Answered step by step

Verified Expert Solution

Question

1 Approved Answer

(Accounting 101). Please assist with the questions and calculations. (18 marks: 22 minutes) Nosipho studied at the University of Johannesburg and has since graduated and

(Accounting 101). Please assist with the questions and calculations.

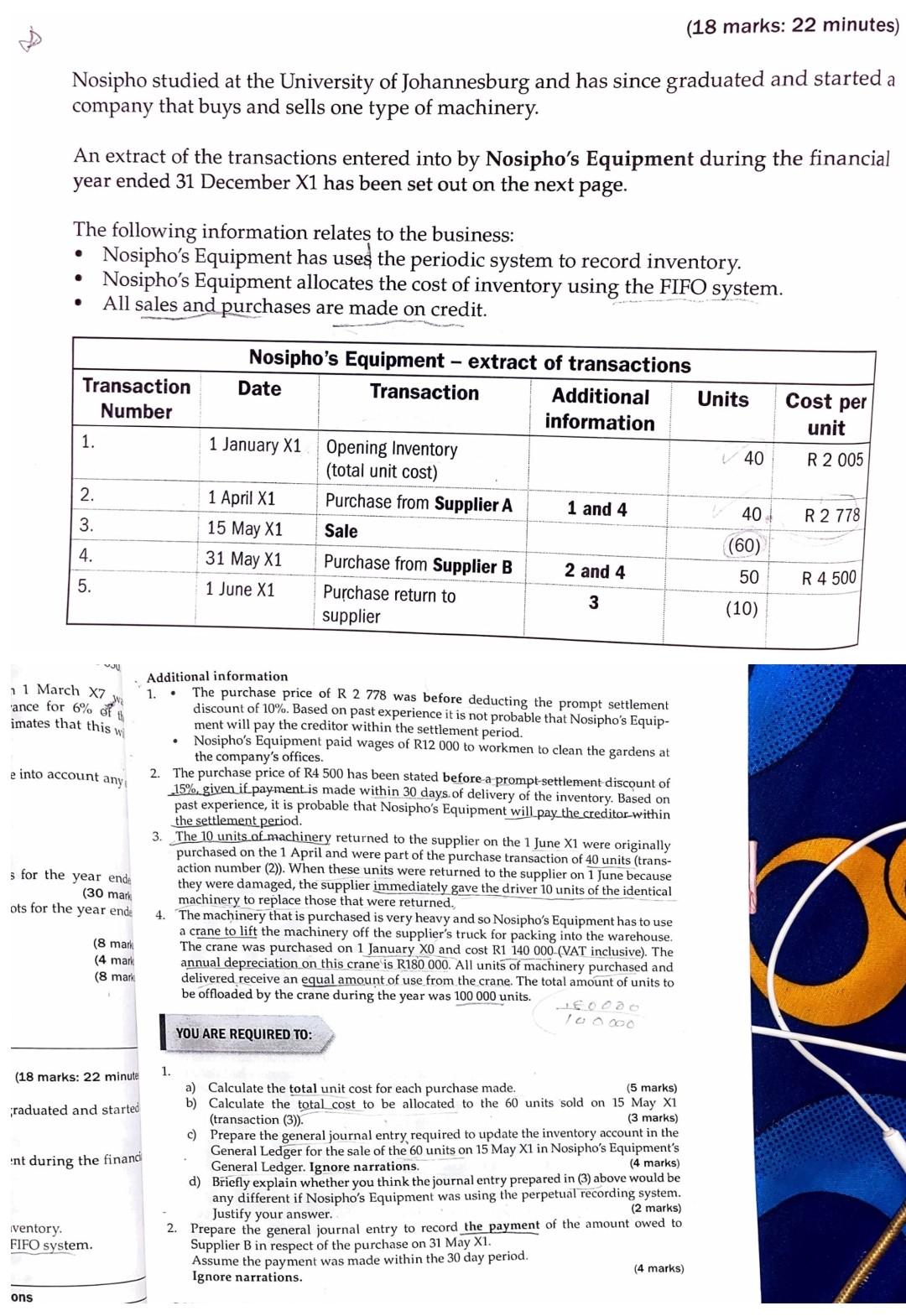

(18 marks: 22 minutes) Nosipho studied at the University of Johannesburg and has since graduated and started a company that buys and sells one type of machinery. An extract of the transactions entered into by Nosipho's Equipment during the financial year ended 31 December X1 has been set out on the next page. The following information relates to the business: - Nosipho's Equipment has used the periodic system to record inventory. - Nosipho's Equipment allocates the cost of inventory using the FIFO system. - All sales and purchases are made on credit. Additional information 1. - The purchase price of R2778 was before deducting the prompt settlement discount of 10%. Based on past experience it is not probable that Nosipho's Equipment will pay the creditor within the settlement period. - Nosipho's Equipment paid wages of R12 000 to workmen to clean the gardens at the company's offices. 2. The purchase price of R4 500 has been stated before-a-prompt-settlement discount of 15%, given if payment is made within 30 days. of delivery of the inventory. Based on past experience, it is probable that Nosipho's Equipment will pay the creditor-within the settlement period. 3. The 10 units of machinery returned to the supplier on the 1 June X1 were originally purchased on the 1 April and were part of the purchase transaction of 40 units (transaction number (2)). When these units were returned to the supplier on 1 June because they were damaged, the supplier immediately gave the driver 10 units of the identical machinery to replace those that were returned. 4. The machinery that is purchased is very heavy and so Nosipho's Equipment has to use a crane to lift the machinery off the supplier's truck for packing into the warehouse. The crane was purchased on 1 January X0 and cost R1 140000 -(VAT inclusive). The annual depreciation on this crane is R 180000 . All units of machinery purchased and delivered receive an equal amount of use from the crane. The total amount of units to be offloaded by the crane during the year was 100000 units. YOU ARE REQUIRED TO: 1. a) Calculate the total unit cost for each purchase made. (5 marks) b) Calculate the total cost to be allocated to the 60 units sold on 15MayX1 (transaction (3)). c) Prepare the general journal entry required to update the inventor ach General Ledger for the sale of the 60 units on 15 May X1 in Nosipho's Equipment's General Ledger. Ignore narrations. (4 marks) d) Briefly explain whether you think the journal entry prepared in (3) above would be any different if Nosipho's Equipment was using the perpetual recording system. Justifyyouranswer.(2marks) 2. Prepare the general journal entry to record the payment of the amount owed to Supplier B in respect of the purchase on 31 May X1. Assume the payment was made within the 30 day period. Ignore narrations. (4 marks) (18 marks: 22 minutes) Nosipho studied at the University of Johannesburg and has since graduated and started a company that buys and sells one type of machinery. An extract of the transactions entered into by Nosipho's Equipment during the financial year ended 31 December X1 has been set out on the next page. The following information relates to the business: - Nosipho's Equipment has used the periodic system to record inventory. - Nosipho's Equipment allocates the cost of inventory using the FIFO system. - All sales and purchases are made on credit. Additional information 1. - The purchase price of R2778 was before deducting the prompt settlement discount of 10%. Based on past experience it is not probable that Nosipho's Equipment will pay the creditor within the settlement period. - Nosipho's Equipment paid wages of R12 000 to workmen to clean the gardens at the company's offices. 2. The purchase price of R4 500 has been stated before-a-prompt-settlement discount of 15%, given if payment is made within 30 days. of delivery of the inventory. Based on past experience, it is probable that Nosipho's Equipment will pay the creditor-within the settlement period. 3. The 10 units of machinery returned to the supplier on the 1 June X1 were originally purchased on the 1 April and were part of the purchase transaction of 40 units (transaction number (2)). When these units were returned to the supplier on 1 June because they were damaged, the supplier immediately gave the driver 10 units of the identical machinery to replace those that were returned. 4. The machinery that is purchased is very heavy and so Nosipho's Equipment has to use a crane to lift the machinery off the supplier's truck for packing into the warehouse. The crane was purchased on 1 January X0 and cost R1 140000 -(VAT inclusive). The annual depreciation on this crane is R 180000 . All units of machinery purchased and delivered receive an equal amount of use from the crane. The total amount of units to be offloaded by the crane during the year was 100000 units. YOU ARE REQUIRED TO: 1. a) Calculate the total unit cost for each purchase made. (5 marks) b) Calculate the total cost to be allocated to the 60 units sold on 15MayX1 (transaction (3)). c) Prepare the general journal entry required to update the inventor ach General Ledger for the sale of the 60 units on 15 May X1 in Nosipho's Equipment's General Ledger. Ignore narrations. (4 marks) d) Briefly explain whether you think the journal entry prepared in (3) above would be any different if Nosipho's Equipment was using the perpetual recording system. Justifyyouranswer.(2marks) 2. Prepare the general journal entry to record the payment of the amount owed to Supplier B in respect of the purchase on 31 May X1. Assume the payment was made within the 30 day period. Ignore narrations. (4 marks)Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started