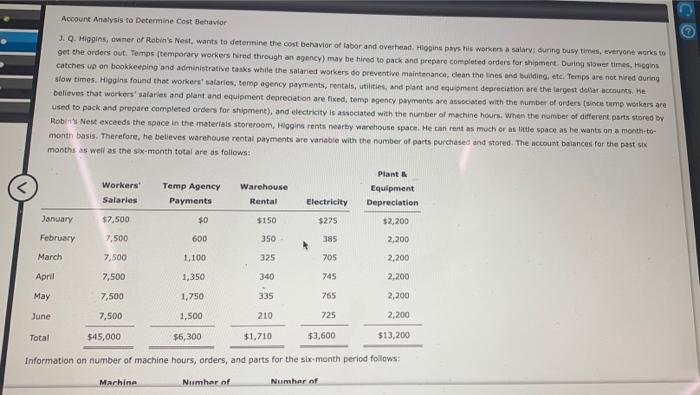

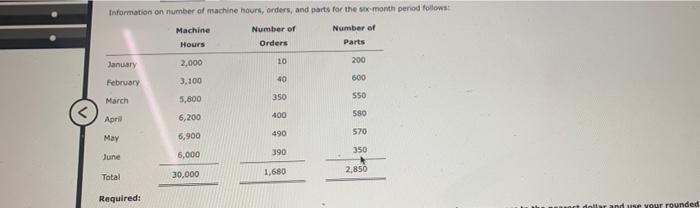

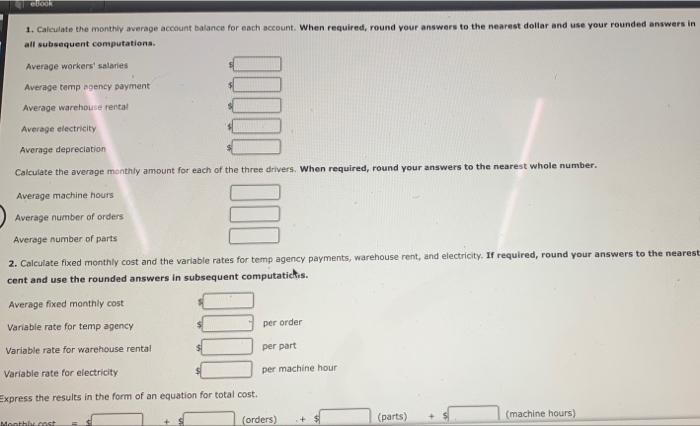

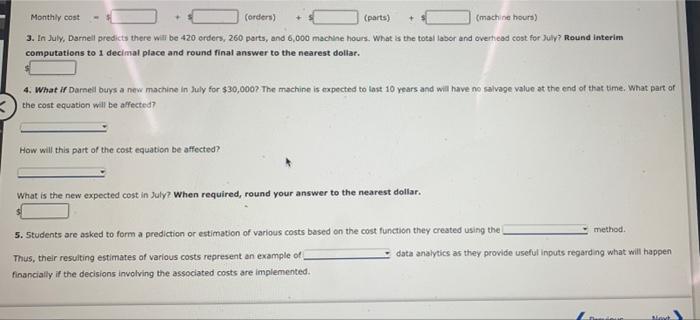

@ Account Analysis to Determine Cost Behavior J. Higgins, owner of Robin's Nest, wants to determine the cost behavior of labor and overhead Hoginu pays his workers a salary: ouning busy times, everyone wants to get the orders out. Temps (temporary workers Nired through an agency) may be hired to pack and prepare completed orders for shipment. During slower times. Hogins catches up on bookkeeping and administrative tasks while the salarest workers do preventive maintenance, clean the lines and building, etc. Temps are not red during slow times. Higgins found that workers' salaries, temp agency payments, rentals, utilities and plant and equipment depreciation are the largest dollar accounts. He believes that workers' salaries and plant and equipment depreciation are fixed, tomp agency payments are associated with the number of orders (em workers are used to pack and prepare completed orders for shipment), and electricity is associated with the number of machine hours. When the number of different parts stored by Robin's Nest exceeds the space in the materials storeroom, Higgins rents nearby warehouse space. He can rent as much or as little space as he wants on a month-to- mont basis. Therefore, he believes warehouse rental payments are variable with the number of parts purchased and stored. The account balances for the past six months as well as the six-month total are as follows: Plant Workers Temp Agency Warehouse Equipment Salaries Payments Rental Electricity Depreciation January $7,500 $0 $150 $275 $2,200 February 7,500 600 350 385 2,200 March 7,500 1,100 325 705 2,200 April 7,500 1,350 340 745 2,200 May 7,500 1,750 335 765 2,200 June 7,500 1,500 210 725 2,200 Total $45,000 $6,300 $1,710 $3,600 513,200 Information on number of machine hours, orders, and parts for the six-month period follows: Machina Number of Number of Information on number of machine hours, orders, and parts for the month period follows: Machine Hours Number of Orders Number of Parts January 10 2,000 200 40 3.100 February 600 350 550 March 5,800 400 580 April 6,200 490 570 6,900 May June 350 390 6,000 Total 2,850 1,680 30,000 Required: US Your rounded 1. Calculate the monthly average account balance for each account. When required, round your answers to the nearest dollar and use your rounded answers in all subsequent computations. Average workers' salaries Average temp agency payment Average warehouse rental DIDI! Average electricity Average depreciation Calculate the average monthly amount for each of the three drivers. When required, round your answers to the nearest whole number. Average machine houts Average number of orders Average number of parts 2. Calculate flwed monthly cost and the variable rates for temp agency payments, warehouse rent, and electricity. If required, round your answers to the nearest cent and use the rounded answers in subsequent computaticis. Average fixed monthly cost Vanable rate for temp agency per order Variable rate for warehouse rental 5 per part Variable rate for electricity per machine hour Express the results in the form of an equation for total cost. (orders) (parts) (machine hours) Monthhoost Monthly cost (parts) (orders) (machine hours) 3. In July, Darnell predicts there will be 420 orders, 260 parts, and 6,000 machine hours. What is the total labor and overhead cost for July? Round interim computations to 1 decimal place and round final answer to the nearest doltar. 4. What if Darnell buys a new machine in July for $30,000? The machine is expected to last 10 years and will have no salvage value at the end of that time. what part of the cost equation will be affected? How will this part of the cost equation be affected? What is the new expected cost in July? When required, round your answer to the nearest dollar. 5. Students are asked to form a prediction or estimation of various costs based on the cost function they created using the method. Thus, their resulting estimates of various costs represent an example of data analyties as they provide useful inputs regarding what will happen financially if the decisions involving the associated costs are implemented