Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Bassam Company acquired a 80 percent interest in Sam Corporation's outstanding common stock on January 1, 2018, for $512,000 cash. The stockholders' equity of

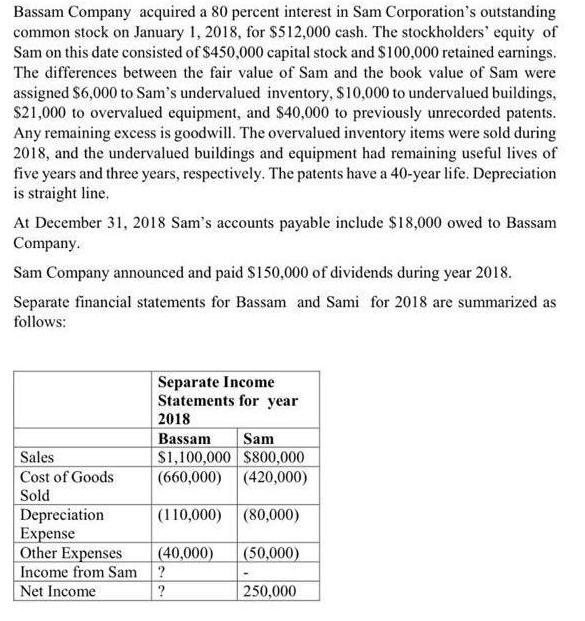

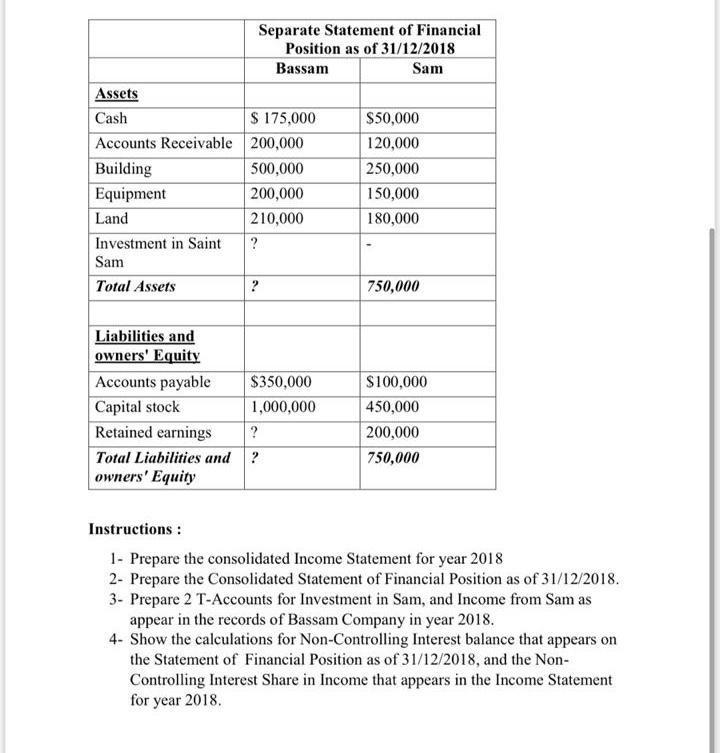

Bassam Company acquired a 80 percent interest in Sam Corporation's outstanding common stock on January 1, 2018, for $512,000 cash. The stockholders' equity of Sam on this date consisted of $450,000 capital stock and $100,000 retained earnings. The differences between the fair value of Sam and the book value of Sam were assigned $6,000 to Sam's undervalued inventory, $10,000 to undervalued buildings, $21,000 to overvalued equipment, and $40,000 to previously unrecorded patents. Any remaining excess is goodwill. The overvalued inventory items were sold during 2018, and the undervalued buildings and equipment had remaining useful lives of five years and three years, respectively. The patents have a 40-year life. Depreciation is straight line. At December 31, 2018 Sam's accounts payable include $18,000 owed to Bassam Company. Sam Company announced and paid $150,000 of dividends during year 2018. Separate financial statements for Bassam and Sami for 2018 are summarized as follows: Sales Cost of Goods Sold Depreciation Expense Other Expenses Income from Sam Net Income Separate Income Statements for year 2018 Bassam Sam $1,100,000 $800,000 (660,000) (420,000) (110,000) (80,000) (40,000) (50,000) ? ? 250,000 Assets Cash $ 175,000 Accounts Receivable 200,000 Building 500,000 Equipment 200,000 Land 210,000 ? Investment in Saint Sam Total Assets Liabilities and owners' Equity Separate Statement of Financial Position as of 31/12/2018 Bassam Sam Accounts payable Capital stock Retained earnings ? $350,000 1,000,000 ? Total Liabilities and ? owners' Equity $50,000 120,000 250,000 150,000 180,000 750,000 $100,000 450,000 200,000 750,000 Instructions: 1- Prepare the consolidated Income Statement for year 2018 2- Prepare the Consolidated Statement of Financial Position as of 31/12/2018. 3- Prepare 2 T-Accounts for Investment in Sam, and Income from Sam as appear in the records of Bassam Company in year 2018. 4- Show the calculations for Non-Controlling Interest balance that appears on the Statement of Financial Position as of 31/12/2018, and the Non- Controlling Interest Share in Income that appears in the Income Statement for year 2018.

Step by Step Solution

★★★★★

3.36 Rating (168 Votes )

There are 3 Steps involved in it

Step: 1

Bassam Investment stock KE Undervalued Juventary Building 450000 100000 Stacke RE Dividend pay ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started