Answered step by step

Verified Expert Solution

Question

1 Approved Answer

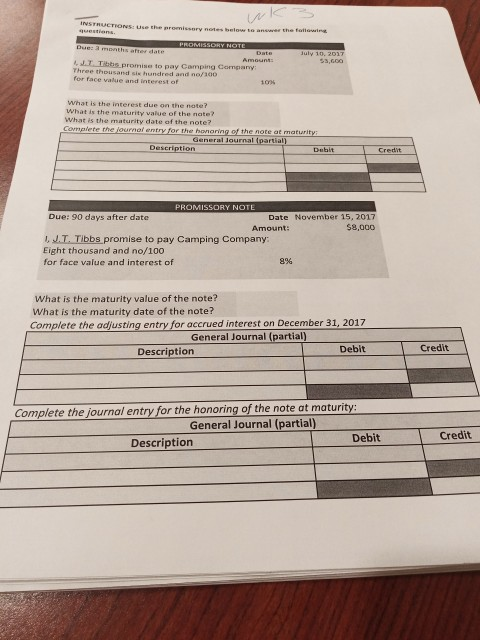

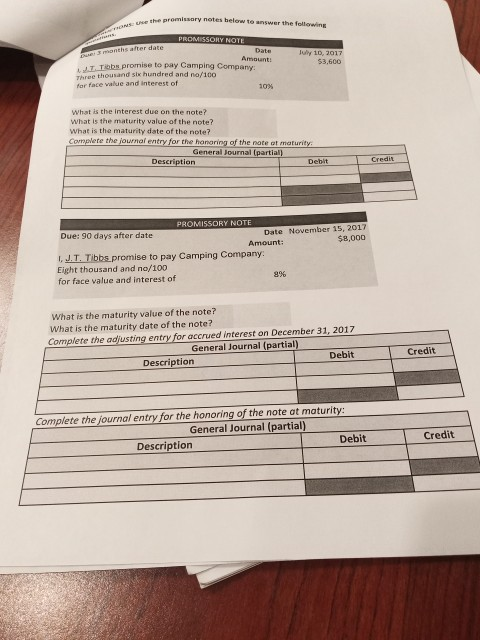

ACC 213 HUCTIO use the promissory notes below to answee the fallawwing JTibb e promise to pay Camping Company 3,G0O 10% What is the interest

ACC 213

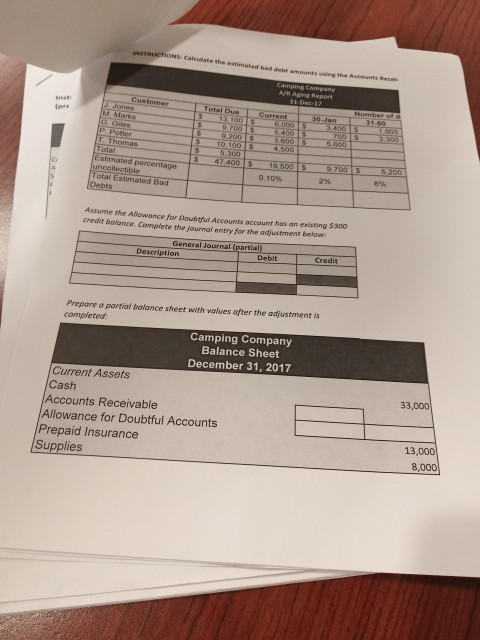

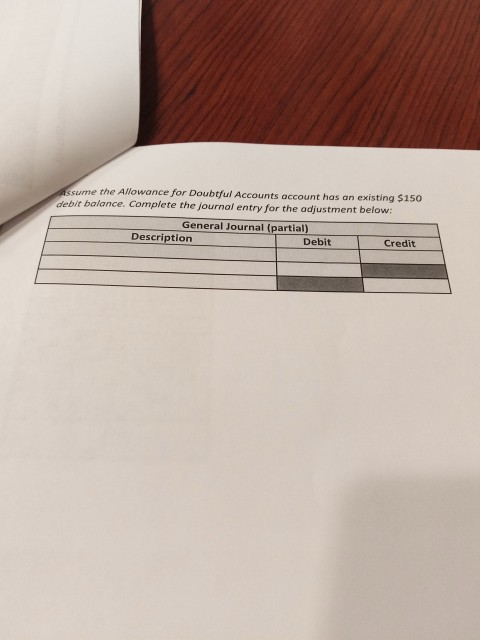

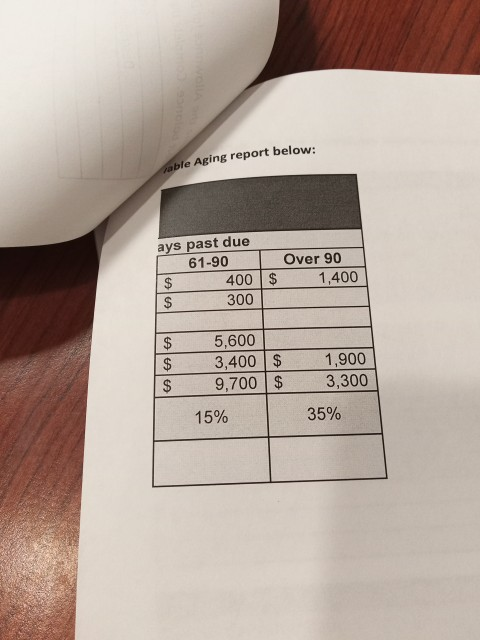

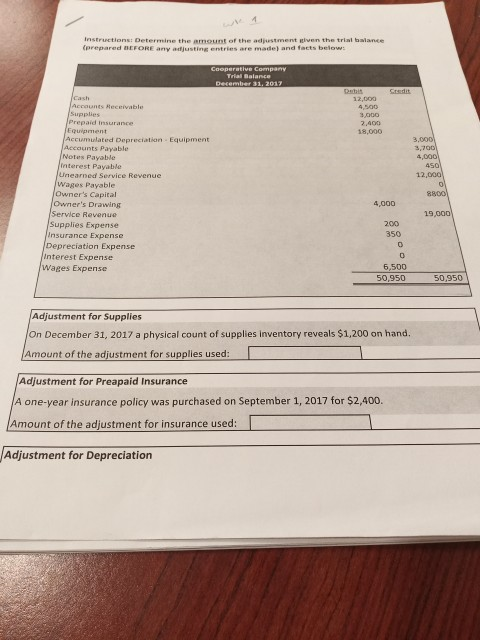

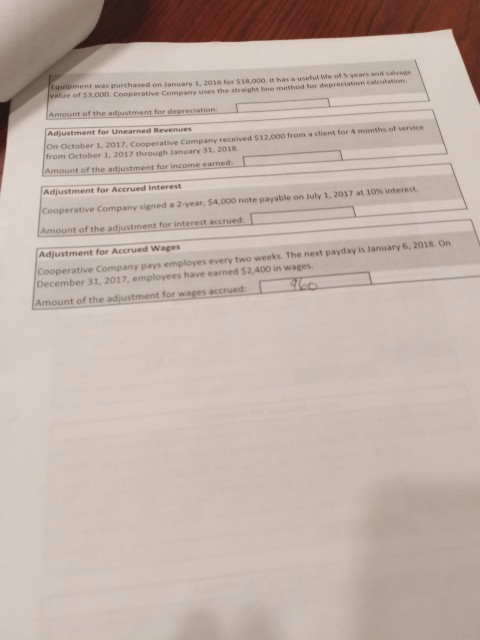

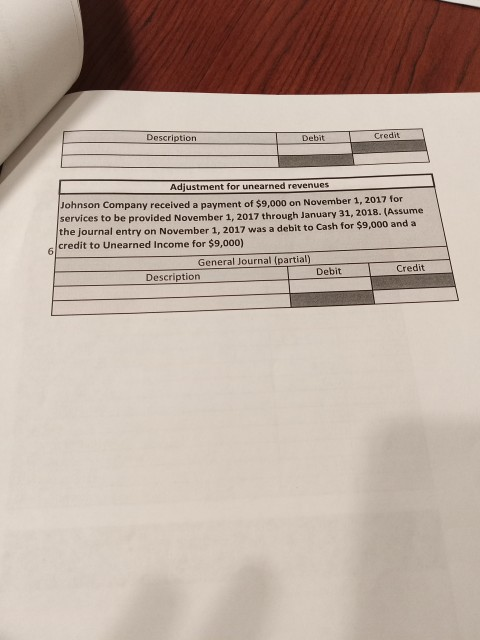

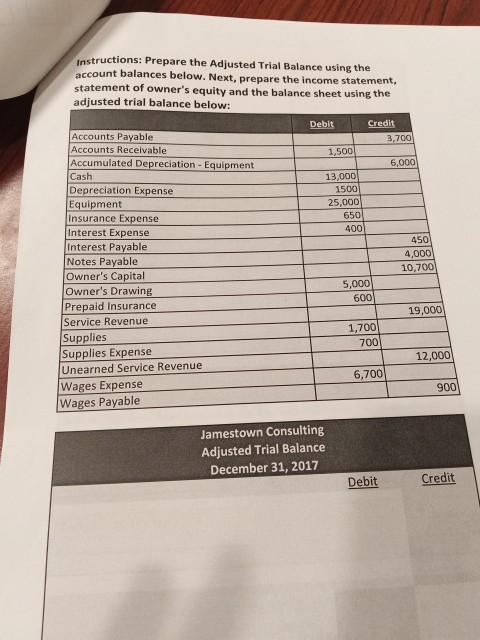

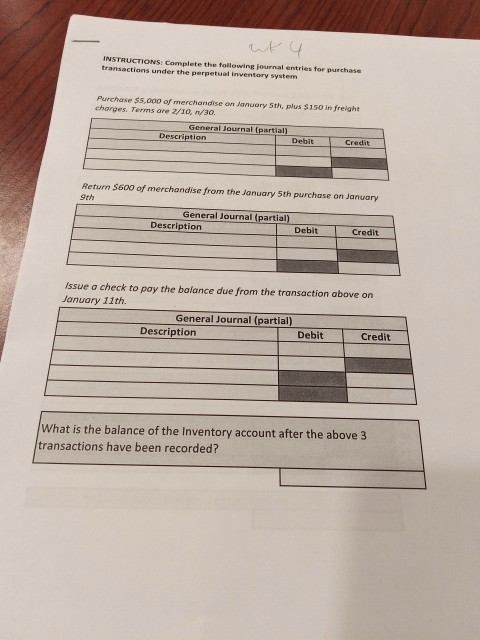

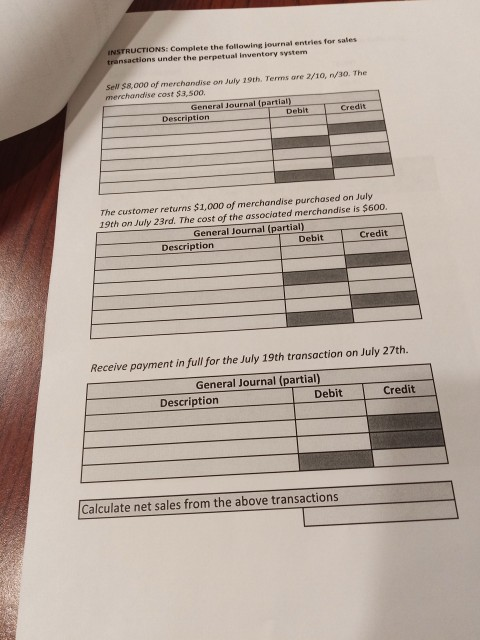

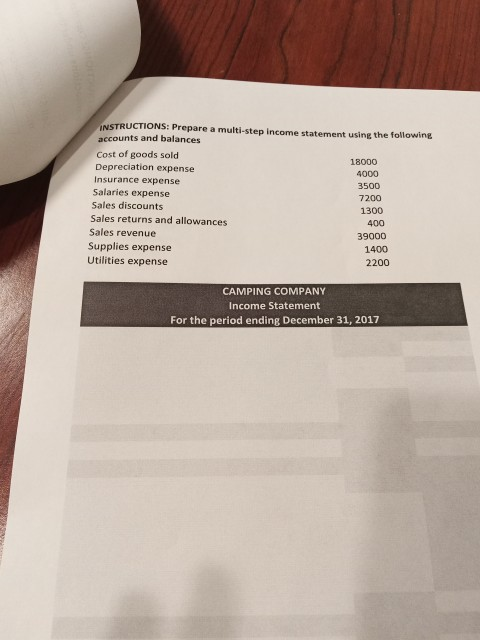

HUCTIO use the promissory notes below to answee the fallawwing JTibb e promise to pay Camping Company 3,G0O 10% What is the interest due on the note? What is the maturity value of the nate? What is the maturity date of the note? Complete the journol entry for the bonoring of the note at maturity General Journal (partial PROMIS Due: 90 days after date Date November 15, 2017 $8,000 Amount L J.T. Tibbs promise to pay Camping Company Eight thousand and no/100 for face value and interest of 896 What is the maturity value of the note? What is the maturity date of the note? Complete the adjusting entry for accrued interest on December 31, 2017 General Journal (partial) Description Debit Credit Complete the journal entry for the honoring of the note at maturity: General Journal (partial) Debit Credit Description ssume the Allowance for Doubtful Accounts account has an existing $150 debit balance. Complete the journal entry for the adjustment below: General Journal (partial) Description Debit Credit able Aging report below: ays past due 61-90 Over 90 400 $ 300 1,400 $5,600 3400 $ 1 $ 9,700 3,300 1,900 15% 35% the promissary notes below te answer the following luly 10, 2017 $3,600 .T.Tbspromise to pay Camping Company: ee thousand six hundred and no/100 ar face value and interest of 10% What is the interest due on the note? What is the maturity value of the note? What is the maturity date of the note? Complete the journaf entry for the hangring of the nate at maturity General Journal (partial) Description Debit Credi Due: 90 days after date Date November 15, 2017 $8,000 Amount l, J. T. TbDEpromise to pay Camping Company; Eight thousand and no/100 for face value and interest of 8% What is the maturity value of the note? What is the maturity date of the note? Complete the adjusting entry for accrued interest on December 31, 2017 General Journal (partial) Debit Credit Description Complete the journal entry for the honoring of the note at maturity: General Journal (partial) Debit Credit Description Equipment was purchased on January 3, 2016 for $18,000 It bas a usetuk Wie of s years and saeags value of s3,000 Cooperative Company uses the straight me method tor depreciation calculation Amount of the adjustment for depreclation Adjustment for Unearned Revenues On October 1, 2017, Cooperative Company received $12,000 from a client for 4 months of from October 1, 2017 through January 31, 2018 service Amount of the adjustment for income earned Adjustment for Accrued Interest tive Company signed a 2-year, $4,000 note payable on buly 1, 2017 at 10% interest Amount of the adjustment for interest accrued Adjustment for Accrued Wages Cooperative Company pays employes every two weeks. The next payday is January 6, 2018. On December 31, 2017, employees have earned $2,400 in wages for accrued Description Debit Credit Adjustment for unearned revenues Johnso Company received a payment of $9,000 on November 1, 2017 for services to be provided November 1, 2017 through January 31, 2018. (Assume the journal entry on November 1, 2017 was a debit to Cash for $9,000 and a credit to Unearned Income for $9,000) General Journal (partial) Debit Credit Description instructions: Prepare the Adjusted Trial Balance using the account balances below. Next, prepare the income statement, statement of owner's equity and the balance sheet using the adjusted trial balance below: Debit Credit Accounts Payable Accounts Receivable Accumulated Depreciation- Equipment Cash Depreciation Expense Equipment Insurance Expense Interest Expense Interest Payable Notes Payable Owner's Capital Owner's Drawing Prepaid Insurance Service Revenue 3,700 1,500 6,000 13,000 1500 25,000 650 400 450 4,000 10,700 5,000 600 19,000 1,700 700 Supplies Supplies Expense Unearned Service Revenue Wages Expense Wages Payable 12,000 6,700 900 Jamestown Consulting Adjusted Trial Balance December 31, 2017 Debit Credit INSTRUCTIONS: Complete the following journal entries for purchase transactions under the perpetual inventory system Purchase $5,000 of merchandise on Januory 5th, plus $150 in freight charges. Terms are 2/10, n/30. General Journal (partial) tpartia Description Debit Credit Return S600 of merchandise from the January 5th purchase on January 9th General Journal (partial) Description Debit Credit Issue a check to pay the balance due from the transaction above on January 11th. General Journal (partial) Description Debit Credit What is the balance of the Inventory account after the above 3 transactions have been recorded? INSTRUCTIONS: Complete the following jurnal entries for sales transactions under the perpetual inventory system Sel $8,000 of merchandise on July 19th. Terms are 2/10, n/3o. The merchandise cost 53,500. General Journal (partial) Description Debit Credit The customer returns $1,000 of merchandise purchased on July 19th on July 23rd. The cost of the associated merchandise is $600 General Journal (partial) Description Debit Credit Receive payment in full for the July 19th transaction on July 27th. General Journal (partial) Description Debit Credit Calculate net sales from the above transactions INSTRUCTIONS: Prepare a multi-step income statement using the following accounts and balances Cost of goods sold Depreciation expense Insurance expense Salaries expense Sales discounts Sales returns and allowances Sales revenue Supplies expense 18000 4000 3500 7200 1300 400 39000 1400 2200 Utilities expense CAMPING COMPANY Income Statement For the period ending December 31, 2017 Gross Profit Operating Expenses Sales Net Income Net Loss Cost of goods sold Depreciation expense nsurance expense Salaries expense Sales discounts Sales returns and allowances Sales revenue Supplies expense Utilities expense HUCTIO use the promissory notes below to answee the fallawwing JTibb e promise to pay Camping Company 3,G0O 10% What is the interest due on the note? What is the maturity value of the nate? What is the maturity date of the note? Complete the journol entry for the bonoring of the note at maturity General Journal (partial PROMIS Due: 90 days after date Date November 15, 2017 $8,000 Amount L J.T. Tibbs promise to pay Camping Company Eight thousand and no/100 for face value and interest of 896 What is the maturity value of the note? What is the maturity date of the note? Complete the adjusting entry for accrued interest on December 31, 2017 General Journal (partial) Description Debit Credit Complete the journal entry for the honoring of the note at maturity: General Journal (partial) Debit Credit Description ssume the Allowance for Doubtful Accounts account has an existing $150 debit balance. Complete the journal entry for the adjustment below: General Journal (partial) Description Debit Credit able Aging report below: ays past due 61-90 Over 90 400 $ 300 1,400 $5,600 3400 $ 1 $ 9,700 3,300 1,900 15% 35% the promissary notes below te answer the following luly 10, 2017 $3,600 .T.Tbspromise to pay Camping Company: ee thousand six hundred and no/100 ar face value and interest of 10% What is the interest due on the note? What is the maturity value of the note? What is the maturity date of the note? Complete the journaf entry for the hangring of the nate at maturity General Journal (partial) Description Debit Credi Due: 90 days after date Date November 15, 2017 $8,000 Amount l, J. T. TbDEpromise to pay Camping Company; Eight thousand and no/100 for face value and interest of 8% What is the maturity value of the note? What is the maturity date of the note? Complete the adjusting entry for accrued interest on December 31, 2017 General Journal (partial) Debit Credit Description Complete the journal entry for the honoring of the note at maturity: General Journal (partial) Debit Credit Description Equipment was purchased on January 3, 2016 for $18,000 It bas a usetuk Wie of s years and saeags value of s3,000 Cooperative Company uses the straight me method tor depreciation calculation Amount of the adjustment for depreclation Adjustment for Unearned Revenues On October 1, 2017, Cooperative Company received $12,000 from a client for 4 months of from October 1, 2017 through January 31, 2018 service Amount of the adjustment for income earned Adjustment for Accrued Interest tive Company signed a 2-year, $4,000 note payable on buly 1, 2017 at 10% interest Amount of the adjustment for interest accrued Adjustment for Accrued Wages Cooperative Company pays employes every two weeks. The next payday is January 6, 2018. On December 31, 2017, employees have earned $2,400 in wages for accrued Description Debit Credit Adjustment for unearned revenues Johnso Company received a payment of $9,000 on November 1, 2017 for services to be provided November 1, 2017 through January 31, 2018. (Assume the journal entry on November 1, 2017 was a debit to Cash for $9,000 and a credit to Unearned Income for $9,000) General Journal (partial) Debit Credit Description instructions: Prepare the Adjusted Trial Balance using the account balances below. Next, prepare the income statement, statement of owner's equity and the balance sheet using the adjusted trial balance below: Debit Credit Accounts Payable Accounts Receivable Accumulated Depreciation- Equipment Cash Depreciation Expense Equipment Insurance Expense Interest Expense Interest Payable Notes Payable Owner's Capital Owner's Drawing Prepaid Insurance Service Revenue 3,700 1,500 6,000 13,000 1500 25,000 650 400 450 4,000 10,700 5,000 600 19,000 1,700 700 Supplies Supplies Expense Unearned Service Revenue Wages Expense Wages Payable 12,000 6,700 900 Jamestown Consulting Adjusted Trial Balance December 31, 2017 Debit Credit INSTRUCTIONS: Complete the following journal entries for purchase transactions under the perpetual inventory system Purchase $5,000 of merchandise on Januory 5th, plus $150 in freight charges. Terms are 2/10, n/30. General Journal (partial) tpartia Description Debit Credit Return S600 of merchandise from the January 5th purchase on January 9th General Journal (partial) Description Debit Credit Issue a check to pay the balance due from the transaction above on January 11th. General Journal (partial) Description Debit Credit What is the balance of the Inventory account after the above 3 transactions have been recorded? INSTRUCTIONS: Complete the following jurnal entries for sales transactions under the perpetual inventory system Sel $8,000 of merchandise on July 19th. Terms are 2/10, n/3o. The merchandise cost 53,500. General Journal (partial) Description Debit Credit The customer returns $1,000 of merchandise purchased on July 19th on July 23rd. The cost of the associated merchandise is $600 General Journal (partial) Description Debit Credit Receive payment in full for the July 19th transaction on July 27th. General Journal (partial) Description Debit Credit Calculate net sales from the above transactions INSTRUCTIONS: Prepare a multi-step income statement using the following accounts and balances Cost of goods sold Depreciation expense Insurance expense Salaries expense Sales discounts Sales returns and allowances Sales revenue Supplies expense 18000 4000 3500 7200 1300 400 39000 1400 2200 Utilities expense CAMPING COMPANY Income Statement For the period ending December 31, 2017 Gross Profit Operating Expenses Sales Net Income Net Loss Cost of goods sold Depreciation expense nsurance expense Salaries expense Sales discounts Sales returns and allowances Sales revenue Supplies expense Utilities expenseStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started