Answered step by step

Verified Expert Solution

Question

1 Approved Answer

ACCOUNTING 2302 QUESTION Can someone please help answer this questions below in bold letters? Thank you!! Check Figure: Cost of Goods Manufactured= $8,980, Net operating

ACCOUNTING 2302 QUESTION

Can someone please help answer this questions below in bold letters? Thank you!!

| Check Figure: Cost of Goods Manufactured= $8,980, Net operating income=$14,270 | ||||

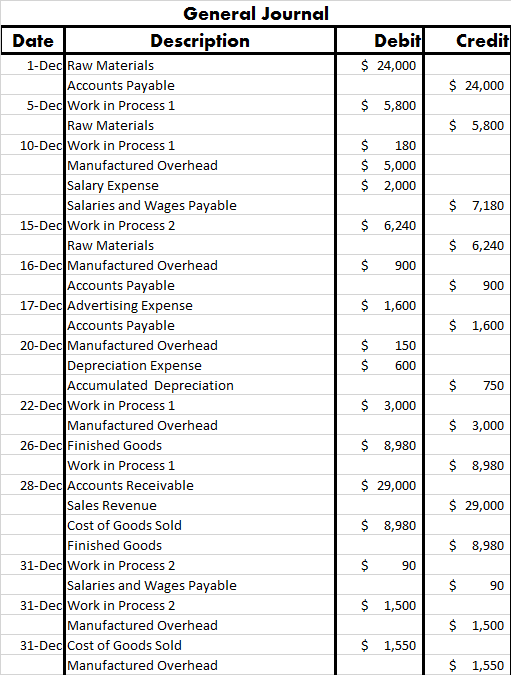

| What is the ending balance for raw materials? | ||||

| What is the ending balance for work in process? | ||||

| What is the ending balance for finished goods? | ||||

| What is the actual manufacturing overhead cost incurred during December before adjustment? | ||||

| What is the total applied manufacturing overhead cost during December before adjustment? | ||||

| What is the unadjusted cost of goods sold? | ||||

| Was the manufacturing overhead for the month of December overapplied/underapplied ? | ||||

| What is the amount of Manufacturing overhead overapplied/underapplied? | ||||

| What is the adjusted cost of goods sold? | ||||

| What is gross margin? | ||||

| What is the total prime cost for Job#1? | ||||

| What is the total conversion cost for job #1? | ||||

| What is the total product cost for job#1? | ||||

| What was the period cost incurred for the month of December? | ||||

| What is the total variable cost incurred for Job #1(assume that all selling and administrative cost and all manufacturing overhead costs are fixed.)? | ||||

| What is the contribution margin for Job #1 (assume that all selling and administrative cost and all manufacturing overhead costs are fixed.)? | ||||

| What would be the actual (not applied) total fixed manufacturing overhead cost incurred for the company for the month if the order in Job #1 is for five tables instead of one table assuming this cost is with in the relevant range? Here is the information given to answer the questions on top:

| ||||

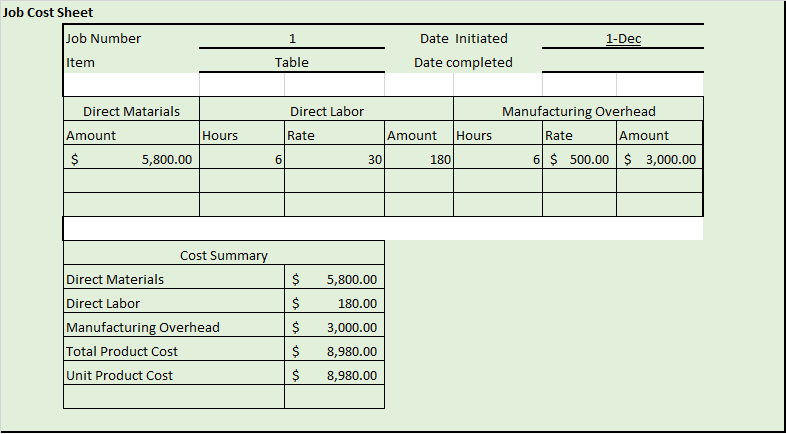

Job Cost Sheet Job Number Date Initiated 1-Dec Table Date completed Item Direct Matarials Direct Labor Manufacturing Overhead Amount Hours Rate Amount Hours Rate Amount R$ 5,800.00 6 6 500.00 s 3,000.00 30 180 Cost Summary 5,800.00 Direct Materials 180.00 Direct Labor 3,000.00 Manufacturing Overhead 8,980.00 Total Product Cost 8,980.00 Unit Product Cost

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started