Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Account options: Accounts Payable Control Direct Manufacturing Labor Efficiency Variance Direct Manufacturing Labor Price Variance Direct Materials Control Direct Materials Efficiency Variance Direct Materials Price

Account options:

Accounts Payable Control

Direct Manufacturing Labor Efficiency Variance

Direct Manufacturing Labor Price Variance

Direct Materials Control

Direct Materials Efficiency Variance

Direct Materials Price Variance

Wages Payable Control

Work in Process Control

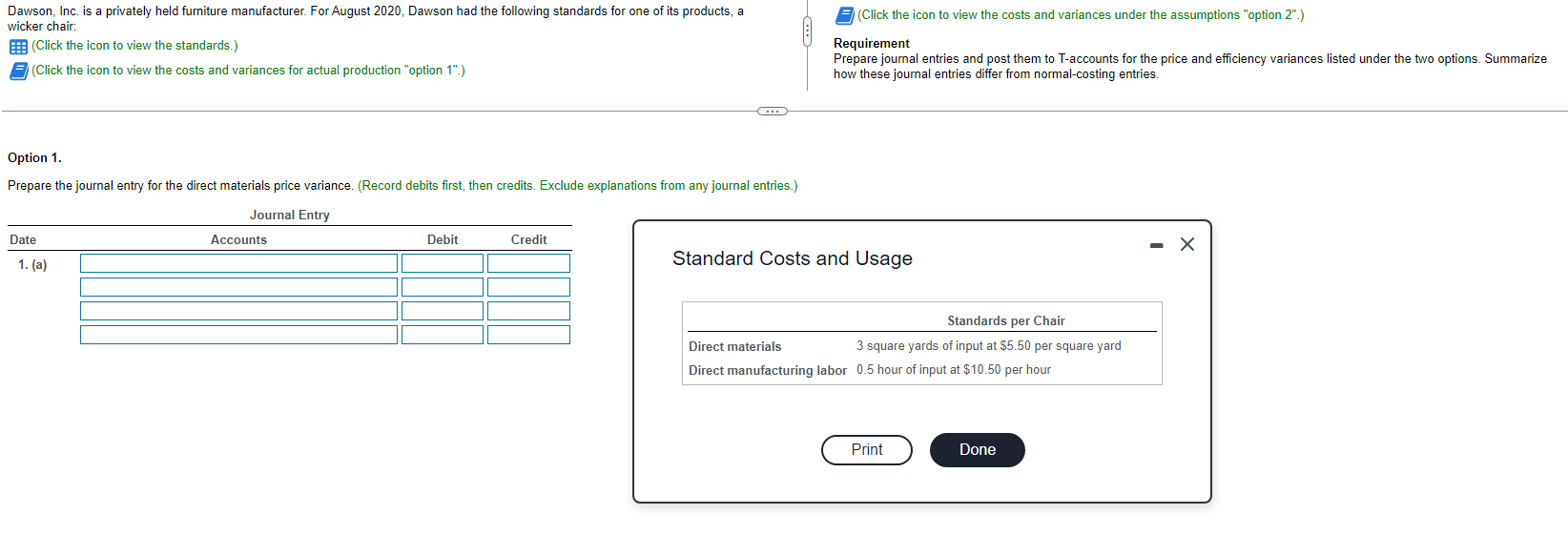

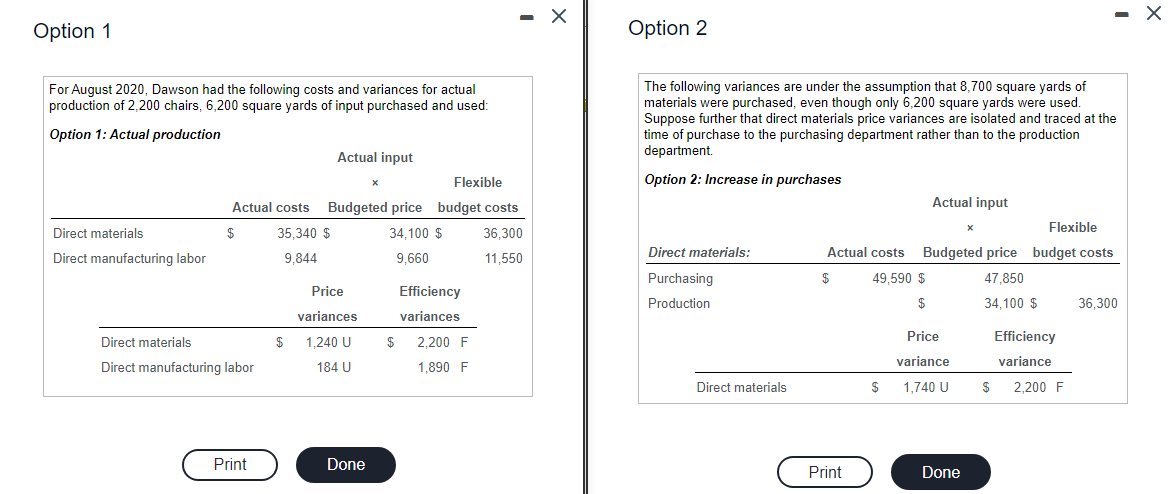

(Click the icon to view the costs and variances under the assumptions "option 2".) Dawson, Inc. is a privately held furniture manufacturer. For August 2020, Dawson had the following standards for one of its products, a wicker chair: : (Click the icon to view the standards.) (Click the icon to view the costs and variances for actual production "option 1".) Requirement Prepare journal entries and post them to T-accounts for the price and efficiency variances listed under the two options. Summarize how these journal entries differ from normal-costing entries. .. Option 1. Prepare the journal entry for the direct materials price variance. (Record debits first, then credits. Exclude explanations from any journal entries.) Journal Entry Date Accounts Debit Credit X 1. (a) Standard Costs and Usage Standards per Chair Direct materials 3 square yards of input at $5.50 per square yard Direct manufacturing labor 0.5 hour of input at $10.50 per hour Print Done - Option 1 Option 2 For August 2020, Dawson had the following costs and variances for actual production of 2.200 chairs, 6,200 square yards of input purchased and used: Option 1: Actual production Actual input Flexible Actual costs Budgeted price budget costs Direct materials $ 35,340 $ 34,100 $ 36,300 Direct manufacturing labor 9,844 9,660 11.550 The following variances are under the assumption that 8,700 square yards of materials were purchased, even though only 6,200 square yards were used. Suppose further that direct materials price variances are isolated and traced at the time of purchase to the purchasing department rather than to the production department Option 2: Increase in purchases Actual input Flexible Direct materials: Actual costs Budgeted price budget costs Purchasing $ 49,590 $ 47,850 Production $ 34,100 $ 36,300 Price variances Efficiency variances $ 2,200 F 1,890 F $ 1,240 U Price Direct materials Direct manufacturing labor Efficiency variance 184 U variance Direct materials $ 1,740 U $ 2,200 F Print Done Print DoneStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started