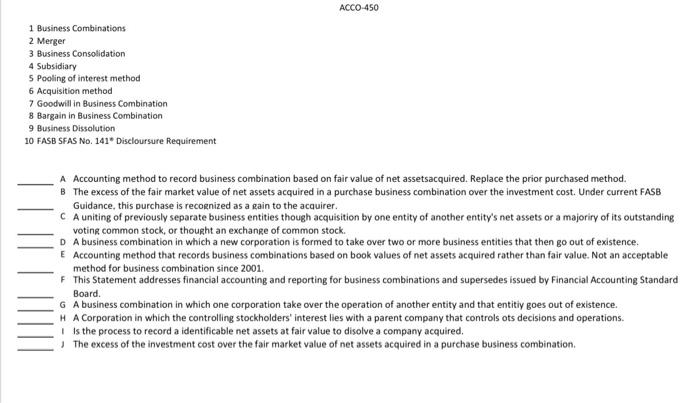

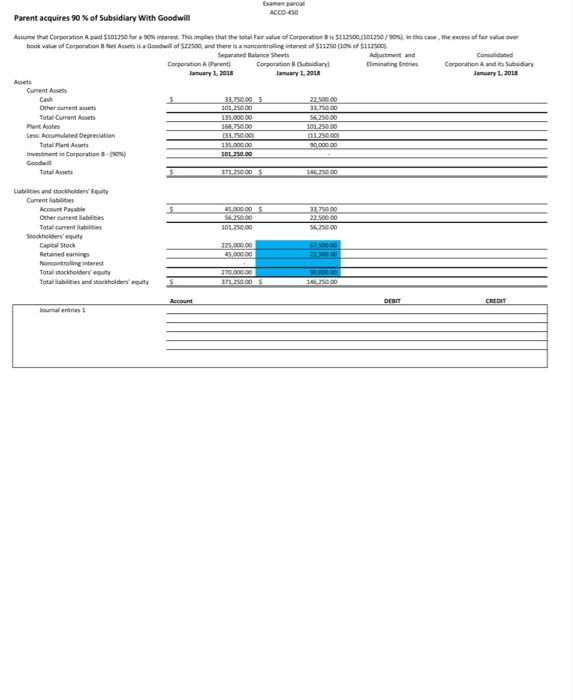

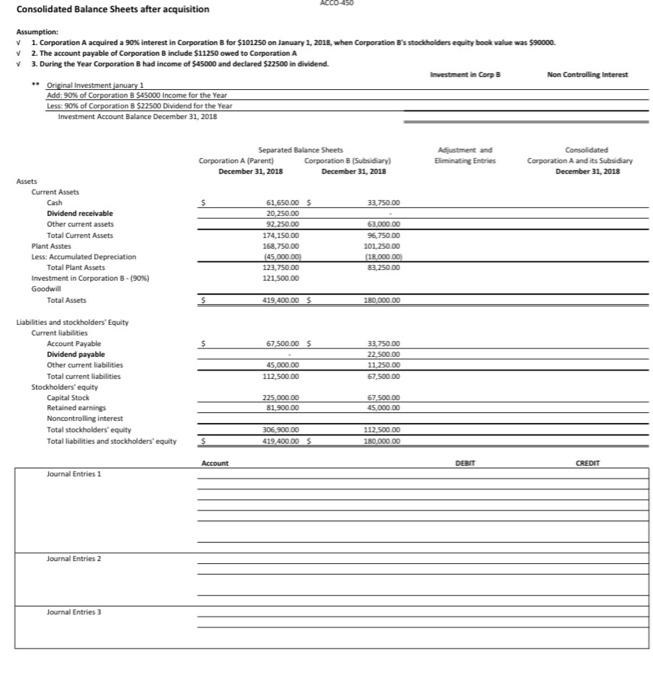

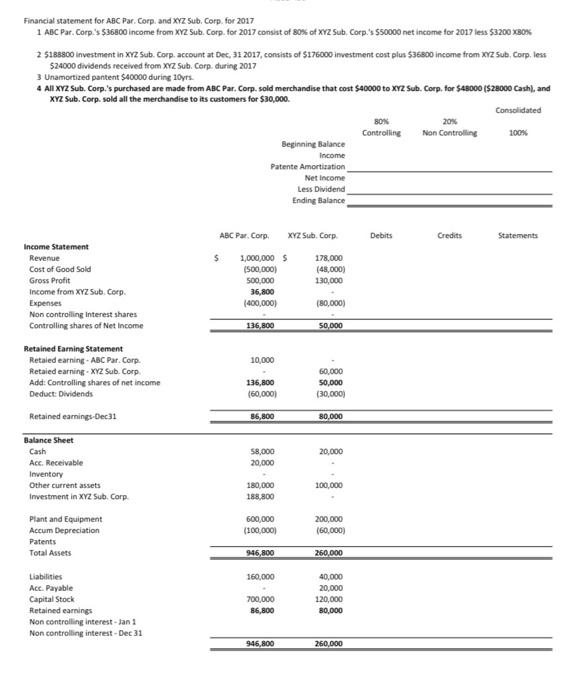

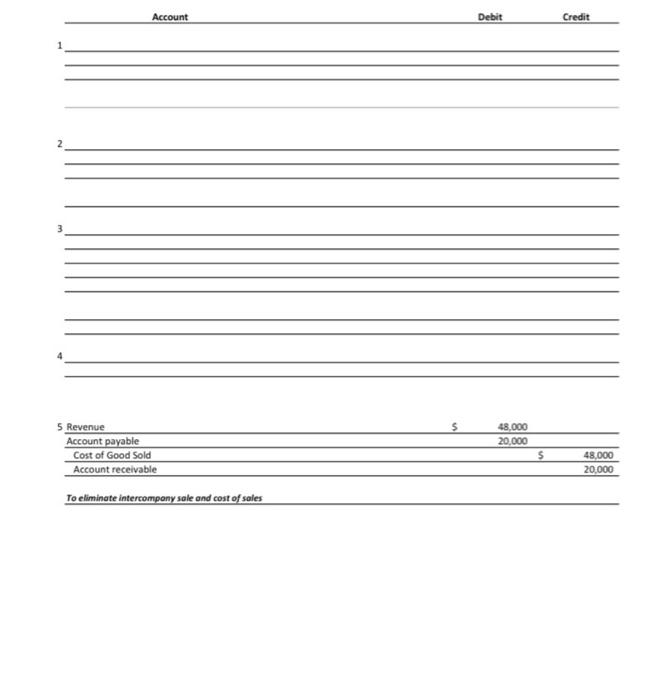

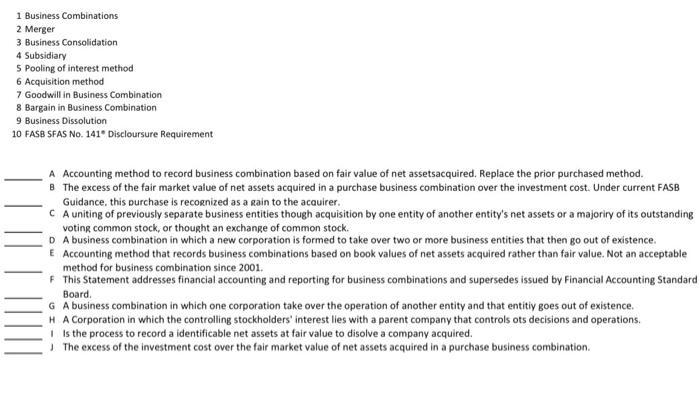

ACCO-450 1 Business Combinations 2 Merger 3 Business Consolidation 4 Subsidiary 5 Pooling of interest method 6 Acquisition method 7 Goodwill in Business Combination 8 Bargain in Business Combination 9 Business Dissolution 10 FASB SFAS No. 141 Discloursure Requirement A Accounting method to record business combination based on fair value of net assetsacquired. Replace the prior purchased method. B The excess of the fair market value of net assets acquired in a purchase business combination over the investment cost. Under current FASB Guidance, this purchase is recognized as a gain to the acquirer. C A uniting of previously separate business entities though acquisition by one entity of another entity's net assets or a majority of its outstanding voting common stock, or thought an exchange of common stock. D A business combination in which a new corporation is formed to take over two or more business entities that then go out of existence. E Accounting method that records business combinations based on book values of net assets acquired rather than fair value. Not an acceptable method for business combination since 2001. F This Statement addresses financial accounting and reporting for business combinations and supersedes issued by Financial Accounting Standard Board. G A business combination in which one corporation take over the operation of another entity and that entitiy goes out of existence. H A Corporation in which the controlling stockholders' interest lies with a parent company that controls ots decisions and operations. Is the process to record a identificable net assets at fair value to disolve a company acquired. The excess of the investment cost over the fair market value of net assets acquired in a purchase business combination Examen parcial Parent acquires 90 % of Subsidiary With Goodwill ACCO 450 Resume that Corporation A pud 5101250 for interme. This implies that the total for all of Corporation $112300_101250/os. this case, the excess of farve over book value of Corporation et At Goodwit of $22500 and there is a noncontriting interest of 11250 (10of $112500 Separated Balance Sheets Adjustment and Comed Corporation Parent Corporation Subsidiary Eliminating the Corporation and its Sudary Ianuary 1, 2015 January 1, 2018 January 1, 2018 Current Assets Cash 33.750.00 22,500.00 Other currentes 101 2000 33,750.00 Total Current Assets 135.000.00 56.250.00 Pant Asstes 168,750.00 10.250.00 Less: Acumulated Depreciation 33.750.00 (11.250.00 Total Plants 115.000.00 10000.00 Investment in Corporation - 300 301.250.00 Good Total Assets 121 250.00 14 20.00 Labies and stockholders Tout Current abilities Account Payable DOS 32350.00 Other current abilities 56.250.00 22.500.00 Total current abilities 201.250.00 56.250.00 Stockholdn't Capital Stoch 225,000.00 Retained earning 500000 Nancontrolling interest Total stockholders equity 270,000.00 Totalbies and stockholders' equity 371.250.00 5 14250.00 0.00 DEN CREDIT Jual entries Consolidated Balance Sheets after acquisition Assumption: V 1. Corporation A acquired a 90% interest in Corporation for $201.250 on January 2, 2018, when Corporation stockholders equity book value was $90000 2. The account payable of Corporation include $11.250 owed to Corporation A 3. During the Year Corporation B had income of $45000 and declared $22500 individend. Investment in corp Non Controlling interest - Orginal investment anuary 1 Add: 90% of Corporation 3 545000 Income for the Year Less 90% of Corporation B 522500 Dividend for the Year Investment Account Balance December 31, 2018 Separated Balance Sheets Corporation A (Parent) Corporation Subsidiary December 31, 2018 December 31, 2018 Adjustment and Eliminating Entries Consolidated Corporation and its subsidiary December 31, 2018 33.750.00 Assets Current Assets Cash Dividend receivable Other current assets Total Current Assets Plant Asstes Less: Accumulated Depreciation Total Plant Assets Investment in Corporation - (90%) Goodwill Total Assets 61,650.00 5 20.250.00 32,250.00 174.150.00 168,750.00 145.000.00 323,750.00 121.500.00 63.000.00 96.750.00 101.250.00 3.000.00 83,250.00 419.400 00 0 000.00 67 500.00 5 33.750.00 22 500.00 11.250.00 57.500.00 45,000.00 312,500.00 Liabilities and stockholders' Equity Current liabilities Account Payable Dividend payable Other current liabilities Total current liabilities Stockholders' equity Capital Stock Retained earnings Noncontrolling interest Total stockholders equity Total liabilities and stockholders' equity 225,000.00 81,900.00 67 500.00 45.000.00 306,900.00 419.400.00 S 112.500.00 150,000.00 $ Account DERIT CREDIT Journal Entries 1 Journal Entries 2 Journal Entries Financial statement for ABC Par Corp. and XYZ Sub. Corp. for 2017 1 ABC Par. Corp.' $36800 income from XYZ Sub. Corp. for 2017 consist of 80% of XYZ Sub. Corp's $50000 net income for 2017 less $3200 XBOX 2 5188300 Investment in XYZ Sub. Corp. account at Dec, 31 2017, consists of $176000 investment cost plus $36800 income from xyz Sub, Corp, less 524000 dividends received from XYZ Sub. Corp. during 2017 3 Unamortized pantent $40000 during 10yrs. 4 All XYZ Sub. Corp's purchased are made from ABC Par. Corp. sold merchandise that cost $40000 to XY2 Sub. Corp. for $48000 ($28000 Cash), and XYZ Sub. Corp. sold all the merchandise to its customers for $30,000 Consolidated SON 20% Controlling Non Controlling 100% Beginning Balance Income Patente Amortization Net Income Less Dividend Ending Balance ABC Par Corp XYZ Sub Corp Debits Credits Statements $ Income Statement Revenue Cost of Good Sold Gross Profit Income from XYZ Sub Corp. Expenses Non controlling interest shares Controlling shares of Net Income 1,000,000 $ (500,000) 500,000 36,800 (400,000) 178,000 (48,000) 130,000 (80,000) 136,300 50.000 10,000 Retained Earning Statement Retaled earning - ABC Par. Corp. Retaied earning - XYZ Sub. Corp. Add: Controlling shares of net income Deduct: Dividends Retained earnings-Dec 31 136,800 (60,000) 60.000 50,000 (30,000) 86,800 80,000 20,000 58,000 20,000 Balance Sheet Cash Acc. Receivable Inventory Other current assets Investment in XYZ Sub. Corp 100,000 180,000 188,800 Plant and Equipment Accum Depreciation Patents Total Assets 600,000 (100,0001 200,000 160,000) 946.800 260.000 160,000 Liabilities Ace. Payable Capital Stock Retained earnings Non controlling interest - Jan 1 Non controlling interest - Dec 31 40,000 20,000 120,000 80,000 700,000 86,800 946,800 260,000 Account Debit Credit 48,000 20.000 5 Revenue Account payable Cost of Good Sold Account receivable $ 48,000 20,000 To eliminate intercompany sale and cost of sales 1 Business Combinations 2 Merger 3 Business Consolidation 4 Subsidiary 5 Pooling of interest method 6 Acquisition method 7 Goodwill in Business Combination 8 Bargain in Business Combination 9 Business Dissolution 10 FASB SFAS No. 141. Discloursure Requirement A Accounting method to record business combination based on fair value of net assetsacquired. Replace the prior purchased method. 8 The excess of the fair market value of net assets acquired in a purchase business combination over the investment cost. Under current FASB Guidance, this purchase is recognized as a sain to the acquirer. C A uniting of previously separate business entities though acquisition by one entity of another entity's net assets or a majoriry of its outstanding voting common stock, or thought an exchange of common stock. DA business combination in which a new corporation is formed to take over two or more business entities that then go out of existence E Accounting method that records business combinations based on book values of net assets acquired rather than fair value. Not an acceptable method for business combination since 2001. F This Statement addresses financial accounting and reporting for business combinations and supersedes issued by Financial Accounting Standard Board G A business combination in which one corporation take over the operation of another entity and that entitly goes out of existence. H A Corporation in which the controlling stockholders' interest lies with a parent company that controls ots decisions and operations, I is the process to record a identificable net assets at fair value to disolve a company acquired. The excess of the investment cost over the fair market value of net assets acquired in a purchase business combination. ACCO-450 1 Business Combinations 2 Merger 3 Business Consolidation 4 Subsidiary 5 Pooling of interest method 6 Acquisition method 7 Goodwill in Business Combination 8 Bargain in Business Combination 9 Business Dissolution 10 FASB SFAS No. 141 Discloursure Requirement A Accounting method to record business combination based on fair value of net assetsacquired. Replace the prior purchased method. B The excess of the fair market value of net assets acquired in a purchase business combination over the investment cost. Under current FASB Guidance, this purchase is recognized as a gain to the acquirer. C A uniting of previously separate business entities though acquisition by one entity of another entity's net assets or a majority of its outstanding voting common stock, or thought an exchange of common stock. D A business combination in which a new corporation is formed to take over two or more business entities that then go out of existence. E Accounting method that records business combinations based on book values of net assets acquired rather than fair value. Not an acceptable method for business combination since 2001. F This Statement addresses financial accounting and reporting for business combinations and supersedes issued by Financial Accounting Standard Board. G A business combination in which one corporation take over the operation of another entity and that entitiy goes out of existence. H A Corporation in which the controlling stockholders' interest lies with a parent company that controls ots decisions and operations. Is the process to record a identificable net assets at fair value to disolve a company acquired. The excess of the investment cost over the fair market value of net assets acquired in a purchase business combination Examen parcial Parent acquires 90 % of Subsidiary With Goodwill ACCO 450 Resume that Corporation A pud 5101250 for interme. This implies that the total for all of Corporation $112300_101250/os. this case, the excess of farve over book value of Corporation et At Goodwit of $22500 and there is a noncontriting interest of 11250 (10of $112500 Separated Balance Sheets Adjustment and Comed Corporation Parent Corporation Subsidiary Eliminating the Corporation and its Sudary Ianuary 1, 2015 January 1, 2018 January 1, 2018 Current Assets Cash 33.750.00 22,500.00 Other currentes 101 2000 33,750.00 Total Current Assets 135.000.00 56.250.00 Pant Asstes 168,750.00 10.250.00 Less: Acumulated Depreciation 33.750.00 (11.250.00 Total Plants 115.000.00 10000.00 Investment in Corporation - 300 301.250.00 Good Total Assets 121 250.00 14 20.00 Labies and stockholders Tout Current abilities Account Payable DOS 32350.00 Other current abilities 56.250.00 22.500.00 Total current abilities 201.250.00 56.250.00 Stockholdn't Capital Stoch 225,000.00 Retained earning 500000 Nancontrolling interest Total stockholders equity 270,000.00 Totalbies and stockholders' equity 371.250.00 5 14250.00 0.00 DEN CREDIT Jual entries Consolidated Balance Sheets after acquisition Assumption: V 1. Corporation A acquired a 90% interest in Corporation for $201.250 on January 2, 2018, when Corporation stockholders equity book value was $90000 2. The account payable of Corporation include $11.250 owed to Corporation A 3. During the Year Corporation B had income of $45000 and declared $22500 individend. Investment in corp Non Controlling interest - Orginal investment anuary 1 Add: 90% of Corporation 3 545000 Income for the Year Less 90% of Corporation B 522500 Dividend for the Year Investment Account Balance December 31, 2018 Separated Balance Sheets Corporation A (Parent) Corporation Subsidiary December 31, 2018 December 31, 2018 Adjustment and Eliminating Entries Consolidated Corporation and its subsidiary December 31, 2018 33.750.00 Assets Current Assets Cash Dividend receivable Other current assets Total Current Assets Plant Asstes Less: Accumulated Depreciation Total Plant Assets Investment in Corporation - (90%) Goodwill Total Assets 61,650.00 5 20.250.00 32,250.00 174.150.00 168,750.00 145.000.00 323,750.00 121.500.00 63.000.00 96.750.00 101.250.00 3.000.00 83,250.00 419.400 00 0 000.00 67 500.00 5 33.750.00 22 500.00 11.250.00 57.500.00 45,000.00 312,500.00 Liabilities and stockholders' Equity Current liabilities Account Payable Dividend payable Other current liabilities Total current liabilities Stockholders' equity Capital Stock Retained earnings Noncontrolling interest Total stockholders equity Total liabilities and stockholders' equity 225,000.00 81,900.00 67 500.00 45.000.00 306,900.00 419.400.00 S 112.500.00 150,000.00 $ Account DERIT CREDIT Journal Entries 1 Journal Entries 2 Journal Entries Financial statement for ABC Par Corp. and XYZ Sub. Corp. for 2017 1 ABC Par. Corp.' $36800 income from XYZ Sub. Corp. for 2017 consist of 80% of XYZ Sub. Corp's $50000 net income for 2017 less $3200 XBOX 2 5188300 Investment in XYZ Sub. Corp. account at Dec, 31 2017, consists of $176000 investment cost plus $36800 income from xyz Sub, Corp, less 524000 dividends received from XYZ Sub. Corp. during 2017 3 Unamortized pantent $40000 during 10yrs. 4 All XYZ Sub. Corp's purchased are made from ABC Par. Corp. sold merchandise that cost $40000 to XY2 Sub. Corp. for $48000 ($28000 Cash), and XYZ Sub. Corp. sold all the merchandise to its customers for $30,000 Consolidated SON 20% Controlling Non Controlling 100% Beginning Balance Income Patente Amortization Net Income Less Dividend Ending Balance ABC Par Corp XYZ Sub Corp Debits Credits Statements $ Income Statement Revenue Cost of Good Sold Gross Profit Income from XYZ Sub Corp. Expenses Non controlling interest shares Controlling shares of Net Income 1,000,000 $ (500,000) 500,000 36,800 (400,000) 178,000 (48,000) 130,000 (80,000) 136,300 50.000 10,000 Retained Earning Statement Retaled earning - ABC Par. Corp. Retaied earning - XYZ Sub. Corp. Add: Controlling shares of net income Deduct: Dividends Retained earnings-Dec 31 136,800 (60,000) 60.000 50,000 (30,000) 86,800 80,000 20,000 58,000 20,000 Balance Sheet Cash Acc. Receivable Inventory Other current assets Investment in XYZ Sub. Corp 100,000 180,000 188,800 Plant and Equipment Accum Depreciation Patents Total Assets 600,000 (100,0001 200,000 160,000) 946.800 260.000 160,000 Liabilities Ace. Payable Capital Stock Retained earnings Non controlling interest - Jan 1 Non controlling interest - Dec 31 40,000 20,000 120,000 80,000 700,000 86,800 946,800 260,000 Account Debit Credit 48,000 20.000 5 Revenue Account payable Cost of Good Sold Account receivable $ 48,000 20,000 To eliminate intercompany sale and cost of sales 1 Business Combinations 2 Merger 3 Business Consolidation 4 Subsidiary 5 Pooling of interest method 6 Acquisition method 7 Goodwill in Business Combination 8 Bargain in Business Combination 9 Business Dissolution 10 FASB SFAS No. 141. Discloursure Requirement A Accounting method to record business combination based on fair value of net assetsacquired. Replace the prior purchased method. 8 The excess of the fair market value of net assets acquired in a purchase business combination over the investment cost. Under current FASB Guidance, this purchase is recognized as a sain to the acquirer. C A uniting of previously separate business entities though acquisition by one entity of another entity's net assets or a majoriry of its outstanding voting common stock, or thought an exchange of common stock. DA business combination in which a new corporation is formed to take over two or more business entities that then go out of existence E Accounting method that records business combinations based on book values of net assets acquired rather than fair value. Not an acceptable method for business combination since 2001. F This Statement addresses financial accounting and reporting for business combinations and supersedes issued by Financial Accounting Standard Board G A business combination in which one corporation take over the operation of another entity and that entitly goes out of existence. H A Corporation in which the controlling stockholders' interest lies with a parent company that controls ots decisions and operations, I is the process to record a identificable net assets at fair value to disolve a company acquired. The excess of the investment cost over the fair market value of net assets acquired in a purchase business combination