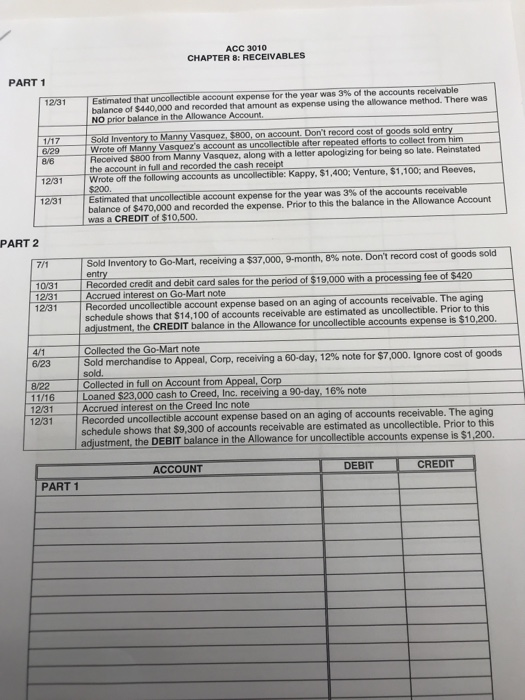

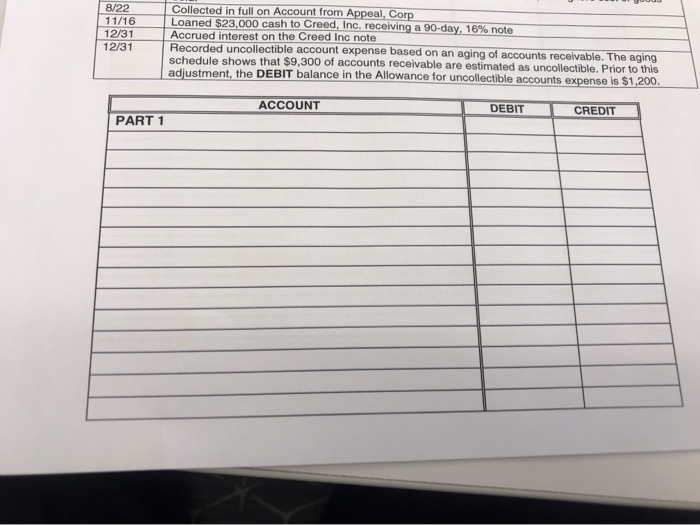

ACC 3010 CHAPTER 8: RECEIVABLES PART 1 12/31 Estimated that uncollectible account expense for the year was 3% of the accounts receivable balance of $440,000 and recorded that amount as expense using the allowance method. There was NO prior balance in the Allowance Account 1/17 6/29 8/6 12/31 Sold Inventory to Manny Vasquez, $800, on account. Don't record cost of goods sold entry Wrote off Manny Vasquez's account as uncollectible after repeated efforts to collect from him Received $800 from Manny Vasquez, along with a letter apologizing for being so late. Reinstated the account in full and recorded the cash receipt Wrote off the following accounts as uncollectible: Kappy, $1,400; Venture, $1,100; and Reeves, $.200 Estimated that uncollectible account expense for the year was 3% of the accounts receivable balance of $470,000 and recorded the expense. Prior to this the balance in the Allowance Account was a CREDIT of $10,500. 12/31 PART 2 7/1 10/31 12/31 12/31 Sold Inventory to Go-Mart, receiving a $37.000, 9-month, 8% note. Don't record cost of goods sold entry Recorded credit and debit card sales for the period of $19,000 with a processing fee of $420 Accrued interest on Go-Mart note Recorded uncollectible account expense based on an aging of accounts receivable. The aging schedule shows that $14,100 of accounts receivable are estimated as uncollectible. Prior to this adjustment, the CREDIT balance in the Allowance for uncollectible accounts expense is $10,200. 4/1 6/23 8/22 11/16 1231 12/31 Collected the Go-Mart note Sold merchandise to Appeal, Corp, receiving a 60-day, 12% note for $7,000. Ignore cost of goods sold. Collected in full on Account from Appeal, Corp Loaned $23,000 cash to Creed, Inc. receiving a 90-day, 16% note Accrued interest on the Creed Inc note Recorded uncollectible account expense based on an aging of accounts receivable. The aging schedule shows that $9,300 of accounts receivable are estimated as uncollectible. Prior to this adjustment, the DEBIT balance in the Allowance for uncollectible accounts expense is $1,200. ACCOUNT DEBIT CREDIT PART 1 8/22 11/16 12/31 12/31 Collected in full on Account from Appeal, Corp Loaned $23,000 cash to Creed, Inc. receiving a 90-day, 16% note Accrued interest on the Creed Inc note Recorded uncollectible account expense based on an aging of accounts receivable. The aging schedule shows that $9,300 of accounts receivable are estimated as uncollectible. Prior to this adjustment, the DEBIT balance in the Allowance for uncollectible accounts expense is $1,200. ACCOUNT DEBIT CREDIT