Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Filing Status Options: Single Head of household Qualifying widow(er) Married filing jointly Married filing separately For each of the independent situations provided in the table

Filing Status Options:

Single

Head of household

Qualifying widow(er)

Married filing jointly

Married filing separately

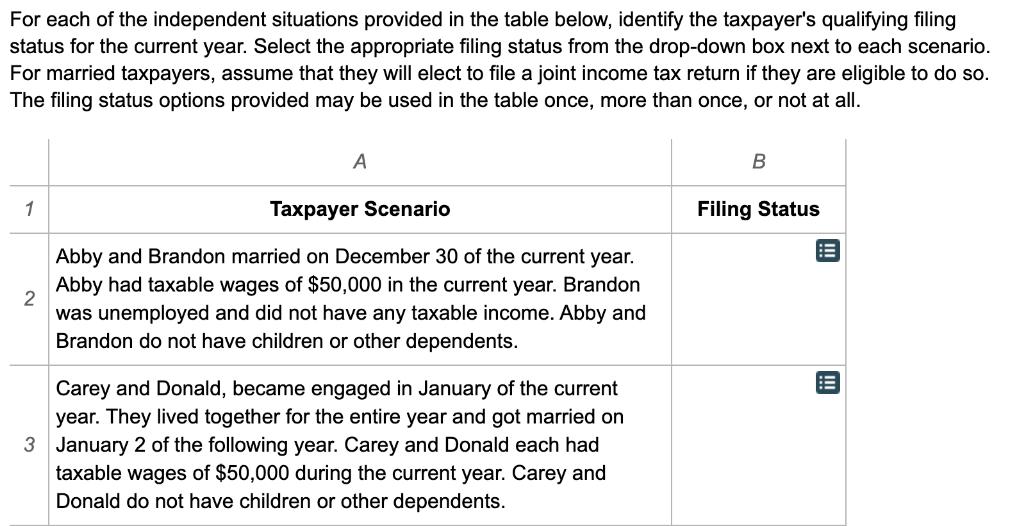

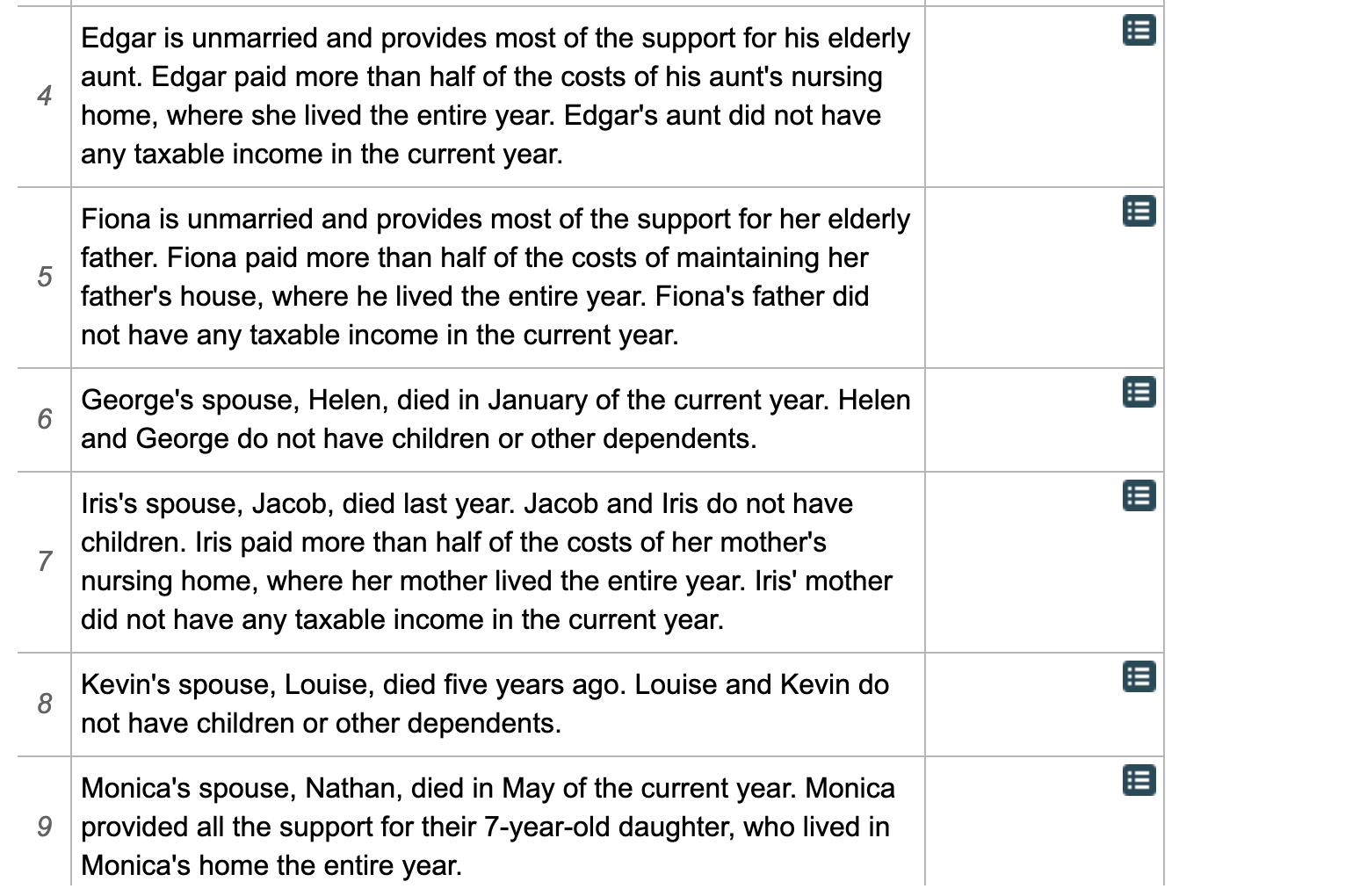

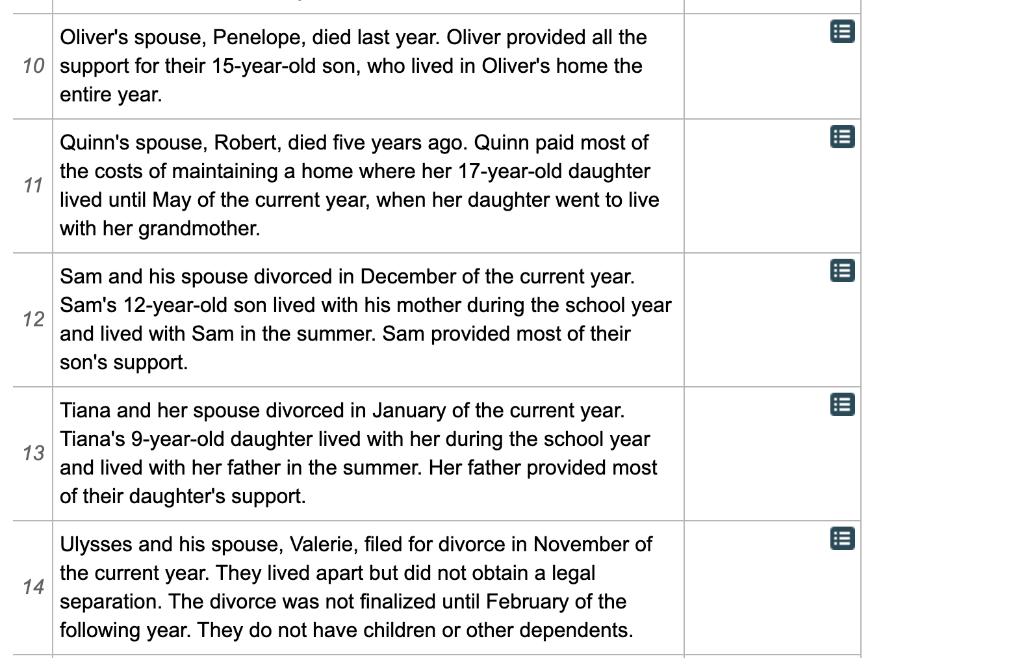

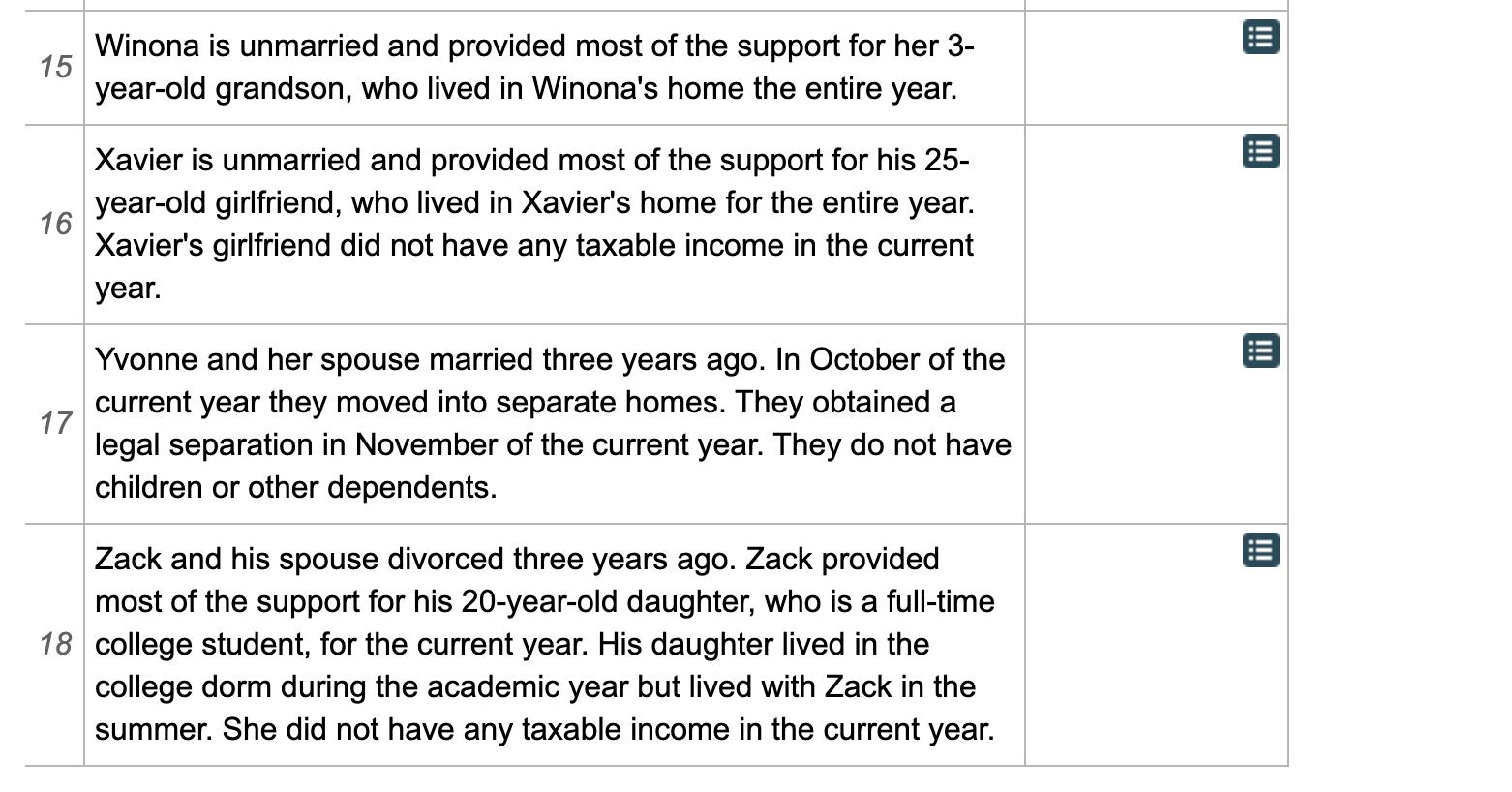

For each of the independent situations provided in the table below, identify the taxpayer's qualifying filing status for the current year. Select the appropriate filing status from the drop-down box next to each scenario. For married taxpayers, assume that they will elect to file a joint income tax return if they are eligible to do so. The filing status options provided may be used in the table once, more than once, or not at all. A B 1 Taxpayer Scenario Filing Status Abby and Brandon married on December 30 of the current year. Abby had taxable wages of $50,000 in the current year. Brandon 2 was unemployed and did not have any taxable income. Abby and Brandon do not have children or other dependents. !! Carey and Donald, became engaged in January of the current year. They lived together for the entire year and got married on 3 January 2 of the following year. Carey and Donald each had taxable wages of $50,000 during the current year. Carey and Donald do not have children or other dependents.

Step by Step Solution

★★★★★

3.41 Rating (148 Votes )

There are 3 Steps involved in it

Step: 1

Answer Answers 1 Taxpayer Scenario A Filling Status B 2 Married filling jointly 3 Marri...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started