Answered step by step

Verified Expert Solution

Question

1 Approved Answer

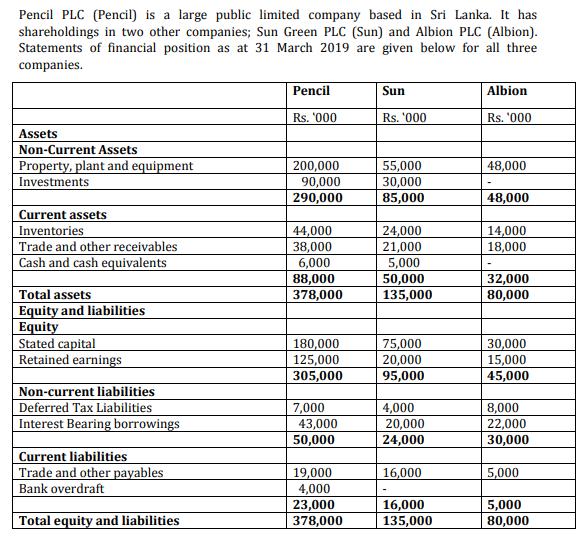

Pencil PLC (Pencil) is a large public limited company based in Sri Lanka. It has shareholdings in two other companies; Sun Green PLC (Sun)

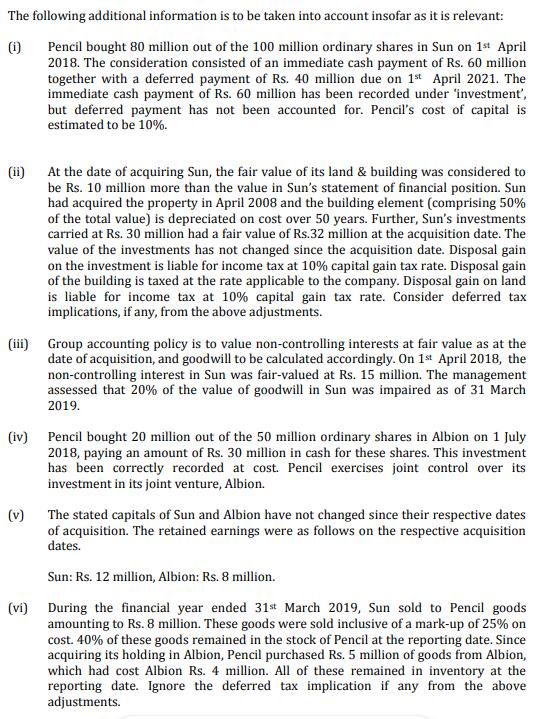

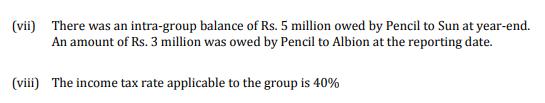

Pencil PLC (Pencil) is a large public limited company based in Sri Lanka. It has shareholdings in two other companies; Sun Green PLC (Sun) and Albion PLC (Albion). Statements of financial position as at 31 March 2019 are given below for all three companies. Assets Non-Current Assets Property, plant and equipment Investments Current assets Inventories Trade and other receivables Cash and cash equivalents Total assets Equity and liabilities Equity Stated capital Retained earnings Non-current liabilities Deferred Tax Liabilities Interest Bearing borrowings Current liabilities Trade and other payables Bank overdraft Total equity and liabilities Pencil Rs. '000 200,000 90,000 290,000 44,000 38,000 6,000 88,000 378,000 180,000 125,000 305,000 7,000 43,000 50,000 19,000 4,000 23,000 378,000 Sun Rs. '000 55,000 30,000 85,000 24,00 21,000 5,000 50,000 135,000 75,000 20,000 95,000 4,000 20,000 24,000 16,000 - 16,000 135,000 Albion Rs. '000 48,000 48,000 18,000 32,000 80,000 30,000 15,000 45,000 8,000 22,000 30,000 5,000 5,000 80,000 The following additional information is to be taken into account insofar as it is relevant: (1) Pencil bought 80 million out of the 100 million ordinary shares in Sun on 1st April 2018. The consideration consisted of an immediate cash payment of Rs. 60 million together with a deferred payment of Rs. 40 million due on 1st April 2021. The immediate cash payment of Rs. 60 million has been recorded under 'investment', but deferred payment has not been accounted for. Pencil's cost of capital is estimated to be 10%. (ii) At the date of acquiring Sun, the fair value of its land & building was considered to be Rs. 10 million more than the value in Sun's statement of financial position. Sun had acquired the property in April 2008 and the building element (comprising 50% of the total value) is depreciated on cost over 50 years. Further, Sun's investments carried at Rs. 30 million had a fair value of Rs.32 million at the acquisition date. The value of the investments has not changed since the acquisition date. Disposal gain on the investment is liable for income tax at 10% capital gain tax rate. Disposal gain of the building is taxed at the rate applicable to the company. Disposal gain on land is liable for income tax at 10% capital gain tax rate. Consider deferred tax implications, if any, from the above adjustments. (iii) Group accounting policy is to value non-controlling interests at fair value as at the date of acquisition, and goodwill to be calculated accordingly. On 1st April 2018, the non-controlling interest in Sun was fair-valued at Rs. 15 million. The management assessed that 20% of the value of goodwill in Sun was impaired as of 31 March 2019. (iv) Pencil bought 20 million out of the 50 million ordinary shares in Albion on 1 July 2018, paying an amount of Rs. 30 million in cash for these shares. This investment has been correctly recorded at cost. Pencil exercises joint control over its investment in its joint venture, Albion. (v) The stated capitals of Sun and Albion have not changed since their respective dates of acquisition. The retained earnings were as follows on the respective acquisition dates. Sun: Rs. 12 million, Albion: Rs. 8 million. (vi) During the financial year ended 31st March 2019, Sun sold to Pencil goods amounting to Rs. 8 million. These goods were sold inclusive of a mark-up of 25% on cost. 40% of these goods remained in the stock of Pencil at the reporting date. Since acquiring its holding in Albion, Pencil purchased Rs. 5 million of goods from Albion, which had cost Albion Rs. 4 million. All of these remained in inventory at the reporting date. Ignore the deferred tax implication if any from the above adjustments. (vii) There was an intra-group balance of Rs. 5 million owed by Pencil to Sun at year-end. An amount of Rs. 3 million was owed by Pencil to Albion at the reporting date. (viii) The income tax rate applicable to the group is 40% Required: Prepare the consolidated statement of financial position of Pencil as of 31 March 2019. (Total: 20 marks)

Step by Step Solution

★★★★★

3.52 Rating (155 Votes )

There are 3 Steps involved in it

Step: 1

The detailed ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started