Answered step by step

Verified Expert Solution

Question

1 Approved Answer

ACC 2101 Problem I am given all this information and I need to make an adjusted trial balance for it ACC 2101 Extra credit problem

ACC 2101 Problem I am given all this information and I need to make an adjusted trial balance for it

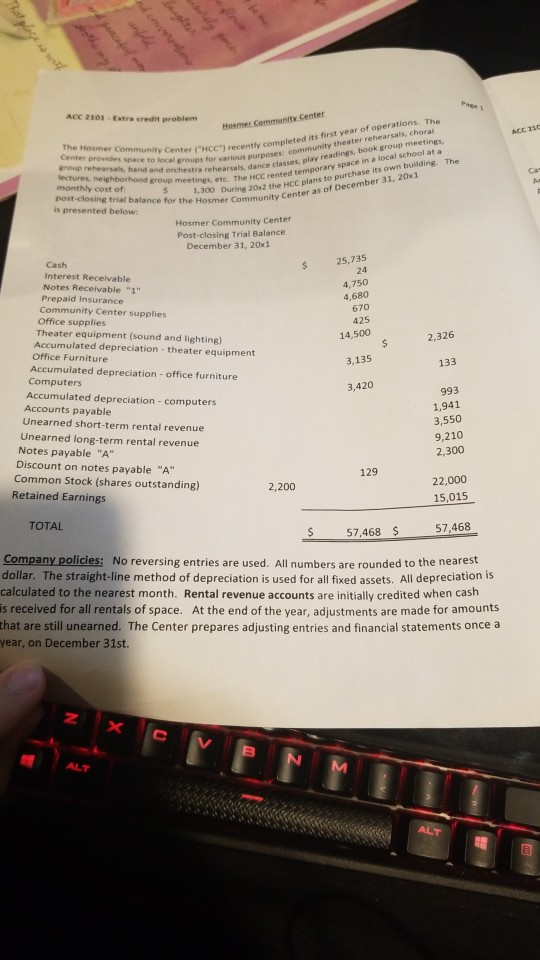

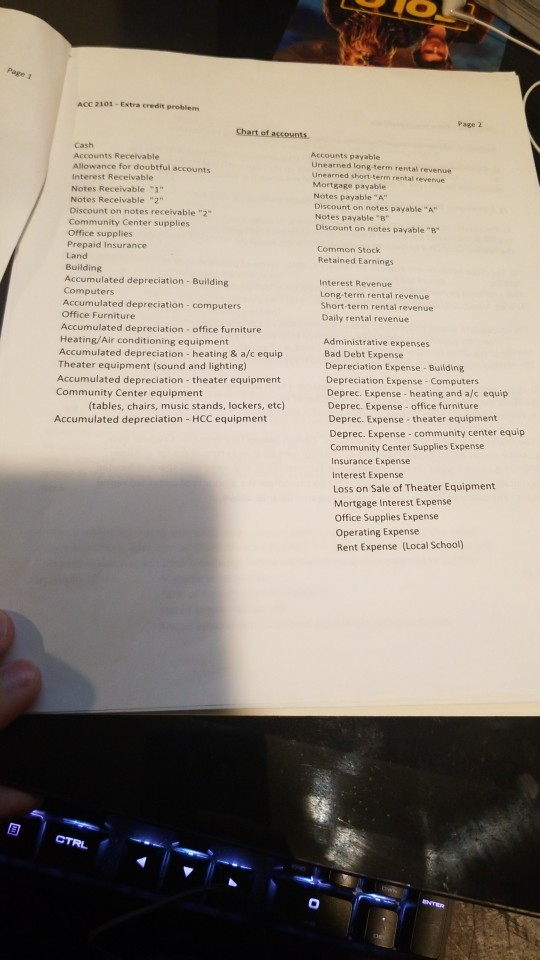

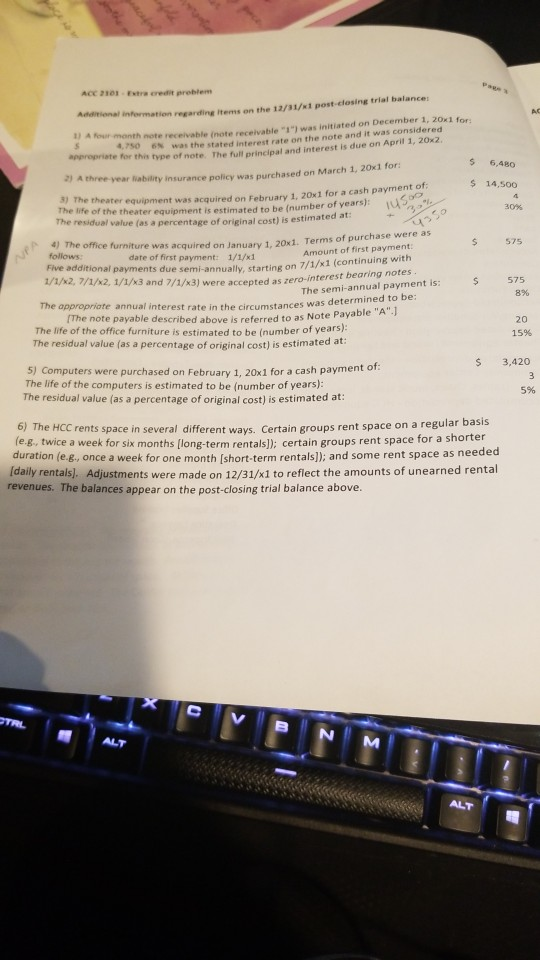

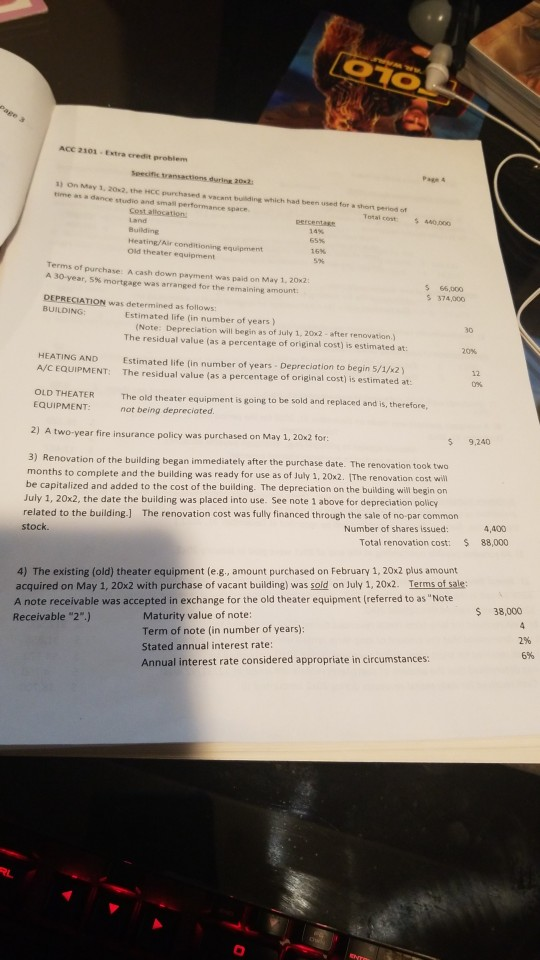

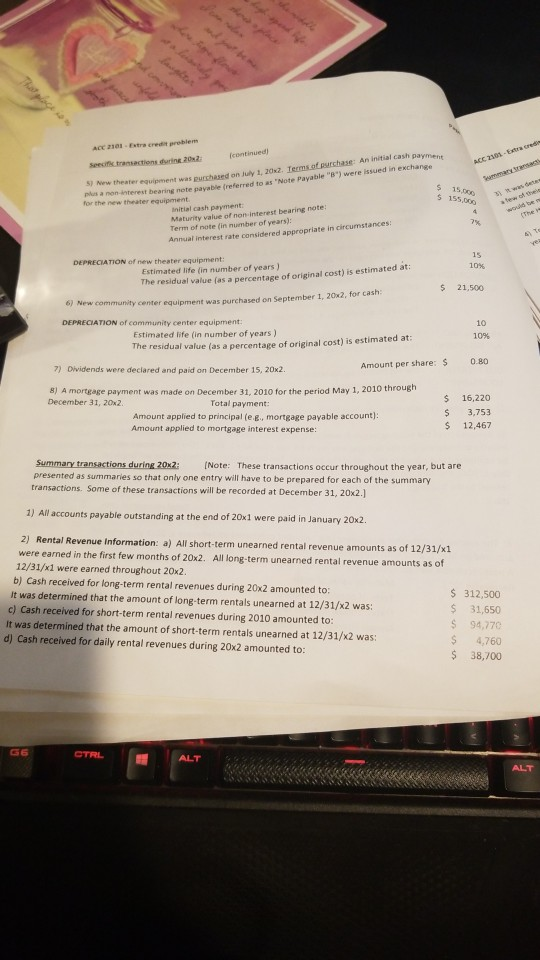

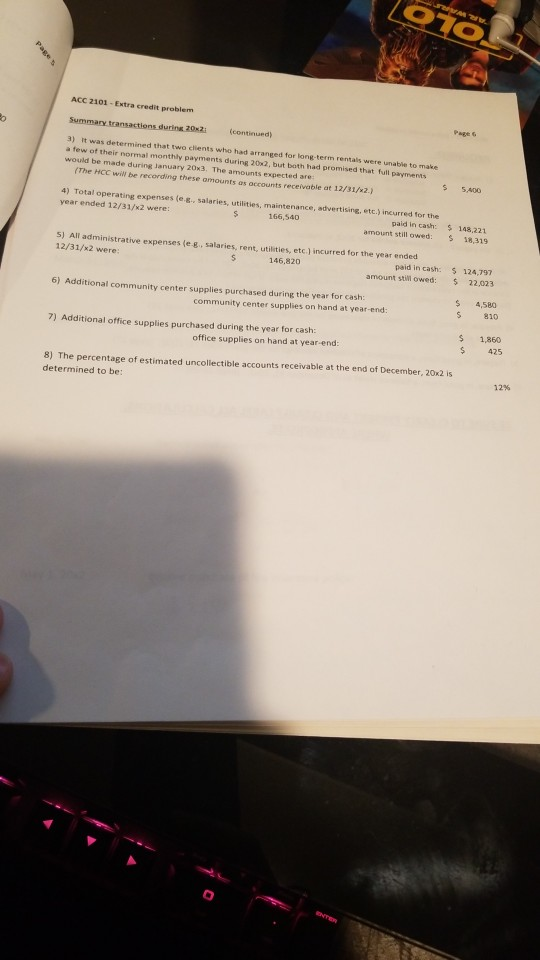

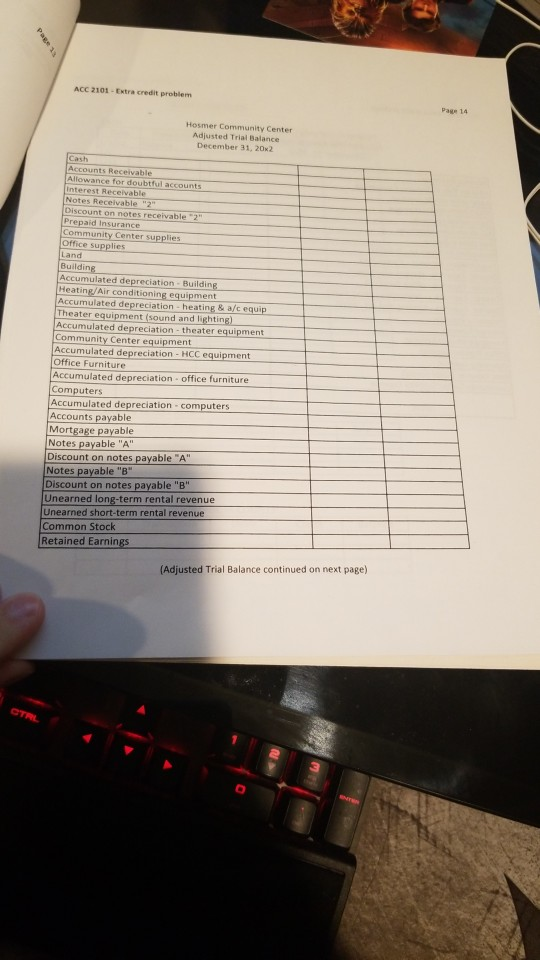

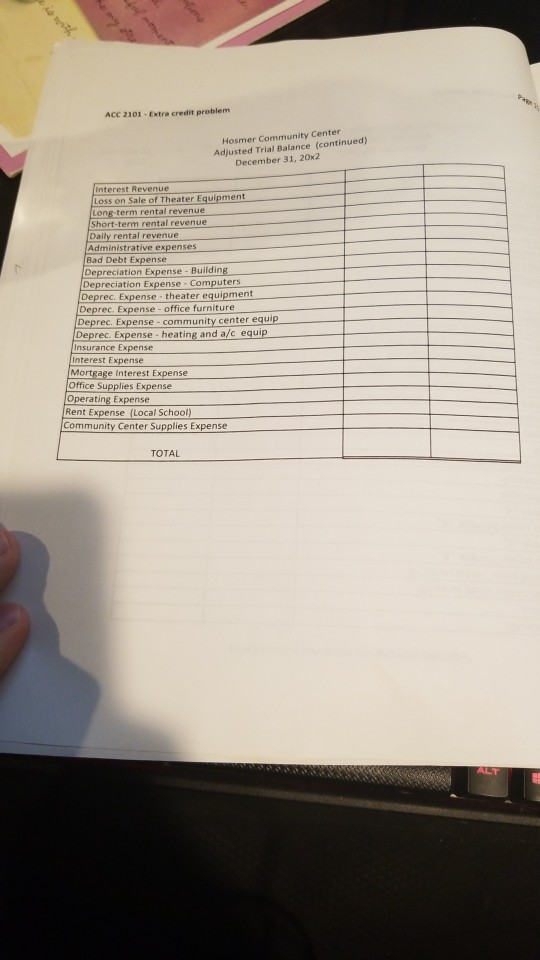

ACC 2101 Extra credit problem Center leted its fstheater rehear The Hosmer Community Center CHCC Center prevides space to local groups for group rehearsals, band and orchestra rehearsals, dance lectures, neighborhood group meetao puring its own r 31, 20x1 etc. The HCC rented the HCC Dl as of Dece monthly cost of: post-closing trial balance for the Hosmer Community is presented below Hosmer Community Center Post-closing Trial Balance December 31, 20x1 24 Interest Receivable Notes Receivable "1" Prepaid Insurance 4,680 Community Center supplies Office supplies Theater equipment (sound and lighting) 14,500 2,326 Accumulated depreciation theater equipment Office Furniture 3,135 Accumulated depreciation- office furniture Computers Accumulated depreciation-computers Accounts payable Unearned short-term rental revenue Unearned long-term rental revenue Notes payable "A" Discount on notes payable "A" Common Stock (shares outstanding) Retained Earnings 2,200 TOTAL Company policies: No reversing entries are used. All numbers are rounded to the nearest dollar. The straight-line method of depreciation is used for all fixed assets. All depreciation is calculated to the nearest month. Rental revenue accounts are initially credited when cash is received for all rentals of space. At the end of the year, adjustments are made for amounts that are still unearned. The Center prepares adjusting entries and financial statements once a year, on December 31st ACC 2101-Extra credit problem Page 2 Chart of accounts Allowance Interest Receivable Notes Receivable "1" Notes Receivable "2" Discount on notes receivable "2" Community Center supplies Office supplies Prepaid Insurance Accounts payable Unearned long-term rental revenue Unearned short-term rental revenue Mortgage payable Notes payable "A Discount on notes payable "A Notes payable "B" Discount on notes payable "B for doubtful accounts Common Stock Retained Earnings Accumulated depreciation- Building Computers Accumulated depreciation - computers Long-term rental revenue Short term rental revenue Daily rental revenue Accumulated depreciation office furniture Heating/Air conditioning equipment Accumulated depreciation - heating & a/c equip Theater equipment (sound and lighting) Accumulated depreciation theater equipment Community Center equipment Administrative Bad Debt Expense Depreciation Expense - Building Depreciation Expense- Computers Deprec. Expense - heating and ac equip Deprec. Expense office furniture Deprec. Expense theater equipment expenses (tables, chairs, music stands, lockers, etc) Accumulated depreciation-HCC equipment Deprec. Expense community center equip Community Center Supplies Expense Insurance Expense Interest Expense Loss on Sale of Theater Equipment Mortgage Interest Expense Office Supplies Expense Operating Expense Rent Expense (Local School) ACC 2101 Extra eredit preblem regarding items on the 12/31/1 post-closing trial balance receivable (note receivable "1") was initiated on December 1, 20xi t 6% 1) A Four month note receivable (note appropriate for this type of note. The full principal and 2) A three year iability insurance policy was purchased on March 1, 20x1 for 4,750 was the stated interest rate on the note and it was considered The full principal and interest is due on April 1, 20x2. $6,480 S 14,5o0 theater equipment was acquired on February 1, 20x1 for a cash payment theater equipment is estimated to be (number of years: 3) The 30% The residual value (as a percentage of original cost) is estimated at ure was acquired on January 1, 20x1. Terms of purchase were as date of first payment: 1/1/x1 p 4 The office furnitu 575 follows Amount of first payment 7/1/x1 (continuing with accepted as zero-interest bearing notes rate in the circumstances was determined to be Five additional payments due semi-annually, starting on 1/1/x2, 7/1/x2, 1/1/x3 and 7/1/x3) were 575 The semi-annual payment is: 896 The appropriate annual interest (The note payable described above is referred to as Note Payable "A"] 20 15% The life of the office furniture is estimated to be (number of years) The residual value (as a percentage of original cost) is estimated at: s 3,420 5) Computers were purchased on February 1, 20x1 for a cash payment o The life of the computers is estimated to be (number of years) The residual value (as a percentage of original cost) is estimated at: 5% 6) The HCC rents space in several different ways. Certain groups rent space on a regular basis (e.g, twice a week for six months [long-term rentals]); certain groups rent space for a s duration (e.g, once a week for one month [short-term rentals]); and some rent sp [daily rentals). Adjustments were made on 12/31/x1 to reflect the amounts of unearned rental revenues. The balances appear on the post-closing trial balance above ace as needed ALT ALT ACC 2103 Extra credit problem Pag 4 1) On May 1, 20x2, t time as a dance studio and small performance space the HCC purchased a vacant building which had been used for a short period of Cost allocation al cost %44000 Heating/Air Old theater equipment conditioning equipment 5% Terms of A 30-yea purchase A cash down payment was paid on May 1, 202: r, 5% mortgage was arranged for the remaining amount 5 66,000 s 374,000 DEPRECIATION was determined as follows: BUILDING: Estimated life (in number of years ) (Note: Depreciation will begin as of July 1, 20x2- after renovation.) The residual value (as a percentage of original cost) is estimated at: 20 HEATING AND Estimated life (in number of years Depreciation to begin 5/1/x2) A/C EQUIPMENT: The residual value (as a percentage of original cost) is estimated at 12 0% OLD THEATER EQUIPMENT The old theater equipment is going to be sold and replaced and is, therefore, not being depreciated. 2) A two-year fire insurance policy was purchased on May 1, 2 0x2 for 5 9,240 3) Renovation of the building began immediately after the purchase date. The renovation took tw months to complete and the building was ready for use as of July 1, 20x2. The renovation cost wiw be capitalized and added to the cost of the building. The depreciation on the building will begin orn July 1, 20x2, the date the building was placed into use. See note 1 above for depreciation policy related to the building-l The renovation cost was fully financed through the sale of no-par common stock. 4,400 Number of shares issued: Total renovation cost: S 88,000 4) The existing (old) theater equipment (e.g., amount purchased on February 1, 20x2 plus amount acquired on May 1, 20x2 with purchase of vacant building) was sold on July 1, 20x2. Te o le: A note receivable was accepted in exchange for the old theater equipment (referred to as "Note Receivable "2".) $ 38,000 Maturity value of note Term of note (in number of years) Stated annual interest rate Annual interest rate considered appropriate in circumstances: 2% 6% ACC 2101 -Extre credit preblem An initial cash payment pls a non-interest bearing note payable (referred to as "Note Payable "B') were issued in exchange for the new theater equipment 5) New theater equipment was S 15000 s 155,000 r initial cash payment Maturity value of non interest bearing note Term of note (in number of years): Annual interest rate considered appropriate in circumstances: 7% DEPRECIATION of new theater equipment Estimated life (in number of years ) The residual value (as a percentage of original cost) is estimate 10% s 21,500 ) New community center equipment was purchased on September 1, 20x2, for cash: DEPRECIATION of community center equipment: er equipment 10 Estimated life (in number of years) The residual value (as a percentage of original cost) is estimated at: 10% 0.80 Amount per share: $ ) Ovidends were deciared and paid on December 15, 20x2. s) A mortgage payment was made on December 31, 2010 for the period May 1, 2010 through $ 16,220 $ 3,753 12,467 December 31, 20x2 Total payment: Amount applied to principal (e.g., mortgage payable account): Amount applied to mortgage interest expense: Summary transactions during 20x2: (Note: These transactions occur throughout the year, but are presented as summaries so that only one entry will have to be prepared for each of the summary transactions. Some of these transactions will be recorded at December 31, 20x2.] 1) All accounts payable outstanding at the end of 20x1 were paid in January 20x2. 2) Rental Revenue Information: a) All short-term unearned rental revenue amounts as of ed in the first few months of 20x2. All long-term unearned rental revenue amounts as of 12/31/x1 were earned throughout 20x2 b) Cash received for long-term rental revenues during 20x2 amounted to It was determined that the amount of long-term rentals unearned at 12/31/x2 was: c) Cash received for short-term rental revenues during 2010 amounted to It was determined that the amount of short-term rentals unearned at 12/31/x2 was: 312,500 $31,650 $ 94,770 $ 4,760 38,700 d) Cash received for daily rental revenues during 20x2 amounted to: G6 CTRI ALT ALT 010 ACC 2101-Extra credit problem Page 6 transact tions durins0Zi (continued) 3) It was determined that two clients who had arranged for long-term rentals were unabie to make a few of their normal monthly payments during 20x2, but both had promised that full payments would be made during January 20x3, Thea $ 500 (The HCC will be recording these amounts as account advertising, etc.) incurred for the 4) Total operating expenses (e.g., salaries, utilities, maintenance year ended 12/31/x2 were paid in cash: 148,221 amount still owed: 18,319 S 166,540 5) A 12/31/x2 were: Il administrative expenses (e-g, salaries, rent, utilities, etc.) incurred for the year ended paid in cash: $ 124,797 amount still owed: $ 22,023 146,820 $4,580 5 810 6) Additional community center supplies purchased during the year for cash community center supplies on hand at year-end: 7) Additional office supplies purchased during the year for cash $ 1,860 425 office supplies on hand at year-end 8) The percentage of estimated uncollectible accounts receivable at the end of December, 20x2 is determined to be: 12% ACC 2101-Extra credit problem Page 14 Hosmer Community Center Adjusted Trial Balance December 31, 20x2 Cash Accounts Receivable Allowance for doubtful accounts Interest Receivable Notes Receivable Discount on notes receivable "2 Prepaid Insurance Community Center supplies Office s Buildi Accumulated depreciation Buildin Heating/Air conditioning equipment Accumulated depreciation heating & a/c equi Theater equipment (sound and lightirn Accumulated depreciation theater equipment Community Center equipment Accumulated d Office Furniture Accumulated depreciation office furniture Computers Accumulated depreciation computers Accounts payable Mortgage payable Notes payable "A" Discount on notes payable A Notes payable "B Discount on notes payable "B" Unearned long-term rental revenue Unearned short-term rental revenue Common Stock reciation-HCC ed prnent Retained Earnin Adjusted Trial Balance continued on next page) ACC 2101-Extra credit problem Hosmer Community Adjusted Trial Balance (continued) Center December 31, 20x2 Interest Revenue Loss on Sale of Theater Equipment term rental revenue Short-term rental revenue Daily rental revenue Administrative expenses Bad Debt Expense reciation Expense Buildin ciation Expense Computers Expense theater equipment Expense office furniture De rec. E nse community center equ Deprec. Expense heating and a/c equ Insurance Expense Interest E se age Interest Ex Office Supplies Expense Operating Expense Rent Ex Local School) Community Center Supplies Expense TOTAL ACC 2101 Extra credit problem Center leted its fstheater rehear The Hosmer Community Center CHCC Center prevides space to local groups for group rehearsals, band and orchestra rehearsals, dance lectures, neighborhood group meetao puring its own r 31, 20x1 etc. The HCC rented the HCC Dl as of Dece monthly cost of: post-closing trial balance for the Hosmer Community is presented below Hosmer Community Center Post-closing Trial Balance December 31, 20x1 24 Interest Receivable Notes Receivable "1" Prepaid Insurance 4,680 Community Center supplies Office supplies Theater equipment (sound and lighting) 14,500 2,326 Accumulated depreciation theater equipment Office Furniture 3,135 Accumulated depreciation- office furniture Computers Accumulated depreciation-computers Accounts payable Unearned short-term rental revenue Unearned long-term rental revenue Notes payable "A" Discount on notes payable "A" Common Stock (shares outstanding) Retained Earnings 2,200 TOTAL Company policies: No reversing entries are used. All numbers are rounded to the nearest dollar. The straight-line method of depreciation is used for all fixed assets. All depreciation is calculated to the nearest month. Rental revenue accounts are initially credited when cash is received for all rentals of space. At the end of the year, adjustments are made for amounts that are still unearned. The Center prepares adjusting entries and financial statements once a year, on December 31st ACC 2101-Extra credit problem Page 2 Chart of accounts Allowance Interest Receivable Notes Receivable "1" Notes Receivable "2" Discount on notes receivable "2" Community Center supplies Office supplies Prepaid Insurance Accounts payable Unearned long-term rental revenue Unearned short-term rental revenue Mortgage payable Notes payable "A Discount on notes payable "A Notes payable "B" Discount on notes payable "B for doubtful accounts Common Stock Retained Earnings Accumulated depreciation- Building Computers Accumulated depreciation - computers Long-term rental revenue Short term rental revenue Daily rental revenue Accumulated depreciation office furniture Heating/Air conditioning equipment Accumulated depreciation - heating & a/c equip Theater equipment (sound and lighting) Accumulated depreciation theater equipment Community Center equipment Administrative Bad Debt Expense Depreciation Expense - Building Depreciation Expense- Computers Deprec. Expense - heating and ac equip Deprec. Expense office furniture Deprec. Expense theater equipment expenses (tables, chairs, music stands, lockers, etc) Accumulated depreciation-HCC equipment Deprec. Expense community center equip Community Center Supplies Expense Insurance Expense Interest Expense Loss on Sale of Theater Equipment Mortgage Interest Expense Office Supplies Expense Operating Expense Rent Expense (Local School) ACC 2101 Extra eredit preblem regarding items on the 12/31/1 post-closing trial balance receivable (note receivable "1") was initiated on December 1, 20xi t 6% 1) A Four month note receivable (note appropriate for this type of note. The full principal and 2) A three year iability insurance policy was purchased on March 1, 20x1 for 4,750 was the stated interest rate on the note and it was considered The full principal and interest is due on April 1, 20x2. $6,480 S 14,5o0 theater equipment was acquired on February 1, 20x1 for a cash payment theater equipment is estimated to be (number of years: 3) The 30% The residual value (as a percentage of original cost) is estimated at ure was acquired on January 1, 20x1. Terms of purchase were as date of first payment: 1/1/x1 p 4 The office furnitu 575 follows Amount of first payment 7/1/x1 (continuing with accepted as zero-interest bearing notes rate in the circumstances was determined to be Five additional payments due semi-annually, starting on 1/1/x2, 7/1/x2, 1/1/x3 and 7/1/x3) were 575 The semi-annual payment is: 896 The appropriate annual interest (The note payable described above is referred to as Note Payable "A"] 20 15% The life of the office furniture is estimated to be (number of years) The residual value (as a percentage of original cost) is estimated at: s 3,420 5) Computers were purchased on February 1, 20x1 for a cash payment o The life of the computers is estimated to be (number of years) The residual value (as a percentage of original cost) is estimated at: 5% 6) The HCC rents space in several different ways. Certain groups rent space on a regular basis (e.g, twice a week for six months [long-term rentals]); certain groups rent space for a s duration (e.g, once a week for one month [short-term rentals]); and some rent sp [daily rentals). Adjustments were made on 12/31/x1 to reflect the amounts of unearned rental revenues. The balances appear on the post-closing trial balance above ace as needed ALT ALT ACC 2103 Extra credit problem Pag 4 1) On May 1, 20x2, t time as a dance studio and small performance space the HCC purchased a vacant building which had been used for a short period of Cost allocation al cost %44000 Heating/Air Old theater equipment conditioning equipment 5% Terms of A 30-yea purchase A cash down payment was paid on May 1, 202: r, 5% mortgage was arranged for the remaining amount 5 66,000 s 374,000 DEPRECIATION was determined as follows: BUILDING: Estimated life (in number of years ) (Note: Depreciation will begin as of July 1, 20x2- after renovation.) The residual value (as a percentage of original cost) is estimated at: 20 HEATING AND Estimated life (in number of years Depreciation to begin 5/1/x2) A/C EQUIPMENT: The residual value (as a percentage of original cost) is estimated at 12 0% OLD THEATER EQUIPMENT The old theater equipment is going to be sold and replaced and is, therefore, not being depreciated. 2) A two-year fire insurance policy was purchased on May 1, 2 0x2 for 5 9,240 3) Renovation of the building began immediately after the purchase date. The renovation took tw months to complete and the building was ready for use as of July 1, 20x2. The renovation cost wiw be capitalized and added to the cost of the building. The depreciation on the building will begin orn July 1, 20x2, the date the building was placed into use. See note 1 above for depreciation policy related to the building-l The renovation cost was fully financed through the sale of no-par common stock. 4,400 Number of shares issued: Total renovation cost: S 88,000 4) The existing (old) theater equipment (e.g., amount purchased on February 1, 20x2 plus amount acquired on May 1, 20x2 with purchase of vacant building) was sold on July 1, 20x2. Te o le: A note receivable was accepted in exchange for the old theater equipment (referred to as "Note Receivable "2".) $ 38,000 Maturity value of note Term of note (in number of years) Stated annual interest rate Annual interest rate considered appropriate in circumstances: 2% 6% ACC 2101 -Extre credit preblem An initial cash payment pls a non-interest bearing note payable (referred to as "Note Payable "B') were issued in exchange for the new theater equipment 5) New theater equipment was S 15000 s 155,000 r initial cash payment Maturity value of non interest bearing note Term of note (in number of years): Annual interest rate considered appropriate in circumstances: 7% DEPRECIATION of new theater equipment Estimated life (in number of years ) The residual value (as a percentage of original cost) is estimate 10% s 21,500 ) New community center equipment was purchased on September 1, 20x2, for cash: DEPRECIATION of community center equipment: er equipment 10 Estimated life (in number of years) The residual value (as a percentage of original cost) is estimated at: 10% 0.80 Amount per share: $ ) Ovidends were deciared and paid on December 15, 20x2. s) A mortgage payment was made on December 31, 2010 for the period May 1, 2010 through $ 16,220 $ 3,753 12,467 December 31, 20x2 Total payment: Amount applied to principal (e.g., mortgage payable account): Amount applied to mortgage interest expense: Summary transactions during 20x2: (Note: These transactions occur throughout the year, but are presented as summaries so that only one entry will have to be prepared for each of the summary transactions. Some of these transactions will be recorded at December 31, 20x2.] 1) All accounts payable outstanding at the end of 20x1 were paid in January 20x2. 2) Rental Revenue Information: a) All short-term unearned rental revenue amounts as of ed in the first few months of 20x2. All long-term unearned rental revenue amounts as of 12/31/x1 were earned throughout 20x2 b) Cash received for long-term rental revenues during 20x2 amounted to It was determined that the amount of long-term rentals unearned at 12/31/x2 was: c) Cash received for short-term rental revenues during 2010 amounted to It was determined that the amount of short-term rentals unearned at 12/31/x2 was: 312,500 $31,650 $ 94,770 $ 4,760 38,700 d) Cash received for daily rental revenues during 20x2 amounted to: G6 CTRI ALT ALT 010 ACC 2101-Extra credit problem Page 6 transact tions durins0Zi (continued) 3) It was determined that two clients who had arranged for long-term rentals were unabie to make a few of their normal monthly payments during 20x2, but both had promised that full payments would be made during January 20x3, Thea $ 500 (The HCC will be recording these amounts as account advertising, etc.) incurred for the 4) Total operating expenses (e.g., salaries, utilities, maintenance year ended 12/31/x2 were paid in cash: 148,221 amount still owed: 18,319 S 166,540 5) A 12/31/x2 were: Il administrative expenses (e-g, salaries, rent, utilities, etc.) incurred for the year ended paid in cash: $ 124,797 amount still owed: $ 22,023 146,820 $4,580 5 810 6) Additional community center supplies purchased during the year for cash community center supplies on hand at year-end: 7) Additional office supplies purchased during the year for cash $ 1,860 425 office supplies on hand at year-end 8) The percentage of estimated uncollectible accounts receivable at the end of December, 20x2 is determined to be: 12% ACC 2101-Extra credit problem Page 14 Hosmer Community Center Adjusted Trial Balance December 31, 20x2 Cash Accounts Receivable Allowance for doubtful accounts Interest Receivable Notes Receivable Discount on notes receivable "2 Prepaid Insurance Community Center supplies Office s Buildi Accumulated depreciation Buildin Heating/Air conditioning equipment Accumulated depreciation heating & a/c equi Theater equipment (sound and lightirn Accumulated depreciation theater equipment Community Center equipment Accumulated d Office Furniture Accumulated depreciation office furniture Computers Accumulated depreciation computers Accounts payable Mortgage payable Notes payable "A" Discount on notes payable A Notes payable "B Discount on notes payable "B" Unearned long-term rental revenue Unearned short-term rental revenue Common Stock reciation-HCC ed prnent Retained Earnin Adjusted Trial Balance continued on next page) ACC 2101-Extra credit problem Hosmer Community Adjusted Trial Balance (continued) Center December 31, 20x2 Interest Revenue Loss on Sale of Theater Equipment term rental revenue Short-term rental revenue Daily rental revenue Administrative expenses Bad Debt Expense reciation Expense Buildin ciation Expense Computers Expense theater equipment Expense office furniture De rec. E nse community center equ Deprec. Expense heating and a/c equ Insurance Expense Interest E se age Interest Ex Office Supplies Expense Operating Expense Rent Ex Local School) Community Center Supplies Expense TOTAL

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started