Answered step by step

Verified Expert Solution

Question

1 Approved Answer

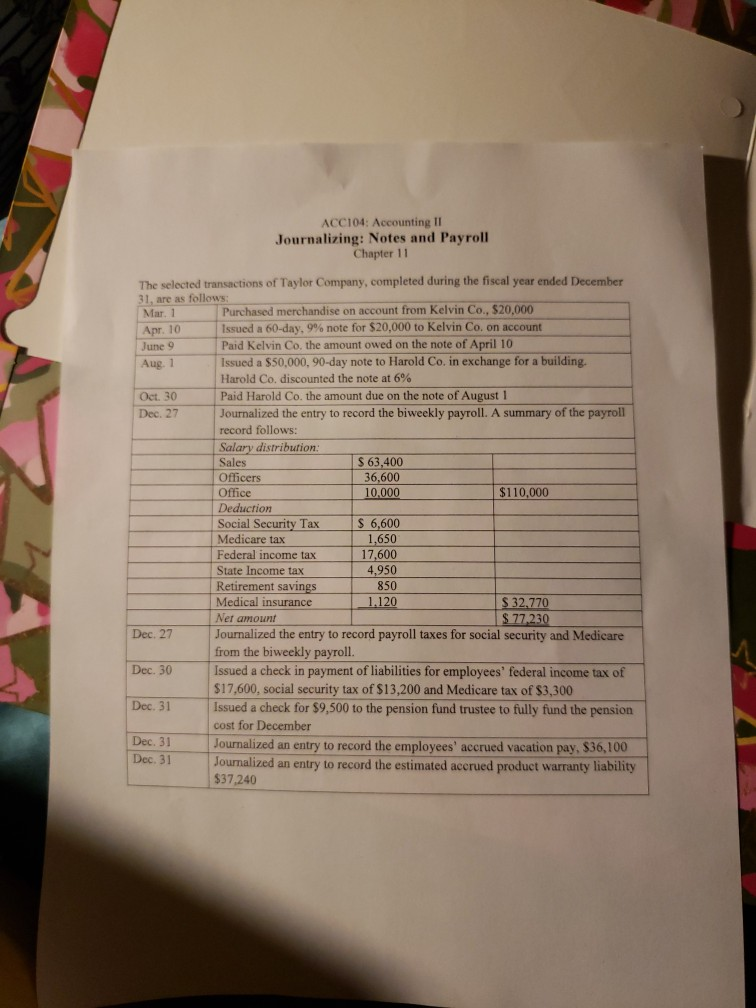

ACC104: Accounting II Journalizing: Notes and Payroll Chapter 11 The selected transactions of Taylor Company, completed during the fiscal year ended December 31, are as

ACC104: Accounting II Journalizing: Notes and Payroll Chapter 11 The selected transactions of Taylor Company, completed during the fiscal year ended December 31, are as follows: Mar. 1 Purchased merchandise on account from Kelvin Co., $20.000 Apr. 10 Issued a 60-day, 9% note for $20,000 to Kelvin Co, on account June 9 Paid Kelvin Co the amount owed on the note of April 10 Aug. 1 Issued a $50,000, 90-day note to Harold Co. in exchange for a building. Harold Co. discounted the note at 6% Oct. 30 Paid Harold Co. the amount due on the note of August 1 Dec. 27 Journalized the entry to record the biweekly payroll. A summary of the payroll record follows: Salary distribution: Sales S63,400 Officers 36,600 Office 10,000 $110,000 Deduction Social Security Tax S 6,600 Medicare tax 1,650 Federal income tax 17,600 State Income tax 4,950 Retirement savings 850 Medical insurance 1.120 S 32,770 Ner amount S 77,230 Dec. 27 Journalized the entry to record payroll taxes for social security and Medicare from the biweekly payroll. Dec. 30 Issued a check in payment of liabilities for employees' federal income tax of $17,600, social security tax of $13,200 and Medicare tax of $3,300 Dec. 31 Issued a check for $9,500 to the pension fund trustee to fully fund the pension cost for December Dec. 31 Journalized an entry to record the employees' accrued vacation pay, $36,100 Dec. 31 Joumalized an entry to record the estimated accrued product warranty liability $37.240

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started