(a)Calculate the risk-adjusted on-balance-sheet assets of the bank as defined under Basel I and II. (b)Estimate the capital required under Basel I (assume no netting for the off-balance sheet items) and discuss whether the bank has sufficient capital to meet the Basel requirements. (c)Calculate the capital required under Basel II if the Standardized Approach is used and show whether the bank has sufficient capital to meet the Basel requirements. If not, calculate the total capital the bank needs to meet the requirement. (d)Calculate the leverage ratio. Briefly discuss the difference between the leverage ratio and the capital adequacy ratio.

(a)Calculate the risk-adjusted on-balance-sheet assets of the bank as defined under Basel I and II. (b)Estimate the capital required under Basel I (assume no netting for the off-balance sheet items) and discuss whether the bank has sufficient capital to meet the Basel requirements. (c)Calculate the capital required under Basel II if the Standardized Approach is used and show whether the bank has sufficient capital to meet the Basel requirements. If not, calculate the total capital the bank needs to meet the requirement. (d)Calculate the leverage ratio. Briefly discuss the difference between the leverage ratio and the capital adequacy ratio.

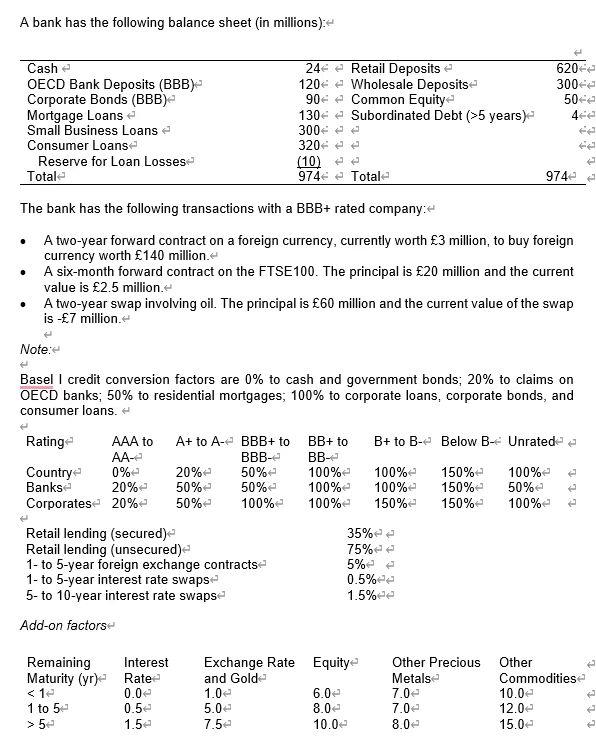

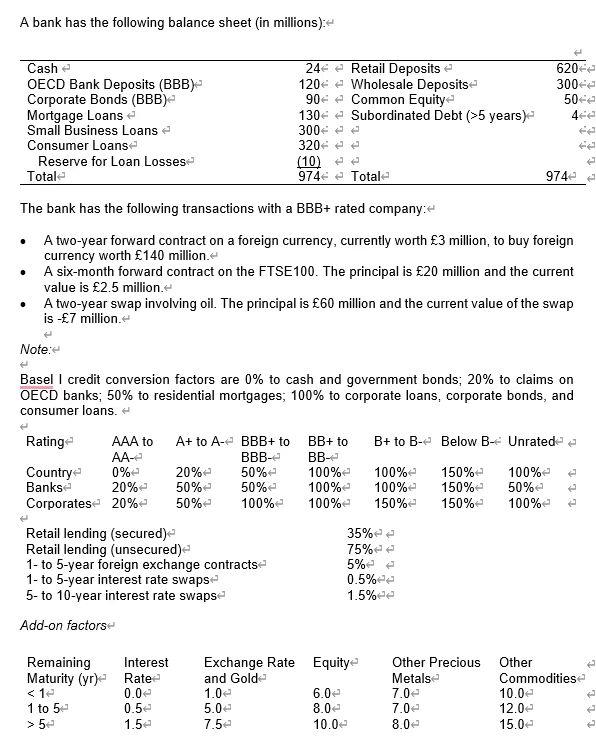

A bank has the following balance sheet (in millions): 300 320 (10) 974 Cash 244 e Retail Depositse 620-2 OECD Bank Deposits (BBB) 120 + Wholesale Deposits 300- Corporate Bonds (BBB) 90Common Equity 50 Mortgage Loans 130 Subordinated Debt (>5 years) 4 Small Business Loans Consumer Loans Reserve for Loan Losses Totale 974 e Totale The bank has the following transactions with a BBB+ rated company: A two-year forward contract on a foreign currency, currently worth 3 million, to buy foreign currency worth 140 millione A six-month forward contract on the FTSE100. The principal is 20 million and the current value is 2.5 million. A two-year swap involving oil. The principal is 60 million and the current value of the swap is -7 million . . . Note: Basel I credit conversion factors are 0% to cash and government bonds; 20% to claims on OECD banks; 50% to residential mortgages; 100% to corporate loans, corporate bonds, and consumer loans. B+ to B- Below B-e Unratede e Rating AAA to AA- Country 0%e Banks 20% Corporatese 20% A+ to A-e BBB+ to BBB- 20% 50% 50%- 50% 50% 100% BB+ to BB- 100% 100% 100% 100% 100% 150% 150% 150% 150%- 100% 50% 100% e Retail lending (secured) Retail lending (unsecured) 1- to 5-year foreign exchange contracts 1- to 5-year interest rate swaps- 5- to 10-year interest rate swaps %35 %75 %5 %0.5 %1.5 Add-on factors Remaining Interest Maturity (yr) Rate 50 1.5e Exchange Rate Equity and Gold 1.02 6.0 5.02 8.0 7.54 10.02 Other Precious Metals 7.00 7.02 8.00 Other Commodities 10.00 12.02 15.02 ttt A bank has the following balance sheet (in millions): 300 320 (10) 974 Cash 244 e Retail Depositse 620-2 OECD Bank Deposits (BBB) 120 + Wholesale Deposits 300- Corporate Bonds (BBB) 90Common Equity 50 Mortgage Loans 130 Subordinated Debt (>5 years) 4 Small Business Loans Consumer Loans Reserve for Loan Losses Totale 974 e Totale The bank has the following transactions with a BBB+ rated company: A two-year forward contract on a foreign currency, currently worth 3 million, to buy foreign currency worth 140 millione A six-month forward contract on the FTSE100. The principal is 20 million and the current value is 2.5 million. A two-year swap involving oil. The principal is 60 million and the current value of the swap is -7 million . . . Note: Basel I credit conversion factors are 0% to cash and government bonds; 20% to claims on OECD banks; 50% to residential mortgages; 100% to corporate loans, corporate bonds, and consumer loans. B+ to B- Below B-e Unratede e Rating AAA to AA- Country 0%e Banks 20% Corporatese 20% A+ to A-e BBB+ to BBB- 20% 50% 50%- 50% 50% 100% BB+ to BB- 100% 100% 100% 100% 100% 150% 150% 150% 150%- 100% 50% 100% e Retail lending (secured) Retail lending (unsecured) 1- to 5-year foreign exchange contracts 1- to 5-year interest rate swaps- 5- to 10-year interest rate swaps %35 %75 %5 %0.5 %1.5 Add-on factors Remaining Interest Maturity (yr) Rate 50 1.5e Exchange Rate Equity and Gold 1.02 6.0 5.02 8.0 7.54 10.02 Other Precious Metals 7.00 7.02 8.00 Other Commodities 10.00 12.02 15.02 ttt

(a)Calculate the risk-adjusted on-balance-sheet assets of the bank as defined under Basel I and II. (b)Estimate the capital required under Basel I (assume no netting for the off-balance sheet items) and discuss whether the bank has sufficient capital to meet the Basel requirements. (c)Calculate the capital required under Basel II if the Standardized Approach is used and show whether the bank has sufficient capital to meet the Basel requirements. If not, calculate the total capital the bank needs to meet the requirement. (d)Calculate the leverage ratio. Briefly discuss the difference between the leverage ratio and the capital adequacy ratio.

(a)Calculate the risk-adjusted on-balance-sheet assets of the bank as defined under Basel I and II. (b)Estimate the capital required under Basel I (assume no netting for the off-balance sheet items) and discuss whether the bank has sufficient capital to meet the Basel requirements. (c)Calculate the capital required under Basel II if the Standardized Approach is used and show whether the bank has sufficient capital to meet the Basel requirements. If not, calculate the total capital the bank needs to meet the requirement. (d)Calculate the leverage ratio. Briefly discuss the difference between the leverage ratio and the capital adequacy ratio.