Question

According to the case study of Monmouth and Robertson under mergers and acquisitions, How the valuation and the synergies would be calculated for the deal

According to the case study of Monmouth and Robertson under mergers and acquisitions, How the valuation and the synergies would be calculated for the deal to go to. in the sense, there is synergy that is created for Simmons and there is a Synergy created between Robertson and Monmouth. could you help create the valuation of the synergy basis the same. additionally, what all cautions and actions should be taken during the mergers acquisition and how can Monmouth meet Simmons criteria of above 50dollars per share with their share cost being lower than that of Robertson?

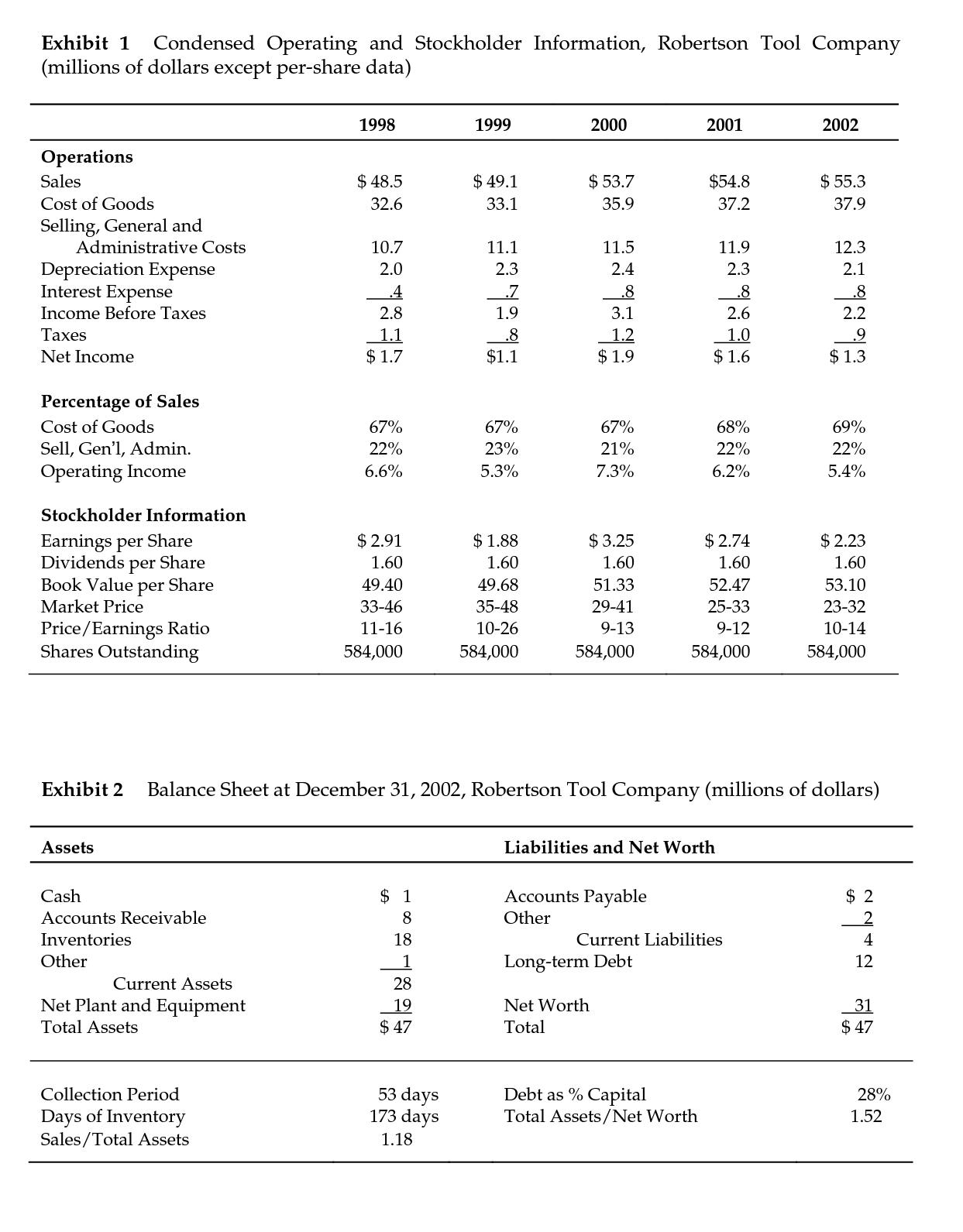

Exhibit 1 Condensed Operating and Stockholder Information, Robertson Tool Company (millions of dollars except per-share data) Operations Sales Cost of Goods Selling, General and Administrative Costs Depreciation Expense Interest Expense Income Before Taxes Taxes Net Income Percentage of Sales Cost of Goods Sell, Gen'l, Admin. Operating Income Stockholder Information Earnings per Share Dividends per Share Book Value per Share Market Price Price/Earnings Ratio Shares Outstanding Assets Cash Accounts Receivable Inventories Other Current Assets Net Plant and Equipment Total Assets 1998 Collection Period Days of Inventory Sales/Total Assets $48.5 32.6 10.7 2.0 .4 2.8 1.1 $ 1.7 67% 22% 6.6% $2.91 1.60 49.40 33-46 11-16 584,000 $ 1 8 18 1 28 19 $47 1999 53 days 173 days 1.18 $49.1 33.1 11.1 2.3 -.7 1.9 .8 $1.1 67% 23% 5.3% $1.88 1.60 49.68 35-48 10-26 584,000 2000 $ 53.7 35.9 11.5 2.4 .8 3.1 1.2 $1.9 67% 21% 7.3% $3.25 1.60 51.33 29-41 9-13 584,000 Net Worth Total Accounts Payable Other 2001 Long-term Debt $54.8 37.2 11.9 2.3 .8 2.6 1.0 $1.6 68% 22% 6.2% Exhibit 2 Balance Sheet at December 31, 2002, Robertson Tool Company (millions of dollars) Liabilities and Net Worth Debt as % Capital Total Assets/Net Worth $2.74 1.60 52.47 25-33 9-12 584,000 Current Liabilities 2002 $ 55.3 37.9 12.3 2.1 .8 2.2 .9 $1.3 69% 22% 5.4% $2.23 1.60 53.10 23-32 10-14 584,000 $2 JANS $ 47 28% 1.52

Step by Step Solution

3.58 Rating (162 Votes )

There are 3 Steps involved in it

Step: 1

Here are the detailed calculations for valuing the synergies in the proposed merger between Monmouth ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started