Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Daniel is considering selling two stocks that have not fared well over recent years. A friend recently informed Daniel that one of his stocks has

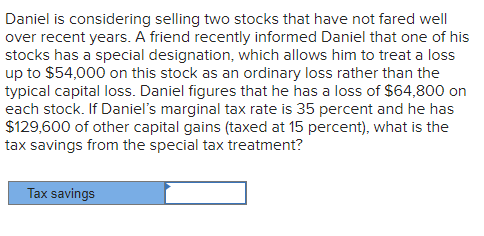

Daniel is considering selling two stocks that have not fared well over recent years. A friend recently informed Daniel that one of his stocks has a special designation, which allows him to treat a loss up to $54,000 on this stock as an ordinary loss rather than the typical capital loss. Daniel figures that he has a loss of $64,800 on each stock. If Daniel's marginal tax rate is 35 percent and he has $129,600 of other capital gains (taxed at 15 percent), what is the tax savings from the special tax treatment

Daniel is considering selling two stocks that have not fared well over recent years. A friend recently informed Daniel that one of his stocks has a special designation, which allows him to treat a loss up to $54,000 on this stock as an ordinary loss rather than the typical capital loss. Daniel figures that he has a loss of $64,800 on each stock. If Daniel's marginal tax rate is 35 percent and he has $129,600 of other capital gains (taxed at 15 percent), what is the tax savings from the special tax treatment Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started