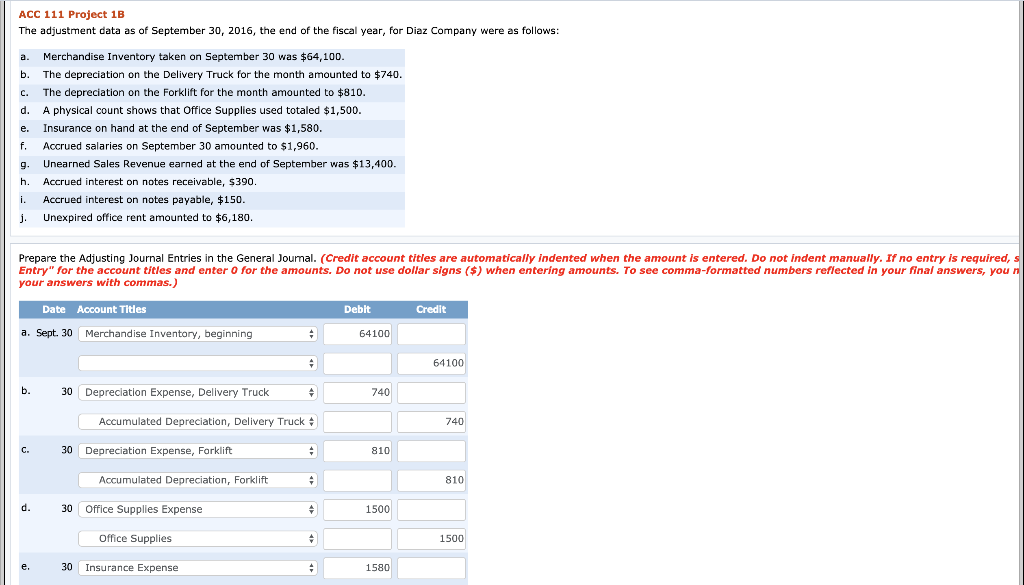

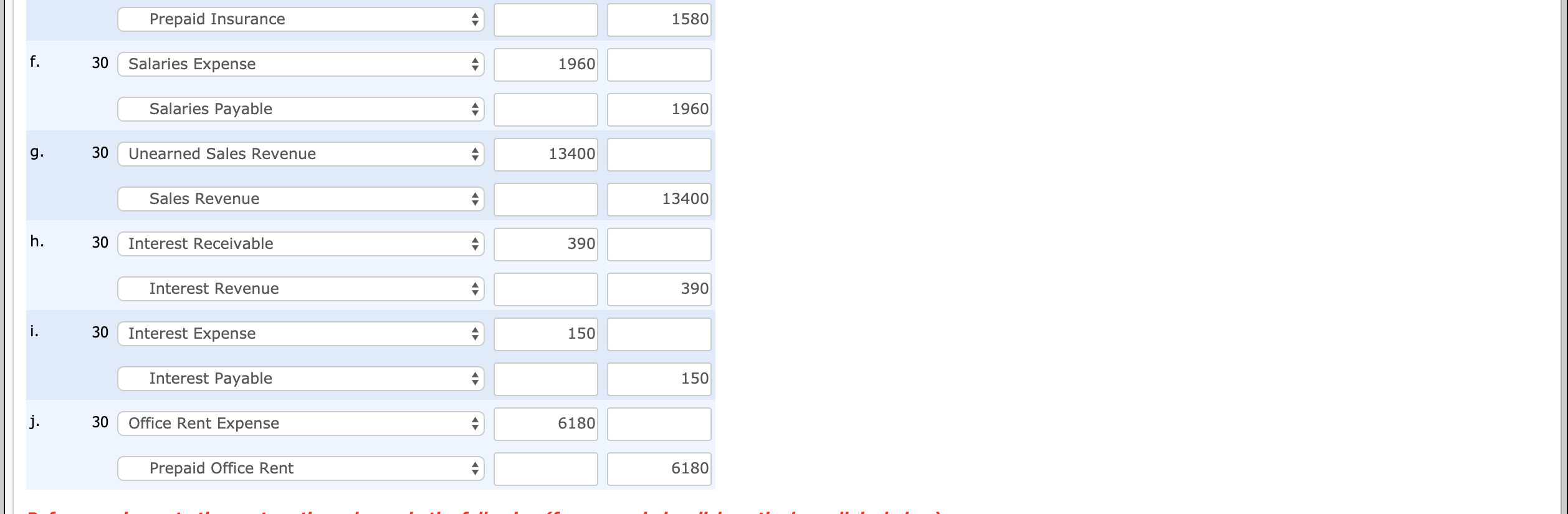

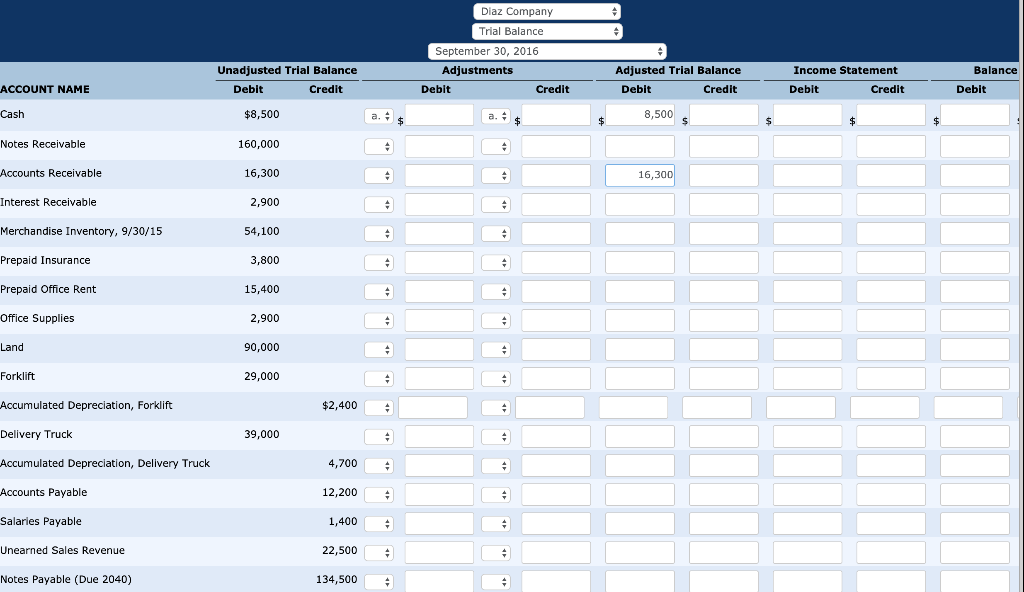

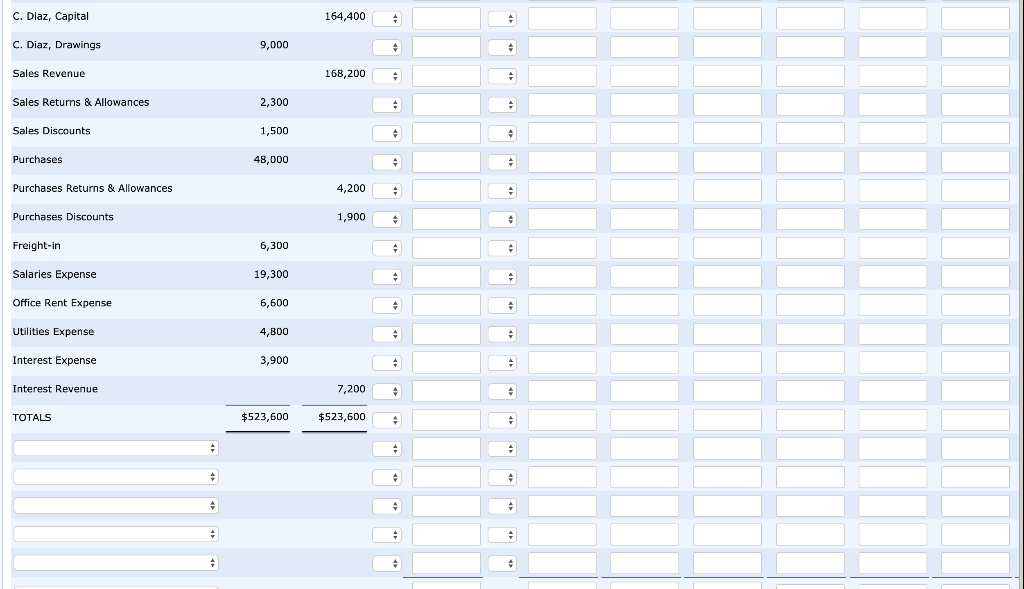

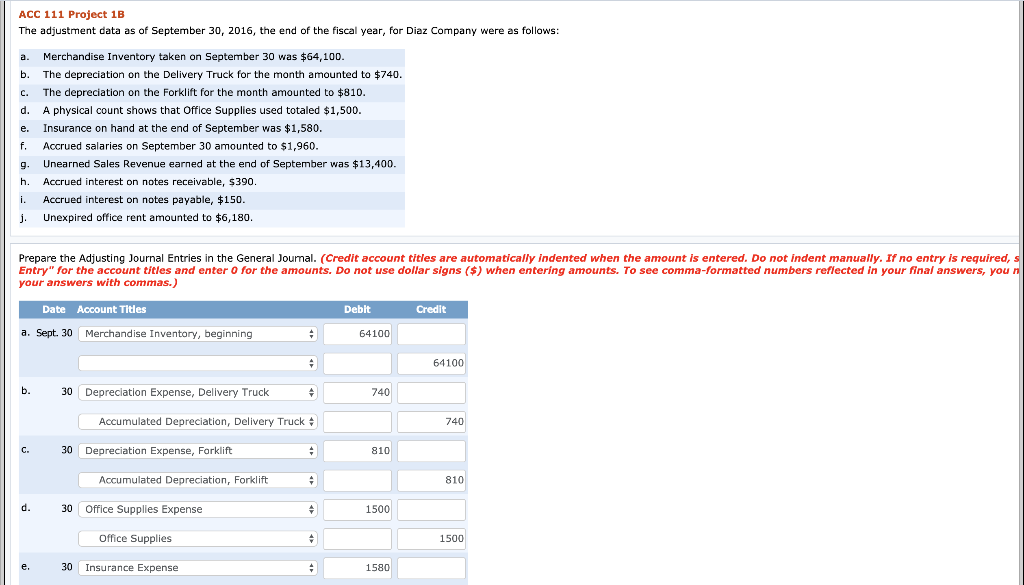

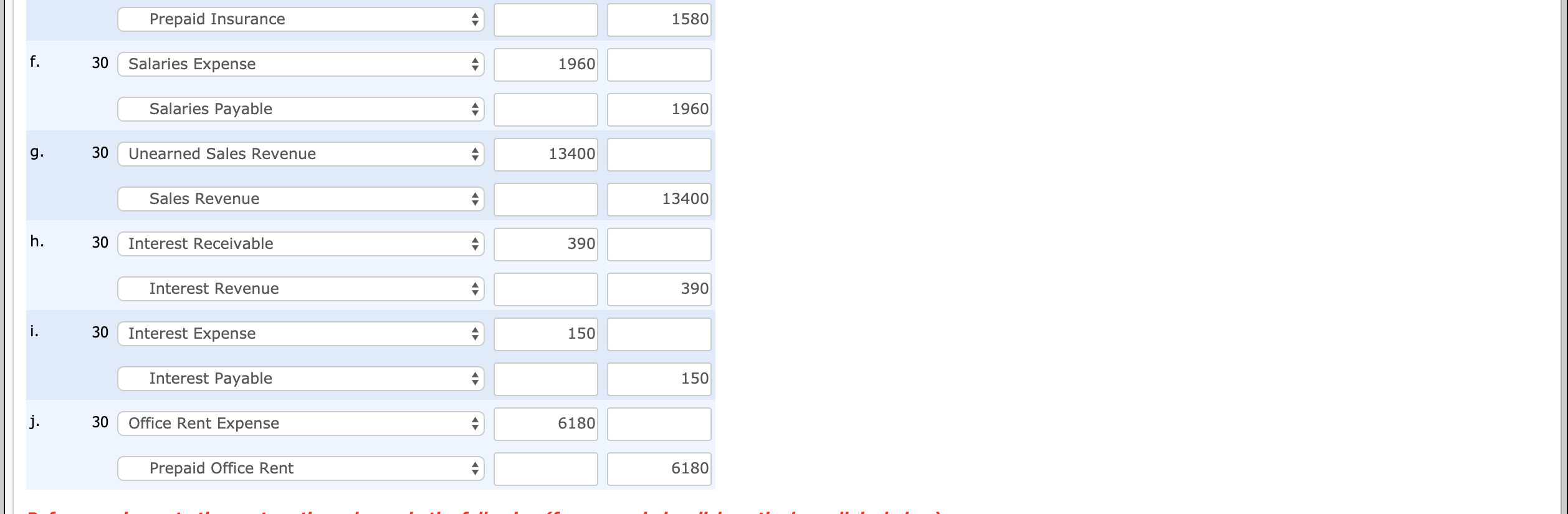

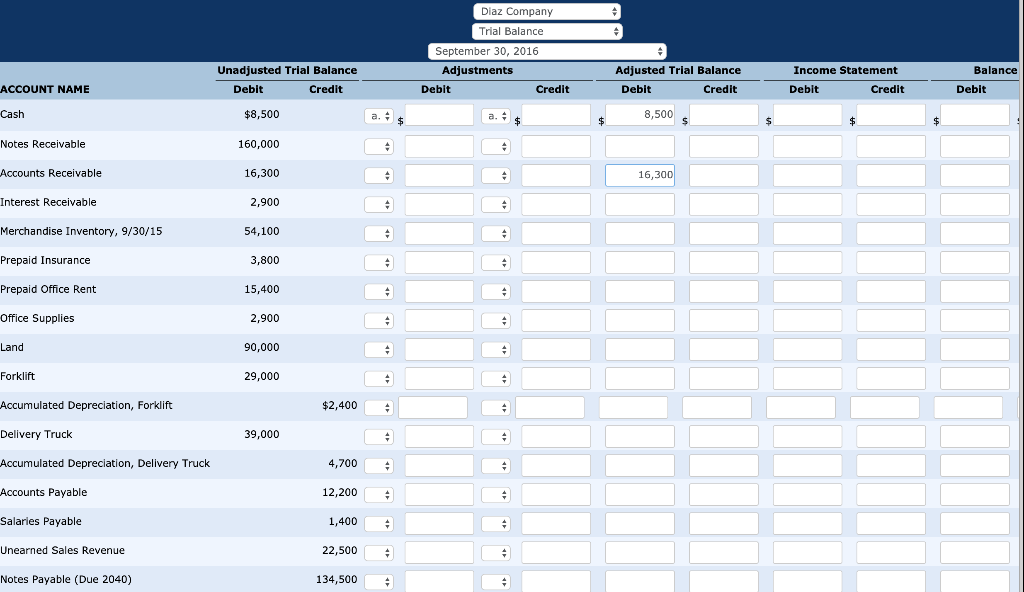

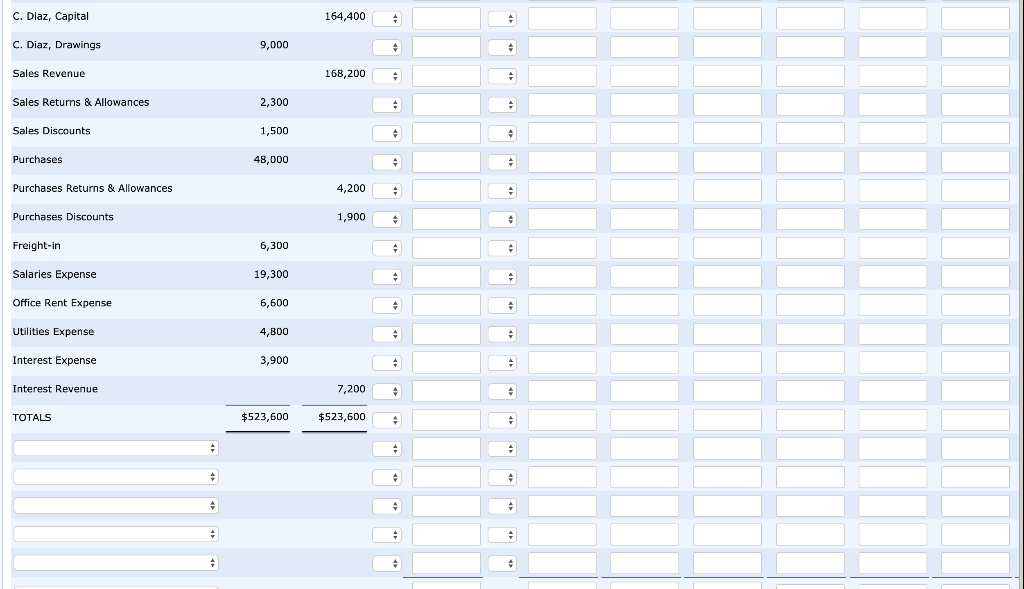

ACC 111 Project 1B The adjustment data as of September 30, 2016, the end of the fiscal year, for Diaz Company were as follows: a. Merchandise Inventory taken on September 30 was $64,100. b. The depreciation on the Delivery Truck for the month amounted to $740. C. The depreciation on the Forklift for the month amounted to $810. d. A physical count shows that Office Supplies used totaled $1,500. e. Insurance on hand at the end of September was $1,580. f. Accrued salaries on September 30 amounted to $1,960. g. Unearned Sales Revenue earned at the end of September was $13,400. h. Accrued interest on notes receivable, $390. i. Accrued interest on notes payable, $150. j. Unexpired office rent amounted to $6,180. Prepare the Adjusting Journal Entries in the General Journal. (Credit account titles are automatically indented when the amount is entered. Do not indent manually. If no entry is required, s Entry" for the account titles and enter o for the amounts. Do not use dollar signs ($) when entering amounts. To see comma-formatted numbers reflected in your final answers, you n your answers with commas.) Date Account Titles Debit Credit a. Sept. 30 Merchandise Inventory, beginning 64100 64100 | b. 30 Depreciation Expense, Delivery Truck 740 Accumulated Depreciation, Delivery Truck # 740 C. 30 Depreciation Expense, Forklift Accumulated Depreciation, Forklift 810 d. 30 Office Supplies Expense 1500 Office Supplies 1500 e. 30 Insurance Expense 1580 Prepaid Insurance 1580 30 Salaries Expense 1960 Salaries Payable 1960 30 Unearned Sales Revenue 13400 Sales Revenue 13400 Interest Receivable 390 Interest Revenue 390 30 Interest Expense 150 Interest Payable 150 |j. 30 Office Rent Expense 6180 Prepaid Office Rent 6180 Diaz Company Trial Balance September 30, 2016 Adjustments Debit Credit ACCOUNT NAME Unadjusted Trial Balance Debit Credit Adjusted Trial Balance Debit Credit 8,500 Income Statement Debit Credit Balance Debit Cash $8,500 Notes Receivable 160,000 Accounts Receivable 16,300 16,300 Interest Receivable 2,900 Merchandise Inventory, 9/30/15 54,100 Prepaid Insurance 3,800 Prepaid Office Rent 15,400 Office Supplies 2,900 Land 90,000 Forklift 29,000 Accumulated Depreciation, Forklift $2,400 Delivery Truck 39,000 Accumulated Depreciation, Delivery Truck 4,700 Accounts Payable 12,200 Salaries Payable 1,400 Unearned Sales Revenue 22,500 Notes Payable (Due 2040) 134,500 C. Diaz, Capital 164,400 C. Diaz, Drawings 9,000 Sales Revenue 168,200 Sales Returns & Allowances 2,300 Sales Discounts 1,500 Purchases 48,000 Purchases Returns & Allowances 4,2009 1,900 Purchases Discounts Freight-in 6,300 Salaries Expense 19,300 Office Rent Expense 6,600 Utilities Expense 4,800 Interest Expense 3,900 Interest Revenue 7,200 TOTALS $523,600 $523,600