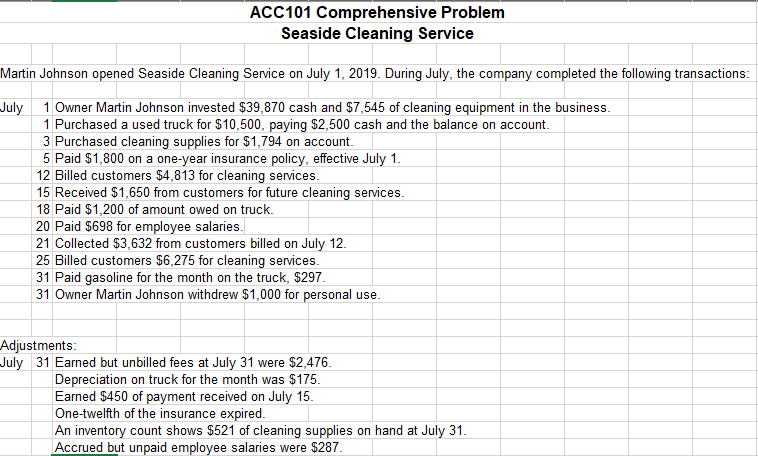

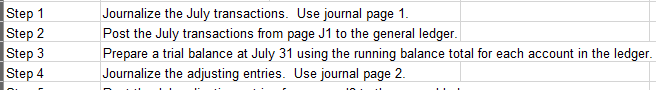

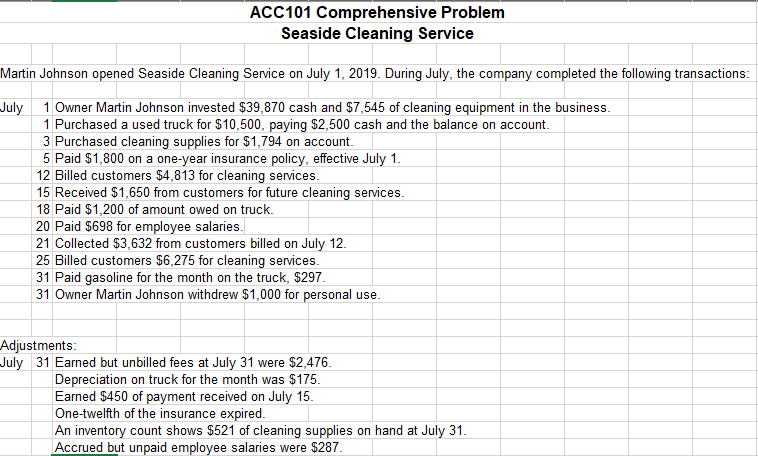

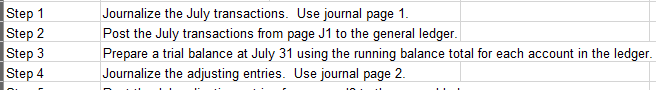

ACC101 Comprehensive Problem Seaside Cleaning Service Martin Johnson opened Seaside Cleaning Service on July 1, 2019. During July, the company completed the following transactions: July 1 Owner Martin Johnson invested $39,870 cash and $7,545 of cleaning equipment in the business. 1 Purchased a used truck for $10,500, paying $2,500 cash and the balance on account. 3 Purchased cleaning supplies for $1,794 on account. 5 Paid $1,800 on a one-year insurance policy, effective July 1. 12 Billed customers $4,813 for cleaning services. 15 Received $1,650 from customers for future cleaning services. 18 Paid $1,200 of amount owed on truck. 20 Paid $698 for employee salaries. 21 Collected $3,632 from customers billed on July 12. 25 Billed customers $6,275 for cleaning services. 31 Paid gasoline for the month on the truck, $297. 31 Owner Martin Johnson withdrew $1,000 for personal use. Adjustments: July 31 Earned but unbilled fees at July 31 were $2,476. Depreciation on truck for the month was $175. Earned $450 of payment received on July 15. One-twelfth of the insurance expired. An inventory count shows $521 of cleaning supplies on hand at July 31. Accrued but unpaid employee salaries were $287. Step 1 Step 2 Step 3 Step 4 Journalize the July transactions. Use journal page 1. Post the July transactions from page J1 to the general ledger. Prepare a trial balance at July 31 using the running balance total for each account in the ledger. Journalize the adjusting entries. Use journal page 2 ACC101 Comprehensive Problem Seaside Cleaning Service Martin Johnson opened Seaside Cleaning Service on July 1, 2019. During July, the company completed the following transactions: July 1 Owner Martin Johnson invested $39,870 cash and $7,545 of cleaning equipment in the business. 1 Purchased a used truck for $10,500, paying $2,500 cash and the balance on account. 3 Purchased cleaning supplies for $1,794 on account. 5 Paid $1,800 on a one-year insurance policy, effective July 1. 12 Billed customers $4,813 for cleaning services. 15 Received $1,650 from customers for future cleaning services. 18 Paid $1,200 of amount owed on truck. 20 Paid $698 for employee salaries. 21 Collected $3,632 from customers billed on July 12. 25 Billed customers $6,275 for cleaning services. 31 Paid gasoline for the month on the truck, $297. 31 Owner Martin Johnson withdrew $1,000 for personal use. Adjustments: July 31 Earned but unbilled fees at July 31 were $2,476. Depreciation on truck for the month was $175. Earned $450 of payment received on July 15. One-twelfth of the insurance expired. An inventory count shows $521 of cleaning supplies on hand at July 31. Accrued but unpaid employee salaries were $287. Step 1 Step 2 Step 3 Step 4 Journalize the July transactions. Use journal page 1. Post the July transactions from page J1 to the general ledger. Prepare a trial balance at July 31 using the running balance total for each account in the ledger. Journalize the adjusting entries. Use journal page 2