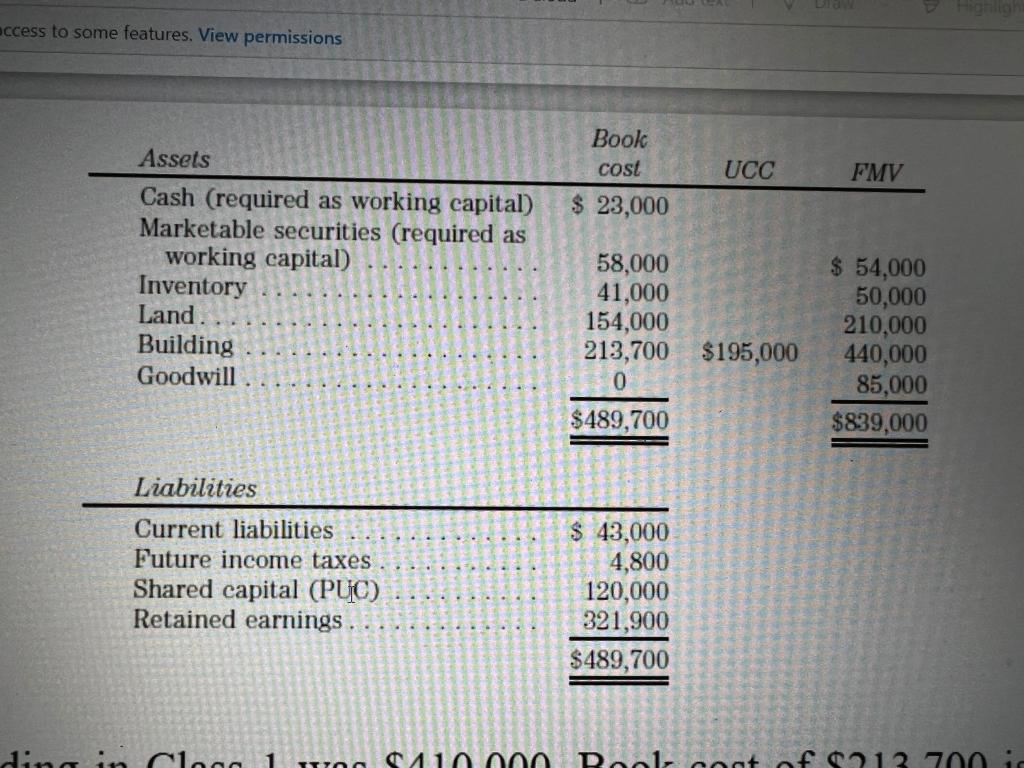

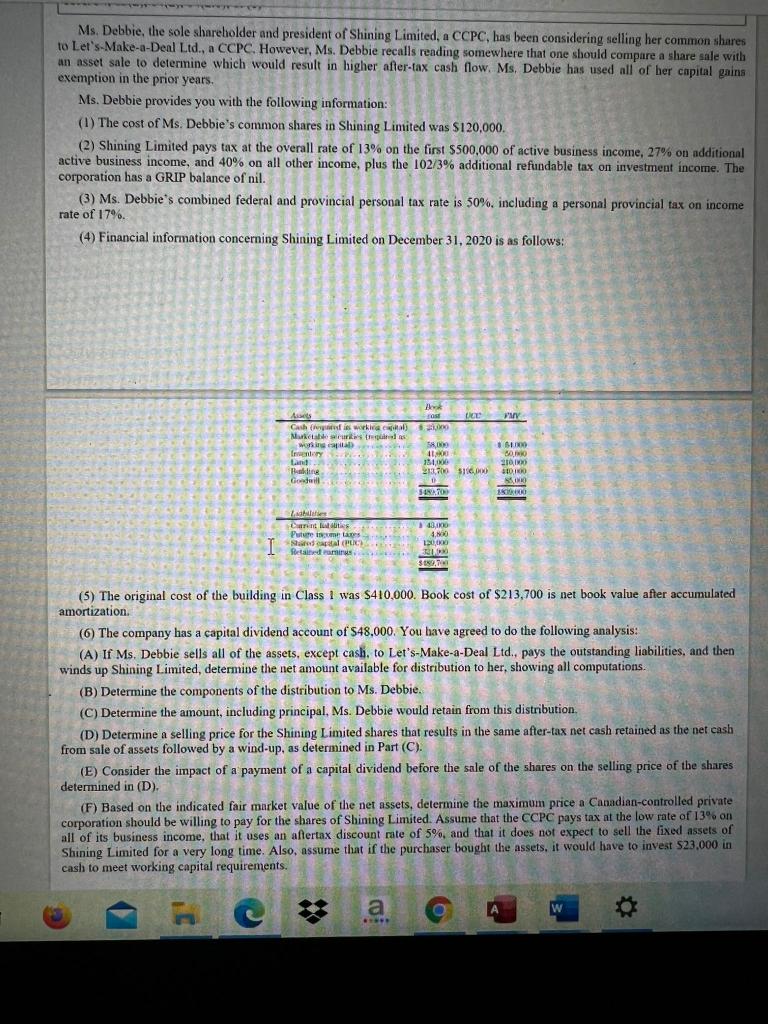

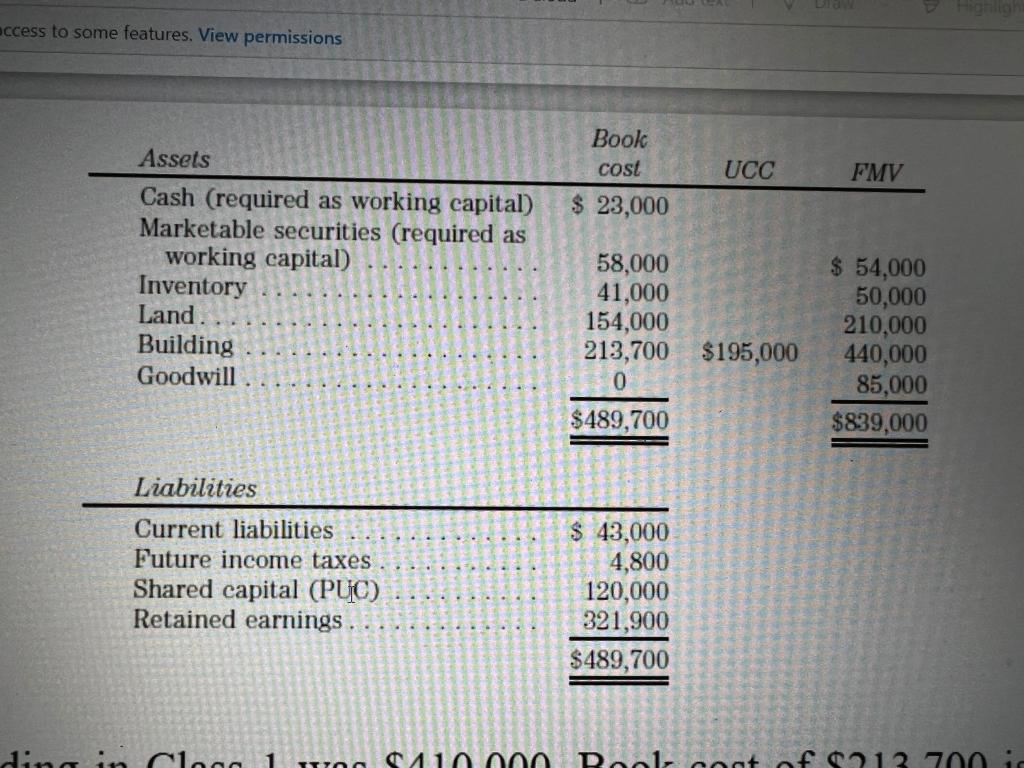

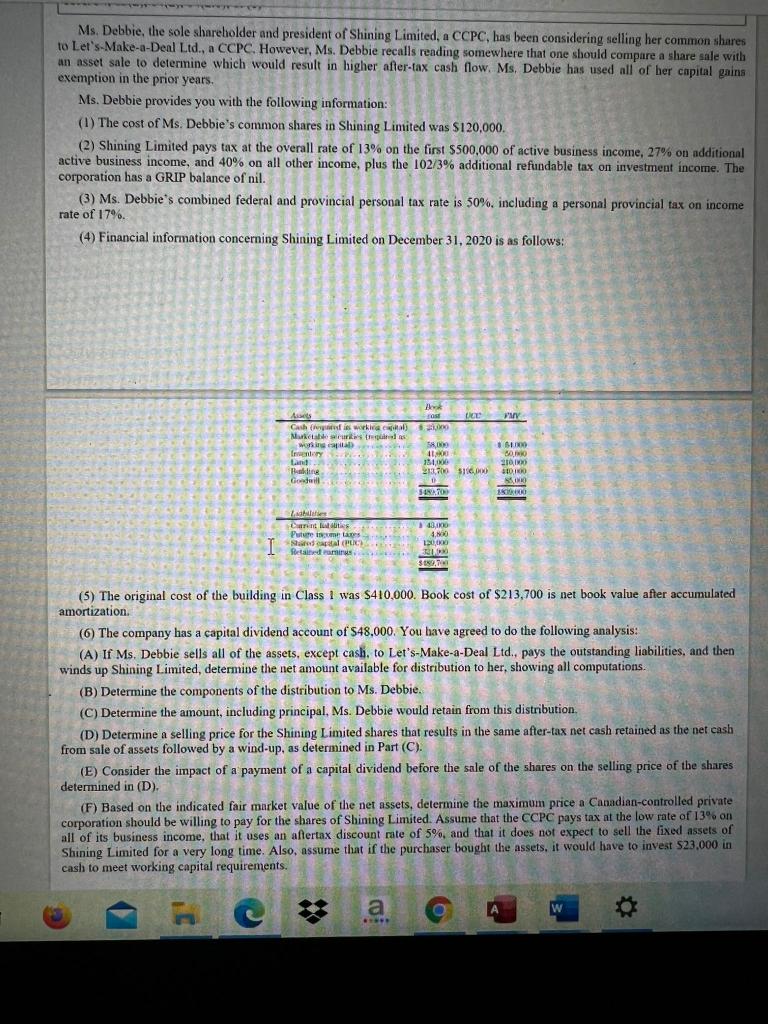

access to some features. View permissions Assets Book cost $ 23,000 UCC FMV Cash (required as working capital) Marketable securities (required as working capital) Inventory Land Building Goodwill 58,000 41,000 154,000 213,700 $195,000 0 $489,700 $ 54,000 50,000 210,000 440,000 85,000 $839,000 .. Liabilities Current liabilities Future income taxes Shared capital (PUC) Retained earnings $ 43,000 4,800 120,000 321,900 $489,700 ding in Clog1 Moon Dot of 12 700 Ms. Debbie, the sole shareholder and president of Shining Limited, a CCPC, has been considering selling her common shares to Let's Make-a-Deal Ltd., a CCPC. However, Ms. Debbie recalls reading somewhere that one should compare a share sale with an asset sale to determine which would result in higher after-tax cash flow. Ms. Debbie has used all of her capital gains exemption in the prior years. Ms. Debbie provides you with the following information: (1) The cost of Ms. Debbie's common shares in Shining Limited was $120,000. (2) Shining Limited pays tax at the overall rate of 13% on the first $500,000 of active business income, 27% on additional active business income, and 40% on all other income, plus the 102/3% additional refundable tax on investment income. The corporation has a GRIP balance of nil. (3) Ms. Debbie's combined federal and provincial personal tax rate is 50%, including a personal provincial tax on income rate of 17% (4) Financial information concerning Shining Limited on December 31, 2020 is as follows: O YUV Asses Ghis working Mukesir woning Ireny Land Baking Godwill 58,009 11 151,000 213,700 5116,00 SHO 80. O 21010 TO SIMO RO D. Isle : 43, Putere come lates4.800 themes I do CPC 130.000 Portaldamine TO 3.182. (5) The original cost of the building in Class I was $410,000. Book cost of $213,700 is net book value after accumulated amortization (6) The company has a capital dividend account of $48.000. You have agreed to do the following analysis: (A) If Ms. Debbie sells all of the assets, except cash, to Let's-Make-a-Deal Ltd., pays the outstanding liabilities, and then winds up Shining Limited, determine the net amount available for distribution to her, showing all computations. (B) Determine the components of the distribution to Ms. Debbie. (C) Determine the amount, including principal, Ms. Debbie would retain from this distribution. (D) Determine a selling price for the Shining Limited shares that results in the same after-tax net cash retained as the net cash from sale of assets followed by a wind-up, as determined in Part (C). (E) Consider the impact of a payment of a capital dividend before the sale of the shares on the selling price of the shares determined in (D) (F) Based on the indicated fair market value of the net assets, determine the maximum price a Canadian-controlled private corporation should be willing to pay for the shares of Shining Limited. Assume that the CCPC pays tax at the low rate of 13% on all of its business income, that it uses an aftertax discount rate of 5%, and that it does not expect to sell the fixed assets of Shining Limited for a very long time. Also, assume that if the purchaser bought the assets, it would have to invest $23.000 in cash to meet working capital requirements. * a A W . access to some features. View permissions Assets Book cost $ 23,000 UCC FMV Cash (required as working capital) Marketable securities (required as working capital) Inventory Land Building Goodwill 58,000 41,000 154,000 213,700 $195,000 0 $489,700 $ 54,000 50,000 210,000 440,000 85,000 $839,000 .. Liabilities Current liabilities Future income taxes Shared capital (PUC) Retained earnings $ 43,000 4,800 120,000 321,900 $489,700 ding in Clog1 Moon Dot of 12 700 Ms. Debbie, the sole shareholder and president of Shining Limited, a CCPC, has been considering selling her common shares to Let's Make-a-Deal Ltd., a CCPC. However, Ms. Debbie recalls reading somewhere that one should compare a share sale with an asset sale to determine which would result in higher after-tax cash flow. Ms. Debbie has used all of her capital gains exemption in the prior years. Ms. Debbie provides you with the following information: (1) The cost of Ms. Debbie's common shares in Shining Limited was $120,000. (2) Shining Limited pays tax at the overall rate of 13% on the first $500,000 of active business income, 27% on additional active business income, and 40% on all other income, plus the 102/3% additional refundable tax on investment income. The corporation has a GRIP balance of nil. (3) Ms. Debbie's combined federal and provincial personal tax rate is 50%, including a personal provincial tax on income rate of 17% (4) Financial information concerning Shining Limited on December 31, 2020 is as follows: O YUV Asses Ghis working Mukesir woning Ireny Land Baking Godwill 58,009 11 151,000 213,700 5116,00 SHO 80. O 21010 TO SIMO RO D. Isle : 43, Putere come lates4.800 themes I do CPC 130.000 Portaldamine TO 3.182. (5) The original cost of the building in Class I was $410,000. Book cost of $213,700 is net book value after accumulated amortization (6) The company has a capital dividend account of $48.000. You have agreed to do the following analysis: (A) If Ms. Debbie sells all of the assets, except cash, to Let's-Make-a-Deal Ltd., pays the outstanding liabilities, and then winds up Shining Limited, determine the net amount available for distribution to her, showing all computations. (B) Determine the components of the distribution to Ms. Debbie. (C) Determine the amount, including principal, Ms. Debbie would retain from this distribution. (D) Determine a selling price for the Shining Limited shares that results in the same after-tax net cash retained as the net cash from sale of assets followed by a wind-up, as determined in Part (C). (E) Consider the impact of a payment of a capital dividend before the sale of the shares on the selling price of the shares determined in (D) (F) Based on the indicated fair market value of the net assets, determine the maximum price a Canadian-controlled private corporation should be willing to pay for the shares of Shining Limited. Assume that the CCPC pays tax at the low rate of 13% on all of its business income, that it uses an aftertax discount rate of 5%, and that it does not expect to sell the fixed assets of Shining Limited for a very long time. Also, assume that if the purchaser bought the assets, it would have to invest $23.000 in cash to meet working capital requirements. * a A W