According to the latest 10-K of NIKE, INS https://www.sec.gov/ix?doc=/Archives/edgar/data/320187/000032018721000028ke-20210531.htm

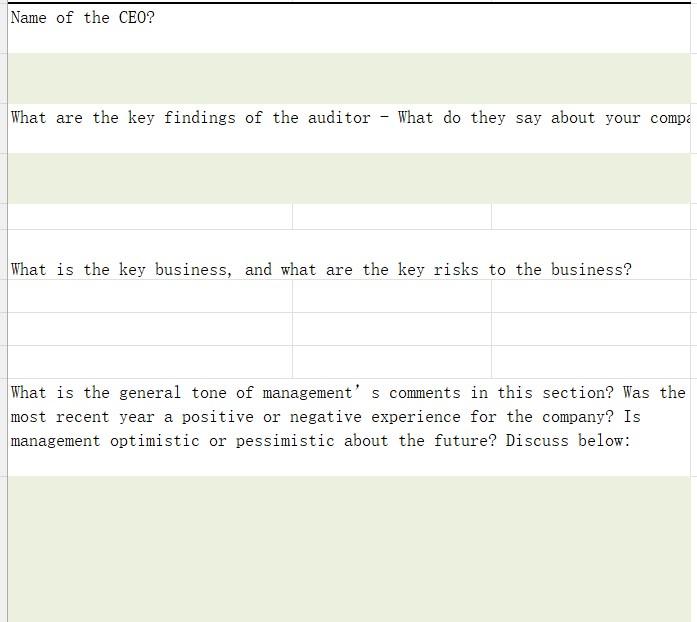

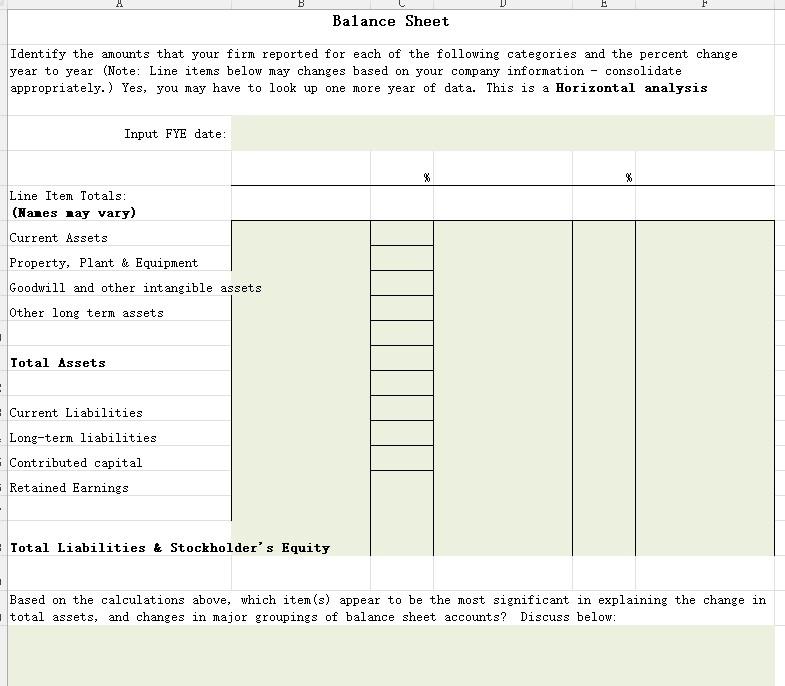

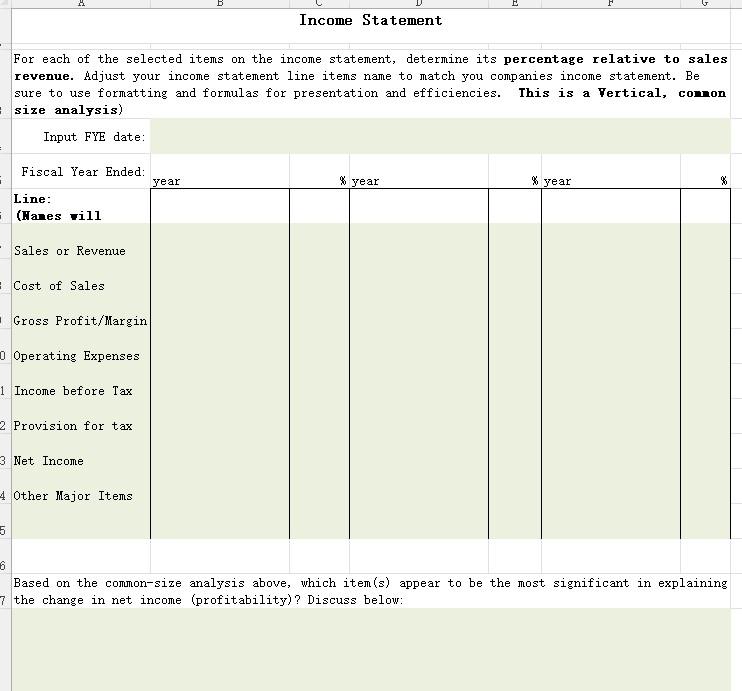

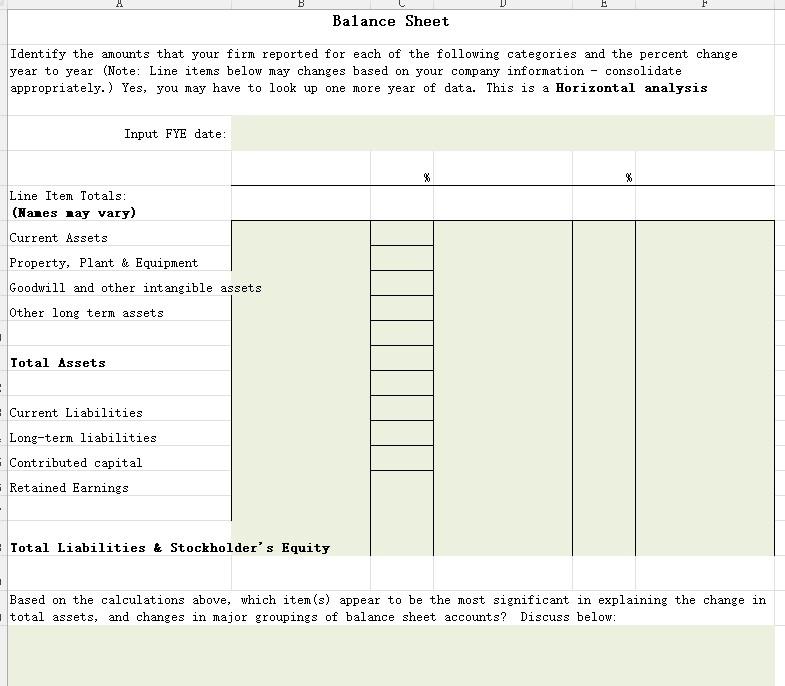

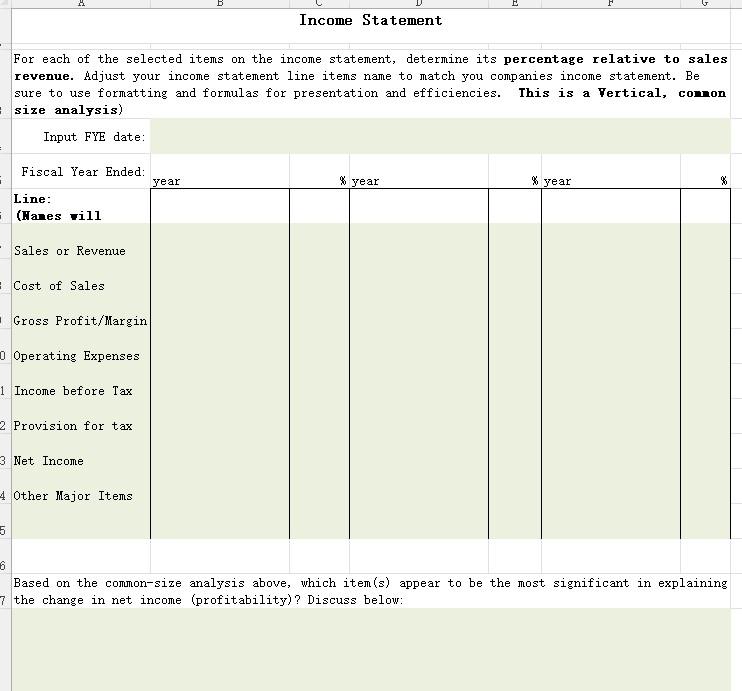

Name of the CEO? What are the key findings of the auditor - What do they say about your compa What is the key business, and what are the key risks to the business? What is the general tone of management's comments in this section? Was the most recent year a positive or negative experience for the company? Is management optimistic or pessimistic about the future? Discuss below: B E F Balance Sheet Identify the amounts that your firm reported for each of the following categories and the percent change year to year (Note: Line items below may changes based on your company information - consolidate appropriately.) Yes, you may have to look up one more year of data. This is a Horizontal analysis Input FYE date: % Line Item Totals: (Nanes nay vary) Current Assets Property, Plant & Equipment Goodwill and other intangible assets Other long term assets Total Assets Current Liabilities Long-term iabiliti Contributed capital = Retained Earnings = Total Liabilities & Stockholder's Equity Based on the calculations above, which item(s) appear to be the most significant in explaining the change in total assets, and changes in major groupings of balance sheet accounts? Discuss below: B Income Statement For each of the selected items on the income statement, determine its percentage relative to sales revenue. Adjust your income statement line items name to match you companies income statement. Be sure to use formatting and formulas for presentation and efficiencies. This is a vertical, comon size analysis) Input FYE date: % year % year % Fiscal Year Ended: year Line: (Hanes vill - Sales or Revenue Cost of Sales Gross Profit/Margin 0 Operating Expenses 1 Income before Tax 2 Provision for tax 3 Net Income 4 Other Major Items 5 6 Based on the common-size analysis above, which item(s) appear to be the most significant in explaining 7 the change in net income (profitability)? Discuss below: Name of the CEO? What are the key findings of the auditor - What do they say about your compa What is the key business, and what are the key risks to the business? What is the general tone of management's comments in this section? Was the most recent year a positive or negative experience for the company? Is management optimistic or pessimistic about the future? Discuss below: B E F Balance Sheet Identify the amounts that your firm reported for each of the following categories and the percent change year to year (Note: Line items below may changes based on your company information - consolidate appropriately.) Yes, you may have to look up one more year of data. This is a Horizontal analysis Input FYE date: % Line Item Totals: (Nanes nay vary) Current Assets Property, Plant & Equipment Goodwill and other intangible assets Other long term assets Total Assets Current Liabilities Long-term iabiliti Contributed capital = Retained Earnings = Total Liabilities & Stockholder's Equity Based on the calculations above, which item(s) appear to be the most significant in explaining the change in total assets, and changes in major groupings of balance sheet accounts? Discuss below: B Income Statement For each of the selected items on the income statement, determine its percentage relative to sales revenue. Adjust your income statement line items name to match you companies income statement. Be sure to use formatting and formulas for presentation and efficiencies. This is a vertical, comon size analysis) Input FYE date: % year % year % Fiscal Year Ended: year Line: (Hanes vill - Sales or Revenue Cost of Sales Gross Profit/Margin 0 Operating Expenses 1 Income before Tax 2 Provision for tax 3 Net Income 4 Other Major Items 5 6 Based on the common-size analysis above, which item(s) appear to be the most significant in explaining 7 the change in net income (profitability)? Discuss below