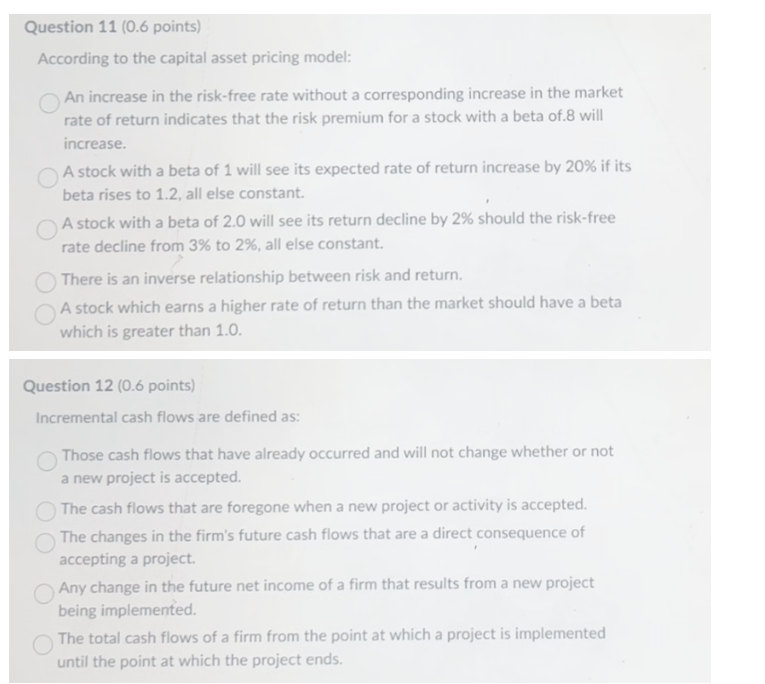

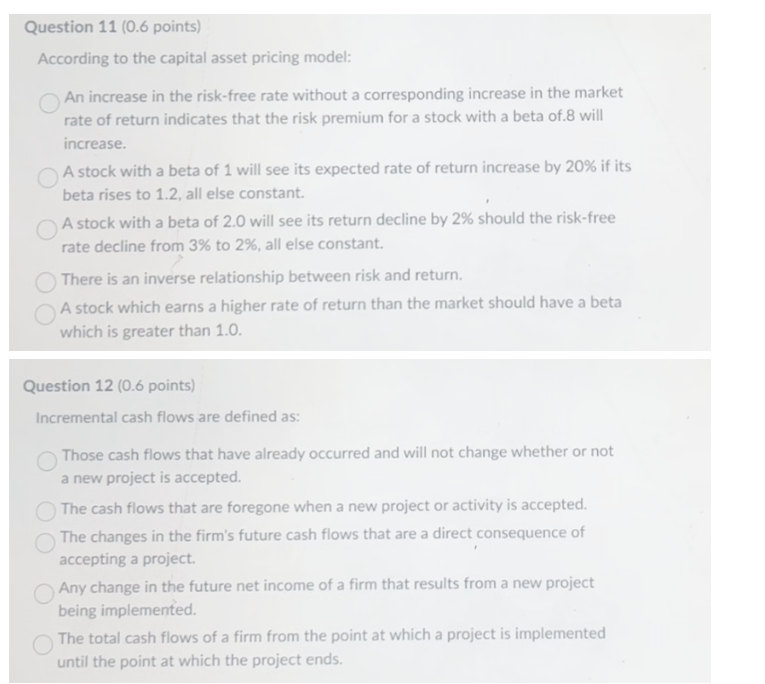

According to the capital asset pricing model: An increase in the risk-free rate without a corresponding increase in the market rate of return indicates that the risk premium for a stock with a beta of 8 will increase. A stock with a beta of 1 will see its expected rate of return increase by 20% if its beta rises to 1.2, all else constant. A stock with a beta of 2.0 will see its return decline by 2% should the risk-free rate decline from 3% to 2%, all else constant. There is an inverse relationship between risk and return. A stock which earns a higher rate of return than the market should have a beta which is greater than 1.0. Question 12 (0.6 points) Incremental cash flows are defined as: Those cash flows that have already occurred and will not change whether or not a new project is accepted. The cash flows that are foregone when a new project or activity is accepted. The changes in the firm's future cash flows that are a direct consequence of accepting a project. Any change in the future net income of a firm that results from a new project being implemented. The total cash flows of a firm from the point at which a project is implemented until the point at which the project ends. According to the capital asset pricing model: An increase in the risk-free rate without a corresponding increase in the market rate of return indicates that the risk premium for a stock with a beta of 8 will increase. A stock with a beta of 1 will see its expected rate of return increase by 20% if its beta rises to 1.2, all else constant. A stock with a beta of 2.0 will see its return decline by 2% should the risk-free rate decline from 3% to 2%, all else constant. There is an inverse relationship between risk and return. A stock which earns a higher rate of return than the market should have a beta which is greater than 1.0. Question 12 (0.6 points) Incremental cash flows are defined as: Those cash flows that have already occurred and will not change whether or not a new project is accepted. The cash flows that are foregone when a new project or activity is accepted. The changes in the firm's future cash flows that are a direct consequence of accepting a project. Any change in the future net income of a firm that results from a new project being implemented. The total cash flows of a firm from the point at which a project is implemented until the point at which the project ends