question 1 of 1 7.32120 s 5 Liabilities and Owner's Equity s Question 1 of 1 7.32120 I $ eTextbook and Media List of Accounts save for Later Attempts: 0 of 5 used Submit Answer Journalize adjusting entries. (Credit account titles are outomatically indented when amount is entered. Do not indent manuall). If no entry is required, select 'No Entry' for the account titles and enter O for the amounts) Question 1 of 1 7.32/20 (To record depreciation) (To record insurance expired) (To record supplies used) (To record salaries payable) eTextbook and Media List of Accounts E. Your answer is partially correct. Post adjusting entries. (Post entries in the order of journal entries posted above) Question 1 of 1 Adjusting AC114 Unit 6 Lab Assignment Question 1 of 1 7.32/20 Question 1 of 1 7.32/20 July 25 6,000 10,500 Adjusting Question 1 of 1 7.32/20 eTextbook and Media List of Accounts Sime for Later Last saved 10 days ago. Attempts: 1 of 5 used Submlt Answer Journalize closing entries and complete the closing process. (Credit account titles are automatically indented when amount is entered. Do not indent manually. Record journal entries in the order displayed in the problem) Question 1 of 1 7.32/20 (To close expense accounts) (To close net income / (loss)) (To close drawings) eTextbook and Media List of Accounts save for Later Attempts: 0 of 5 used Submit Answer Your answer is correct. Post closing entries. (Post entries in the order of journal entries posted above.) Q AC114 Unit 6 Lab Assignment Question 1 of 1 7.32/20 July 1 8.800 8,800 Question 1 of 1 7.32/20 AC114 Unit 6 Lab Assignment Question 1 of 1 7.32/20 Service kevenue No. 400 Credit4,5006,0002,700 Balance \begin{tabular}{|cccc|} \hline \multicolumn{3}{|c|}{ Gasoline Expense } & \\ \hline Date & Explanation & Debit & Credit \\ \hline July 31 & & 350 & \\ \hline July 31 & Closing & & \\ \hline \end{tabular} No. 633 Supplies Expense No. 631 \begin{tabular}{lllll} \hline Date Explanation & Debit & \multicolumn{1}{c}{ Credit } \\ \hline July 31 & & 1,400 & \\ \hline July 31 & & \\ \hline \end{tabular} 4,500 10,500 13,200 \begin{tabular}{|clcccc|} \hline \multicolumn{2}{c}{ Depreciation Expense } & & No. 711 \\ \hline Date & Explanation & Debit & Credit & Balance \\ \hline July 31 & Adjusting & & 500 & & 500 \\ \hline & & & & \\ \hline \end{tabular} Question 1 of 1 eTextbook and Media List of Accounts Prepare a post-closing trial balance at July 31 . Question 1 of 1 7.32/20 Supglies 800 Prepald Insurance 1650 Equipment Aceumulated Depreciation-Equipment Accumulated Depreciation-Equipment Accounts Payable. 3,800 Salaries and Wages Payable Omner's Capital Totals eTextbook and Media List of Accounts Attempts: 1 of 5 used The questions are completed. I apology for the missing information. Erane Clark opened Crane's Cleaning Service on July 1,2022 During July, the following transactions were completed. July 1 Cranc invested $19,900 cash in the business 1 Purchased used truck for $8,800, paying $3,900 cash and the balance on account. 3 Purchased cleaning supplies for $2,000 on account 5 Paid 51,800 cash on a 1-year insurance policy effective July 1. 12 Billed customers $4,500 for cleaning services: 18 Paid $1,600 cash on amount owed on truck and $1,500 on amount owed on cleaning supplies. 20 Paid \$2.500 cash for employee salaries. 21 Collected $3,400 cash from customers billed on July 12 25 Billed customers $6,000 for cleaning services. 31 Paid $350 for the monthiy gasoline bill for the truck. 31 Withdraw $5,600 cash for personal use Prepare a trial balance at July 31 on a worksheet. Enter the following adjustinents on the worksheet and coinplete the worksheet (1) Unbilled and uncollected revenue for services performed at July 31 were $2,700. (2) Depreciation on equipment for the month was $500 (3) One-twelth of the irsurance expired. (4) An inventory count shows $600 of cleaning supplies on hand at July 31 (5) Accrued but unpaid employee salaries were $1.010. Question 1 of 1 7.32/20 Supolies Prepolit Insurance Equipment Accounts Payable Owneris Capital Owner's Drawings Service Revenue Gavoline Expense Saluries and Wages Expense Totals Depreciation Expense Accum. Depr-Equipment Invuncifincave Question 1 of 1 7.32/20 Totals Depreciation Expense Accurn. Dept--Equipment Insurance Expense Supplies Expense Salaries and Wages Pavable Totals Net Income Totals eTextbook and Media List of Accounts Sive for Later Attempts: 0 of 5 used Submit Answer Prepare the income statement for July. Enter ncgothe amounts uning either a negative sign preceding the number es. 45 or Darentheseses (45)) Question 1 of 1 7.32120 5 eTextbook and Media List of Accounts: suve for Liatec Attempts: 0 of 5 used Prepare the owner's equity statement for July. (Uist iterns that increase owners equity fint) eTextbook and Media Prepare a classified balance sheet at July 31 . (Lht Curent Assets in order of Hiquidity) Question 1 of 1 7.32120 5 Liabilities and Owner's Equity eTextbook and Media List af Accounts sime for Later Attempts: 0 of 5 used Subrit Antwer Journalize adjusting entries. (Credit occount title are automatically indented when ambunt is entered. Do not indent manually. If no entry is required, select "No Entry' for the account titles and enter of for the amounts. (To record insurance expired) (To record supplies used) (To record salaries payoble) eTextbook and Media List of Accounts Save for Later Attempts: 0 of 5 used Submit Answer Post adjusting entries. (Post entries in the order of journal entries ported above) July 25 6,000 Julv 31 Adjusting \begin{tabular}{|ll} \hline Date Explanation \\ July 3 \\ \hline & Adjusting \end{tabular} Question 1 of 1 7.32/20 eTextbook and Media List of Accounts Sove for Later Lavtsaved 7 days ago. Attempts: 1 of 5 used Submit Anwwer (f1) Journalize closing entries and complete the closing process. (Credit occount titles are dutornatically indented when amount is entered. Do not indent manually. Record journal entries in the order displayed in the problem. (To dose expense accounts) (To close net income/ / (loss)) (To close drawings) eTextbook and Media List of Accounts Save for Later Attempts: 0 of 5 used Crane Clark opened Crane's Cleaning Service on July 1. 2022. During July, the following transactions were complete July 1 Crane invested $19,900 cash in the business. 1 Purchased used truck for $8,800, paying $3,900 cash and the balance on account. 3 Purchased cleaning supplies for $2,000 on account. 5 Paid $1,800 cash on a 1-year insurance policy effective July 1. 12 Billed customers $4,500 for cleaning services. 18 Paid $1,600 cash on amount owed on truck and $1,$00 on amount owed on cleaning supplies. 20 Paid $2,500 cash for employee salaries: 21 Collected $3,400 cash from customers billed on July 12 . 25 Billed customers $6,000 for cleaning services. 31 Paid $350 for the monthly gasoline bill for the truck. 31 Withdraw $5,600 cash for personal use. Journalize the July transactions. (Credit account titles are automatically indented when amount is entered. Do not indent manually. Record journalentries in the order displayed in the problem. If no entry is required, select "No Entry' for the account titles and enter O for the amounts.) Accounts recedvoble July 25 Accounts Receivable d000 Service Reverue July 31 Gasolime Expense 350 Eash 18 chilc ity. Ac sks an creatis (To record gasoline expense) July 31= Owners Drawings 5800 Cisty 350 (To record drawings) eTextbook and Media Assistance Used ticultur ject ca ind pat ves and List of Accounts Attempts: 2 of 5 used Your answer is correct Post the July transactions. (Post entries in the order of journal entries posted above.) Question 1 of 1 7.32/20 Prepare a trial balance at July 31 on a worksheet. Enter the following adjustments on the worksheet and complete the worksheet. (1) Unbilied and uncollected revenue for services performed at July 31 were $2,700. (2) Depreciation on equipment for the month was $500. (3) One-twelfth of the insurance expired. (4) An inventory count shows $600 of cleaning supplies on hand at July 31 . (5) Accrued but unpaid employee salaries were $1,010. Question 1 of 1 7.32/20 Trial Balance Adjus Account Titles Dr Cr. Dr. Cash Accounts Receivable Supplies Prepaid Insurance Equipment Accounts Payable Owner's Capital Owner's Drawings Service Revenue Question 1 of 1 7.32/20 Gasoline Expense Salaries and Wages Expense Totals Depreciation Expense Accum. Depr--Equipment Insurance Expense Supplies Expense Salaries and Wages Payable Totals Net Income Totals eTextbook and Media Prepare the income statement for July. (Enter negative amounts using either a negative sign preceding the number eg. -45 or parentheseseg. (45)) Question 1 of 1 7.32/20 eTextbook and Media List of Accounts 5 Save for Later Attempts: 0 of 5 used (d2) Prepare the owner's equity statement for July. (List items that increase owner's equity first.) Prepare the owner's equity statement for July. (List items that increase owner's equity first). Prepare a classified balance sheet at July 31. (List Current Assets in order of liquidity.) Prepare a classified balance sheet at July 31. (List Current Assets in order of liquidity) Question 1 of 1 7.32120 s 5 Liabilities and Owner's Equity s Question 1 of 1 7.32120 I $ eTextbook and Media List of Accounts save for Later Attempts: 0 of 5 used Submit Answer Journalize adjusting entries. (Credit account titles are outomatically indented when amount is entered. Do not indent manuall). If no entry is required, select 'No Entry' for the account titles and enter O for the amounts) Question 1 of 1 7.32/20 (To record depreciation) (To record insurance expired) (To record supplies used) (To record salaries payable) eTextbook and Media List of Accounts E. Your answer is partially correct. Post adjusting entries. (Post entries in the order of journal entries posted above) Question 1 of 1 Adjusting AC114 Unit 6 Lab Assignment Question 1 of 1 7.32/20 Question 1 of 1 7.32/20 July 25 6,000 10,500 Adjusting Question 1 of 1 7.32/20 eTextbook and Media List of Accounts Sime for Later Last saved 10 days ago. Attempts: 1 of 5 used Submlt Answer Journalize closing entries and complete the closing process. (Credit account titles are automatically indented when amount is entered. Do not indent manually. Record journal entries in the order displayed in the problem) Question 1 of 1 7.32/20 (To close expense accounts) (To close net income / (loss)) (To close drawings) eTextbook and Media List of Accounts save for Later Attempts: 0 of 5 used Submit Answer Your answer is correct. Post closing entries. (Post entries in the order of journal entries posted above.) Q AC114 Unit 6 Lab Assignment Question 1 of 1 7.32/20 July 1 8.800 8,800 Question 1 of 1 7.32/20 AC114 Unit 6 Lab Assignment Question 1 of 1 7.32/20 Service kevenue No. 400 Credit4,5006,0002,700 Balance \begin{tabular}{|cccc|} \hline \multicolumn{3}{|c|}{ Gasoline Expense } & \\ \hline Date & Explanation & Debit & Credit \\ \hline July 31 & & 350 & \\ \hline July 31 & Closing & & \\ \hline \end{tabular} No. 633 Supplies Expense No. 631 \begin{tabular}{lllll} \hline Date Explanation & Debit & \multicolumn{1}{c}{ Credit } \\ \hline July 31 & & 1,400 & \\ \hline July 31 & & \\ \hline \end{tabular} 4,500 10,500 13,200 \begin{tabular}{|clcccc|} \hline \multicolumn{2}{c}{ Depreciation Expense } & & No. 711 \\ \hline Date & Explanation & Debit & Credit & Balance \\ \hline July 31 & Adjusting & & 500 & & 500 \\ \hline & & & & \\ \hline \end{tabular} Question 1 of 1 eTextbook and Media List of Accounts Prepare a post-closing trial balance at July 31 . Question 1 of 1 7.32/20 Supglies 800 Prepald Insurance 1650 Equipment Aceumulated Depreciation-Equipment Accumulated Depreciation-Equipment Accounts Payable. 3,800 Salaries and Wages Payable Omner's Capital Totals eTextbook and Media List of Accounts Attempts: 1 of 5 used The questions are completed. I apology for the missing information