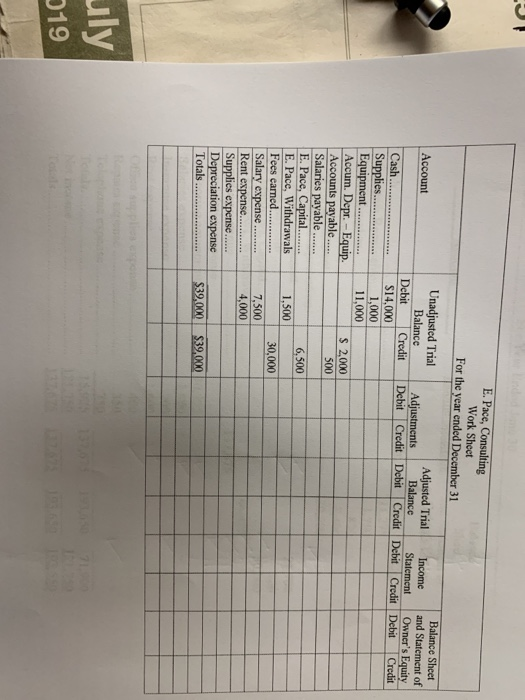

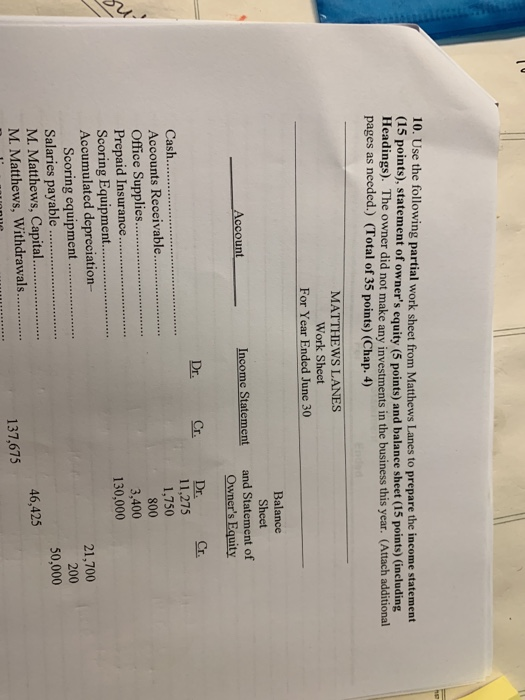

Account E. Pace, Consulting Work Sheet For the year ended December 31 Unadjusted Trial Adjusted Trial Balance Sheet Balance Income Adjustments and Statement of Balance Debit Credit Statement Debit Credit Debit Owner's Equity Credit Debit $14,000 Credit Debit Credit 1,000 11,000 $ 2,000 500 Cash.... Supplies..... Equipment........ Accum. Depr. - Equip. Accounts payable.... Salaries payable ....... E. Pace, Capital........ E. Pace, Withdrawals Fees carned. Salary expense ........ Rent expense............ Supplies expense...... Depreciation expense Totals .. 6,500 1,500 30,000 7,500 4,000 $39,000 $39.000 uly 519 10. Use the following partial work sheet from Matthews Lanes to prepare the income statement (15 points), statement of owner's equity (5 points) and balance sheet (15 points) (including Headings). The owner did not make any investments in the business this year. (Attach additional pages as needed.) (Total of 35 points) (Chap. 4) MATTHEWS LANES Work Sheet For Year Ended June 30 Balance Sheet and Statement of Owner's Equity Account Income Statement Dr. Cr. Cr. Dr. 11,275 1,750 800 3,400 130,000 Cash. Accounts Receivable... Office Supplies.... Prepaid Insurance...... Scoring Equipment.... Accumulated depreciation- Scoring equipment Salaries payable..... M. Matthews, Capital.. M. Matthews, Withdrawals.. 21,700 200 50,000 46,425 137,675 Account E. Pace, Consulting Work Sheet For the year ended December 31 Unadjusted Trial Adjusted Trial Balance Sheet Balance Income Adjustments and Statement of Balance Debit Credit Statement Debit Credit Debit Owner's Equity Credit Debit $14,000 Credit Debit Credit 1,000 11,000 $ 2,000 500 Cash.... Supplies..... Equipment........ Accum. Depr. - Equip. Accounts payable.... Salaries payable ....... E. Pace, Capital........ E. Pace, Withdrawals Fees carned. Salary expense ........ Rent expense............ Supplies expense...... Depreciation expense Totals .. 6,500 1,500 30,000 7,500 4,000 $39,000 $39.000 uly 519 10. Use the following partial work sheet from Matthews Lanes to prepare the income statement (15 points), statement of owner's equity (5 points) and balance sheet (15 points) (including Headings). The owner did not make any investments in the business this year. (Attach additional pages as needed.) (Total of 35 points) (Chap. 4) MATTHEWS LANES Work Sheet For Year Ended June 30 Balance Sheet and Statement of Owner's Equity Account Income Statement Dr. Cr. Cr. Dr. 11,275 1,750 800 3,400 130,000 Cash. Accounts Receivable... Office Supplies.... Prepaid Insurance...... Scoring Equipment.... Accumulated depreciation- Scoring equipment Salaries payable..... M. Matthews, Capital.. M. Matthews, Withdrawals.. 21,700 200 50,000 46,425 137,675