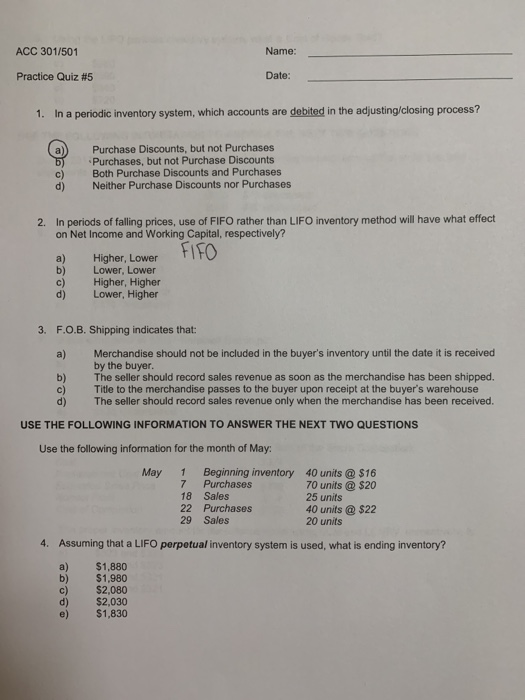

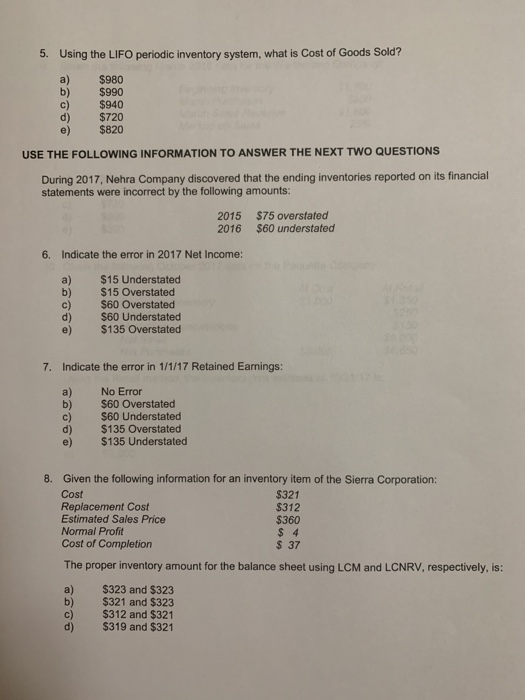

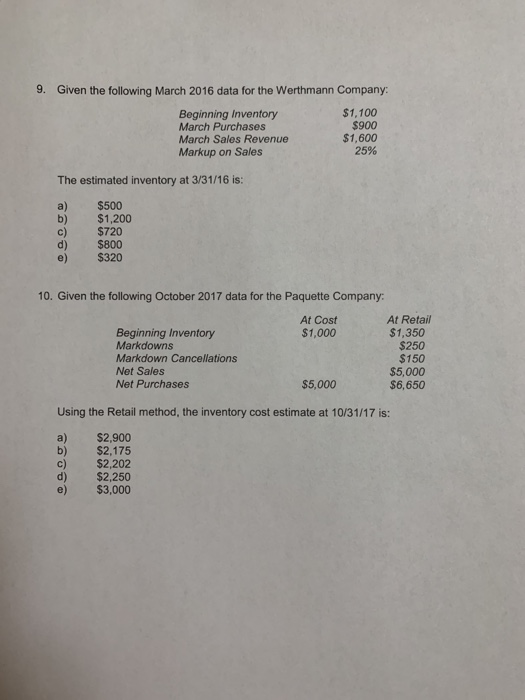

ACC 301/501 Name: Practice Quiz #5 Date: 1. In a periodic inventory system, which accounts are debited in the adjusting/closing process? b) c) d) Purchase Discounts, but not Purchases Purchases, but not Purchase Discounts Both Purchase Discounts and Purchases Neither Purchase Discounts nor Purchases 2. In periods of falling prices, use of FIFO rather than LIFO inventory method will have what effect on Net Income and Working Capital, respectively? a) Higher, Lower FIFO b) Lower, Lower c) Higher, Higher d) Lower, Higher 3. F.O.B. Shipping indicates that: a) Merchandise should not be included in the buyer's inventory until the date it is received by the buyer. b) The seller should record sales revenue as soon as the merchandise has been shipped. c) Title to the merchandise passes to the buyer upon receipt at the buyer's warehouse d) The seller should record sales revenue only when the merchandise has been received. USE THE FOLLOWING INFORMATION TO ANSWER THE NEXT TWO QUESTIONS Use the following information for the month of May: May 1 Beginning inventory 40 units @ $16 Purchases 70 units @ $20 18 Sales 25 units 22 Purchases 40 units @ $22 29 Sales 20 units 4. Assuming that a LIFO perpetual inventory system is used, what is ending inventory? a) $1,880 b) $1,980 $2,080 d) $2,030 e) $1,830 7 c) 5. Using the LIFO periodic inventory system, what is Cost of Goods Sold? c) d) $980 $990 $940 $720 $820 USE THE FOLLOWING INFORMATION TO ANSWER THE NEXT TWO QUESTIONS During 2017, Nehra Company discovered that the ending inventories reported on its financial statements were incorrect by the following amounts: 2015 2016 $75 overstated $60 understated 6. Indicate the error in 2017 Net Income: a) b) $15 Understated $15 Overstated $60 Overstated $60 Understated $135 Overstated 7. Indicate the error in 1/1/17 Retained Earnings: a) b) No Error $60 Overstated $60 Understated $135 Overstated $135 Understated e 8. Given the following information for an inventory item of the Sierra Corporation: Cost $321 Replacement Cost $312 Estimated Sales Price $360 Normal Profit $ 4 Cost of Completion $ 37 The proper inventory amount for the balance sheet using LCM and LCNRV, respectively, is: a) $323 and $323 b) $321 and $323 c) $312 and $321 d) $319 and $321 9. Given the following March 2016 data for the Werthmann Company: Beginning Inventory $1,100 March Purchases $900 March Sales Revenue $1,600 Markup on Sales 25% The estimated inventory at 3/31/16 is: a) b) c) d) $500 $1,200 $720 $800 $320 10. Given the following October 2017 data for the Paquette Company: At Cost $1,000 Beginning Inventory Markdowns Markdown Cancellations Net Sales Net Purchases At Retail $1,350 $250 $150 $5,000 $6,650 $5,000 Using the Retail method, the inventory cost estimate at 10/31/17 is: a) $2,900 b) $2,175 $2,202 d) $2,250 e) $3,000