Answered step by step

Verified Expert Solution

Question

1 Approved Answer

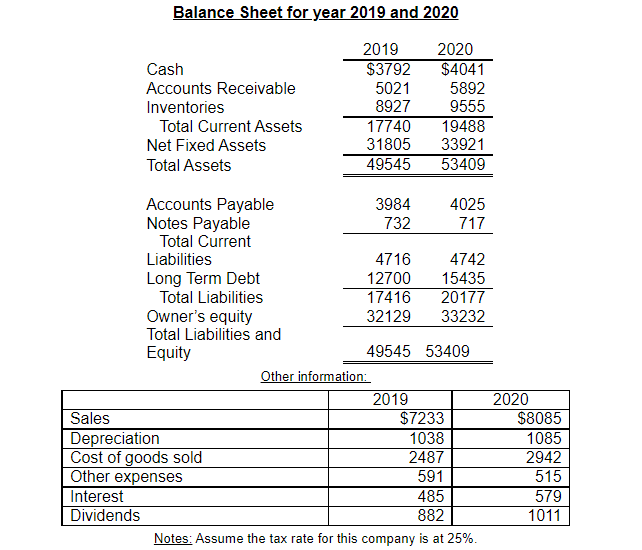

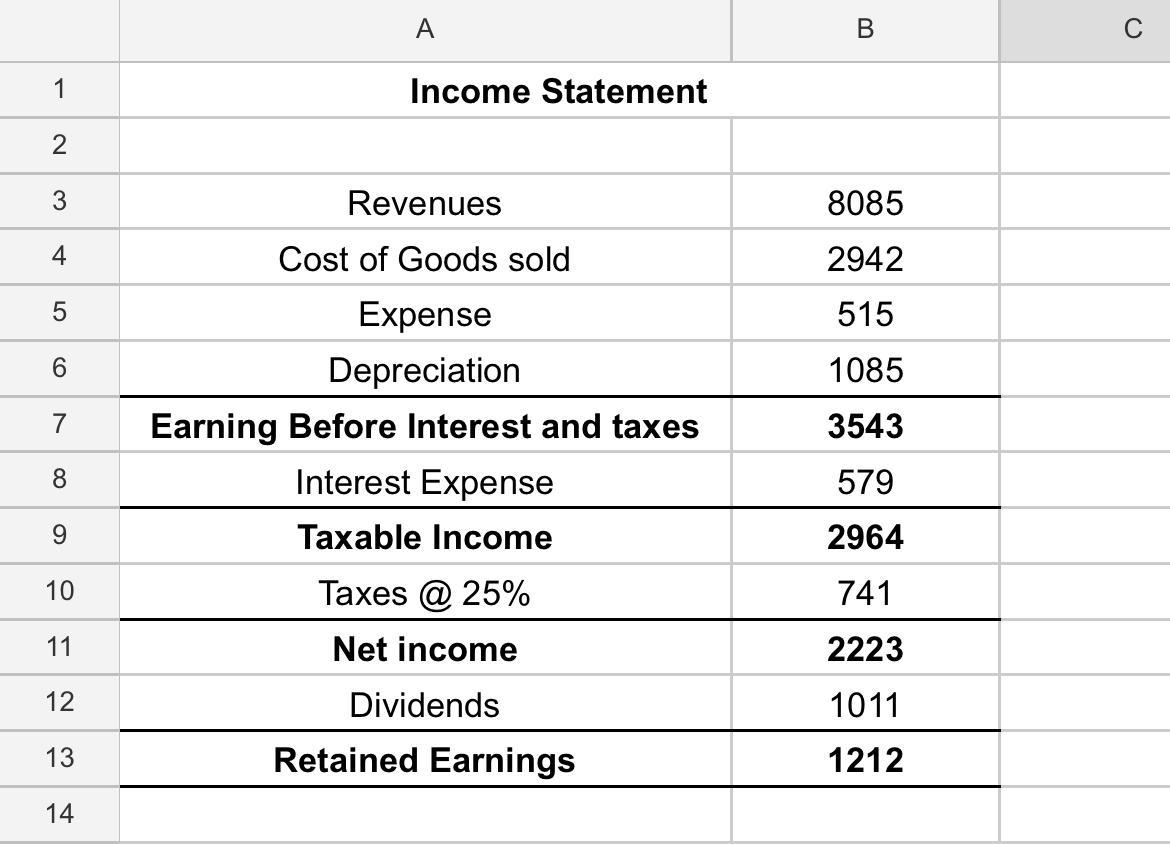

According to the info in the graph, calculate the cash flow from assets for year 2020. Fill in the blanks with the correct formulae. Balance

According to the info in the graph, calculate the cash flow from assets for year 2020.

Fill in the blanks with the correct formulae. Balance Sheet is given for reference.

Fill in the blanks with the correct formulae. Balance Sheet is given for reference.

a) Operating Cash Flow = $____ + $____ $____ = $____

b) Net Capital Spending = $____ $____ + $1085 = $____

c) Net Working Capital 2019 = $____ $____ = $____

d) Net Working Capital 2020 = $____ $____ = $____

e) Changes in Net Working Capital = $____ $____ = $____

f) Cash Flow from Assets = $____ $____ $____ = $ ____

Balance Sheet for year 2019 and 2020 Cash Accounts Receivable Inventories Total Current Assets Net Fixed Assets Total Assets 2019 $3792 5021 8927 17740 31805 49545 2020 $4041 5892 9555 19488 33921 53409 Accounts Payable 3984 4025 Notes Payable 732 717 Total Current Liabilities 4716 4742 Long Term Debt 12700 15435 Total Liabilities 17416 20177 Owner's equity 32129 33232 Total Liabilities and Equity 49545 53409 Other information: 2019 2020 Sales $7233 $8085 Depreciation 1038 1085 Cost of goods sold 2487 2942 Other expenses 591 515 Interest 485 579 Dividends 882 1011 Notes: Assume the tax rate for this company is at 25%. A B 1 Income Statement N 3 Revenues 8085 4 Cost of Goods sold 2942 5 515 CO 1085 7 3543 8 579 9 Expense Depreciation Earning Before Interest and taxes Interest Expense Taxable Income Taxes @ 25% Net income Dividends Retained Earnings 2964 10 741 11 2223 12 1011 13 1212 14Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started