Answered step by step

Verified Expert Solution

Question

1 Approved Answer

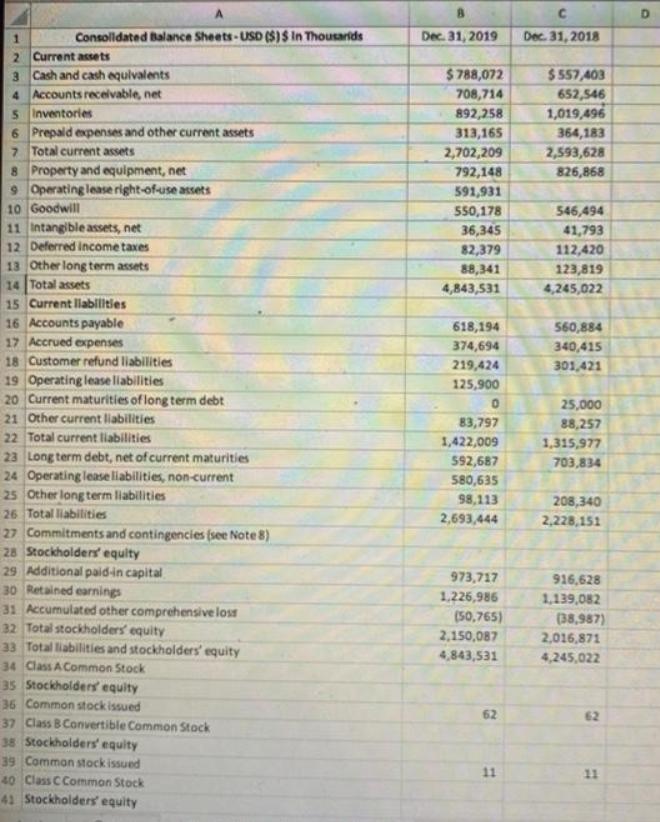

Calculate Underarmour's net operating assets for 2019. A. C. D. Consolldated Balance Sheets-USD (S)$ In Thousarids Dec. 31, 2019 Dec. 31, 2018 2 Current assets

A. C. D. Consolldated Balance Sheets-USD (S)$ In Thousarids Dec. 31, 2019 Dec. 31, 2018 2 Current assets 3 Cash and cash equivalents 4 Accounts recelvable, net s Inventories 6 Prepaid expenses and other current assets $788,072 $557,403 708,714 652,546 892,258 1,019,496 313,165 364,183 7 Total current assets 2,702,209 2,593,628 8 Property and equipment, net 9 Operating lease right-of-use assets 10 Goodwill 11 intangible assets, net 792,148 591,931 826,868 550,178 546,494 36,345 41,793 12 Deferred income taxes 82,379 112,420 13 Other long term assets 14 Total assets 15 Current llabilities 16 Accounts payable 17 Accrued expenses 18 Customer refund liabilities 88,341 123,819 4,843,531 4,245,022 618,194 560,884 374,694 340,415 219,424 301,421 19 Operating lease liabilities 20 Current maturities of long term debt 21 Other current liabilities 22 Total current liabilities 23 Long term debt, net of current maturities 24 Operating lease liabilities, non-current 25 Other long term liabilities 125,900 25,000 83,797 88,257 1,422,009 1,315,977 592,687 703,834 580,635 98,113 208,340 26 Total liabilities 2,693,444 2,228,151 27 Commitments and contingencies (see Note 8) 28 Stockholders equity 29 Additional paid-in capital 30 Retained earnings 31 Accumulated other comprehensive lost 32 Total stockholders equity 33 Total liabilities and stockholders' equity 34 Class A Common Stock 35 Stockholders equity 36 Common stock issued 37 Class BConvertible Common Stock 973,717 916,628 1,226,986 1,139,082 (50,765) (38,987) 2,150,087 2,016,871 4,843,531 4,245,022 62 62 38 Stockholders' equity 39 Comman stock issued 40 Class C Common Stock 41 Stockholders equity 11 11

Step by Step Solution

★★★★★

3.38 Rating (160 Votes )

There are 3 Steps involved in it

Step: 1

OPerating Asssets for 2019 To tell ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started